Medicare Recovery Audit Contractor Audits (RACs, or RAs) were introduced beginning in 2005 to identify and recover improper payments made in Medicare and Medicaid transactions between providers and payors. They were (and are) conducted by Recovery Audit Contractors (also known as RACs).

What are RAC audits?

Nov 16, 2021 · Medicare Recovery Audit Contractor Audits (RACs, or RAs) were introduced beginning in 2005 to identify and recover improper payments made in Medicare and Medicaid transactions between providers and payors. They were (and are) conducted by Recovery Audit Contractors (also known as RACs).

What Medicare claims do RACS review?

RAC Audits, also known as Medicaid Audits, Medicare Audits, MAC Audits, or MIC Audits are ongoing, aggressive, intrusive programs with the sole purpose of recovering reimbursement from health care providers. These audits are expected to become more frequent for the foreseeable future. Whatever type of audit is conducted, they pose a serious threat to your …

What is the Medicare Part D RAC?

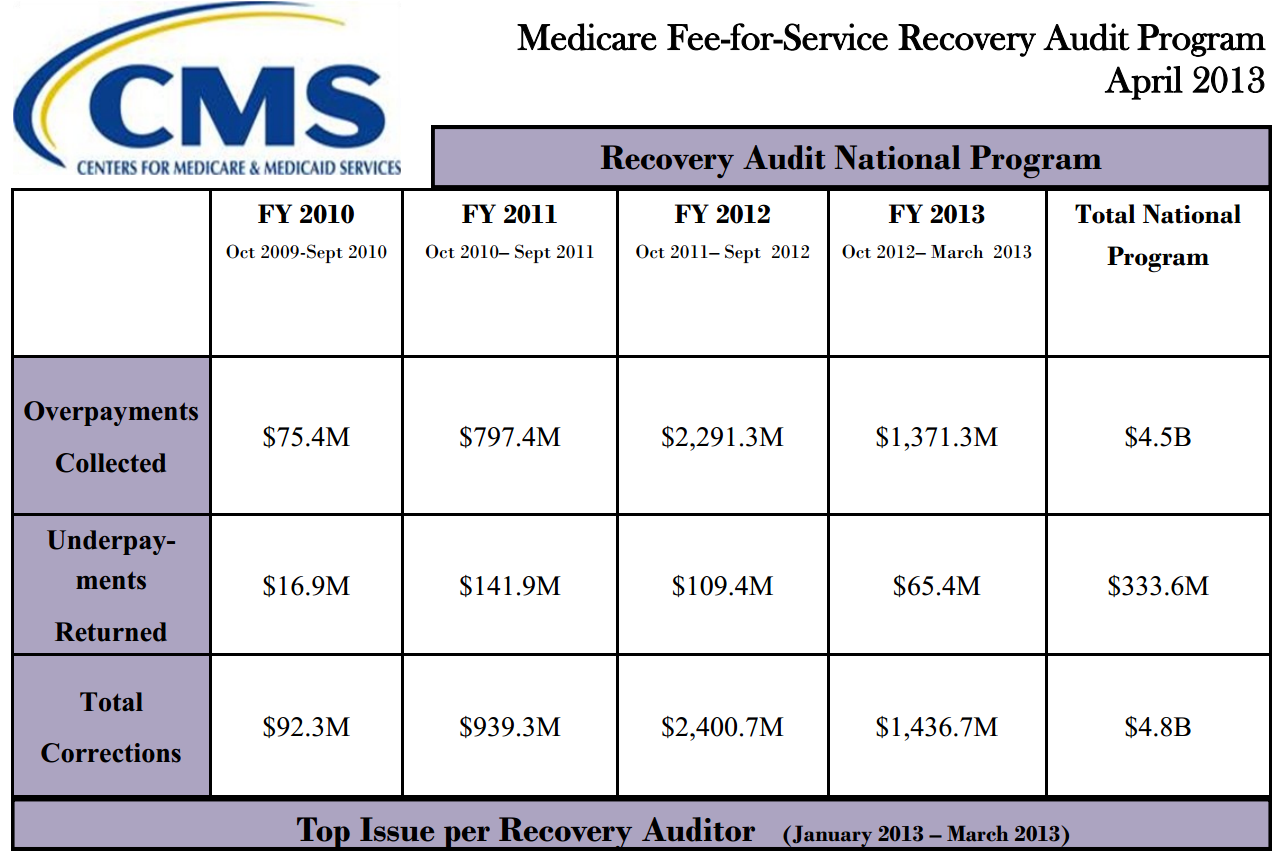

Apr 13, 2021 · What is a RAC Audit? RAC audits are run by the Centers for Medicare and Medicaid Services (CMS). Their goal is to uncover improper Medicaid and Medicare claim payments and get the money back. RAC auditors have collected back over $2 billion for CMS.

What does RAC stand for?

Dec 01, 2021 · Refers any potential fraud findings identified during the auditing process to the Medicare Drug Integrity Contractor. RACs are paid on a contingency basis. They only collect payment improper payments recovered by CMS. Sponsors may appeal RAC findings (see the Part D RAC Appeals section).

What triggers RAC audits?

RAC audits are not one-time or intermittent reviews and can be triggered by anything from an innocent documentation error to outright fraud. They are part of a systematic and concurrent operating process that ensures compliance with Medicare's clinical payment criteria, documentation and billing requirements.

What are RAC audits looking for?

They look for improper payments RAC looks for both overpayments made to patients and underpayments made to providers. While many RAC audits do uncover fraud, it is important to note that innocent mistakes or errors in documentation can also trigger an audit.Nov 29, 2016

What triggers a Medicare audit?

What Triggers a Medicare Audit? A key factor that often triggers an audit is claiming reimbursement for a higher than usual frequency of services over a period of time compared to other health professionals who provide similar services.

What does RAC audit stand for?

recovery audit contractorRAC is an acronym for recovery audit contractor. RAC represents an effort to audit health care providers on behalf of Medicare and Medicaid in order to identify improper payments made on claims of health care services provided to Medicare beneficiaries.Apr 2, 2017

What is a Medicare RAC review?

What does a Recovery Audit Contractor (RAC) do? RAC's review claims on a post-payment basis. The RAC's detect and correct past improper payments so that CMS and Carriers, FIs, and MACs can implement actions that will prevent future improper payments.Dec 1, 2021

How do I prepare for a RAC audit?

Here are five ways you can prepare.Perform an Internal Audit. This action will help you to determine the likelihood of coding and billing mistakes within your company.Identify and Correct Coding/Billing Issues. ... Review Problem Areas. ... Check Documentation. ... Find Assistance.Mar 31, 2021

What happens if you fail a Medicare audit?

If you fail to comply with the request, you will not receive reimbursement for the submitted claims. Even if you comply but the documentation doesn't support what you billed for, you won't get reimbursement.Jan 6, 2015

How far back can Medicare audit go?

three yearsMedicare RACs perform audit and recovery activities on a postpayment basis, and claims are reviewable up to three years from the date the claim was filed.Nov 1, 2015

How long do Medicare audits take?

After the provider is “targeted” using data analytics, the MAC performs up to three rounds of "probe and Educate." Each round takes about 90 days—30 days for MAC to review the claims, a few days to schedule an educational call, 45 days for providers to show improvement—and is centered around a one-on-one educational ...Jan 17, 2018

Why do CMS and RAC auditors have the right to access your medical records?

RAC auditors will usually request medical records to complete the audit. For example, they may request medical records that detail a more complex procedure to ensure you were paid correctly for the services you provided.Apr 13, 2021

What are CMS audits?

These program audits measure a sponsoring organization's compliance with the terms of its contract with CMS, in particular, the requirements associated with access to medical services, drugs, and other enrollee protections required by Medicare.

Compliance

The burden of compliance is the responsibility of healthcare providers. Outside of basic written guidelines, Medicare will not provide any specific guidance to the physician or provider.

RAC Fees

RAC contracts fees are contingency-based, so auditors have every incentive to discover errors. RAC contingency fees vary and are established during contract negotiations with CMS.

What is RAC audit letter?

If your practice receives a RAC audit notification letter, it’s generally to investigate suspicion of an improper payment on a claim (either an overpayment or an underpayment). RAC auditors will usually request medical records to complete the audit. For example, they may request medical records that detail a more complex procedure to ensure you were paid correctly for the services you provided. Medical records that don’t meet the criteria for medical necessity or claims that contain CMS coding violations could uncover an overpayment. In these cases, you could be required to send the money you previously received back to CMS.

How long does it take to get an overpayment letter from the RAC?

After receiving a demand letter, you are required to call the RAC within 15 days to discuss how you plan to proceed. In response to an overpayment demand letter, you essentially have three options:

How to appeal overpayment?

If the audit of your records determines you received an overpayment, you will receive an overpayment demand letter from the RAC. After receiving a demand letter, you are required to call the RAC within 15 days to discuss how you plan to proceed. In response to an overpayment demand letter, you essentially have three options: 1 Pay it in full 2 Request an extended repayment schedule 3 File an appeal

Who is Jody Erdfarb?

Just make sure to stay on top of the deadlines because if you miss one, you’re out of luck. Healthcare attorney, Jody Erdfarb, JD, can help you prepare for a RAC audit and appeal during her online training. Jody will help you be better prepared should you be targeted for a RAC audit.

What to do if you disagree with a demand letter?

If you disagree with the overpayment demand letter you received, you have the option to appeal the findings. There are five different levels of appeals, and each one has its own set of deadlines that you must adhere to.

What is RAC audit?

What Are Recovery Audit Contractor (RAC) Audits? Also known as a Medicare audit or a MAC audit, the Recovery Audits Contract (RAC) program is an aggressive campaign seeking reimbursement from healthcare service providers. These audits have become increasingly frequent over the past few years, and they will continue to for the foreseeable future.

What to do if you are subject to a RAC audit?

If you are subject to a RAC audit, make sure to make an informed decision selecting an attorney. You’ll need an experienced team well versed in this subject to effectively refute fraud claims, especially in complex RAC audits.

What is Medicare Recovery Audit Contractor?

These include services that are deemed “not reasonably necessary.”

What is automated review?

These audits, also known as automated reviews, aim to search for and identify any suspicious claims from healthcare providers. They use proprietary algorithms to ensure compliance and that healthcare providers aren’t charging or claiming funds incorrectly.

How long does Medicare Part D RAC take?

The Medicare Part D RAC will allow the plan sponsor a period of 60 or 90 days (90 days if prescriptions are requested) to provide additional information to refute all or some of the RAC’s findings. The RAC will not factor into the improper payment calculation any documentation it receives after this timeframe, and the RAC will render a decision based only on the data and the PDE records that plan sponsors submit during the appropriate timeframe. Once the RAC finalizes a decision and the DVC validates and concurs with this decision, plan sponsors will receive a Notification of Improper Payment (NIP).

What does the DVC need to validate RAC findings?

Further, the DVC must validate the RAC's improper payment findings before the RAC is permitted to actively pursue overpayments from sponsors.

What is CMS CPI?

The CMS Center for Program Integrity (CPI) serves as CMS' focal point for all national and state-wide Medicare and Medicaid programs and CHIP integrity fraud and abuse issues. Identifying and preventing improper payments in Medicare Parts C and D is central to that work. CMS/CPI manages the Medicare Part D RAC program as a component of that goal.

What is a CMS/CPI audit?

CMS/CPI determines the specific criteria on which the Part D RAC must review audit packages. To direct the RAC's review, CMS/CPI mandates review of files that fall within a particular year and contract for a particular plan. CMS/CPI further defines the audit scope to include the exact audit issue to be reviewed. Additional audit topics may be proposed to reflect results of studies that have been highlighted as problem areas by the U.S. Department of Health and Human Services (HHS), the HHS Office of the Inspector General and the U.S. Government Accountability Office.

What is a NIP in Medicare?

The NIP indicates the audit issue being reviewed, the applicable laws, the amount of the overpayment, how it was calculated and the plan sponsor’s appeal rights. The Improper Payment Exception Report, an encrypted file sent with the NIP, will include the PDE records associated with the identified improper payment.

What is an improper payment?

An Improper Payment is defined as any payment to the wrong provider for the wrong services or in the wrong amount. The IPRP contains the audit issue, audit year and contract number along with supporting documentation identifying the impacted PDE records that support improper payment findings.

When will CMS resume medical review?

August 05, 2020 - CMS recently resumed medical review activities, including pre- and post-payment reviews conducted by Medicare Administrative Contractors (MACs) and Recovery Audit Contractors (RACs), which were paused earlier this year due to the COVID-19 public health emergency.

Is there a backlog in Medicare appeals?

The Medicare appeals backlog has been a priority for HHS ever since the Government Accountability Office reported in 2016 that the increasing number of pending appeals showed “no signs of abating,” particularly at higher levels of the appeals process.

What Are Recovery Audit Contractor (RAC) Audits?

- Also known as a Medicare audit or a MAC audit, the Recovery Audits Contract (RAC)program is an aggressive campaign seeking reimbursement from healthcare service providers. These audits have become increasingly frequent over the past few years, and they will continue to for the foreseeable future. Whenever a healthcare facility gets hit with a Recov...

A Quick History

- The Medicare Recovery Audit Contractor program started in 2005 and was created as part of the Medicare Integrity Program from the Centers for Medicare and Medicaid Services (CMS). The objective of this program is to discover any improper payments that are charged for uncovered services. These include services that are deemed “not reasonably necessary.” The RAC audits al…

Remediation and Protection Procedures

- These days, healthcare service providers have become increasingly concerned about Medicare RAC audits. It’s easy to see why. Some hospitals have millions of dollars’ worth of claims, and all of these could suddenly go under appeal at any second. Hospitals already face having to reduce profit margins due to low reimbursement rates and higher costs. An RAC audit could have devas…

Compliance

- Medicare already has specific guidance in place for every healthcare provider and physician. Outside of that, it won’t provide any more guidance. To keep yourself in the best position possible, your practice needs to have a system that monitors coding and documentation for compliance. You will also need to have an effective framework for keeping track of all RAC requests. Of cour…

RAC Fees

- The fees for RAC audits are generally based on contingency, as explained earlier. This provides an additional incentive for auditors to find errors. Note that while these fees are contingency-based, they will depend on contract negotiations directly with the CMS. The fee structure generally follows: Region A:12.45% States:Connecticut, Delaware, District of Columbia, Maine, Maryland, …

Conclusion

- If you are subject to a RAC audit, make sure to make an informed decision selecting an attorney. You’ll need an experienced team well versed in this subject to effectively refute fraud claims, especially in complex RAC audits.