Original Medicare costs include premiums, deductibles, and co-pays. Medicare was signed into law in 1965 by President Lyndon B

Lyndon B. Johnson

Lyndon Baines Johnson, often referred to as LBJ, was an American politician who served as the 36th president of the United States from 1963 to 1969. Formerly the 37th vice president of the United States from 1961 to 1963, he assumed the presidency following the assassination of Presid…

Full Answer

What is considered Original Medicare?

Original Medicare is our country’s federal health insurance program available for people over 65, people with disabilities including ALS, and end-stage kidney disease. It includes Part A (hospital insurance) and Part B (medical insurance) and works on a fee-for-service basis.

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

How much does Medicare Part B and D cost?

You pay your portion of the monthly premium if you receive Part D coverage as part of Medicare. The cost varies, but the nationwide base is about $33 per month in 2022. Each plan will also have a copayment and coinsurance amount. You can add Part D coverage to Medicare Parts A and/or B.

What are the out-of-pocket costs of Medicare?

Costs can hit hard. Average annual out-of-pocket costs associated with a new cancer diagnosis were $2,116 for Medicaid beneficiaries, $2,367 for those covered by VA, $5,492 for those with employer plans, $5,670 for those with Medigap, $5,976 for those in a Medicare HMO, and $8,115 for those with no supplemental insurance.

What is the true cost of Medicare?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

What does Original Medicare include?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

Does Medicare cover 100% of costs?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the difference between traditional Medicare and Original Medicare?

Original Medicare covers most medically necessary services and supplies in hospitals, doctors' offices, and other health care facilities. Original Medicare doesn't cover some benefits like eye exams, most dental care, and routine exams.

What is not covered by Original Medicare?

Generally, Original Medicare does not cover dental work and routine vision or hearing care. Original Medicare won't pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions. The same holds true for routine vision checks. Eyeglasses and contact lenses aren't generally covered.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Why is Medicare Part B so expensive?

Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much is Medicare Part B?

Medicare Part B has a standard monthly premium of $144.60 in 2020, for people who earn up to $87,000 a year ($174,000 for a married couple). The premiums are higher if your income exceeds that amount. Part B enrollees pay an annual deductible of $198 in 2020. The Social Security Cost of Living Adjustment (COLA) was sufficient to cover the full amount of the Part B premium increase in 2020 for most beneficiaries, so most people are paying the standard premium.

How much is Medicare premium for 2020?

Although most Medicare beneficiaries receive Part A with no premium, if you do have to pay for it, the premium in 2020 is $458 per month if you worked less than 7.5 years, and $252 per month if you worked between 7.5 and 10 years.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.

What Are Your Medicare Costs?

We touched on this in a previous post, How Much Is My Medicare Deductible? As a refresher, Medicare breaks down cost-sharing like this:

How Much Does Medicare Part A Cost?

Medicare Part A is the hospital insurance portion of Original Medicare. For most people, Part A has no monthly premium, because they or their spouse worked and paid Medicare taxes for the required 40 quarters (10 years).

How Much Does Medicare Part B Cost?

Even if you choose a Medicare Advantage plan, you still have a Part B premium. The standard amount is $134 per month. You will pay this amount if any of the following are true:

What Does Medicare Part D Cost?

As with Original Medicare, Part D has a variety of cost-sharing features, including monthly premiums and co-pays. All amounts vary according to the plan you choose and your provider, as Part D plans are sold by Medicare-approved private insurance companies.

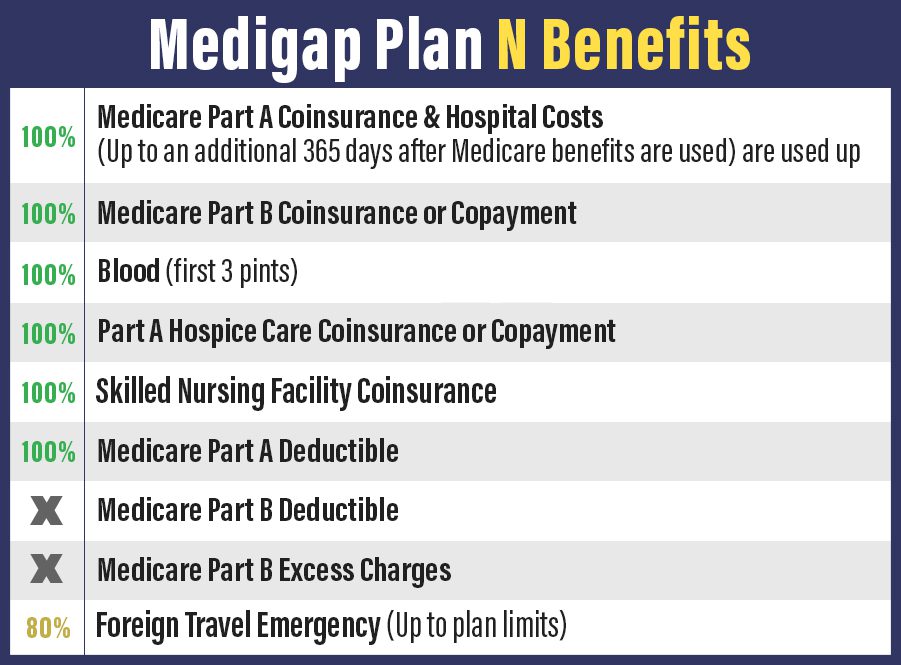

Adding a Medigap Plan

You can reduce your out-of-pocket expenses with a Medigap plan. As with Part D, these plans are offered by Medicare-approved private insurers. Premiums vary, as do plan details. To learn more about your Medigap options, call us toll-free at 855-350-8101 to speak to a licensed agent.

How much is Medicare Part B premium 2020?

There is a monthly premium fee you will have to pay with Medicare Part B. In 2020, the monthly premium cost is $144.60. However, the exact monthly fee you will pay is based on your income. If your yearly gross income exceeds a certain amount, you will be required to pay both the monthly premium and an Income Related Monthly Adjustment Amount ...

What is Medigap insurance?

Medigap insurance is supplemental private health insurance that is specifically offered to cover the “gaps” in Original Medicare coverage. For example, it can help cover the costs of deductibles (except your deductible for Part B for those born after January 1, 2020), copayments, and coinsurance.

What is Medicare Part B?

Medicare Part B refers to the “medical insurance” portion of Medicare, so it covers doctor’s visits, certain outpatient care like X-rays and lab tests, outpatient surgery, emergency services, some medical supplies, and preventative care, like a yearly wellness check.

How much is Part A 2020?

In 2020, Part A requires a deductible of $1,408 for each benefit period and a $352 co-insurance daily fee for each day after 60 days of care is reached (before 60 days, there is no coinsurance fee).

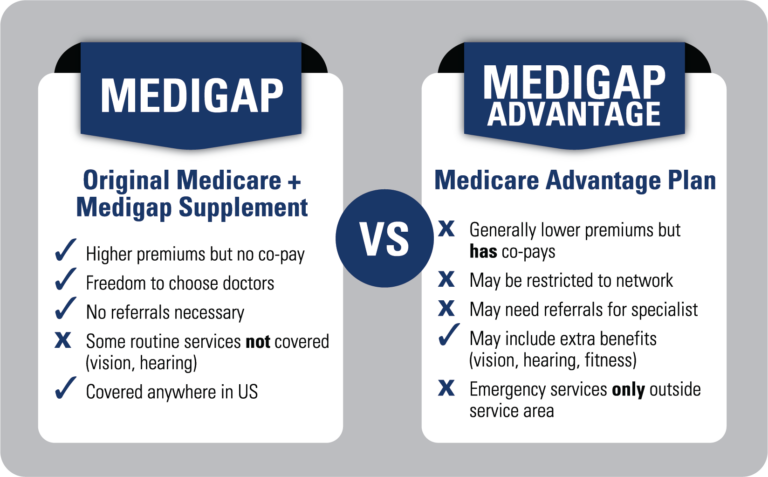

Does Medicare cover supplemental insurance?

Supplemental Coverage. Because Original Medicare does not cover all healthcare costs, some people may purchase supplemental coverage through private insurers to help pay some of the services Medicare doesn’t cover. We’ll cover two types of ancillary coverage — Medigap insurance and Medicare Advantage plans.

Does Medicare Part A cover all of the costs?

Original Medicare Part A and Part B only covers 80% of the costs of medical services; Medicare Advantage plans cover everything Part A and Part B cover, but charge a small copayment or coinsurance for services. Most Part C plans also have set yearly maximum out-of-pocket costs.

Does Medicare Advantage cover dental?

Medicare Advantage plans (also known as Part C) are set up like an HMO or PPO with yearly maximum out-of-pocket costs, and may also provide coverage for dental, vision, and hearing needs, which Original Medicare doesn’t cover. Part D plans cover prescription drugs.

Medicare Advantage

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

Medicare Advantage

Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Medicare Advantage

Original Medicare covers most medically necessary services and supplies in hospitals, doctors’ offices, and other health care facilities. Original Medicare doesn’t cover some benefits like eye exams, most dental care, and routine exams.