What if I overpaid my Medicare premium?

overpayment to Medicare within: 60 days of overpayment identification 6 years from overpayment receipt, generally known as the “lookback period” If applicable, the cost report due date When you get an overpayment of $25 or more, your MAC initiates overpayment recovery by sending a demand letter requesting repayment.

How to refund Medicare overpayment?

Overpayment Refund Form. When you identify a Medicare overpayment, use the Overpayment Refund Form to submit the voluntary refund. This will ensure we properly record and apply your check. NOTE: Type directly into the required fields on the Overpayment Refund Form, then print. Illegible forms may cause a delay in processing.

What to do about Medicare overpayments?

Medicare Overpayments

- Reasons for Overpayment. A provider is liable for an overpayment received unless they are "without fault". ...

- Identifying an Overpayment. A voluntary/unsolicited refund made to Novitas when a provider has discovered an error, which resulted in an overpayment.

- Appeal. ...

- Extended Repayment Schedule. ...

- Bankruptcy. ...

- Accelerated Payment. ...

Can I avoid paying more in Medicare premiums?

You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums. Medicare is available to all Americans who are age 65 or older, regardless of income.

Why would an overpayment be made?

An overpayment is defined as any payment that is larger than the invoice's outstanding amount. This can occur if the wrong amount is paid, or if an invoice is accidentally settled twice.

When Should Medicare overpayments be returned?

Section 1128J(d) of the Act provides that an overpayment must be reported and returned by the later of: (i) the date which is 60 days after the date on which the overpayment was identified; or (ii) the date any corresponding cost report is due, if applicable.

Does Medicare refund overpayment?

Voluntary Refund (Provider/Beneficiary Reported) If the amount of deductible or coinsurance liability collected from the beneficiary changes because of the identified overpayment, the provider must return the over collected funds to the beneficiary as appropriate.

What happens if I overpay my Medicare deductible?

because you'll receive bills from medical providers. And, you want to make sure you only pay the amount you're responsible for. Once you overpay, then you have to try and get your money back from the provider.

What should you do if Medicare overpays you for patient treatment?

If You Find the Overpayment If you or your staff detects an overpayment from Medicare, you can report it either electronically, through the eRefunds or Overpayment Claim Adjustment (OCA) features in the WPS-GHA portal, or by mail, using the Overpayment Notification/Refund Form.

How do I get a refund for overpayment?

There are two main ways to file a refund claim for overpayment of taxes. The first is to file an amended return that corrects the error you had previously made. The other option is to file a Form 843 Claim for Refund and Request for Abatement.

What are overpayments?

Definition of overpayment : payment that exceeds what is necessary overpayment of taxes … implemented electronic payrolls for all employees to prevent overpayment …— Jocelyn Brumbaugh also : an amount that is paid in excess … two taxpayers could not get refunds of tax overpayments dating back more than four years … —

Why did I get a Medicare refund?

For many, this money is taken out of their Social Security checks. It's possible seniors are being overcharged for Medicare and may be entitled to a refund.

What does overpayment recovery mean?

Overpayments can be recovered by sending back the incorrect paycheck, setting up an overpayment on the Additional Pay page or allowing the automatic retro process to recover the overpaid amount.

Why did my Medicare premium double?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

How Much Can Social Security take for overpayment?

If an overpayment has been made, by law Social Security can deduct 10% of your benefit check until it collects its loss. A request for a Reduced Rate of Repayment asks Social Security to collect less than the 10% because that is as much as you can afford to pay every month.

When is an overpayment identified?

This final rule states that a person has identified an overpayment when the person has or should have, through the exercise of reasonable diligence, determined that the person has received an overpayment and quantified the amount of the overpayment.

How long does it take for Medicare to report overpayments?

The Centers for Medicare & Medicaid Services (CMS) has published a final rule that requires Medicare Parts A and B health care providers and suppliers to report and return overpayments by the later of the date that is 60 days after the date an overpayment was identified, or the due date of any corresponding cost report, if applicable.

What is CMS 1128J?

CMS published a proposed rule to implement the provisions of section 1128J (d) of the Act for Medicare Parts A and B providers and suppliers. The major provisions of this final rule include clarifications around: the meaning of overpayment identification; the required lookback period for overpayment identification;

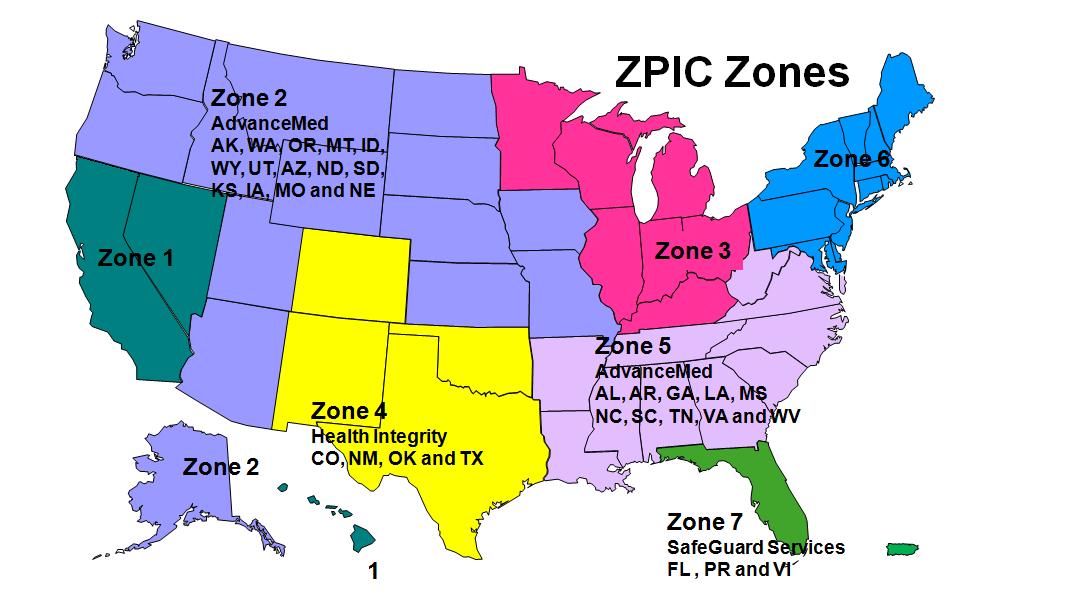

Who is the contractor for Medicare overpayment?

Once a determination of an overpayment has been made, the amount of the overpayment is a debt owed to the United States Government, via Novitas Solutions , as one of its Medicare contractors.

What are some examples of overpayments?

Examples of overpayments where you could be liable include, but are not limited to, the following: Payment exceeds the reasonable charge for the service. Duplicate payments of the same service (s) Incorrect provider payee. Incorrect claim assignment resulting in incorrect payee.

What is Medicare overpayment?

Overpayments are Medicare payments to a provider/supplier in excess of amounts due and payable under the statute and regulations. Once a determination of an overpayment has been made, the amount is considered a debt owed by the debtor to the United States Government and CGS must attempt recovery of the overpayment in accordance with ...

How can Medicare funds be recovered?

The funds can be recovered voluntarily from the beneficiary or supplier through a voluntary payment or through a demand letter . There are two types of voluntary refunds: Non-MSP – where Medicare fee-for-service iis primary, and. MSP – where Medicare fee-for-service is secondary.

What is risk adjusted payment mechanism?

This “risk adjusted” payment mechanism is intended to encourage MA plans to develop systems of care that are attractive to beneficiaries most in need and to prevent MA plans from profiting by attracting only good risks.

What is the coding intensity adjustment for Medicare?

Recognizing the likelihood that MA plans will report diagnostic information differently than is reported in traditional Medicare, in the Deficit Reduction Act of 2005, Congress gave CMS the authority to implement a “coding intensity adjustment” to adjust for differences in coding patterns between MA and traditional Medicare. In 2010, CMS implemented a 3.41 percent coding intensity adjustment, reducing MA risk scores by that amount. The Affordable Care Act, and subsequently the American Taxpayers Relief Act of 2012, created a schedule of minimum adjustments, starting at 4.71 percent in 2014, increasing to 5.91 percent in 2018.

Why has CMS not implemented a larger coding intensity adjustment?

The main reason that CMS has not implemented a larger coding intensity adjustment is that there is little political gain from doing so, and the decision about the coding intensity adjustment is, ultimately, made by political appointees. If CMS were to implement an adjustment that is larger than the statutory minimum, MA plans would make their displeasure known to members of Congress. Furthermore, an adjustment larger than the statutory minimum might result in higher MA premiums or fewer extra benefits for enrollees, raising the likelihood of constituent dissatisfaction.