Original Medicare Part A and Part B for 2021

| Costs | |

| Part A deductible and coinsurance1 | $1,484 deductible for each benefit perio ... |

| Part B premium1 | The standard Part B monthly premium amou ... |

| Part B deductible and coinsurance5 | In 2021, the annual deductible for Part ... |

| Annual maximum out-of-pocket costs | There is no maximum out-of-pocket limit ... |

Full Answer

How much are healthcare out of pocket costs?

Per the study, “PYMNTS’ research has found that 54% of Americans earning between $50,000 and $100,000 annually live paycheck to paycheck,” with 40% of those earning more than $100,000 also reporting living paycheck to paycheck. This is true even though research also found that nearly 54% of U.S. households have family medical policies.

How much is health insurance out of pocket cost?

Your deductible, copayments and coinsurance payments count toward the annual maximum out-of-pocket limit. For the 2020 plan year, the out-of-pocket limit for an ACA plan can’t be more than $8,150 for an individual and $16,300, as reported on Healthcare.gov. Many plans offer lower out-of-pocket limits.

How much did you pay out of pocket?

Your out-of-pocket maximum is the absolute most you will have to pay towards your medical costs for the duration of your health insurance policy. Once your out-of-pocket limit is met, your health insurance plan will cover 100% of all your eligible medical expenses. How Out-of-Pocket Maximums Work?

How much does Medicare take out of your paycheck?

Your Medicare costs

- Get help paying costs. Learn about programs that may help you save money on medical and drug costs.

- Part A costs. Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

- Part B costs. ...

- Costs for Medicare health plans. ...

- Compare procedure costs. ...

- Ways to pay Part A & Part B premiums. ...

- Costs at a glance. ...

What is Medicare out of pocket?

Original Medicare (Part A and Part B) is the federal health insurance program for people age 65 and older and individuals with certain disabilities. Although Original Medicare provides comprehensive coverage, it still leaves some out-of-pocket costs to recipients.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is coinsurance in Medicare?

Coinsurance is the percentage of costs you pay for health care expenses after your deductible is met. In most cases, your Medicare Part B coinsurance is 20 percent of the cost of Medicare-approved services. In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows:

How much is Medicare Part A coinsurance for 2021?

In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows: Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each lifetime reserve day after day 90 for each benefit period ...

What is the deductible for Medicare Part A in 2021?

In 2021, the deductible for Medicare Part A is $1,484 per benefit period , and the deductible for Medicare Part B is $203 per year.

How many Medigap plans are there?

Medicare Supplement Insurance provides full or partial coverage for some of the out-of-pocket expenses listed above. There are currently 10 standardized Medigap plans available in most states, and each includes a unique blend of basic benefits.

What is the deductible for Plan L in 2021?

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

How much does Medicare pay for a hospital stay?

Part A: No fee for hospital stays of 60 days or less. For 61 to 90 days, $341 per day. For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once.

How much does Medicare pay for 91 days?

For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

How often does the Medicare tab swing?

And the tab can swing wildly each year, depending on the state of a beneficiary’s health, where he or she lives, and whether the government and insurers have instituted any price increases — or decreases. Individual plans can also tinker with the services and drugs they cover.

Does Medicaid pay out of pocket?

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as “dual eligibles.”.

Does Medicare have out of pocket costs?

Medicare’s out-of-pocket costs — premiums, deductibles, copays and coinsurance — can easily result in a large tab each year. If you’re struggling to meet those expenses, you might be eligible for federal and state assistance. If you qualify for Medicaid, the federal-state health insurance program for people with low incomes ...

What is Medicare out of pocket?

Medicare Out-of-Pocket Costs. Original Medicare (Medicare Part A and Part B) covers some hospital and medical costs, but you're responsible for certain out-of-pocket costs, such as deductibles, copayments and coinsurance.

What is Medicare monthly premium?

Your monthly premiums are the amounts you pay each month for your Medicare benefits. Most people do not pay a premium for Medicare Part A, as long as they paid sufficient Medicare taxes while working.

What is Medicare Part A?

Medicare Part A out-of-pocket costs. Medicare Part A (hospital insurance) helps cover inpatient hospital stays, skilled nursing facility care, hospice care, and limited home health care services. Let's take a look at some of the costs associated with Medicare Part A below.

How much is Medicare Part A deductible for 2021?

In 2021, the Medicare Part A deductible is $1,484 per benefit period. Benefit periods under Part A are based on how long you've been discharged from the hospital, which means you could encounter multiple Part A benefit periods in the same calendar year if you're hospitalized more than once.

What is Medicare out of pocket?

Here's what you can expect to pay for Medicare out of pocket: Premiums. Deductibles and coinsurance.

How much does Medicare cost for a hospital stay?

Medicare Hospital Stays Costs. If you are hospitalized, Medicare Part A has a $1,408 deductible. If you end up spending more than 60 days in the hospital, it will cost you $352 per day for days 61 through 90 and $704 for up to 60 lifetime reserve days after that.

Why do Medicare beneficiaries pay lower premiums?

Medicare Part B payments are prevented by law from reducing Social Security payments, so some Social Security beneficiaries pay lower premiums because their Social Security payments have not increased enough to cover the current standard Medicare premiums.

How much is Medicare Part B deductible?

Medicare Deductibles and Coinsurance. Medicare Part B has a $198 deductible in 2020. After that, Medicare beneficiaries typically need to pay 20% of the cost of most doctor's services.

How many days can you go without prescriptions?

Premiums are higher for people who go 63 or more days without prescription drug coverage after becoming eligible for Medicare and for high-income Medicare beneficiaries. To get the best value for your money, you will need to continue to compare plans each year because the prices and covered medications change annually.

How long do you have to sign up for Medicare?

You can first sign up for Medicare during the seven-month initial enrollment period that begins three months before you turn 65. If you don't sign up for Medicare during this initial enrollment period, you could be charged a late enrollment penalty as long as you are enrolled in Medicare. Your Part B premiums will increase by 10% for each 12-month period you delayed Medicare coverage after becoming eligible for it. If you didn't sign up for Medicare because you receive group health insurance through your job or your spouse's job, you need to sign up for Medicare within eight months of leaving the job or the coverage ending to avoid the penalty.

Do Medicare beneficiaries pay for hospital insurance?

Most Medicare beneficiaries don't pay a premium for Medicare Part A hospital insurance. The premium cost for Medicare Part D prescription drug coverage varies depending on the plan you select. Most Medicare beneficiaries have their premiums deducted from their Social Security check.

Do you have to pay out of pocket for Medicare?

Whether you’re covered through Original Medicare or a Medicare Advantage Plan, there are some costs and expenses you’ll need to pay out-of-pocket, even after you pay your monthly premium. Your actual out-of-pocket costs depend on the exact Medicare coverage you have, your health care needs, your prescriptions, and how often you need health care ...

Can you compare out of pocket costs with Medicare?

You can compare estimated out-of-pocket costs side-by-side for various Medicare coverage combinations. For example, you can compare your costs with Original Medicare plus a Medigap policy plus a Medicare prescription drug plan, versus your costs with a Medicare Advantage Plan with drug coverage.

General out-of-pocket costs

Most every insurance has the following out-of-pocket elements. Medicare also imposes penalties for signing up too late for Part B or Part D. All rates below are for 2021.

Provider-based expenses

Your out-of-pockets are directly affected by the healthcare provider you see. Make sure you take this into consideration before you schedule any appointments.

Hospital-based expenses

Staying overnight in a hospital does not necessarily mean you are admitted as an in -patient. You pay for inpatient hospital stays with a Part A deductible and a 20% Part B coinsurance for any physician services. When you are placed under observation, Part B provides your only coverage.

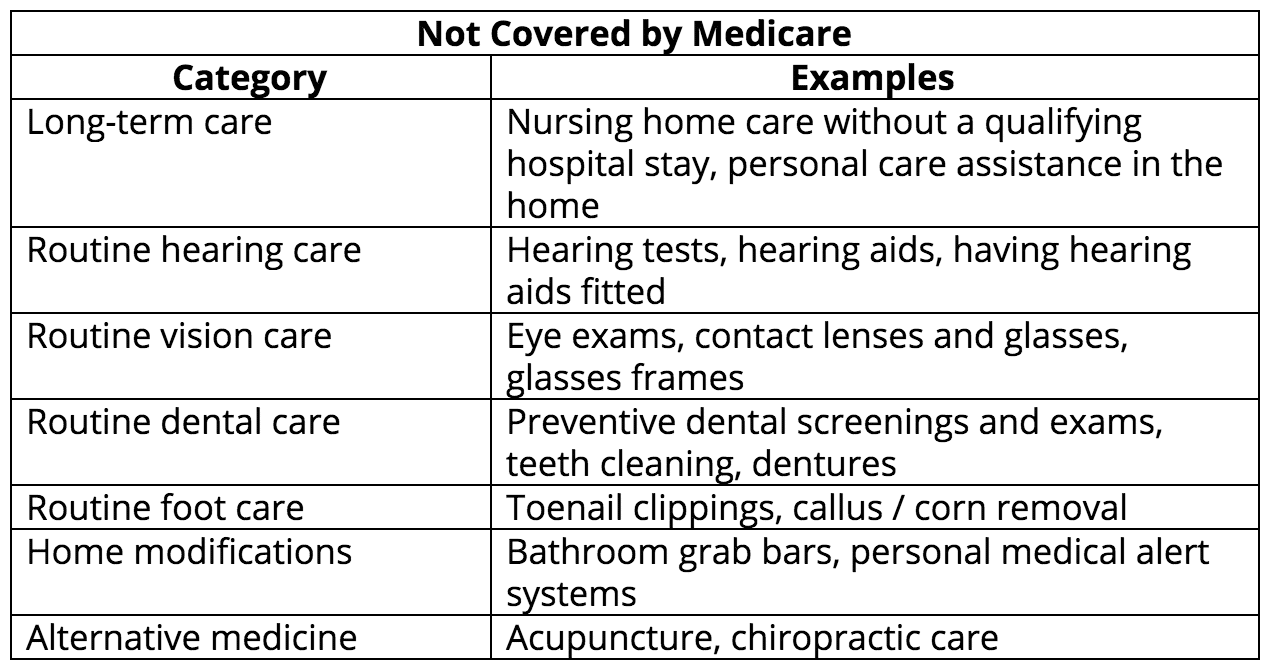

What do you need to know about Medicare?

Understanding Medicare's out-of-pocket costs. Don’t be frightened by the numbers. You have options. One of the first things you probably want to know when considering a Medicare plan is what it covers. That makes perfect sense, but it’s important to know what Medicare doesn’t cover, as well. Those numbers can add up.

How long did Medicare spend on cancer?

A Journal of the American Medical Association Oncology study published in 2016 looked at the out-of-pocket costs Medicare beneficiaries diagnosed with cancer between 2002 and 2012 spent.

What is a Part D premium?

Part D premium (prescription drug plan) Part D premiums, deductibles and copays vary by plan. See costs for our Medicare prescription drug plans. Medicare Supplement insurance. There is a monthly premium for these plans. Medicare Supplement plans help pay some of the healthcare costs that Original Medicare doesn't cover, like copayments, ...

How much is Part B premium 2020?

Part B premium1. The standard Part B monthly premium amount in 2020 is $144.60 or higher depending on your income.

When does the SNF benefit period end?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after 1 benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period.

How much is Part B deductible?

Part B deductible and coinsurance1. In 2020, the annual deductible for Part B coverage is $198 per year, after which you typically pay 20% of the Medicare-approved amount for most doctor services, outpatient therapy, and durable medical equipment (DME) Annual maximum out-of-pocket costs. There is no maximum out-of-pocket limit with Original ...

Do you have to pay out of pocket for a new pair of shoes?

Yep, you’ll be paying out-of-pocket for a new pair. Add to that out-of-pocket costs for plan copays, deductibles and monthly premiums and you might start feeling the pinch. And that’s if you’re generally healthy. An unexpected illness or injury requiring a hospital stay can send those numbers through the roof.