The funds for the program come from a few different sources, with the primary source being FICA payroll taxes. These taxes are in addition to the 6.2% Social Security tax or OASDI

Social Security

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance program and is administered by the Social Security Administration. The original Social Security Act was signed into law by President Franklin D. Roosevelt in 1935, and the current version of the Act, as amended, encompasses several social welfare and social insurance programs.

How to calculate Medicare and Social Security tax?

Social Security And Fica

- The Social Security portion of FICA is 6.2% of the maximum taxable wages.

- If you reach the maximum payment, you do not pay any more Social Security tax until the next calendar year.

- The maximum taxable wage for Social Security is adjusted each year. ...

What is the percentage for Social Security and Medicare tax?

What Percentage Is the Social Security Tax?

- Total Social Security Tax. The Social Security tax rate is 10.4 percent for the tax year 2012. ...

- Employer Contributions. If you work for an employer, the employer must pay 6.2 percent and the employee must pay 4.2 percent.

- Self-Employed Workers. ...

- Medicare Tax. ...

- Medicare Tax Rate. ...

- 2013 Additional Medicare Tax. ...

How much is Social Security and Medicare tax?

Social Security and Medicare taxes together are commonly referred to as the “FICA” tax. This is a 7.65% tax both employees and employers pay into the FICA system. Your FICA tax gets ...

What percentage is Social Security and Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers.

What tax is used to fund Social Security?

payroll taxSocial Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

How is Medicare and Social Security funded?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

Which type of tax is taken out of each paycheck and includes Medicare and Social Security taxes payroll sales Property Corporate income?

FICA taxes support Social Security and Medicare. Employees pay Social Security tax at a rate of 6.2% with a wage-based contribution limit and they pay Medicare tax at 1.45% without any cap.

Are income taxes used for Social Security and Medicare?

We use the Social Security taxes you and other workers pay into the system to pay Social Security benefits. You pay Social Security taxes based on your earnings, up to a certain amount. In 2022, that amount is $147,000. You pay Medicare taxes on all of your wages or net earnings from self-employment.

Is Medicare funded by taxes?

Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

What do federal taxes pay for?

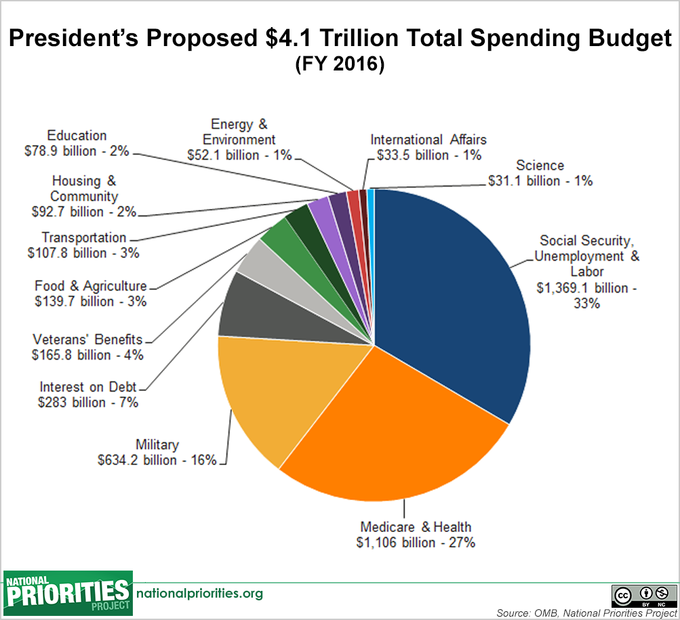

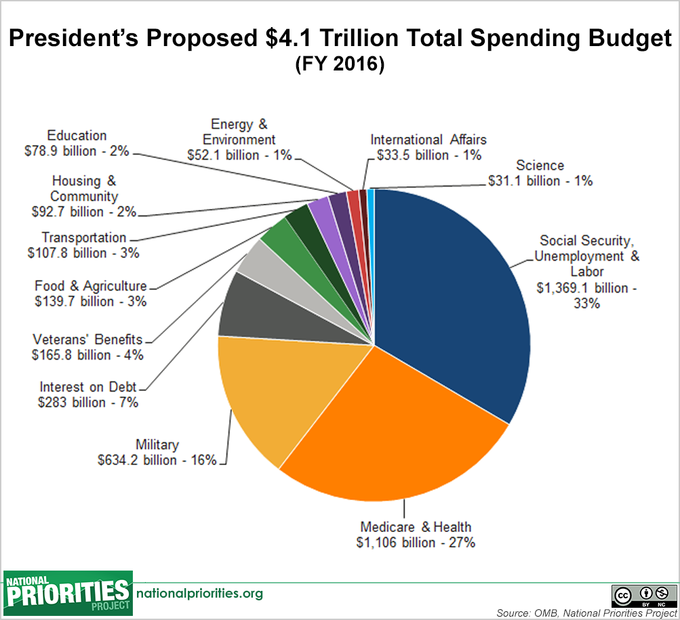

As you might have expected, the majority of your Federal income tax dollars go to Social Security, health programs, defense and interest on the national debt. In 2015, the average U.S. household paid $13,000 in Federal income taxes.

What are the 3 types of taxes?

Tax systems in the U.S. fall into three main categories: Regressive, proportional, and progressive. Two of these systems impact high- and low-income earners differently.

Which type of tax is taken out of each paycheck and includes Medicare and Social Security taxes payroll sales property corporate income Brainly?

FICA tax. Federal Insurance Contributions Act (FICA) tax is made up of Social Security and Medicare taxes. Both the employee and employer contribute to FICA tax equally. Social Security tax is 6.2% of an employee's income if it is at or below the Social Security wage base.

What is direct & indirect tax?

While direct taxes are imposed on income and profits, indirect taxes are levied on goods and services. A major difference between direct and indirect tax is the fact that while direct tax is directly paid to the government, there is generally an intermediary for collecting indirect taxes from the end-consumer.

Where does the money for the Social Security fund come from?

Social Security benefits are paid from the reserves of the Old-Age, Survivors, and Disability Insurance ( OASDI ) trust fund. The reserves are funded from dedicated tax revenues and interest on accumulated reserve holdings, which are invested in Treasury securities.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee's paycheck or paid as a self-employment tax.

Who pays a FICA tax?

EmployersEmployers and employees both pay FICA taxes. You cannot opt out of paying FICA taxes. FICA funds Social Security programs that include survivors, children and spouses, retirement, and disability benefits. The amount of FICA tax withheld from your paycheck depends on your gross wages.

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

What is Medicare Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and. Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

How many people did Medicare cover in 2017?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

What is the threshold for Social Security?

An income threshold is set every year for the Social Security tax withholding. Once a worker reaches that limit, the deductions cease for the remainder of the year. While that may sound like good news, the flip side is that earnings above the threshold are not included in earnings toward the benefit. Looking at the Social Security wages column on your W-2 Form, you may also notice that any pretax benefits such as medical, dental or vision care premiums are excluded from the earnings factored into your benefits. For 2019, earnings beyond $132,900 are not subject to the SS payroll tax. There is no limit set for Medicare tax deductions.

How many credits do you need to get Social Security?

With the exception of survivor and disability beneficiaries, the requirement for most people is a minimum of 40 credits earned over the course of their working life. In 2019, $1,360 is worth one credit, and up to four credits may be earned per year. However, it is important to note that it is neither the earned credits nor the amount of taxes deducted by Payroll that factors into the benefit calculation. The benefit is based on average earnings over your life. That is why it is critical to review your annual earnings record for accuracy, which is accessible to those who register on the SSA website.

What is the purpose of tax dollars?

The majority of tax dollars helps to fund defense, Social Security, Medicare, health programs and social safety net programs such as food stamps and disability payments, along with paying off interest on the national debt. Here’s how it breaks down.

How much did the federal government spend on the federal government in 2018?

Total spending by the federal government in 2018 was $4.22 trillion. But some programs actually raised money, such as leases for the Outer Continental Shelf, which lowered the total 2018 outlay to $4.11 trillion. The majority of tax dollars helps to fund defense, Social Security, Medicare, health programs and social safety net programs such as food ...

Can you earmark your taxes?

Unfortunately, you can’t earmark your tax dollars to departments or programs you support. Your taxes go into the bigger pool contributed by everyone else and are allocated based on need and policy direction.

What is the tax withheld from payroll?

The simple answer is that the Social Security tax, which is withheld by payroll in accordance with law, is used to fund the Social Security program. In reality, it is a bit more complicated than that.

What is Social Security Disability?

The Social Security Administration describes Social Security as a U.S. program that offers protection against lost earnings as a result of retirement, death or disability. Under separate Social Security Act amendments, the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) programs were established. The OASI Trust Fund became effective in 1939 to provide retirement benefits for retirees and their families as well as survivors of deceased retired workers. The Disability Insurance Trust Fund was created in 1957 to fund reserves for disabled workers and their families.

How much is Social Security taxed in 2020?

The Social Security wage base is set at $137,700 in 2020. This means that you’ll pay the Social Security tax on 6.2% on your earnings up to $137,000. Your wages above that limit will not be taxed for Social Security. Medicare tax does not have an earnings limit, so you’ll be expected to pay the 1.45% tax on all your earnings.

What is FICA tax?

FICA taxes fund Social Security benefits and the Medicare program. (Getty Images) FICA stands for the Federal Insurance Contributions Act. This law outlines that taxes should be withheld from paychecks and used to fund the Social Security and Medicare programs. Both employees and employers are impacted by the FICA tax.

What is the FICA tax rate for 2020?

FICA taxes are divided into two parts: Social Security tax and Medicare tax. The Social Security tax rate is 6.2% of wages for 2020, and the Medicare tax rate is 1.45% of wages. Together, these make up a tax rate of 7.65% for FICA taxes.

How much do you pay for FICA?

You can calculate how much you’ll pay for FICA taxes by multiplying your salary by 7.65% , taking into account any exceptions or limits that might apply to your situation. For example, “If you earn $50,000, you will pay $3,825 as a FICA contribution,” Raynott says. This is found by multiplying the 7.65% rate by $50,000.

How many credits can you get from FICA?

Every year, you can receive up to four credits. Once you have earned at least 40 credits, you will be eligible to receive Social Security retirement benefits beginning at age 62. Paying FICA taxes also qualifies you for disability and life insurance benefits. If you become disabled, you may be eligible for Social Security disability benefits ...

When was FICA tax passed?

The law that created the FICA tax was passed in 1935 . The funds are used to provide a retirement savings and insurance program for working Americans. “FICA taxes are the primary funding source for Social Security benefits,” say Ben Dobler, a certified financial planner and founder of Stewardship Financial Counsel in Cincinnati, Ohio.

Do state employees pay FICA taxes?

Some state and local government salaries. State and local government employees in some states who are entitled to a pension may only be required to pay the Medicare portion of FICA taxes. If you are a religious employee, your organization could choose to claim an exemption from the FICA tax.