Which insurance companies sell the most Medicare supplements?

United World Medicare Supplement Insurance is available in 12 states:

- Nevada

- Nebraska

- Iowa

- Illinois

- Mississippi

- Tennessee

- Kentucky

- Indiana

- Michigan

- West Virginia

What are the top 10 Medicare companies?

Top 10 Medicare Supplement Insurance Companies

- Top 10 Medicare Supplement Insurance Companies in 2020. ...

- Top 10 Medicare Supplement Insurance Companies. ...

- Aetna in 2021. ...

- Anthem Blue Cross in 2021. ...

- Bankers Fidelity in 2021. ...

- Cigna in 2021. ...

- Manhattan Life in 2021. ...

- Mutual of Omaha in 2021. ...

- UnitedHealthcare in 2021. ...

- Transamerica in 2021. ...

What are the top Medicare supplement insurance companies?

- Medicare Advantage, also known as Part C is an alternative to Original Medicare.

- Medicare Advantage is run by private Medicare-approved insurance companies.

- Medicare Advantage is a bundle of Original Medicare, but provides more benefits than just Part A, Part B, and Part D (most plans), such as dental, hearing and vision, which ...

Who has the best Medicare supplement plans?

What are the Top 5 Rated Medicare Prescription Drug Plans for 2021

- SilverScript

- Humana

- Cigna

- Mutual of Omaha

- UnitedHealthcare

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Plans and Coverage: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Which Medicare Supplement plan is the most comprehensive?

Medicare Supplement Plan FMedicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Who has the cheapest Medicare supplement insurance?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022.

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

What is the most popular Medigap plan for 2021?

Medigap Plans F and GMedigap Plans F and G are the most popular Medicare Supplement plans in 2021. Learn more about other popular plans like Plan N and compare your Medigap plan options.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Is AARP UnitedHealthcare good?

Yes, AARP/UnitedHealthcare Medicare Advantage plans provide good coverage and have an average overall rating of 4.2 stars. The company stands out for cheap PPO plans that cost $15 per month on average. The downside is overall customer satisfaction trails behind other companies such as Humana and Anthem.

Is plan G better than plan F?

Ultimately, Plan G has the same benefits as the Plan F, except for coverage for the Part B deductible ($233 for 2022). Once you pay the Part B deductible, the coverage is the same for both plans.

How much does Humana Medicare Supplement cost?

between $120 and $314 per monthHow much does a Humana Medicare Supplement plan cost? The average cost for Humana Medicare Supplement Plan G (our recommendation for the best overall plan) is between $120 and $314 per month. For the cheapest coverage available to new enrollees, Plan K costs between $59 and $174 per month, on average.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Why is AARP the best Medicare supplement?

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older. This is especially helpful if you are still covered under your employer's insurance and may require coverage after the age of 65.

What Does a Medicare Supplement Plan Typically Cost?

Without providing detailed personal information, most providers are unable to release estimated costs. However, most plans begin in the range of $100 per month, and many providers offer discounts for a variety of qualifiers (such as being female or a non-smoker, or if you have more than one policy from that provider).

When Can I Buy a Medicare Supplement Plan?

When it comes to Medicare eligibility, you can buy a Medicare Supplement policy beginning on the first day of the month you turn 65, and for the following six months. Depending on the plan and state, however, people who are under 65 may qualify if they are permanently disabled. You may be subject to a medical underwriting examination, which is a detailed review of your medical history.

Is a Medicare Supplement Plan Worth It?

Yes. A Medicare Supplement plan can help cover what Medicare can’t—from prescription medicine to ER visits to extended stays in the hospital. Some even cover nursing care or facility stays. Depending on the plan you choose, you may have copays, for example, or extremely limited doctor visits. Even getting one ER visit covered can be a huge benefit financially.

How is Medicare Supplement Plan cost determined?

The cost of a Medicare Supplement plan is determined by the individual insurance company that sells it. When researching different companies, be sure to ask how they price their policies. 10 Learning which factors they base their pricing on will help you determine both the costs for you today and what to expect in the future if your health situation changes.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

When is the best time to buy a Medicare Supplement?

The best time to buy a Medicare Supplement policy is during your Initial Medicare Open Enrollment Period. This is a one-time only, six-month span when federal law allows you to sign up for any Medicare Supplement policy you want that is sold in your state. Preexisting conditions are accepted during this time period, and you can't be denied a Medicare Supplement policy or charged more due to past or present health problems. Make sure you know when your Open Enrollment Period starts. 12

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

When will Medicare Supplement Plan F be available?

Medicare Supplement Plan F and Plan C are not available for sale to Medicare beneficiaries who became eligible for Medicare on or after Jan. 1, 2020.

What is the deductible for Medicare 2021?

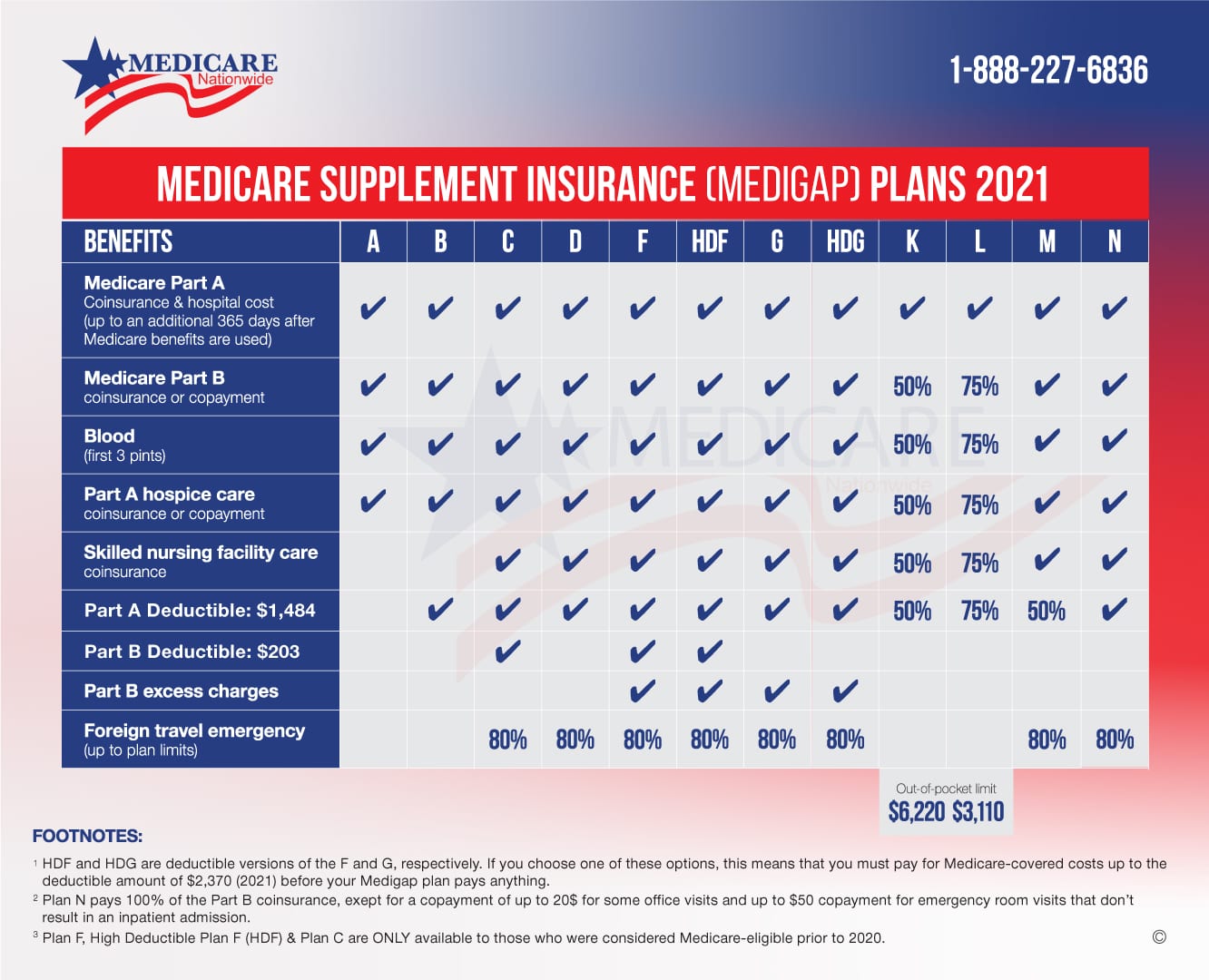

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

Does Aetna offer Medigap?

Aetna offers a diverse portfolio of insurance products that includes Medigap plans. Over 1 million people trust Aetna for their Medicare Supplement Insurance. 3. Aetna offers several different types of Medigap plans. Plan availability may vary based on your location.

Is Wellcare the same as Medigap?

It’s important to keep in mind that although each company’s plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of O maha Medicare Supplement Insurance plans come with an Additional Benefit Rider that may include services such as discounts on fitness programs, hearing care and vision care. Mutual of Omaha offers several types of Medigap plans. Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement Insurance ...

Which Medicare supplement has the highest premium?

You’ll find then that Plan F usually has the highest premiums, followed by Plan G and then Plan N. While there are 7 other Medicare supplement plans for sale, we seldom get requests for them because they cover less and so beneficiaries just have less interest in them.

What to know before comparing Medicare Supplements?

As we mentioned above, Medicare supplements are standardized. This means that a Plan G from one company has the same benefits as a Plan G from another company. However, financial ratings and rate increase histories will be different.

How many different Medicare plans does BCBS have?

BCBS has 7 different Medigap plans. The plans are A, F, G, K, L, and N. Alternatively, they offer a high-deductible version of Plan F. As mentioned, Plans K and L are offered however, these two Medicare supplements seem to have less interest from the general majority.

Why are Medicare benefits standardized?

After all, benefits are standardized so that the benefits for each plan letter are the same from company to company. Medicare supplement companies also pay your bills like clockwork because Medicare is the decision maker, so we never hear that any of them have slow-pay issues like the Medicare Advantage plans often do.

Why do seniors use Medicare Supplements?

Their Medicare Supplements are some of senior’s favorite products they offer. One reason this is, is because they offer guaranteed renewable coverage. Our clients like to use the My Coverage Portal to review policy info, check claims status and access other customer benefits.

Is Aetna a Medigap?

Aetna is one of the oldest carriers around, and this means stability. Likewise, they have been doing Medicare supplement business for over a decade. if Medigap insurance company ratings matter to you, then you can’t go wrong with Aetna. Currently they have an A rating with A.M. Best.

Is Blue Cross Blue Shield Medicare Supplements?

Blue Cross Blue Shield Medicare Supplements in 2021. Blue Cross Blue Shield is an established Medicare Supplement carrier. Founded in 1929, they have evolved into one of the leading insurance companies with nearly 1 in 3 Americans covered by them. BCBS has 7 different Medigap plans.

When Can I Purchase a Medicare Supplement Plan?

You can apply for a Medicare Supplement plan once you have enrolled in Medicare Part A and Medicare Part B. You must also be a citizen of the United States (for at least the past five consecutive years) and be 65 years of age or older. Those diagnosed with some specific physical conditions and those receiving disability benefits are also eligible (even before the age of 65). 11

How Do Medicare Supplement Plans Work?

Medicare Supplement Plans are designed to pick up the slack where Medicare payments leave off. Medicare Supplement policies are standardized by the federal (and some state) governments. This means that the benefits of each policy are the same, regardless of which company you select to purchase your policy from. The only real difference is what type of policy each company offers, the prices charged, and how the company determines rate increases. You can keep your own doctor with Medicare Supplement policies.

Can I Choose My Own Healthcare Providers With a Medicare Supplement Plan?

Each Medigap plan allows you to keep your doctors and hospitals (provided they accept Medicare payments). You can see any Medicare contracted physician and visit any contracted facility.

How Do I Know for Sure Which Plan Is Best for Me?

There are several factors to consider, including whether or not you will be able to buy a plan from a specific insurance company based on your personal situation (such as your age, the state you live in, your health, and more). Also, keep in mind that every state has its own regulations for the type of coverage that insurance companies must offer and how they approve or deny each applicant.

When does AARP insurance require coverage?

This is especially helpful if you are still covered under your employer's insurance and may require coverage after the age of 65. In states where insurers use an attained-age rating (a policy in which rates are based on your age at the time of enrollment), AARP can be competitively priced by offering discounts.

Is Manhattan Life Medicare Supplement a good insurance company?

Manhattan Life Medicare Supplement was also selected because of its long history in the insurance business; the company has been insuring Americans since 1850, marking perhaps one of the longest track records for a modern-day independent insurance company. With a B+ AM Best rating, it’s also a financially solid company. 7 The dental, hearing, and vision plan is not available in all states, and if you are over 85 you are not eligible for this coverage.

Do All Doctors Accept Medicare Supplement Plan Insurance?

Although most physicians do accept Medicare payments, there are some that do not . You must ask your health care provider about accepting Medicare assignment; this means that they will be willing to accept the amount Medicare pays for services. There are many reasons a doctor may refuse to take Medicare, including low reimbursement rates, administrative paperwork that must be done, and more.

What is Medicare Supplement 2020?

Top 10 Medicare Supplement Companies in 2020. As a senior, having a Medicare Supplement Insurance plan (also known as a Medigap plan) is a crucial step in taking care of your health care bills. This plan covers some or all of the expenses Original Medicare does not cover in Part A and B coverage. All the benefits under the plan are standardized, ...

How long does Medicare plan A last?

Plan A covers the basics, including Part A coinsurance and hospital care for 365 days after Medicare no longer works.

How many states does Humana have?

Since its creation in 1961, Humana has continued to thrive in the healthcare industry. The company has providers in 22 states in the country. You can enjoy Plan A, B, C, F, G, and K Medigap plans by Humana.

What are the benefits of Plan F?

Some of the benefits under the plans include: Plan F is comprehensive and covers all gaps, including Part B coinsurance, Part A and B deductibles, blood, hospice coinsurance, deductibles, and excess charges.

How many states does Blue Cross Blue Shield cover?

Blue Cross Blue Shield (BCBS) has coverage in 36 states in the United States. The company is one of the oldest providers, dating back to the 1980s. Some of the plans include Plan A, F, G, K, L, and N. Plan A covers basic benefits, including foreign emergency travel and nursing coinsurance.

Is Transamerica a good company?

Transamerica has been operations since the 1900s and has an A+ rating by A.M. Best. With such a strong rating, you can trust the company to deliver . Some of the plans on offer include Plan A, F, G, K, and N.

Does Plan G cover Part B?

However, Plan G doesn’t cover Part B deductible. Plan N also offers all coverage except Part B deductible and Part B excess charges. Like most companies, the plans have national coverage, the ability to see any doctor that accepts Medicare, guaranteed renewable, and a 30-day free look period. 10.

What is the best Medicare Supplement?

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

What is the most popular Medicare plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan. Plan G has 22% of the market, making it the most popular choice for those who are newly eligible for Medicare.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

What is the best Medigap plan?

If you qualified for Medicare before Jan. 1, 2020, Plan F is the best Medigap plan. Plans will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

How much is Medicare Part A deductible for 2022?

Say you need surgery in the upcoming year. For the 2022 plan year, the Medicare Part A deductible is $1,556. Some Medicare Supplement policies, such as Plan A, provide no coverage for this deductible. Therefore, you would be responsible for paying the entire $1,556 out of pocket before your Original Medicare coverage would kick in.

How much does Medigap Plan G cost?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give you comprehensive medical coverage from a well-rated company. However, all Supplement plans have standardized benefits that will help protect you from out-of-pocket medical expenses you'd have with Original Medicare (Part A and Part B).