Qualified plans include 401 (k) plans, 403 (b) plans, profit-sharing plans, and Keogh (HR-10) plans. Nonqualified plans include deferred-compensation plans, executive bonus plans, and split-dollar life insurance plans. The tax implications for the two plan types are also different.

Full Answer

What are AARP Medicare supplement plans?

May 02, 2022 · Hospital Services for Medicare Part A: Plan K pays only 50% (or $778) of the $1,556 Part A deductible. It pays up to $97.25, instead of $194.50, per day for days 21 to 100 for care at a skilled nursing facility. It pays only 50% of the cost of the first three pints of blood if you need a transfusion.

How do I qualify for AARP Medigap?

May 04, 2022 · Medicare Supplement insurance, often called "Medigap," helps pay some of the out‑of‑pocket costs not paid by Original Medicare (Parts A and B). There are ten plans standardized by the federal government. Each Medicare Supplement plan offers the same basic benefits no matter which insurance company sells it.

Is an AARP plan right for You?

May 04, 2022 · Qualified Medicare Beneficiary (QMB) Program. Specified Low-Income Medicare Beneficiary (SLMB) Program. Qualifying Individual (QI) Program. Qualified Disabled and Working Individuals (QDWI) Program. Individual Monthly Income. $1,084. $1,296. $1,456. $4,339.

How many AARP Medigap plans are there?

May 04, 2022 · The primary goal of a Medicare Supplement insurance (Medigap) plan is to help cover some of the out-of-pocket costs of Original Medicare (Parts A & B). As a general rule, the more comprehensive the coverage, the higher the premium, however, premiums will also vary by insurance company, and premium amounts can change yearly. Learn more about costs …

What is a non standard Medicare supplement?

What are the criteria's of a Medicare supplement plan?

What are the four different types of Medicare plans one can be enrolled in?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

Does AARP plan g cover Medicare Part B deductible?

What is the difference between Medicare gap and Medicare Advantage?

Is Medigap the same as supplemental?

What is the difference between Medicare Part C and Part D?

What are the two types of Medicare plans?

Are you automatically enrolled in Medicare if you are on Social Security?

What is the difference between Plan G and high deductible plan G?

What is the deductible for Plan G in 2021?

What Plan G does not cover?

What are the features of Medicare Supplement plans?

Helps cover some out-of-pocket costs that Original Medicare doesn’t pay.See any doctor who accepts Medicare patients.No referrals needed to see a s...

What Medicare Supplement plans are available?

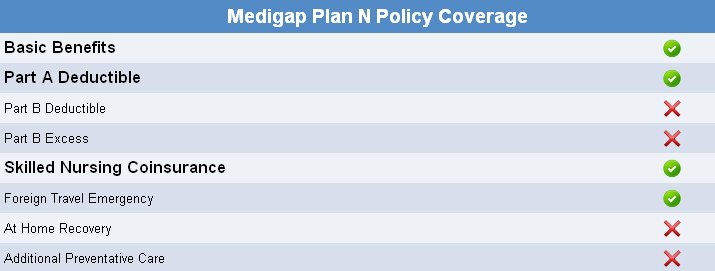

Medicare Supplement plans are often called “Medigap.” There are ten standardized Medicare Supplement plans.Each plan has a letter assigned to it. E...

What does each Medicare Supplement plan cover?

Each of the Medicare Supplement plans offers a varying level of coverage. See what plans match up with the coverage you want.

What is QI in Medicaid?

Qualifying Individual Program (QI): State program that helps pay for Part B premiums. You must apply every year for QI benefits, and applications are granted on a first-come, first-serve basis. People who qualify for Medicaid may NOT get QI benefits.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Is AARP an insurer?

AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products.

Does AARP endorse agents?

AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP® Medicare Supplement Insurance Plans.

When is the best time to enroll in Medicare Supplement?

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you're both age 65 or older and enrolled in Medicare Part B.

Does Medigap work with Medicare?

When you have a Medigap plan to work with Original Medicare it can help with some of the following costs that you would have to pay on your own: About 20% in out-of-pocket expenses not paid by Medicare Part B for doctor and outpatient medical expenses (after the annual deductible is met—$203 in 2021).

Does UnitedHealthcare have a Medicare Advantage plan?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare. You do not need to be an AARP member to enroll in a Medicare Advantage ...

What is Medicare Supplement?

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as "Medigap", are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits.

How long does Medicare cover hospital coinsurance?

Part A coinsurance, and most plans include a benefit for the Part A deductible (which could be one of the largest out-of-pocket expenses if you need to spend time in a hospital.) Hospital coverage up to an additional 365 days after Medicare benefits are used up. Part A hospice/respite care coinsurance or copayment.

What is Medicare Advantage?

Medicare Advantage (Part C) plans combine your Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) in one plan and usually include prescription drug coverage. These plans often also offer additional benefits such as dental, vision and fitness.

What is a special needs plan?

Special Needs Plans are Medicare Advantage plans designed for specific needs that include prescription drug coverage. Plans may also include other benefits like care coordination. There are four types of Special Needs Plans including Dual Special Needs Plans for people with both Medicare and Medicaid.

Does Medicare Part A cover vision?

Original Medicare (Parts A & B) doesn't cover everything you may need to live a healthy lifestyle. Medicare Part A and Part B do not provide prescription drug coverage, nor do they offer other health care benefits such as for dental, vision or hearing that you may consider important to your health. There are plans offered by private insurance companies that can either supplement Original Medicare or be chosen as an alternative that may help you get the additional coverage you need.

What is AARP insurance?

AARP is a nonprofit, membership organization. It offers medical supplement insurance plans through the United Healthcare insurance company. The plans, also known as Medigap, help people pay for out-of-pocket medical expenses that original Medicare does not cover. This article looks at the various AARP medical supplement insurance plans.

Is AARP a nonprofit?

Summary. AARP is a nonprofit organization. One of its membership benefits includes discounts on Medigap plans through United Healthcare. The eight AARP Medigap plans offered by AARP cover some of the gaps left in original Medicare coverage, including out-of-pocket costs such as copays, coinsurance, and deductibles.

How does Medigap work?

The premiums for AARP Medigap plans vary depending on a person’s location, and on the method a company uses to set prices. The three systems include: 1 community rated, where everyone who has the policy pays the same premium, regardless of their age 2 issue-age rated, where the premium is based on a person’s age when they first get a policy, but does not increase because of age 3 attained-age rated, where the premium is age-related and may increase as a person gets older

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Does Medicare cover copays?

Original Medicare pays a proportion of covered healthcare costs. However, Medicare beneficiaries must also pay copays, coinsurance, and an annual deductible. Private insurance companies sell supplement insurance plans, known as Medigap, to fill these payment gaps. However, Medigap policies do not cover all healthcare costs.

Does Medigap cover dental?

Private insurance companies sell supplement insurance plans, known as Medigap, to fill these payment gaps. However, Medigap policies do not cover all healthcare costs. Typically, they do not include services such as long-term care, vision or dental care, or private-duty nursing. They also may not cover hearing aids or eyeglasses.

Does Medicare cover hearing aids?

Typically, they do not include services such as long-term care, vision or dental care, or private-duty nursing. They also may not cover hearing aids or eyeglasses. Depending on where a person lives and when they became eligible for Medicare, they can choose from up to 10 different Medigap policies.

How long do you have to wait to get Medicare?

If you’re under age 65 and qualify for Social Security disability benefits, in most circumstances you must wait for two years before qualifying for Medicare. Your Medicare coverage begins during your 25th month of receiving disability benefits.

How old do you have to be to get a green card?

But in each case you must meet certain conditions: Qualifying on the basis of age: You must be 65 or older and. a United States citizen, or. a permanent legal resident (green card holder) who has lived in the United States for at least five years before applying; or.

How long do you have to be married to get a green card?

a green card holder who has been married to a fully insured U.S. citizen or green card holder for at least one year. To be “fully insured” you must have earned at least 40 work credits through paying Medicare payroll taxes at work (equivalent to about 10 years of employment).

What is a dual special needs plan?

A Dual Special Needs Plan (D-SNP) is a unique Medicare Advantage plan that combines your Medicare Part A and Part B benefits, and your Medicare Part D prescription drug coverage. You'll get extra support to help coordinate ...

What is a dual SNP?

A Dual Special Needs Plan (D-SNP) is a unique Medicare Advantage plan that combines your Medicare Part A and Part B benefits, and your Medicare Part D prescription drug coverage. You'll get extra support to help coordinate the plan with your Medicaid plan. In addition, a dual health plan provides extra benefits not provided by ...

What is Medigap insurance?

A: Medigap is private insurance that covers out-of-pocket expenses in the Original Medicare program. (If you are under age 65 and have Medicare due to disability, see the next Q&A in this section, because the rules are different for your situation.) — Read Full Answer.

Does Medicare cover all medical expenses?

A: Medicare does not cover all your health care costs. It requires you to pay premiums, deductibles and copays, which vary according to the type of Medicare coverage you choose and, in some cases, your income. — Read Full Answer. Q: I want to be sure I understand the Part D “doughnut hole” or coverage gap.