What are the proposed changes to Medicare?

· Older Americans would see their health coverage expanded as part of the $3.5 trillion budget plan approved by the House on Tuesday. Medicare, which is relied on by most Americans once they reach...

What are the changes in Medicare?

· The Bipartisan Budget Act of 2018 contains a "health extenders" package, which includes a number of wide-ranging provisions relating to various health programs. Repeal of Medicare Outpatient Therapy Caps Since the Balanced Budget Act of 1997, outpatient therapy under Medicare Part B has been subject to annual dollar limits, or caps.

How new changes to Medicare may affect your healthcare?

· As of January 2021, there were 63.1 million people enrolled in Medicare. (2) Along with lowering the eligibility age, the Biden administration's current proposed budget for Medicare would expand...

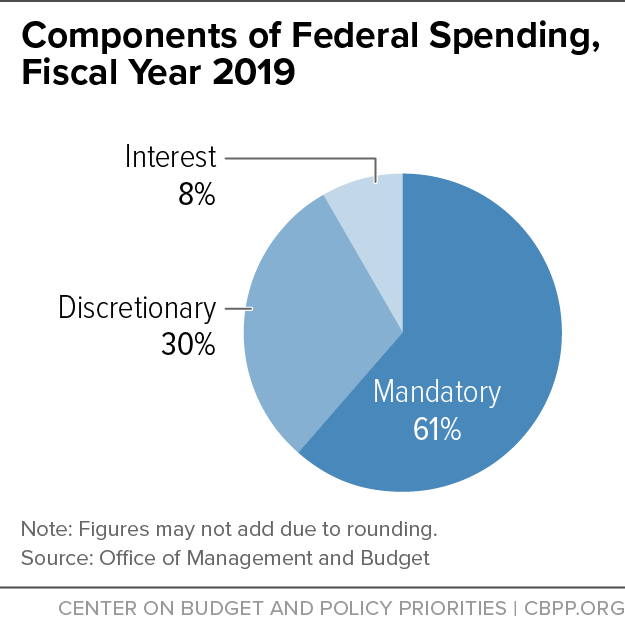

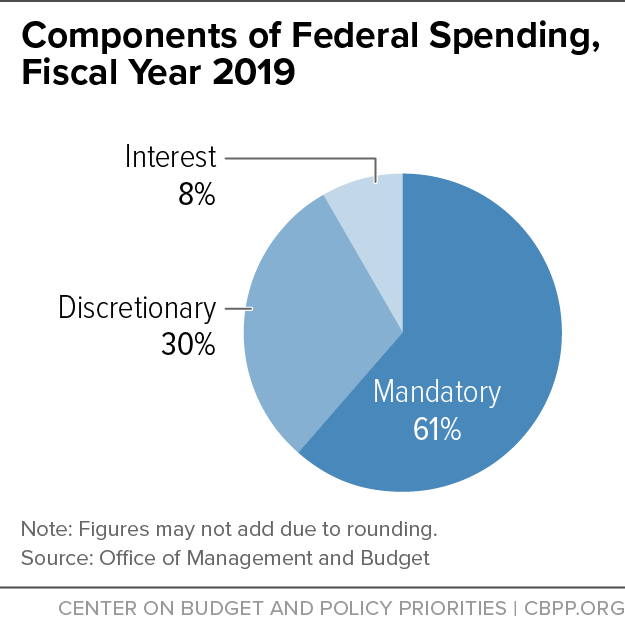

How much does Medicare cost the federal government?

· The standard Part B premium is $170.10 for 2022 (largest increase in program history, but Social Security COLA also historically large). The Part B deductible is $233 in 2022 …

What are the new proposed changes to Medicare?

The biggest change Medicare's nearly 64 million beneficiaries will see in the new year is higher premiums and deductibles for the medical care they'll receive under the federal government's health care insurance program for individuals age 65 and older and people with disabilities.

What are the major Medicare changes for 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What are the major changes in Medicare for 2020?

In 2020, the Medicare Part A premium will be $458, however, many people qualify for premium-free Medicare Part A. The Medicare Part B premium will increase to $144.60, and the Medicare Part B deductible will rise to $198 in 2020.

Is Medicare being lowered to 60?

Lowering the eligibility age is no longer part of the U.S. Government's budget for Fiscal Year 2022. So, the Medicare eligibility age will not see a reduction anytime in the next year.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.

Will Medicare Part B go up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

What changes are coming to Medicare in 2022?

In 2022, some of these new medications and technologies have shaped new Medicare benefits. These benefits include increased telehealth coverage, additional help with insulin costs and the potential coverage of a new Alzheimer's drug.

How much money is taken out of Social Security for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What changes are there in Medicare 2022?

Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022.

Is Congress going to lower the age for Medicare?

More than 125 House lawmakers introduced legislation Friday that lowers the Medicare eligibility age to 60 from 65. The Improving Medicare Coverage Act — led by Reps.

Will the Medicare age be raised to 67?

3 The retirement age will remain 66 until 2017, when it will increase in 2-month increments to 67 in 2022. Several proposals have suggested raising both the normal retirement age and the Medicare eligibility age.

Is Biden going to lower the age for Medicaid?

During the 2020 presidential campaign, then-Candidate Joe Biden proposed lowering the Medicare eligibility age to 60.

Q: What are the changes to Medicare benefits for 2022?

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that...

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Roughly 1% of Medicare Part A enrollees pay premiums; the rest get it for free based on their work history or a spouse’s work history. Part A premi...

Is the Medicare Part A deductible increasing for 2022?

Part A has a deductible that applies to each benefit period (rather than a calendar year deductible like Part B or private insurance plans). The de...

How much is the Medicare Part A coinsurance for 2022?

The Part A deductible covers the enrollee’s first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage duri...

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are n...

Are there inflation adjustments for Medicare beneficiaries in high-income brackets?

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does “high income” mean? The high-income brackets were in...

How are Medicare Advantage premiums changing for 2021?

According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which...

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does no...

How is Medicare Part D prescription drug coverage changing for 2022?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans is $480 in 2022, up from $445 in 2021. A...

Who was the first president to make Medicare a national health insurance program?

Medicare, notes Rich, has a long and complicated history. The first president to call for a national health insurance program for Americans was Theodore Roosevelt, who made it a part of his platform in 1912. Harry Truman called for such a plan in 1945, and Medicare became a reality in 1965, when Lyndon Johnson signed it into law. As of January 2021, there were 63.1 million people enrolled in Medicare. (2)

Will Medicare change in 2022?

Regardless of the outcome of these negotiations, says Rich, it seems likely that there will be changes in Medicare coverage for 2022, as there is virtually every year. To one degree or another, these changes will be reflected in the available array of Medicare Advantage plans, now used by over 40% of all Medicare beneficiaries.

When will the 2% sequestration charge be reinstated?

Congress also temporarily suspended the 2% sequestration charge applied to all provider services from January 1, 2021 through March 31, 2021. Sequestration had been on hold since May 2020 under the 2020 Coronavirus Economic Relief and Security (CARES) Act but was scheduled to resume on January 1, 2021.

When will the telehealth waivers end?

On January 7, 2021, HHS Secretary Alex Ajar renewed the current PHE, allowing the current telehealth waivers to remain in effect through April 20, 2021.

Does Medicare reimburse telehealth providers?

Psychologists are reminded that once the PHE ends, Medicare will no longer reimburse providers for furnishing services via audio-on ly devices .

When did Medicare start putting new brackets?

These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

What the House Passed

The Medicare-related legislation, doesn't do everything APTA and other organizations have asked for, but it comes close. Here's what's in the bill.

The Senate Path

While the House passed the Medicare changes as standalone legislation, the journey the changes will take in the Senate is a little trickier— which could be a good thing. (This is where staying awake in civics class pays off.)

No Guarantees

As with all machinations on Capitol Hill, there's never a sure bet. That's why we need to be ready to advocate for S.610. Stay tuned to APTA — by way of our website, member emails, social media, and the APTA Advocacy Network — for calls to action in the coming days.

How did the ACA reduce Medicare costs?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare. But implementing the cuts has been a bit of an uphill battle.

How many people will be on Medicare in 2021?

However, those concerns have turned out to be unfounded. In 2021, there were 26 million Medicare Advantage enrollees, and enrollment in Advantage plans had been steadily growing since 2004.; Medicare Advantage now accounts for 42% of all Medicare beneficiaries. That’s up from 24% in 2010, which is the year the ACA was enacted (overall Medicare enrollment has been growing sharply as the Baby Boomer population ages into Medicare, but Medicare Advantage enrollment is growing at an even faster pace).

What is Medicare D subsidy?

When Medicare D was created, it included a provision to provide a subsidy to employers who continued to offer prescription drug coverage to their retirees, as long as the drug covered was at least as good as Medicare D. The subsidy amounts to 28 percent of what the employer spends on retiree drug costs.

How much will Medicare Part B cost in 2021?

In 2021, most Medicare Part B enrollees pay $148.50/month in premiums. But beneficiaries with higher incomes pay additional amounts – up to $504.90 for those with the highest incomes (individuals with income above $500,000, and couples above $750,000). Medicare D premiums are also higher for enrollees with higher incomes.

Why did Medicare enrollment drop?

When the ACA was enacted, there were expectations that Medicare Advantage enrollment would drop because the payment cuts would trigger benefit reductions and premium increases that would drive enrollees away from Medicare Advantage plans.

What percentage of Medicare donut holes are paid?

The issue was addressed immediately by the ACA, which began phasing in coverage adjustments to ensure that enrollees will pay only 25 percent of “donut hole” expenses by 2020, compared to 100 percent in 2010 and before.

What is the medical loss ratio for Medicare Advantage?

This is the same medical loss ratio that was imposed on the private large group health insurance market starting in 2011, and most Medicare Advantage plans were already conforming to this requirement; in 2011, the average medical loss ratio for Medicare Advantage plans was 86.3%. The medical loss ratio rules remain in effect, but starting in 2019, the federal government has reduced the reporting burden for Medicare Advantage insurers.