CMS has made the following changes to Medicare insurance benefits for the new year:

- Cognitive assessment and care plan services When you visit your health care provider in 2021 for your annual Wellness...

- Blood-based biomarker test Starting in 2022, Medicare will cover a blood-based biomarker test in certain cases one...

- COVID-19 coverage

What are the proposed changes to Medicare?

Nov 12, 2021 · CMS has made the following changes to Medicare insurance benefits for the new year: 1. Cognitive assessment and care plan services When you visit your health care provider in 2021 for your annual Wellness... 2. Blood-based biomarker test Starting in 2022, Medicare will cover a blood-based biomarker ...

How new changes to Medicare may affect your healthcare?

Nov 15, 2021 · But there are also changes to Original Medicare cost-sharing and premiums, the high-income brackets, and more. The standard premium for Medicare Part B is $170.10/month in 2022. This is an increase of nearly $22/month over the standard 2021 premium, and is the largest dollar increase in the program’s history.

When can I make changes to my Medicare coverage?

Mar 17, 2022 · Changes are coming to Medicare because of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). First-dollar coverage for Medicare Supplement plans (also known as Medigap plans) will no longer be available to anyone new to Medicare. This will affect choices for Medicare Supplement plan availability, but that might end up being a good thing.

Are big changes coming for Medicare, Social Security?

Dec 07, 2021 · Highlighted below are some of the biggest changes you can expect to see in 2022. Price Changes Medicare Parts A, B, and D are all increasing in price in 2022. The biggest change in Part A is the deductible, which is increasing to $1,556 in 2022 up from $1,484. Some coinsurance amounts are increasing modestly as well.

What changes are being made to Medicare?

What are the major changes to Medicare for 2021?

Are there any major changes to Medicare in 2022?

What are the major changes in Medicare for 2020?

Is Medicare Part B going up 2022?

Is Medicare going up 2021?

What changes are coming to Social Security in 2022?

How much does Medicare cost in 2022 for seniors?

Will Social Security get a raise in 2022?

Are Medicare premiums deducted from Social Security?

How much does Medicare take out of Social Security in 2021?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, which is an increase of $76 from $1,408 in 2020.

Q: What are the changes to Medicare benefits for 2022?

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that...

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Roughly 1% of Medicare Part A enrollees pay premiums; the rest get it for free based on their work history or a spouse’s work history. Part A premi...

Is the Medicare Part A deductible increasing for 2022?

Part A has a deductible that applies to each benefit period (rather than a calendar year deductible like Part B or private insurance plans). The de...

How much is the Medicare Part A coinsurance for 2022?

The Part A deductible covers the enrollee’s first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage duri...

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are n...

Are there inflation adjustments for Medicare beneficiaries in high-income brackets?

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does “high income” mean? The high-income brackets were in...

How are Medicare Advantage premiums changing for 2021?

According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which...

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does no...

How is Medicare Part D prescription drug coverage changing for 2022?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans is $480 in 2022, up from $445 in 2021. A...

When will the Medicare Advantage health question go away?

With the 21st Century Cures Act, that health question is going away for coverage starting January 1, 2021.

Do you pay more for Medicare if you have a high income?

If you have a high income, you pay a higher premium for Medicare coverage. As of 2021, the income thresholds have gone up slightly. For example, if you’re married filing jointly and make more than $176,000, you’ll pay more. Previously, that threshold was $174,000, but the slight increase is to account for inflation. 2.

What is the Medicare deductible for 2021?

Your costs for Original Medicare, which includes Parts A and B, have increased slightly for 2021. The standard Medicare Part B premium is $148.50. And the Medicare Part A deductible is $1,484. If you have a high income, you pay a higher premium for Medicare coverage.

How much is Medicare Part B 2021?

Your costs for Original Medicare, which includes Parts A and B, have increased slightly for 2021. The standard Medicare Part B premium is $148.50. The Medicare Part B deductible is $203. And the Medicare Part A deductible is $1,484. If you have a high income, you pay a higher premium for Medicare coverage.

What is the Medicare Part B deductible?

The Medicare Part B deductible is $203. And the Medicare Part A deductible is $1,484. If you have a high income, you pay a higher premium for Medicare coverage. As of 2021, the income thresholds have gone up slightly. For example, if you’re married filing jointly and make more than $176,000, you’ll pay more.

How many acupuncture visits does Medicare cover?

2. Acupuncture Coverage Updates. Medicare now covers up to 12 acupuncture visits in 90 days for chronic lower back pain. Medicare will cover an additional eight sessions if the beneficiary shows improvement.

How many sessions does Medicare cover?

Medicare will cover an additional eight sessions if the beneficiary shows improvement. 3. Expanded Telehealth Benefits. Because of COVID-19, many Medicare beneficiaries prefer to have routine appointments and concerns handled virtually.

Medicare changes just about every year, and this year is no different

Changes are coming to Medicare, but that’s nothing new. Slight changes are made to Medicare every year to make it work better for enrollees and this year is no different. Have you kept up with all the latest Medicare changes? If not, don’t worry—we’ll fill you in.

Medicare Premiums

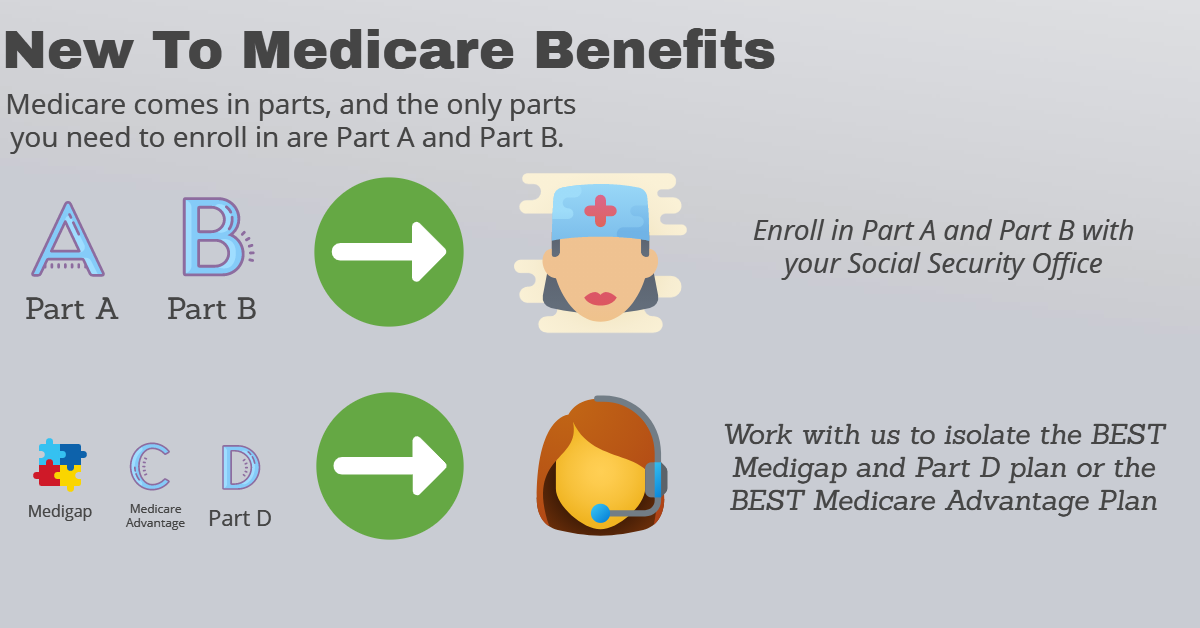

The first thing to understand is that Original Medicare is comprised of two basic building blocks: Part A and Part B. Part A, which mainly covers hospital care, is generally available at no monthly premium.

Medicare Advantage on the Rise

One of the biggest changes to Medicare over the past 10 years has been the increase in people choosing Medicare Advantage plans. In 2021, 43% of Medicare beneficiaries throughout the U.S. selected a Medicare Advantage plan. In 2019, 41% of the people in Michigan who are eligible for Medicare chose a Medicare Advantage plan.

The make-up of a Medicare Advantage plan

Medicare Advantage plans take the place of Original Medicare—or Part A and Part B. They’re offered by private insurance companies and cover everything Original Medicare does—plus they often offer additional benefits like gym memberships, prescription coverage and health and wellness programs.

Plan Ratings can Change Every Year

How well a health plan takes care of its members should be an important part of your Medicare decision-making process. Fortunately, the Centers for Medicare and Medicaid Services (CMS) offers an easy way to gauge a plan’s quality: star ratings.

When will Medicare continue to cover you?

The current Plan C, F, and F High Deductible plan that you have today will continue to cover you providing you remain in the plan and continue to pay your monthly plan premium. If you become Medicare eligible before January 1, 2020 based on disability or ESRD status, OR turn 65 before January 1, 2020, whether eligible for Medicare on ...

Does Medicare have a new card?

Instead, the cards will have a new Medicare Beneficiary Identifier (MBI) that will be used for billing and for checking your eligibility and claims status. Medicare is finally doing its part to strengthen fraud protection and ensure your personal information is secure.

What is the Medicare donut hole?

If you have a Medicare Part D prescription drug plan, you’ve probably heard of the coverage gap that’s sometimes called the Medicare donut hole. This means that after you and your Medicare drug plan have spent a certain amount of money for covered prescription drugs, you may have to pay for some or all the costs of your prescriptions up to a certain limit. There are exciting changes to the donut hole scheduled between now and 2020. Basically, the amount you will have to pay in the donut hole will decrease each year. Which means that a year and a half from now, you’ll pay no more than 25 percent for covered brand-name and generic drugs in the donut hole!