Does the Senate Republicans’ plan end Social Security and Medicare?

The Democratic Senatorial Campaign Committee claimed that the "Senate Republicans’ plan" would "end Social Security" and "end Medicare." The ad refers not to a plan from Senate Republicans but from one Republican, Scott. The plan would sunset all federal laws after five years, requiring Congress to renew the laws it wants to keep.

Why do Republicans want to get rid of Medicare?

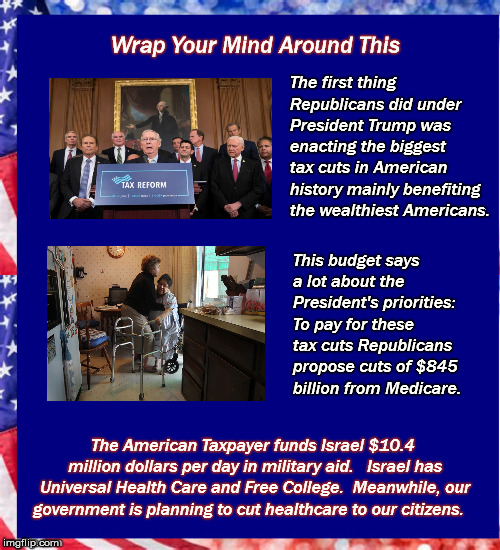

“The Republicans have run enormous deficits up to provide tax cuts to big corporations, millionaires and billionaires,” he said. “Now that we have this deficit problem that we caused with our tax bill, they turn around and they say they got to get rid of Medicare, Medicaid and Social Security.”

Did Rick Scott say ‘no plan to eliminate Medicare and Social Security’?

He added, “There is no ‘plan’ put forward by the Republican Party to eliminate Medicare and Social Security.” In the same “Fox News Sunday” interview featured in the DSCC ad and tweet, Scott went on to say that he had no intention of eliminating Social Security, Medicare or Medicaid.

How much will Medicare and Medicaid be cut under Trump’s plan?

Specifically, there would be a $1.5 trillion cut to Medicaid and the ACA and a $537 billion cut to Medicare under the plan. “Absent reform, reality will be harsh,” House Budget Committee Chairman Steve Womack said in June. “In fact, it’s not a matter of if but when programs will be unable to fulfill their promise.”

Who is the Republican who slashed Social Security?

Robert Reich explains the longtime Republican plan to slash Social Security, Medicare and Medicaid.

What do Paul Ryan and Republicans want to do?

Paul Ryan and Republicans want to give tax breaks to the rich and make the middle class & the poor pay for those tax breaks by increasing their taxes AND cutting Social Security, Medicare, and Medicaid.

How much debt did the Bush administration have?

Under president Bush, Republicans ran up a huge debt of 10 Trillion Dollars. Now, they want to balance the budget on the backs of the poor and middle class, by cutting food stamps, social security, medicare and medicaid while refusing to cut military spending.

How many people would lose health insurance?

Lawrence O’Donnell talks to Ezra Klein about the “catastrophic” CBO report – which estimates 22 million people would lose health care coverage – and GOP Rep. David Jolly shares his personal story of what happened when he found himself unemployed and uninsured. (June 26, 2017)

Did the Senate GOP draft a secret health care bill?

Senate GOP drafted a secret, partisan health care bill behind closed doors, refusing any meaningful bipartisan input on the bill and refusing to hold any hearings on this legislation that would impact one sixth of our economy. Senate Democrats today urged the GOP to reverse course on this tactic and release to the public the legislation that would impact the health and bottom lines of millions of Americans. (Jun 13, 2017)

Will Trump cut Medicare?

Despite Trump’s promises NOT to cut Medicare, Medicaid & Social Security, that is exactly what he intends to do IF he is re-elected in 2020.

Did Democrats succeed in keeping the benefit cuts out of the short term fiscal cliff?

Democrats in Congress succeeded in keeping these devastating benefit cuts out of the short-term “fiscal cliff” deal. Unfortunately, important leverage was also lost. Washington’s well-financed anti-entitlement lobby continues to pretend that “shared sacrifice” means that if a millionaire loses a tax break (which he or she doesn’t need and America can’t afford) then the middle-class and poor must also pay more for or risk losing their health care benefits in Medicare and Medicaid. [Source: http://ncpssm.org/EntitledtoKnow/entryid/1962/Cutting-Medicare-Medicaid-Social-Security-in-the-113th-Congress]

When did the Cares Act expire?

The pandemic-related deficits are mainly temporary. Congress enacted the CARES Act in March 2020, which offered temporary relief mainly to families, unemployed workers and closed business. Most of its provisions expired in the second half of 2020. The newly elected Congress then enacted the American Rescue Plan in March 2021.

What was Donald Trump's signature legislative achievement?

Donald Trump’s signature legislative achievement was the Tac Cuts and Jobs Act of 2017. It showered trillions of dollars on highly profitable corporations and the richest American households that had seen the largest economic gains in the wake of the Great Recession from 2007 to 2009. Moreover, many provisions of this tax legislation are now permanent fixtures of the tax code and many temporary ones, such as tax cuts for high-income earners will likely become permanent, if past supply-side tax cuts are any indication.

What are the temporary fiscal interventions of 2020 and 2021?

The temporary fiscal interventions of 2020 and 2021, which the senators opposed, provide a much higher bang for the buck than the long-term budget busting trickle-down tax cuts of 2017, which many supported.

What are the immediate benefits of a tax increase?

The immediate benefits are less inequality and better health outcomes, both of which ultimately support stronger economic growth. Improving revenues for these programs by, for example, increasing payroll taxes on the top income earners will ultimately result in stronger growth and shrinking federal deficits.

Is the program cutting push for a balanced budget wrong?

The program-cutting push for a balanced budget ignores two key aspects of fiscal policy. First, it matters whether fiscal interactions create temporary or permanent deficits and second, it matters whether the spending or tax cuts underlying the deficits resulted in faster growth. On both counts, using the pandemic-related fiscal measures to justify cuts for Social Security, Medicare and Medicaid is wrong.

Does the Cares Act help the economy?

In contrast, the CARES Act offered much needed relief amid the worst unemployment crisis since the Great Depression, while it helped to stem the tide on declining economic growth. And experts predict that ARPA will boost economic growth to its highest rate in decades.

Is a balanced budget a public goal?

But a balanced budget is a completely arbitrary public finance goal. A country that has strong growth amid historically low interest rates can and will shrink its debt burden – defined as either the ratio of debt to gross domestic product (GDP) or as the share of interest payments out of GDP.

Why did Matt Gaetz vote to allow Medicare cuts?

Matt Gaetz (R-FL) said in a statement that he voted to allow the cuts because the bill "fails to address the financial needs of our country now, in real time [... and] allows Medicare to circumvent the rules to add on to an already unbalanced budget.".

Why was the American Rescue Plan enacted without a Republican vote?

The legislation was necessary because the $1.9 trillion American Rescue Plan — enacted without a single Republican vote — relied on deficit spending. Under the 2010 Statutory Pay-As-You-Go Act, that relief package automatically triggered cuts to Medicare, farm subsidies, and other programs.

What was the effect of the 2010 Pay As You Go Act?

Under the 2010 Statutory Pay-As-You-Go Act, that relief package automatically triggered cuts to Medicare, farm subsidies, and other programs. According to an estimate by the Congressional Budget Office, this would have resulted in $36 billion in Medicare reductions and tens of billions in cuts to other things.

Did the GOP vote to let the cuts happen?

But rather than fix it, the GOP lawmakers on Tuesday voted to let the cuts happen.

Will Medicare be cut in 2031?

Tuesday's legislation will prevent those automatic Medicare cu ts for this year, but extend the deficit reduction provisions by an extra year — leaving them in place until the 2031 budget. On March 19, the House passed a bill by Budget Committee Chair John Yarmuth, to prevent all of the automatic budget cuts triggered by the law.

What are the causes of the shortfall in Medicare?

The trustees of Social Security and Medicare say that an aging Baby Boomer population, combined with lower fertility rates amongst younger generations are contributing to the funding shortfall.

When will Medicare become insolvent?

Experts say the cost of Medicare and Social Security will become insolvent within the next two decades. Medicare will become insolvent in 2026, according to the program’s trustees, and trust funds for Social Security will be depleted by 2034.

Who said cuts to entitlements are needed to tackle the deficit?

Stivers was echoing the sentiments of party leaders like House Speaker Paul Ryan and Senate Majority Leader Mitch McConnell, who argue that cuts to entitlements are needed to tackle the deficit. “Frankly, it’s the health care entitlements that are the big drivers of our debt.

How much was spent on Social Security in 2018?

In fiscal year 2018, nearly half ($1.95 trillion) of federal spending was directed toward the major entitlement programs: $977 billion was spent on Social Security, $585 billion on Medicare and $389 billion on Medicaid.