What is the best Medicare Supplement?

| Plan K | Plan L | |

| Medicare Part A coinsurance | 100% | 100% |

| Medicare Part B coinsurance | 50% | 75% |

| Blood (3 pints) | 50% | 75% |

| Part A hospice care coinsurance | 50% | 75% |

What are the top 5 Medicare supplement plans?

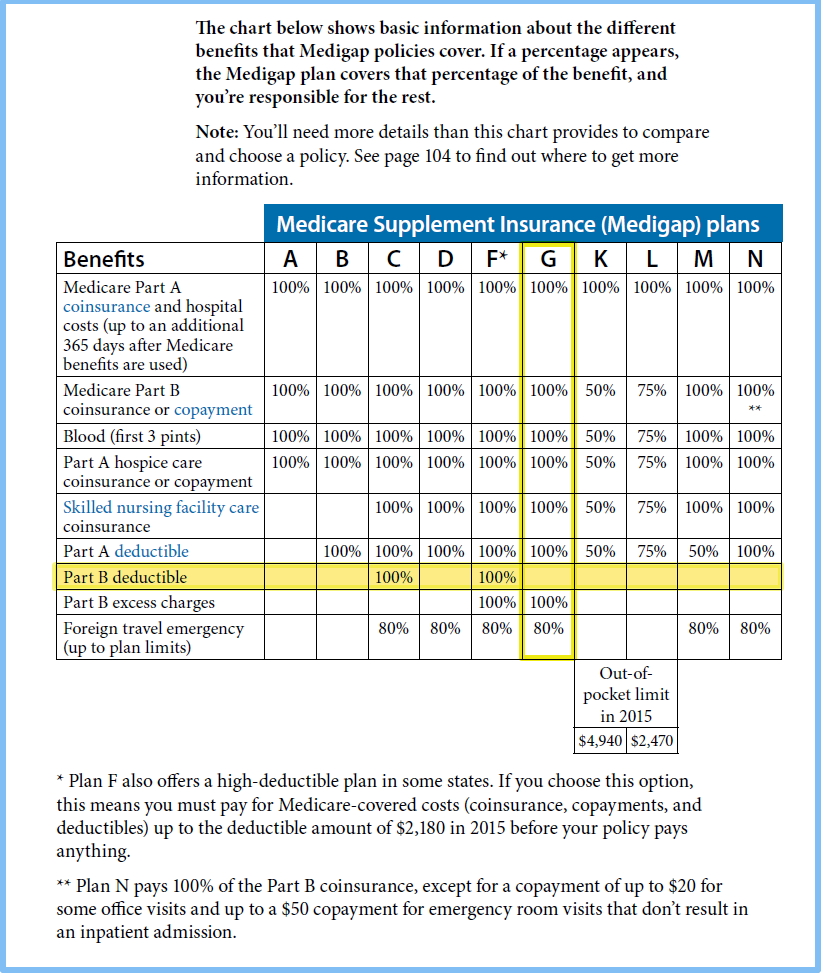

Jan 20, 2022 · 80%. 80%. 80%. 80%. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,490 in 2022.

What is the best and cheapest Medicare supplement insurance?

Apr 23, 2022 · All Medicare supplement plans come with different monthly premiums. You can compare 15+ different insurance companies instantly for free by filling out our quoter. Keep in mind Medicare supplement rates are not locked in for life like other types of insurance. Every Medicare supplement plan raises rates every year, albeit at a small amount.

How to pick the best Medicare supplement plan?

Mar 09, 2022 · before the plan begins to pay. Once the plan deductible is met, the plan pays 100% of covered services for the rest of the calendar year. High deductible plan G does not cover the Medicare Part B deductible. However, these plans credit your payment of the Medicare Part B deductible (but not the foreign travel deductible) towards meeting

How much does Medicare supplement insurance cost?

If Medicare Supplemental Insurance Rates are similar with several different companies, you should keep in mind the financial standing and reputation of each company and go with the one that is the most secure. For those with very limited incomes, a supplemental insurance plan may be financially hard to maintain. If that is the case for you ...

What is the supplemental Medicare rate?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization. Several factors impact Medigap costs, including your age and where you live.

How much do Medicare supplements increase each year?

between 3% and 10% per yearMedicare supplement rate increases usually average somewhere between 3% and 10% per year. And sometimes Medicare supplement rate increases even happen twice in the same year!7 days ago

What are the top 3 Medicare Supplement plans?

Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold). Here's an in-depth look at this trio of Medicare Supplement plans, and the reasons so many people choose them.Sep 25, 2021

What is the most comprehensive Medicare Supplement plan?

Overview. Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

Does Plan G have a deductible?

Plan G also covers some of the expenses related to your Medicare policy. For example, Medicare Part A has a deductible of $1,408. If you don't have Plan G, then you'll pay that deductible out of pocket. But with Plan G coverage, your health insurer would pay for the entire deductible.Jan 24, 2022

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the least expensive Medicare Supplement plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.Mar 16, 2022

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Does Plan N cover Medicare Part B deductible?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor's office and emergency room visits.Nov 23, 2021

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

Is Medicare Plan G good?

Is Medicare Plan G worth it? Absolutely, Plan G is worth the cost because it covers the expenses you'd otherwise pay. The policy is especially beneficial when your health starts to decline or when you need routine care.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

How do insurance companies determine their rates?

Insurance companies use different pricing structures to determine rates 1 Community-rated plans charge the same rate for every plan member, regardless of age. For example, a 75-year-old Medigap beneficiary with a community-rated plan will pay the same rate as a 65-year-old beneficiary with the same plan. 2 Issue-age-rated plans have rates based on the age at which you purchased the plan. Your premium rate will be fixed and it won’t change as you age. While your initial Medigap rate could be higher than a community-rated plan, it could potentially cost less in the long term. 3 Attained-age-rated plans have rates that increase as you age. As you get older, your Medigap rate will gradually go up.

How long does it take to enroll in Medigap?

Your Medigap Open Enrollment Period starts as soon as you are at least 65 years old and enrolled in Medicare Part B. During the six months of your Medigap OEP, insurance companies cannot deny you a Medigap plan or charge you higher plan premiums based on your health.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

What is community rated health insurance?

Community-rated plans charge the same rate for every plan member, regardless of age. For example, a 75-year-old Medigap beneficiary with a community-rated plan will pay the same rate as a 65-year-old beneficiary with the same plan. Issue-age-rated plans have rates based on the age at which you purchased the plan.

Does Medigap offer discounts?

Some insurance companies may offer Medigap plan discounts for women, non-smokers, married couples, those who pay their premium for the entire year and more. Be sure to ask your plan provider if they offer any discounts before you sign up for a Medigap plan.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

Do you have to pay Medicare premiums if you are 65?

Part A covers inpatient hospital services, as well as care in a hospice or skilled nursing facility and some home health care expenses. Most people don’ t have to pay a premium for Part A ( premium-free Part A), but if you’re 65 and you didn’t pay the Medicare tax for 10 years or more, you may have to pay a premium.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

What is Plan F?

Plan F. Plan F is the most extensive Medicare Supplement Insurance plan available. It covers everything the other plans cover, in addition to 100% of Medicare Part B excess charges. Plan F also covers 80% of medical emergency expenses when you travel outside of the country.