The Biggest Medicare Changes for 2021

- Increased Coverage for Telehealth Services. One of the most important changes happening within Medicare is the addition of more coverage for telehealth services and telemedicine.

- New Long-Term Care Coverage Options. Long-term care coverage isn’t exactly comprehensive under Medicare. ...

- More Choices and Coverage for Seniors With End-Stage Renal Disease. In years past, individuals living with end-stage renal disease (ESRD) had very limited options under Medicare.

- Make Changes to Your Medicare Coverage Before Open Enrollment Ends. You only get one opportunity to make changes to your Medicare coverage – and it’s during open enrollment.

Full Answer

How will Medicare change?

Like other years, Medicare beneficiaries will pay a higher Part B monthly premium in 2021 than in 2020, but the increase is small. The Part B premium for 2021 will be $148.50, an increase of $3.90 from the 2020 premium of $144.60 (a 2.7% increase). For comparison, the premium increased 6.7% from 2019 to 2020.

How much does Medicare cost at age 65?

Sep 27, 2021 · The Medicare Part A deductible in 2021 is $1,484, which is $76 more than in 2020. While a less than $8 per month increase may seem negligible, it is important to remember that you could pay more...

What is the best Medicare plan?

What Are the Changes to Medicare Part A in 2021? Medicare Part A implemented the following changes in 2021: Medicare Part A maximum premium is $471 ($458 in 2020) Medicare Part A deductible is $1,484 per benefit period. Medicare Part A hospital inpatient coinsurance for days 61-90 is $371 ($352 in 2020)

What are new Medicare benefits?

Nov 06, 2020 · The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What changes are coming to Medicare in 2021?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

What changes are being made to Medicare?

The annual Part B deductible will be $233 this year, an increase of $30. For Medicare Part A, which covers hospitalizations, hospice care and some nursing facility and home health services, the inpatient deductible that enrollees must pay for each hospital admission will be $1,556, an increase of $72 over 2021.Jan 3, 2022

What is the new Medicare payment for 2021?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Will Medicare benefits increase in 2021?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

How much is Medicare going up next year?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021). And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.Jan 4, 2022

What is the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

How much does Medicare take out of Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

What is Medicare Advantage?

Medicare Advantage ( Medicare Part C) is health insurance for Americans aged 65 and older that blends Medicare benefits with private health insurance. This typically includes a bundle of Original Medicare (Parts A and B) and Medicare Prescription Drug Plan (Part D). starting in 2021. Telehealth and telemedicine coverage will extend to 2021, ...

How much has Medicare increased in 2020?

For comparison, the premium increased 6.7% from 2019 to 2020. The Part A premium — which must only be paid by enrollees who paid Medicare taxes for less than 10 years (40 quarters) through an employer — also experienced modest increases.

Is acupuncture good for back pain?

For the first time, acupuncture may be a benefit for chronic low back pain. Each year, the Centers for Medicare & Medicaid Services (CMS) adjusts its rates and policies based on several factors, including data and need. The changes coming to Medicare in 2021 go well past the usual standard rate hikes. If you’re enrolled in Medicare ...

What will Medicare do in 2021?

What Are The Changes To Medicare For 2021? Your Medicare coverage in 2021 may expand to provide lower costs and more services. This year will bring a cap on insulin prices and extended coverage for telehealth and COVID-19 services. Medicare Advantage coverage expands to acupuncture and beneficiaries with end stage renal disease.

Does Medicare cover end stage renal disease?

Medicare Advantage will cover End-Stage Renal Disease (ESRD) Starting in 2021, Patients with ESRD can enroll in a Medicare Advantage plan. Now, those with ESRD can take advantage of the out-of-pocket maximums many Medicare Advantage plans offer. And while MA beneficiaries may have different costs and restrictions than those with Original Medicare, ...

Will Medicare expand telehealth?

CMS expanded telehealth and telemedicine services in 2020 as a way of keeping seniors safe during the COVID-19 pandemic. Those expansions will remain in place for 2021. That means you can take advantage of services like E-visits, check-ups, and more — all via your computer’s camera and microphone. This development should have a significant impact on Medicare in 2021 as recent studies show that 68% of Medicare-eligible adults had access to a computer and the internet at their homes.

Is Medicare Supplement endorsed by the government?

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money. If you’re looking for the government’s Medicare site, please navigate to www.medicare.gov.

What Are the 2020 Cost Changes for Medicare Part A?

Hospital and inpatient services are covered by Medicare Part A. Most Medicare beneficiaries are still eligible for premium-free Part A. For those who don’t qualify for free Part A (depending on how many years you’ve worked and paid social security taxes), you could pay up to $458 per month — $21 more than in 2019.

What Are the 2020 Cost Changes for Medicare Part B?

Medicare Part B is your medical insurance, covering doctor visits, medical supplies, and more.

Medicare Advantage Increases Coverage in 2020

Beginning in 2020, Medicare Advantage plans can offer benefits that aren’t strictly medical. For example, transportation, meal delivery, personal care services, and many more are now covered.

Medicare Part D Changes for 2020

Original Medicare beneficiaries who want coverage for prescription drugs can enroll in a Medicare Part D plan. Like Medicare Advantage, there are many Part D plans, and you can use the Medicare Plan Finder tool to find and compare plans available to you.

2020 Medigap Cost Updates

Available Medicare Supplement plans (also known as Medigap) changed significantly in 2020. Beginning on January 1, Plans C and F were no longer available to new enrollees.

What is Medicare Part D?

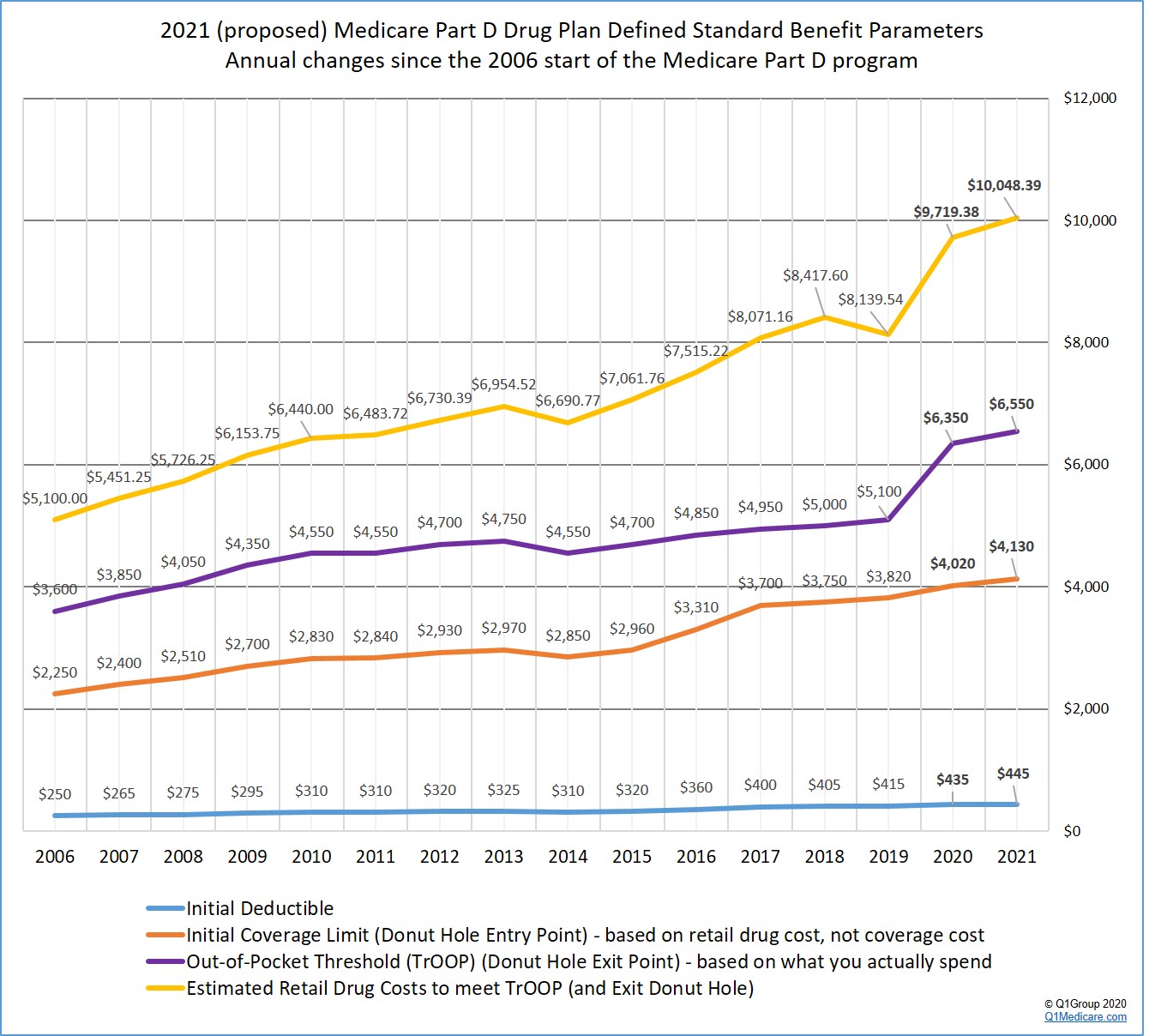

Medicare Part D introduced a program to help people control their insulin costs, increased the maximum deductible allowed for standard plans, and raised the threshold spending amount to enter catastrophic coverage. Some Medicare Supplement Insurance plans, more commonly known as Medigap plans, received changes to their deductible amounts ...

How much is Medicare Part A deductible?

Medicare Part A deductible is $1,484 per benefit period. Medicare Part A hospital inpatient coinsurance for days 61-90 is $371 ($352 in 2020) Medicare Part A hospital inpatient coinsurance for lifetime reserve days is $742 ($704 in 2020) The vast majority of people on Medicare don’t have to pay an additional premium for Part A.

Does Medicare cover end stage renal disease?

People with End-Stage Renal Disease are no longer limited to certain types of Medicare Advantage plans, and the maximum out-of-pocket spending limit allowed has changed. Medicare often puts changes into effect at the start of a new year, and this year was no different. Let’s take a look at the most notable changes in Medicare for 2021.

What is the deductible for Medicare Part D 2021?

What Are the Changes to Medicare Part D in 2021? Rules for Medicare Part D plans were also updated for 2021: The highest deductible amount that standard plans can set is now $445. The “donut hole” (coverage gap) has been eliminated, and the threshold to enter the catastrophic coverage phase has been raised to $6,550.

Does Medigap Plan G cover Medicare Part B?

Take Medigap Plan G, for instance. Medigap Plan G doesn’t cover the Medicare Part B deductible , which rose to $203 this year.

What is the maximum out of pocket limit for Medicare?

The highest maximum out-of-pocket limit plans can set is $7,550 ($6,700 in 2020) Prior 2021, only certain Medicare Advantage plans, like Special Needs Plans, were required to accept people with End-Stage Renal Disease.

What is the Medicare number for 2021?

If you still have questions about the 2021 changes in Medicare, we’re here to help. Give us a call at (877)896-4612 TTY 711 and one of our knowledgeable licensed insurance advisors will be happy to assist you.

What is the APA 2021?

APA and other health care societies have been lobbying members of Congress to protect health care professionals, including psychologists, from the cuts projected by the Centers for Medicare and Medicaid Services (CMS) in the proposed and final rules on the 2021 Physician Fee Schedule.

Does Medicare reimburse telehealth providers?

Psychologists are reminded that once the PHE ends, Medicare will no longer reimburse providers for furnishing services via audio-on ly devices .

What is PPP loan?

The Paycheck Protection Program ( PPP) Another key element in the new law is the PPP, designed to provide financial assistance to businesses impacted by the PHE. The eligibility criteria for PPP loan assistance in 2021 differs depending upon whether it is the first or second time an entity is applying.

Can a psychologist provide telehealth?

When the PHE ends, psychologists can continue to furnish telehealth services to patients who do not reside in rural areas. The law also allows patients to receive mental health services via telehealth in their own homes. These changes apply only to diagnostic, evaluation, and treatment services for a mental illness.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

Why is telemedicine important?

As increasingly more individuals need to meet with doctors in their own homes, telemedicine is providing the opportunity for patients to schedule appointments to “see” doctors on video calls. It’s a great way for seniors and high-risk people to get medical treatment without leaving home.

How long does Medicare cover long term care?

In years past, both Original Medicare and Medicare Advantage plans have both covered only skilled services or rehabilitative care for a maximum of 100 days.

When does Medicare change plans?

Each year, Medicare subscribers have the chance to make changes to their coverage. During a brief window from October 15 to December 7, anyone who’s on Medicare can change plans and update their coverage for the next year. Since significant changes in coverage are planned each year, make sure to search online to find out more about 2021 changes ...

Can you telehealth with Medicare?

Depending on the specifics of the coverage you choose, you may be able to meet with telehealth providers for your primary care, cardiology, dermatology, psychiatry, gynecology, and endocrinology needs. During open enrollment, make sure to look into telehealth and telemedicine coverage as you update or re-enroll in Medicare.

Can I get Medicare Advantage for end stage renal disease?

In years past, individuals living with end-stage renal disease (ESRD) had very limited options under Medicare. They could only enroll in Medicare Advantage under certain restricted circumstances. But during the 2020 open enrollment period, those living with ESRD can sign up for Medicare Advantage and pick a new plan.

Does Medicare cover ESRD?

And it comes with a number of benefits. Medicare Advantage plans that now accept ESRD patients can offer critical coverage for services like dialysis, case management, and ongoing healthcare support.