What did the Medicare Act change?

On July 30, 1965, President Lyndon B. Johnson signed the Medicare and Medicaid Act, also known as the Social Security Amendments of 1965, into law. It established Medicare, a health insurance program for the elderly, and Medicaid, a health insurance program for people with limited income.Feb 8, 2022

What is the big change in Medicare?

The biggest change Medicare's nearly 64 million beneficiaries will see in the new year is higher premiums and deductibles for the medical care they'll receive under the federal government's health care insurance program for individuals age 65 and older and people with disabilities.Jan 3, 2022

What is the Medicare rate for 2018?

Most people who sign up for Medicare in 2018 or who do not have their premiums deducted from their Social Security benefits are not protected by the hold-harmless provision and will pay the full $134 per month. And some people will pay even more.

What are the major changes to Medicare for 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.Sep 24, 2021

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

What was Irmaa for 2018?

An upper-income household in 2018 will face an IRMAA surcharge of $294.60/month (which is $3,535/year) once income exceeds $160,000/year, yet even that still only the equivalent of “just” a 2.2% surtax on income. Viewing IRMAA surcharges relative to income is important.Nov 29, 2017

What will Medicare cost in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

Is Medicare going up 2021?

The increase in the standard monthly premium—from $148.50 in 2021 to $170.10 in 2022—is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly ...Nov 12, 2021

Is Medicare issuing new cards in 2021?

All Medicare beneficiaries will be receiving new Medicare cards with their MBI. Current beneficiaries will be mailed a replacement Medicare card and instructions, while individuals who are new to Medicare in or after April 2018 will receive a new Medicare card with their MBI upon enrollment.

Is there a new Medicare card coming out?

Cards will be mailed between April 2018 – April 2019 This will help keep your information more secure and help protect your identity. You'll get a new Medicare Number that's unique to you, and it will only be used for your Medicare coverage. The new card won't change your coverage or benefits.

How much will Social Security increase in 2018?

After several years of no or very small increases, Social Security benefits will increase by 2.0 percent in 2018 due to the Cost of Living adjustment.

When did Medicare Part A and B premiums come out?

2018 Medicare Parts A & B Premiums and Deductibles. On November 17, 2017 , the Centers for Medicare & Medicaid Services (CMS) released the 2018 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible ...

What is the deductible for Medicare Part B?

The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B ...

What is the Medicare Part B premium?

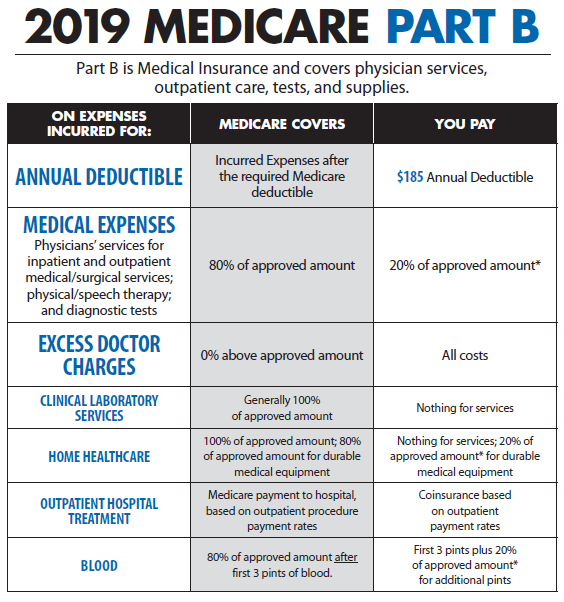

Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

How much is the Part B premium in 2018?

The 30 percent of all Part B enrollees who are not subject to the “hold harmless” provision will pay the full premium of $134 per month in 2018. Part B enrollees who were held harmless in 2016 ...

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.