When will Medicare increase?

Beginning in 2020, Medicare made several changes to coverage of certain services, benefits, and prescriptions. These included: Allowing Medicare Advantage plans to cover additional non-health related supplemental benefits for plan members with chronic illnesses

How much is Medicare increasing?

While increases in premiums are common for Medicare, 2020 brought changes that go much deeper. These changes are due to the SUPPORT Act, the Bipartisan Budget Act of 2018, and the 2020 Medicare Physician Fee Schedule. This year’s changes include new coverage areas, expansion of benefits, and changes in allowed policies.

Will Medicare increase this year?

The 2020 changes affect Medicare Supplement plan options and Medicare Part A, Part B, and Part D costs. With these changes comes a bit of confusion among seniors, who have already been through the bewildering open enrollment season that ended December 7. We’d like to help by summarizing and explaining a bit about what is new to Medicare costs ...

Are Medicare costs increasing?

Nov 08, 2019 · Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019.

What changes are coming to Medicare in 2021?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

Are there big changes coming to Medicare?

The biggest change Medicare's nearly 64 million beneficiaries will see in the new year is higher premiums and deductibles for the medical care they'll receive under the federal government's health care insurance program for individuals age 65 and older and people with disabilities.Jan 3, 2022

What changes are being made to Medicare?

But there are also changes to Original Medicare cost-sharing and premiums, the high-income brackets, and more. The standard premium for Medicare Part B is $170.10/month in 2022. This is an increase of nearly $22/month over the standard 2021 premium, and is the largest dollar increase in the program's history.

Is Medicare cost increasing in 2021?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

How much does Medicare cost in 2022 for seniors?

The Center for Medicare and Medicaid Services estimates that the average monthly premium will be $19 in 2022, down from $21.22 in 2021.

What are the changes to Medicare in July 2021?

The MBS indexation factor for 1 July 2021 is 0.9%. Indexation will be applied to most of the general medical services items, all diagnostic imaging services, except nuclear medicine imaging and magnetic resonance imaging (MRI) and two pathology items (74990 and 74991).Jun 30, 2021

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Does Medicare have new 2022 cards?

15 through Dec. 7, the more than 63 million Medicare beneficiaries can pick a new Medicare Part D drug plan, a new Medicare Advantage plan, or switch from Original Medicare into a Medicare Advantage plan or vice versa. Any coverage changes made during this period will go into effect Jan. 1, 2022.Oct 15, 2021

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

Why did I get an extra Social Security payment this month 2021?

Social Security benefits are getting their biggest increase in 40 years this month, thanks to soaring inflation in 2021. A new cost of living adjustment has increased payments by 5.9%, about $93 more per month on average for seniors and other beneficiaries, or $1,116 more per year.Jan 12, 2022

Why did my Medicare premium go up in 2022?

The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

What changes will Medicare make in 2020?

Medicare Changes in 2020: Facts for Consumers. In 2020, Medicare expanded supplemental benefits and opioid treatment program coverage, but also enabled some drug plans to implement indication-based formularies. Beginning in 2020, Medicare made several changes to coverage of certain services, benefits, and prescriptions.... Skip to Main Content.

When did Medicare change coverage?

Beginning in 2020, Medicare made several changes to coverage of certain services, benefits, and prescriptions.... Skip to Main Content.

Does Medicare cover prescriptions?

Beginning in 2020, Medicare made several changes to coverage of certain services, benefits, and prescriptions. These included: Allowing Medicare Advantage plans to cover additional non-health related supplemental benefits for plan members with chronic illnesses.

How much is Medicare Part A 2020?

In 2020, the Medicare Part A premium will be $458, however, many people qualify for premium-free Medicare Part A. The Medicare Part B premium will increase to $144.60, and the Medicare Part B deductible will rise to $198 in 2020.

What is the Medicare premium for 2020?

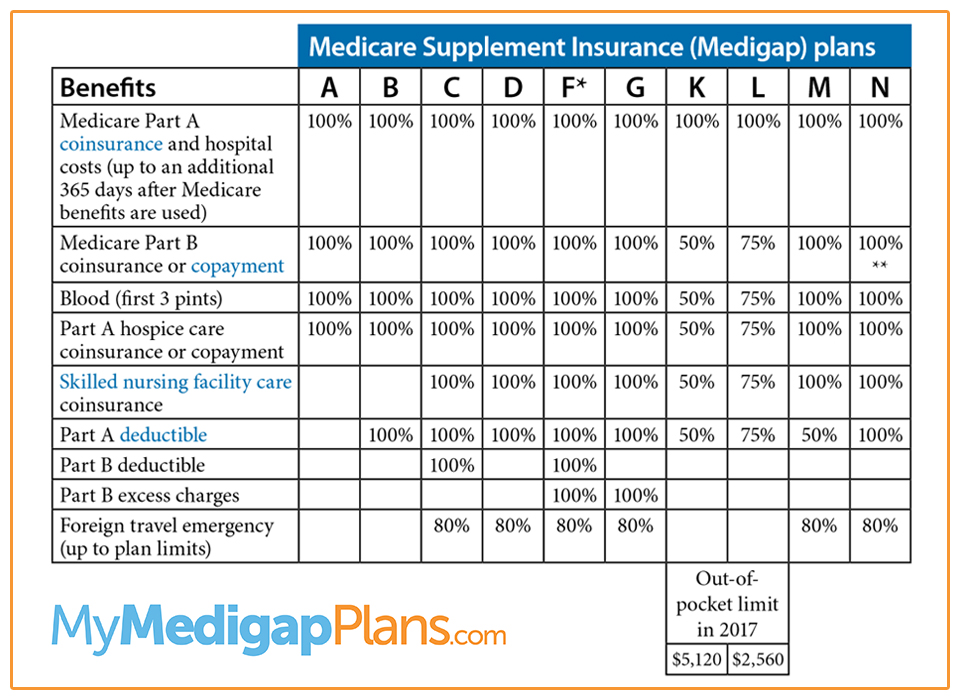

Some of the most important 2020 Medicare changes include: Part A premium will be $458 (many qualify for premium-free coverage) Part B premium will increase to $144.60. Part B deductible will rise to $198. Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020.

What are the changes to Medicare?

Summary: Medicare 2020 changes may affect your Medicare Supplement plan options and Medicare Part A, Part B and Part D costs. Some of the most important 2020 Medicare changes include: 1 Part A premium will be $458 (many qualify for premium-free coverage) 2 Part B premium will increase to $144.60 3 Part B deductible will rise to $198 4 Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020 5 Medicare will begin closing the Medicare Part D Donut Hole in 2020

When will Medicare change?

Why are Changes Coming to Medicare in 2020? Whether Medicare has been your health care plan for many years, or you expect to be eligible for Medicare on or after January 1, 2020, the changes coming to Medicare Supplement plans and the Donut Hole may affect you. Legislation established these changes in 2015 to try and reduce unnecessary costs ...

What is the gap in Medicare Part D?

The gap in Medicare Part D drug plans is often referred to as the “Donut Hole.”. The Donut Hole varies in size depending on the plan, but the high out-of-pocket costs negatively affect enrollees that entered it.

How to check if you qualify for Medicare?

You can check your eligibility by looking at the Medicare Part A start date on your Medicare card. If your Medicare Part A began before the cut-off date, you will be eligible to apply for Plan F, Plan F High-Deductible, or Plan C even after 2020.

When will the donut hole close?

If you’re in the Donut Hole, you will now get a discount on your brand-name drugs and additional savings on your generic and brand-name drugs until it’s officially closed in 2020. Manufacturers will continue paying large percentages of the drug, while Medicare drug plans will increase the amount they cover.

When will Medicare and Medicaid integration go into effect?

These requirements do not go into effect until 2021, but many providers have started implementing changes this year.

Does Medicare cover methadone?

This coverage has been expanded in hopes of addressing the opioid epidemic by providing access to more services. Prior to 2020, there was no Medicare coverage for opioid use disorder treatment, including methadone treatment, because it is only provided at OTPs (methadone for pain relief can be obtained elsewhere). Medicare now covers treatment at OTPs, such as treatment medications and the dispensing and administering of them, substance counseling, individual and group therapy, toxicology testing, intake activities, and periodic assessments. There will not be any cost-sharing required once the deductible is met with OTP services in order to minimize barriers to accessing care.

What is the Medicare premium for 2020?

Part B premiums increased. According to Medicare Resources, in 2020, the standard premium for Medicare Part B was increased to $144.60 (up from $135.50 in 2019). This increase is due to the Social Security cost of living adjustment at 1.6% for 2020.

How much is the 2020 Part B deductible?

The Part B deductible will increase by $13 to a total of $198 in 2020. If you are enrolled in Part B, you may have supplemental coverage that pays your deductible.

How to compare Medicare plans?

In August 2019, The Medicare Plan Finder tool was upgraded. According to CMS, the new tool will make it easier for beneficiaries to see 2020 Medicare changes and to: 1 Compare pricing between Original Medicare, Medicare prescription drug plans, Medicare Advantage plans, and Medicare Supplement Insurance (Medigap) policies; 2 View different coverage options on their smartphones and tablets; 3 Compare up to three drug plans or three Medicare Advantage plans side-by-side; 4 Get plan costs and benefits, including which Medicare Advantage plans offer extra benefits; 5 Build a personal drug list and find Medicare Part D prescription drug coverage that best meets their needs.

How much is coinsurance for Part A?

This additional coinsurance charge is $352 per day for the 61st through 90th day of inpatient care. Beyond that, coinsurance for inpatient care will cost $704 in 2020 (for up to a total of 60 days), which is up from $682 in 2019. After you use up your lifetime reserve days, you pay all costs.

Can you keep Medigap plans?

In a summary of changes from Medicare Resources, their website explains that you can keep Medigap Plans C or F if you already have them. However, in an attempt to curtail the overutilization of services , these plans are no longer available to those who are newly-eligible for Medicare after January 1, 2020. A new high-deductible plan, Plan G, has been made available to replace the high deductible Plan F.

How much will Medicare premiums decline in 2020?

As previously announced, as a result of CMS actions to drive competition, on average for 2020, Medicare Advantage premiums are expected to decline by 23 percent from 2018, and will be the lowest in the last thirteen years while plan choices, benefits and enrollment continue to increase. Premiums and deductibles for Medicare Advantage ...

What is the Medicare premium for 2020?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due ...

What percentage of Medicare Part B premiums are based on income?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table: Beneficiaries who file.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is coinsurance for 2020?

In 2020, beneficiaries must pay a coinsurance amount of $352 per day for the 61st through 90th day of a hospitalization ($341 in 2019) in a benefit period and $704 per day for lifetime reserve days ($682 in 2019). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

Is Medicare Part B deductible higher in 2020?

Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts.

MEDICARE PART A

Part A, which covers hospitalization costs, will see an increase in premium based on their work history.

MEDICARE PART B

The monthly premium for Medicare Part B will be $144.60 in 2020 (up from $135.50 in 2019).

MEDIGAP PLANS C AND F

These plans will not be available for newly eligible Medicare enrollees in 2020. Those who are already eligible before 2020 can continue to enroll in them or apply at a later time. Part B deductibles are covered under Medigap Plans C and F, but other Medigap enrollees have to pay their Part B premiums out-of-pocket.

PART D DONUT HOLE

The maximum allowable deductible in 2020 for standard Part D plans is $435.

PLAN FINDER

A new resource for shopping for Medicare Part D (Drug) plans and Medicare Advantage Plans can be found at https://www.medicare.gov/plan-compare.

How much will Medicare copay be in 2021?

The copay amounts for people who reach the catastrophic coverage level in 2021 will increase slightly, to $3.70 for generics and $9.20 for brand-name drugs. Medicare beneficiaries with Part D coverage (stand-alone or as part of a Medicare Advantage plan) will have access to insulin with a copay of $35/month in 2021.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

Is Medicare Advantage available for ESRD?

Under longstanding rules, Medicare Advantage plans have been unavailable to people with end-stage renal disease (ESRD) unless there was an ESRD Special Needs Plan available in their area. But starting in 2021, Medicare Advantage plans are guaranteed issue for all Medicare beneficiaries, including those with ESRD. This is a result of the 21st Century Cures Act, which gives people with ESRD access to any Medicare Advantage plan in their area as of 2021.

Is there a donut hole in Medicare?

The Affordable Care Act has closed the donut hole in Medicare Part D. As of 2020, there is no longer a “hole” for brand-name or generic drugs: Enrollees in standard Part D plans pay 25 percent of the cost (after meeting their deductible) until they reach the catastrophic coverage threshold.

What is the maximum deductible for Part D?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans will be $445 in 2021, up from $435 in 2020. And the out-of-pocket threshold (where catastrophic coverage begins) will increase to $6,550 in 2021, up from $6,350 in 2020.

How much is the Part A deductible for 2021?

If the person needs additional inpatient coverage during that same benefit period, there’s a daily coinsurance charge. For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020).