Full Answer

What is the greatest challenge facing Medicare Today?

Challenges to Medicare Medicare continues to be a target for policymakers that support privatizing the program and changing it into a “premium support” (voucher program), that would likely lead to many people paying more for less coverage.

What are the challenges for Medicare beneficiaries around enrollment?

Jun 18, 2018 · The relentless growth of Medicare spending threatens seniors and taxpayers alike. The CBO projects overall Medicare spending will double over …

What are the biggest challenges facing the healthcare system today?

Oct 08, 2020 · Challenges of Medicare enrollment Better Medicare Alliance identified five challenges for Medicare beneficiaries around enrollment. First, there is no single government entity in charge of...

What drives annual growth in Medicare spending?

Apr 13, 2020 · Part One: (400 words) What are Medicare’s biggest challenges today and why? Part Two: (400 words) Discuss how Medicaid can be considered to be 50 different programs. Don't use plagiarized sources. Get Your Custom Essay on The biggest challenge of Medicare today Just from $10/Page Order Essay Get professional assignment help cheaply Are you …

What are some of the biggest challenges with Medicare today?

As the Medicare system itself faces financial troubles, Medicare beneficiaries also face higher costs. Today, beneficiaries pay nearly 30 percent of their health care costs from their own pockets. In 1995, those costs averaged $2,563 per person to pay for premiums, services and products not covered by Medicare.

What are problems with Medicare?

"Medicare is not complete coverage. It doesn't include dental, vision and hearing. It doesn't cover long-term care. There can be high out-of-pocket costs if you don't have supplemental coverage, and supplemental coverage in Medicare is complicated," said Roberts, who wrote an editorial that accompanied the new study.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What are the major changes in Medicare for 2020?

In 2020, the Medicare Part A premium will be $458, however, many people qualify for premium-free Medicare Part A. The Medicare Part B premium will increase to $144.60, and the Medicare Part B deductible will rise to $198 in 2020.

What is a disadvantage of Medicare?

Hospital You might not be able to choose when to be admitted. Medicare doesn't include ambulance service costs. Medicare won't cover you for private patient hospital costs, such as theatre fees and accommodation. It won't cover you for medical and hospital costs you incur in another country.

Has Medicare been successful?

Medicare's successes over the past 35 years include doubling the number of persons age 65 or over with health insurance, increasing access to mainstream health care services, and substantially reducing the financial burdens faced by older Americans.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What are the advantages and disadvantages of Medicare supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

What are the changes to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.Sep 24, 2021

Are Medicare premiums deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Are Medicare Part B premiums going up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much will Medicare spend in the next decade?

The CBO projects overall Medicare spending will double over the next decade, from $707 billion to over $1.5 trillion annually. Even the hottest economy cannot “outgrow” the deficits and debt worsened by financially troubled Medicare and other federal entitlements.

How much of Social Security will Medicare cost in 2030?

Medicare premiums consumed 23 percent of the average Social Security benefit in 2015, and they are on track to consume 30 percent of the average Social Security benefit by 2030. Moreover, seniors’ access to care could decline, thanks to Obamacare. Over the next 10 years, Obamacare is scheduled to squeeze out more than $800 billion in Medicare ...

How much is Medicare unfunded?

According to the Office of the Actuary at the Center for Medicare and Medicaid Services, Medicare’s unfunded obligations will reach $37.7 trillion during that same 75-year timeframe.

How long does Medicare have to draw money?

For the second consecutive year, the trustees project that Medicare will have to draw 45 percent of its money from general funds within seven years. The Heritage Foundation suggests that Congress gradually raise the normal age of Medicare eligibility to 67 and reduce the taxpayer subsidies. Copied.

What was the income for Obamacare in 2010?

For the first few years, Obamacare’s s Medicare tax hike would strike only the “rich” — statutorily defined as persons with annual incomes of $200,000 (or $250,000 for couples).

Is Medicare in trouble?

Medicare is in trouble. Again. The Medicare Trustees report the program’s Hospital Insurance trust fund is spending billions more than it takes in. In just eight years, they estimate, the fund will be insolvent. At that point, the account will decline, and the trustees warn, “Beneficiary access to health care services could rapidly be curtailed.”.

Will Medicare consume all federal funds by 2039?

The Medicare Payment Advisory Commission warns that entitlement spending, plus interest on the debt, will consume all federal revenues by 2039, and perhaps even earlier. The trustees report was especially bad news for working families, who fund the program through both Medicare payroll taxes and income taxes.

How many people are confused by Medicare?

Meanwhile, well over a third of Medicare beneficiaries (37 percent) are confused by Medicare enrollment support resources, a separate survey by GoHealth found.

Is there a single government entity in charge of enrollment?

First, there is no single government entity in charge of enrollment. Instead, beneficiaries receive communications from numerous unassociated entities. Furthermore, the enrollment process takes place via the Social Security Administration instead of CMS, which experts said seems like a more natural option.

Should organizations and businesses that offer Medicare guidance but are unaffiliated with CMS be subject to a review?

Organizations and businesses that offer Medicare guidance but are unaffiliated with CMS should be subject to a review to ensure that their information is correct. "Enforcement actions should be increased for those that misrepresent Medicare’s brand and information,” the white paper added.

Should HHS take over Medicare?

HHS should take over Medicare enrollment, the organization recommended, with the enrollment process designated specifically to CMS. Thus, education materials and enrollment processes would be within the same agency and department. Better Medicare Alliance also stressed having Medicare subject matter experts available locally.

Can navigators be used for Medicare?

Navigators are available but cannot recommend specific plans and sufficiency of navigator training varies by state. The Medicare & You booklet that CMS issues each year to cover Medicare plan options is not tailored; the handbook for 2021 spans 124 pages.

Is Medicare enrollment challenging?

Medicare enrollment continues to pose challenges for beneficiaries, but there are concrete steps that policymakers can take to reduce the burden according to Better Medicare Alliance. October 08, 2020 - Beneficiaries suffer from chronic confusion over Medicare enrollment but policymakers can take action to streamline the process ...

What happens if Medicare Advantage doesn't comply with the law?

If health plans don’t stay in compliance, there can be financial penalties or they can take hits to their public ratings, both of which are serious business problems that can be avoided with the right technology tools.

What percentage of 2020 plan beneficiaries are enrolled in contracts that have 4 or more stars?

But 81 percent of 2020 plan year beneficiaries are enrolled in contracts that have 4 or more stars. The premium cost of a one-star plan typically isn’t much lower than a five-star plan, so clinical quality, administrative responsiveness, and member engagement are real differentiators.

What is CMS audit?

The Centers for Medicare and Medicaid Services (CMS) keeps a close eye on MA plans with regular audits. The audit results are public and can have a significant impact on a health plan’s reputation, so it’s important for administrators to be able to demonstrate organized compliance with federal regulations.

What percentage of MA plans have 4 stars?

For the 2020 plan year, 52 percent of MA plans with prescription drug benefits achieved 4 stars or higher, says CMS. But 81 percent of 2020 plan year beneficiaries are enrolled in contracts ...

Is data everywhere in healthcare?

Data is everywhere in healthcare. Faxes, apps, portals, emails, phone calls, and even text messages all play a crucial role in making the industry work, yet few organizations have fully cracked the code on how to make sense of the deluge of information.

What are the recommendations regarding Part B enrollment and prescription drug appeals?

Among the recommendations regarding Part B enrollment and prescription drug appeals are: Better education for newly eligible beneficiaries and for employers. Streamline and align enrollment periods. Include the reason for a drug denial in the pharmacy counter notice, and allow an immediate request for an appeal.

What is Medicare Part B?

Navigating Medicare Part B Enrollment: Many individuals who call Medicare Rights are confused by Medicare enrollment rules, and specifically by decision-making related to taking or declining Part B, which covers doctors’ and other services.

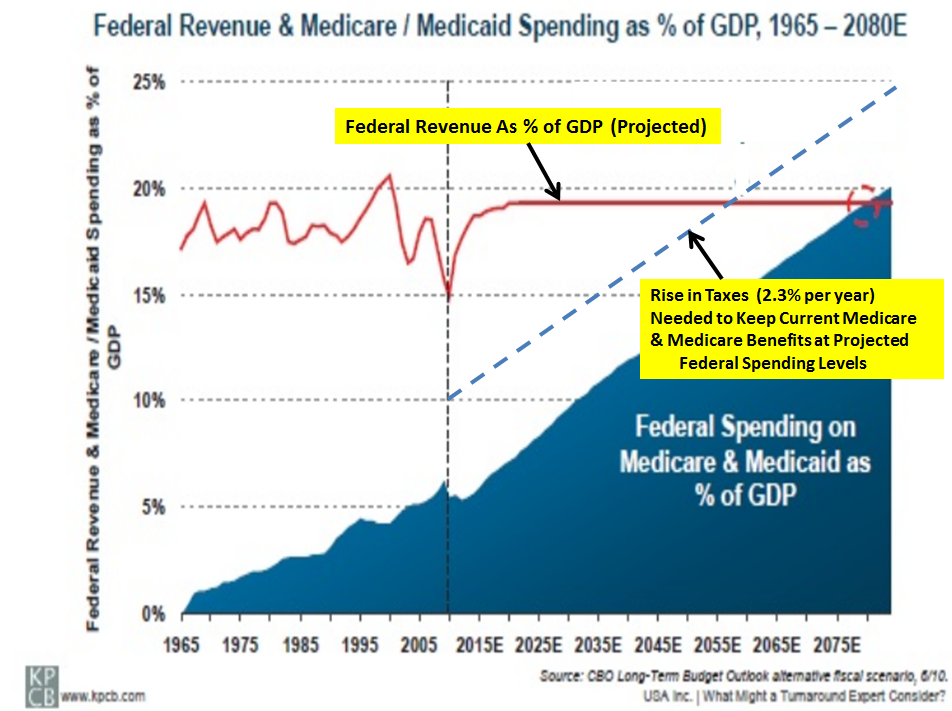

Why is Medicare facing a challenge?

Financing care for future generations is perhaps the greatest challenge facing Medicare, due to sustained increases in health care costs, the aging of the U.S. population, and the declining ratio of workers to beneficiaries. Annual increases in health care costs are placing upward pressure on Medicare spending, as for other payers.

How does Medicare affect spending?

Annual growth in Medicare spending is largely influenced by the same factors that affect health spending in general: increasing prices of health care services, increasing volume and utilization of services, and new technologies. In the past, provider payment reforms, such as the hospital prospective payment system, ...

What is Medicare Advantage?

Medicare beneficiaries have the option to get their benefits through the traditional fee-for-service (FFS) program – sometimes called Original Medicare – or through private health plans, such as health maintenance organizations (HMOs) and preferred provider organizations (PPOs) – currently called Medicare Advantage.

What is the role of Medicare in the future?

Medicare plays a central role in broader discussions about the future of entitlement programs. Together, Medicare, Medicaid and Social Security account for more than 40 percent of the federal budget.

What is the source of Medicare funding?

Medicare funding comes primarily from three sources: payroll tax revenues, general revenues, and premiums paid by beneficiaries.

What is Medicare and Social Security?

Like Social Security, Medicare is a social insurance program that provides health coverage to individuals, without regard to their income or health status.

What are the goals of Medicare?

Achieving a reasonable balance among multiple goals for the Medicare program—including keeping Medicare fiscally strong, setting adequate payments to private plans, and meeting beneficiaries’ health care needs —will be critical issues for policymakers in the near future.