How are Social Security and Medicare wages calculated?

What counts as Social Security wages?

What are Medicare wages on w2?

Why are Medicare and Social Security wages different?

Are Medicare wages the same as gross wages?

Are Social Security wages gross income?

What are Social Security wages on my W-2?

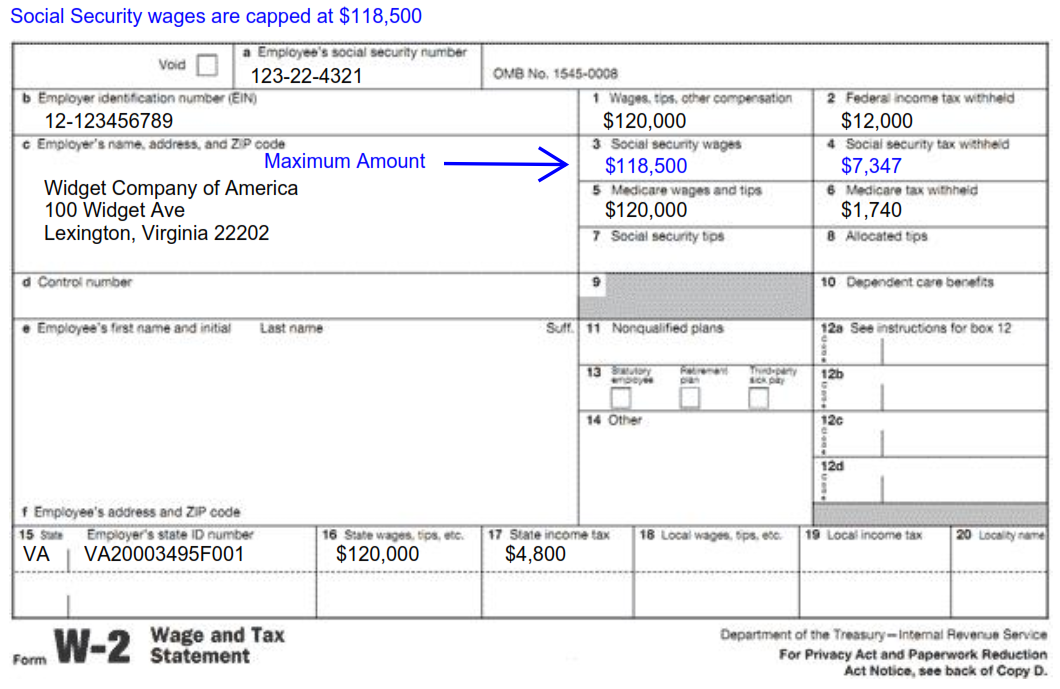

Box 3 on the W-2 form shows the total wages an employee received that are subject to the Social Security tax. Each year, the Internal Revenue Service sets a maximum amount of income that is subject to the Social Security tax. For 2019, the taxable wage base limit is $132,900.

What is the difference between wages and Medicare wages on W-2?

Why does my W-2 not have Social Security wages?

Why is my Social Security wages higher than wages?

Why is Medicare wages higher than wages?

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the wage base limit for Social Security in 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the difference between Social Security and Medicare?

Self-employed persons are responsible for both the employee and employer portions. Social Security involves retirement and disability benefits. Medicare involves health care for people 65 years of age and older.

How much is Medicare payroll tax?

Medicare Payroll Tax. The Medicare payroll tax is 1.45% and is based on each employee's earnings without limit. The Medicare tax is withheld from each employee's earnings and is also matched by the employer. This makes the total Medicare tax equal to 2.9% on every dollar of earnings.

What is the Social Security payroll tax rate for 2021?

In the calendar year 2021, the Social Security payroll tax rate of 6.2% is applied to each employee's earnings up to the maximum of $142,800. The 6.2% that is withheld from the employee is also matched by the employer. As a result, the total Social Security tax in 2021 for an employee is equal to 12.4% of each employee's annual earnings up ...

What is the FICA rate for Social Security?

The combination of Social Security taxes and Medicare taxes is referred to as FICA. We often refer to the FICA tax rate as 7.65% (6.2% Social Security + 1.45% Medicare) of each employee's first $137,700 of annual earnings in 2020 and the first $142,800 of annual earnings in 2021. Each employee's earnings in excess of the annual ceiling amount are taxed only for Medicare at 1.45% for the employee and 1.45% for the employer. (However, there is also an Additional Medicare Tax that is withheld from high income employees' pay, but the employer does not match the Additional Medicare Tax amounts.)

What is the FICA rate?

FICA Payroll Tax. The combination of Social Security taxes and Medicare taxes is referred to as FICA. We often refer to the FICA tax rate as 7.65% (6.2% Social Security + 1.45% Medicare) of each employee's first $137,700 of annual earnings in 2020 and the first $142,800 of annual earnings in 2021. Each employee's earnings in excess ...

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

What is the Social Security tax rate for 2021?

For 2021, the rate for the Social Security tax is 6.2% for the employee and 6.2% for the employer, or 12.4% total—the same as 2020. The tax applies to the first $142,800 of income in 2021. The Social Security tax rate is assessed on all types of income that an employee earns, including salaries, wages, and bonuses. 4 .

What is the maximum Social Security tax for self employed in 2021?

5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . ...

What is the Medicare tax rate for 2021?

In 2021, the Medicare tax on a self-employed individual’s income is 2.9%, while the Social Security tax rate is 12.4%. 5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically ...

Do self employed people pay Medicare?

Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically pay half of these taxes. But they are allowed to deduct half of their Medicare and Social Security taxes from their income taxes. 6 .

What is Social Security wages?

What Are Social Security Wages? Social Security wages are an employee’s earnings that are subject to federal Social Security tax withholding ( 6.2% for the employer and 6.2% for the employee for the 2020 tax year). Employers must deduct this tax even if the employee doesn’t expect to qualify for Social Security benefits.

What is gross income?

Gross income is the total of all compensation from which the amount of taxes and other withholdings are calculated. Social Security wages are based on the gross income and have specific inclusions (as listed above) and exclusions (as listed below).

How much tax do you pay on Medicare?

There are no tax limits for Medicare. You will pay taxes at a rate of 1.45% on all of your taxable wages. In addition, employers are required to withhold Additional Medicare tax of 0.9% once taxable wages are over $200,000 for the year.

How much does Bob earn?

Bob is paid semi-monthly. On this paycheck, he earned $8,000 in salary. Bob gets a semi-monthly auto allowance of $1,000. He has a medical deduction of $1,500, and he contributes 10% of his income to his 401k.

Who is Matthew Keller?

Matthew Keller is a Senior Payroll Specialist at Zenefits who authors our "Money Matters" column. With 20+ years of experience in payroll and accounting, Matt wants to help customers navigate frequent law changes, taxes, and more.