To successfully age in place, older Americans need nonmedical benefits, such as nonmedical home care and home modifications to ensure their health and safety. Many seniors, especially those on a fixed income, can’t afford the cost of these benefits, but Medicare may help.

Full Answer

What do Medicare health plans cover?

What Medicare health plans cover Medicare health plans include Medicare Advantage, Medical Savings Account (MSA), Medicare Cost plans, PACE, MTM Preventive & screening services Part B covers many preventive services.

What if I need services medicare doesn't cover?

If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

What does it mean to be a non Medicare eligible retiree?

Non-Medicare Eligible Retirees A non-Medicare retiree is a former employee entitled to City Retiree health coverage but who is not currently eligible for Medicare. Non-Medicare retirees are subject to the Health Benefits Program procedures for Retirees.

What is an example of a non covered service under Medicare?

For example, a 67-year-old established patient presents for a covered service, such as an office visit for a chronic illness (e.g., 99213). At the same encounter, the patient chooses to receive a preventive medicine examination (e.g., 99397), which is a non-covered service under Medicare.

What are non-Medicare plans?

The Enhanced Care PPO (ECP) plan is the primary plan for non-Medicare Trust members. This nationwide health plan provides unlimited primary care physician (PCP) and specialist physician office visits at a flat dollar copay, as well as other helpful programs.

What are non covered benefits?

A non-covered service in medical billing means one that is not covered by government and private payers. The four categories of items and services that Medicare does not cover are: Medically unreasonable and unnecessary services and supplies. Noncovered items and services.

Which type of care is not covered by Medicare?

does not cover: Routine dental exams, most dental care or dentures. Routine eye exams, eyeglasses or contacts. Hearing aids or related exams or services.

What is the difference between Medicare and non-Medicare insurance?

Private health insurance often allows you to extend coverage to dependents, such as your spouse and children. Medicare, on the other hand, is individual insurance. Most people with Medicare coverage have to qualify on their own through age or disability.

What is the difference between a covered service and a non-covered service?

Whether or not a service is covered is dependent upon your insurance policy. For example, Medicare will pay for an annual physical exam as part of a covered service. However, Medicare does not pay for normal dental procedures. Non-covered services are services patients are responsible for paying on their own.

What is covered and non-covered services in medical billing?

In medical billing, the term non-covered charges refer to the billed amount/charges that are not paid by Medicare or any other insurance company for certain medical services depending on various conditions. Filing claims for non-covered charges are likely to result in denial of claims.

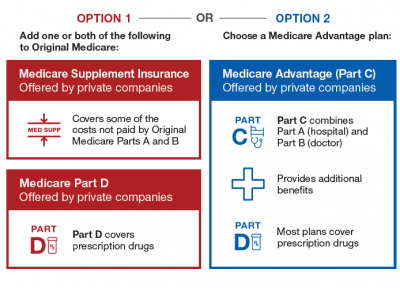

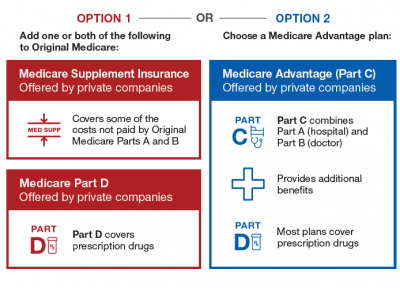

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Which of the following does Medicare Part A not provide coverage for?

Medicare Part A does not cover 24-hour home care, meals, or homemaker services if they are unrelated to your treatment. It also does not cover personal care services, such as help with bathing and dressing, if this is the only care that you need.

Which of the following is not provided under Part A of Medicare?

Part A does not cover the following: A private room in the hospital or a skilled nursing facility, unless medically necessary. Private nursing care.

Is it better to have private insurance or Medicare?

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

What is the benefit of choosing Medicare Advantage rather than the original Medicare plan?

Under Medicare Advantage, you will get all the services you are eligible for under original Medicare. In addition, some MA plans offer care not covered by the original option. These include some dental, vision and hearing care. Some MA plans also provide coverage for gym memberships.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.

What is Medicare Part C?

Medicare Part C is another name for Medicare Advantage and is administered through a private insurance company, not the federal government. Medicar...

Does Medicare cover home modifications for seniors?

Original Medicare doesn’t cover home modifications for seniors, but Medicare Part C does cover a variety of modifications that make the home safe...

Does Medicare pay for bathroom modifications?

Medicare Part C usually covers modifications in bathrooms that help make the area safer, including traction and non-skid strips, walk-in tubs, show...

Does Medicare cover stair lifts for the elderly?

Medicare Part C may cover stair lifts , but traditional Medicare usually doesn’t. A stair lift assists with a senior’s diminished ability to climb...

How often are Medicare plans reviewed?

Also, keep in mind that plan options are reviewed annually to determine if they will be renewed. Often times there are yearly changes that are communicated to you in the Benefit Highlights newsletter mailed every fall.

What is an enhanced care PPO?

The Enhanced Care PPO (ECP) plan is the primary plan for all non-Medicare Trust members. This nationwide health plan provides unlimited Primary Care Physician (PCP) and Specialist Physician office visits, as well as other helpful programs.

Does Medicare cover exceptions?

This booklet outlines the 4 categories of items and services Medicare doesn’t cover and exceptions (items and services Medicare may cover). This material isn’t an all-inclusive list of items and services Medicare may or may not cover.

Does Medicare cover personal comfort items?

Medicare doesn’t cover personal comfort items because these items don’t meaningfully contribute to treating a patient’s illness or injury or the functioning of a malformed body member. Some examples of personal comfort items include:

Does Medicare cover dental care?

Medicare doesn’t cover items and services for the care, treatment, filling, removal, or replacement of teeth or the structures directly supporting the teeth, such as preparing the mouth for dentures, or removing diseased teeth in an infected jaw. The structures directly supporting the teeth are the periodontium, including:

Does Medicare cover non-physician services?

Medicare normally excludes coverage for non-physician services to Part A or Part B hospital inpatients unless those services are provided either directly by the hospital/SNF or under an arrangement that the hospital/SNF makes with an outside source.

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

What are non covered services?

Medicare Non-covered Services. There are two main categories of services which a physician may not be paid by Medicare: Services not deemed medically reasonable and necessary. Non-covered services. In some instances, Medicare rules allow a physician to bill the patient for services in these categories. Understanding these rules and how ...

What are the two resources that Medicare considers medically reasonable?

There are two resources to help you determine if Medicare considers services to be medically reasonable and necessary: national coverage determinations (NCDs) and local coverage determinations (LCDs). These documents provide information regarding CPT and Healthcare Common Procedure Coding System (HCPCS) codes, ICD-10 codes, billing information, as well as service delivery requirements.

What is the modifier for ABN?

If an ABN is obtained, attach modifier -GA (waiver of liability statement issued as required by payer policy, individual case) to the line item (s) within the claim to indicate the patient has been notified.

What is CMS database?

The Centers for Medicare & Medicaid Services (CMS) offers an online, searchable Medicare Coverage Database that allows anyone to freely search NCDs, LCDs, and other Medicare coverage documents. The database has quick and advanced search capabilities to search by geography, Medicare contractor, key words, CPT codes, HCPCS codes, and ICD-10 codes.

When Medicare or another payer designates a service as “bundled,” does it make separate payment for the pieces of the?

When Medicare or another payer designates a service as “bundled,” it does not make separate payment for the pieces of the bundled service and does not permit you to bill the patient for it since the payer considers payment to already be included in payment for another service that it does cover. Coordination of Benefits.

Is coordination of benefits a responsibility of health insurance?

All payers will demand that correct coordination of benefits be followed for claims payment. Medical services are not always the responsibility of a health insurer. Payment may be the responsibility of other entities, such as automobile insurance, workers’ compensation, liability insurance, etc. Likewise, if a patient has multiple health insurance coverage (e.g., Medicare and employer coverage), one health insurer may be primary, and the secondary insurer will not pay until the primary policy has paid. You should verify coordination of benefits in all cases of accident, injury, and when multiple insurance policies are involved.

Is it reasonable to ask for a service from Medicare?

Medically Reasonable and Necessary. A patient may ask for a service that Medicare does not consider medically reasonable and necessary under the circumstances. For instance, the patient wants the service more frequently than Medicare allows or for a diagnosis that Medicare does not cover.