Generally, a Medicare health plan:

- Is offered by a private company

- Contracts with Medicare to provide Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. ...

- Provides these benefits to people with Medicare who enroll in the plan

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

What is the best Medicare program?

- Medicare Advantage, also known as Part C is an alternative to Original Medicare.

- Medicare Advantage is run by private Medicare-approved insurance companies.

- Medicare Advantage is a bundle of Original Medicare, but provides more benefits than just Part A, Part B, and Part D (most plans), such as dental, hearing and vision, which ...

What are private Medicare Advantage plans?

Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

How to find the best Medicare Advantage plans?

“Medicare is a national program but Medicare Advantage plans tend to be very local in nature,” Slome notes. “Many consumers prefer working with a local Medicare agent rather than an anonymous person at a call center. Access the directory at www.medicaresupp.org.

What are the disadvantages of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the two types of Medicare plans?

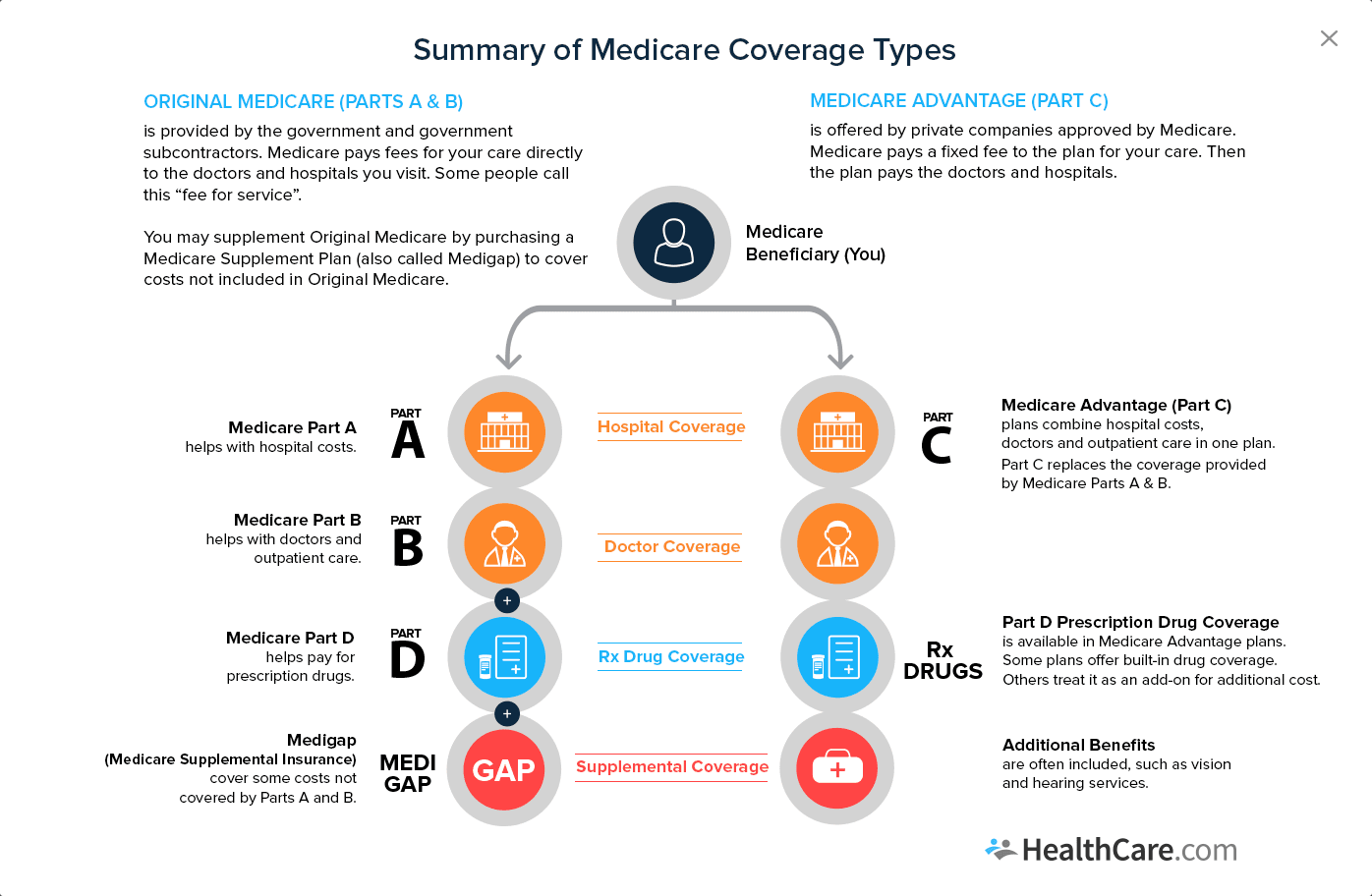

There are 2 main ways to get Medicare: Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). If you want drug coverage, you can join a separate Medicare drug plan (Part D).

Is private insurance Medicare?

The federal government provides original Medicare, and private companies administer private health insurance and Medicare Advantage plans on behalf of the government. The cost of private insurance varies by plan type and coverage levels.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the difference between Medicare and private insurance?

The difference between private health insurance and Medicare is that Medicare is mostly for individual Americans 65 and older and surpasses private health insurance in the number of coverage choices, while private health insurance allows coverage for dependents.

Can I have Medicare and private insurance at the same time?

It is possible to have both private insurance and Medicare at the same time. When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer.

What does private health insurance cover that Medicare doesn t?

Medicare doesn't cover the cost of ambulances, glasses/contact lenses or hearing aids. It also excludes therapies such as speech pathology, osteopathy and remedial massage. Private health insurance can fill the gaps in Medicare's coverage and give you more choice about your treatment.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

Whats the difference between Medicare Part A and B?

Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care. These plans aren't competitors, but instead are intended to complement each other to provide health coverage at a doctor's office and hospital.

How does Medicare work?

Examples of how coordination of benefits works with Medicare include: 1 Medicare recipients who have retiree insurance from a former employer or a spouse’s former employer will have their claims paid by Medicare first and their retiree insurance carrier second. 2 Medicare recipients who are 65 years of age or older and have health insurance coverage through employers with 20 or more employees will have their claims paid by their employer’s health plan first and Medicare second. 3 Medicare recipients who are under 65 years of age and disabled with health insurance coverage through employers with less than 100 employees will have their claims paid by Medicare first and by their employer’s health plan second.

What is Medicare coordination?

Coordination of Benefits with Private Insurance Plan. When a Medicare recipient had private health insurance not related to Medicare, Medicare benefits must be coordinated with that plan provider in order to establish which plan is the primary or secondary payer.

How old do you have to be to get Medicare?

Medicare recipients who are 65 years of age or older and have health insurance coverage through employers with 20 or more employees will have their claims paid by their employer’s health plan first and Medicare second.

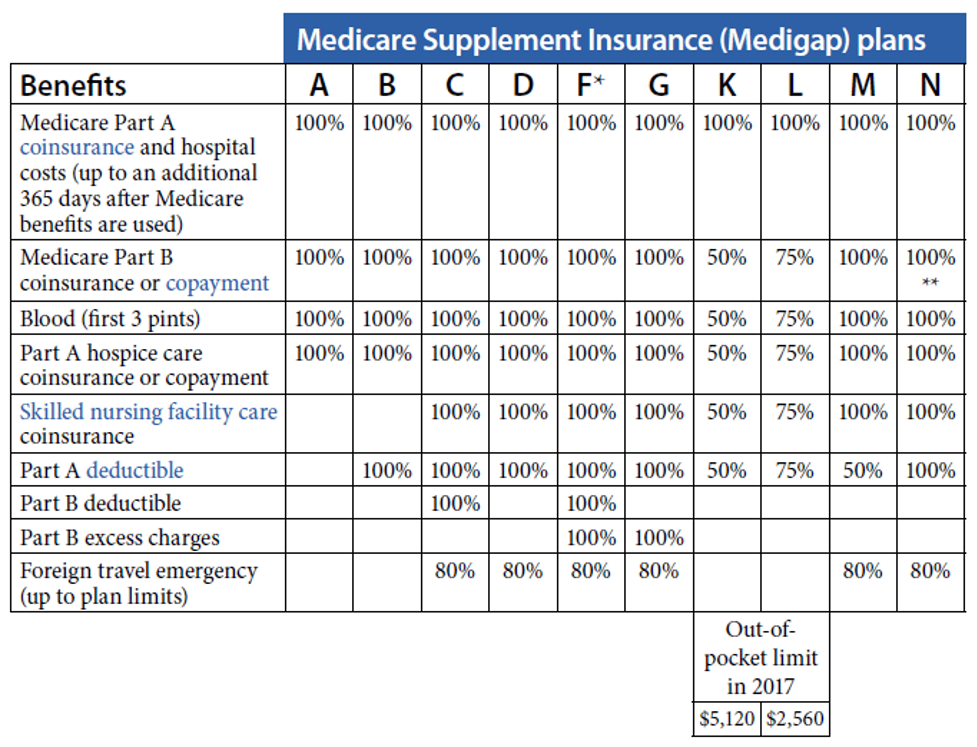

Does Medigap cover foreign travel?

For certain plans, Medigap adds a few new benefits, such as foreign travel coverage. The monthly premium for one of these plans is separate from the premium paid for Original Medicare. In order to make identifying Medigap plans easier, they follow a letter-name standardization in most states.

Does Medicare provide expanded benefits?

Through these contractual relationships, Medicare is able to provide recipients with an expanded or enhanced set of benefits in a variety of ways.

What is private insurance?

Private insurance plans are responsible for covering at least your preventative healthcare visits. If you need additional coverage under your plan, you must choose one that offers all-in-one coverage or add on additional insurance plans.

What is Medicare Advantage?

Medicare Advantage plans are a popular option for Medicare beneficiaries because they offer all-in-one Medicare coverage. This includes original Medicare, and most plans also cover prescription drugs, dental, vision, hearing, and other health perks.

What is deductible insurance?

Deductible. A deductible is the amount that you must pay out of pocket before your insurance company begins paying its share. Generally, as your deductible goes down, your premium goes up. Plans with lower deductibles tend to pay out much faster than plans with high deductibles.

How much does Medicare Advantage cost in 2021?

The most a Medicare Advantage plan can charge in out-of-pocket costs is $7,550 in 2021.

How many tiers of private insurance are there?

There are four tiers of private insurance plans within the insurance exchange markets. These tiers differ based on the percentage of services you are responsible for paying. Bronze plans cover 60 percent of your healthcare costs. Bronze plans have the highest deductible of all the plans but the lowest monthly premium.

Is Medicare a government or private insurance?

Medicare is government-funded health insurance that may help you save on your monthly medical costs but does not have a limit on how much you might pay out of pocket each year.

Does Medicare Advantage have a monthly premium?

Part C. In addition to paying Part A and Part B costs, a Medicare Advantage plan may also have its own monthly premium, yearly deductible, drug deductible, coinsurance, and copayments. These amounts vary based on the plan you choose. Part D.

What is Medicare Advantage?

Medicare Advantage: Private Health Insurance Through Medicare. Medicare Advantage plans are required to cover the same services that Original Medicare covers. Some may also cover prescription drugs and dental or vision care. Medicare Advantage plans may give you some discounts or pay for services that Original Medicare may not cover, ...

What happens if you switch to a 5 star Medicare Advantage plan?

If you switch from a Medicare Advantage plan that includes prescription drug coverage to a 5-star Medicare Advantage plan that does not, you will lose your drug coverage. You’ll have to wait until the next open enrollment period to select a Part D prescription drug plan and you may have to pay a late enrollment penalty.

When does Medicare open enrollment start?

15 and Dec. 7, with coverage kicking in Jan. 1. Beginning in 2019, there is an additional Medicare Advantage Open Enrollment period from Jan. 1 to March 31, when you can make changes to your coverage.

Does Medicare Advantage cover dental?

Medicare Advantage plans may give you some discounts or pay for services that Original Medicare may not cover, like vision and dental care. However, Medicare Advantage plans are administered by private health insurers and you'll be required to follow your plan's rules.

Can you switch Medicare Advantage Plan to another?

During this time you can switch from one Medicare Advantage plan to another or disenroll from your Medicare Advantage plan and return to Original Medicare. You can only make one change during this period. If you are not already enrolled in a Medicare Advantage plan you cannot enroll during this period.

What is Medicare approved private insurance?

The health insurance that Medicare-approved private companies provide varies among plan providers, but it may include coverage for the following: assistance with Medicare costs, such as deductible, copays, and coinsurance. prescription drug coverage through Medicare Part D plans.

What is Medicare Advantage?

Medicare Advantage plans, which replace original Medicare , may offer coverage that more closely resembles that of a private insurance plan. Many Medicare Advantage plans offer dental, vision, and hearing care and prescription drug coverage.

How much is the deductible for Medicare Part A?

Medicare Part A: $1,484. Medicare Part B: $203. As this shows, the deductible for Medicare Part A is lower than the average deductible for private insurance plans.

Why does Medicare cost more?

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

How many employees does Medicare have?

For example, Medicare is the primary payer when a person has private insurance through an employer with fewer than 20 employees. To determine their primary payer, a person should call their private insurer directly.

What are the factors that affect the cost of private insurance?

Other factors affecting the cost of private insurance include: the age of the person. where they live. the benefits of the plan. the out-of-pocket expenses. Generally, private insurance costs more than Medicare. Most people qualify for a $0 premium on Medicare Part A.

Does Medicare cover physical therapy?

Private insurance and original Medicare plans provide varying benefits and coverage. Most of both types of plans cover hospital care and outpatient medical services, including doctor’s visits, physical therapy, and diagnostic tests. However, Medicare may have gaps in coverage that private insurers cover.

What is a private fee for service plan?

A Private Fee-For-Service (PFFS) plan is a Medicare Advantage (MA) health plan, offered by a State licensed risk bearing entity, which has a yearly contract with the Centers for Medicare & Medicaid Services (CMS) to provide beneficiaries with all their Medicare benefits, plus any additional benefits ...

What is PFFS plan?

Chapter 16a (PFFS Plan) of the Medicare Managed Care Manual. On May 27, 2011, CMS released a new Chapter 16a of the Medicare Managed Care Manual, "Private Fee-for-Service (PFFS) Plans.".