2022 costs at a glance

| Part A premium | Most people don't pay a monthly premium ... |

| Part A hospital inpatient deductible and ... | You pay: $1,556 deductible for each bene ... |

| Part B premium | The standard Part B premium amount is $1 ... |

| Part B deductible and coinsurance | $233. After your deductible is met, you ... |

| Part C premium | The Part C monthly premium The periodic ... |

Full Answer

How much does Medicare Part a cost per month?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B.

How much is the deductible for Medicare Part?

Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses. The Medicare Part B deductible for 2020 is $198 in 2020.

How much does Medicare Part B and D cost?

You pay your portion of the monthly premium if you receive Part D coverage as part of Medicare. The cost varies, but the nationwide base is about $33 per month in 2022. Each plan will also have a copayment and coinsurance amount. You can add Part D coverage to Medicare Parts A and/or B.

What is the deductible for Medicare Part?

Today Medicare is a counterproductive mix of mandatory (part A) and voluntary enrollment (parts B ... Congress should combine parts A and B into one policy with a single deductible and cost-sharing designed to encourage cost-effective use of care.

What cost are billed to Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Why am I being charged for Medicare Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

Is Medicare Part A free for everyone?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.

How much is taken out of your Social Security check for Medicare?

Medicare Part B If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30. If you receive Social Security benefits, your monthly premium will be deducted automatically from that amount.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do you have to pay for Medicare Part B?

Part B premiums You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Does Medicare Part A cover emergency room visits?

Does Medicare Part A Cover Emergency Room Visits? Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

Is Medicare Part A automatically deducted from Social Security?

No, Medicare Part A premiums may not be deducted directly from your Social Security check. However, most beneficiaries do not need to pay a premium for Part A. If you or your spouse have worked and paid Medicare taxes for at least 40 quarters (10 years), you will likely qualify for premium-free Part A.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

How much is the Part A deductible?

Part A Deductible: The deductible is an amount paid before Medicare begins to pay its share. The Part A deductible for an inpatient hospital stay is $1,556 in 2022.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

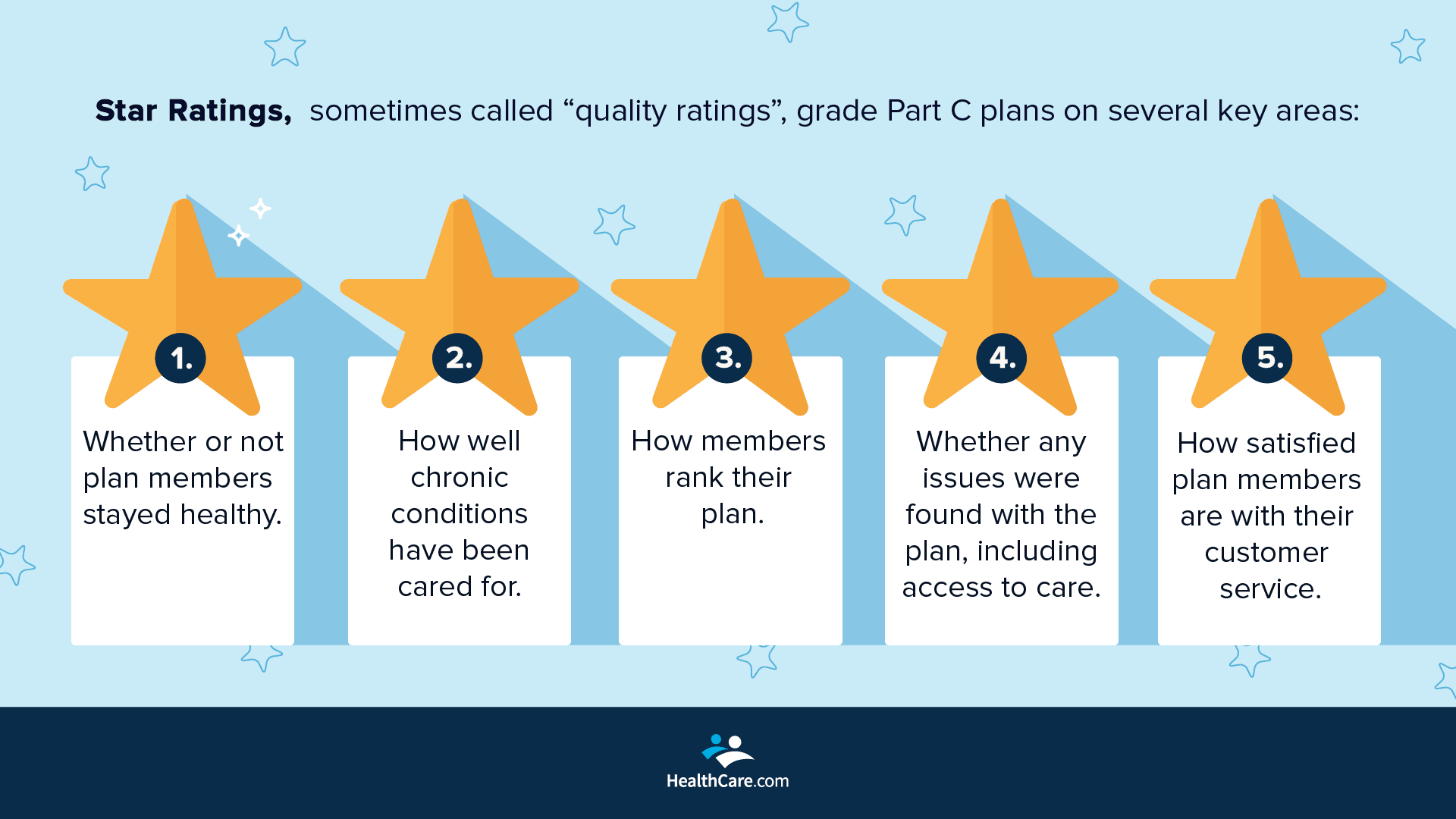

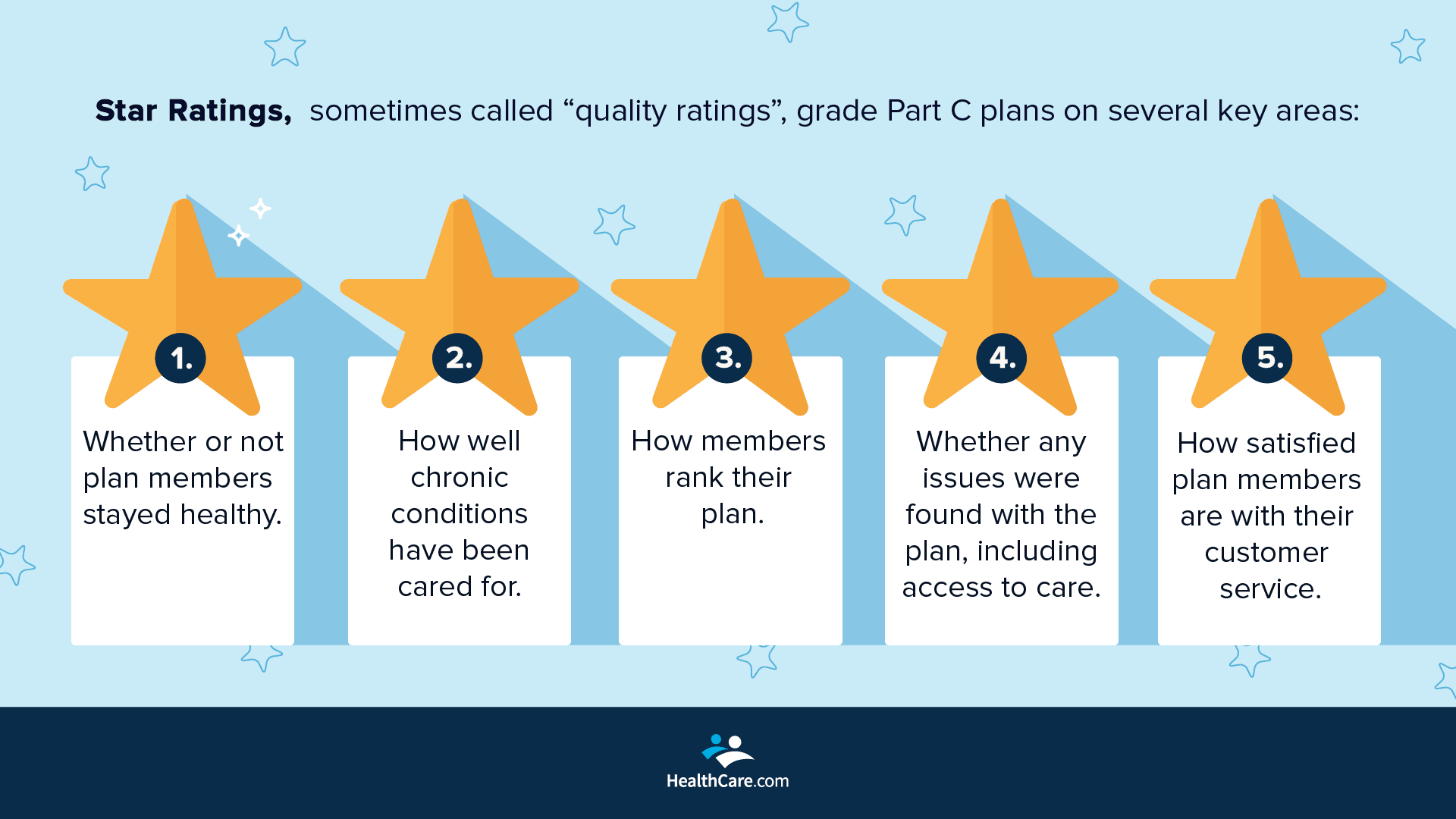

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for a month?

If you’re getting retirement benefits or are eligible for retirement benefits, Medicare Part A has a $0 monthly premium payment. The same rule applies if you’re under 65 years old and have been claiming federal disability benefits for at least 24 months, or if you’ve been diagnosed with end-stage renal disease or Lou Gehrig’s disease (amyotrophic lateral sclerosis, or ALS). Americans who are eligible for Medicare, but not other federal benefits, can still get coverage for a monthly premium up to $471.

What is Medicare Part A?

Medicare Part A, when combined with Medicare Part B (which covers outpatient insurance) is known as Original Medicare. Much of the care you receive through Medicare Part A is free, like home health services and hospice care.

How much is Medicare coinsurance for 2021?

Days 61-90 : $352 coinsurance per day ($371 in 2021) Day 91 and beyond : $704 coinsurance per day for each "lifetime reserve day" after the benefit period ($742 in 2021) You get 60 “lifetime reserve days” while on Medicare. These are extra days you can apply toward your qualified stay.

When do you enroll in Medicare Part A?

If you’re on federal retirement benefits, you get automatically enrolled in Medicare Part A and Medicare Part B on the first day of the month you turn 65. Otherwise, you will need to sign up yourself during your initial enrollment period, which starts three months before you turn 65.

Is Medicare Part A covered by Medicare Part B?

Not covered. Not covered. Medicare Part A and Medicare Part B work in tandem. You enroll in them, or opt for Medicare Advantage plans through Part C. Advantage plans are provided by private insurance companies that approved by the Medicare program. Lastly, prescription drug coverage is provided by Medicare Part D.

Does Medicare cover inpatient hospital?

Medicare Part A covers the cost of an inpatient hospital stay, but fees charged by a doctor or specialist physician will be covered by Part B. Medicare Part A does not cover the following at any hospital or facility: A private room, unless medically necessary. In-room television and phone services. Personal items.

Does Medicare cover home health care?

Medicare can cover the cost of home health care — like intermittent skilled nursing care or home health aides — in specific circumstances. Primarily, you must have recently had prior inpatient hospitalization and be homebound (unable to leave your home for medical reasons).

What is Medicare Part A?

Medicare Part A Premiums Part A Costs Coverage and Enrollment FAQs. Medicare Part A, commonly referred to as “hospital insurance,” covers most inpatient services. To be eligible for Medicare Part A, you must be a U.S. resident age 65 or older. To qualify for Medicare Part A with no monthly premium, you must have paid Medicare taxes ...

How long does Medicare cover hospital expenses?

In the simplest terms, after you pay the deductible associated with a qualifying hospital stay, the hospital portion of your bill is covered for the first 60 days. Not everything is simple when it comes to Medicare Part A costs.

How long does Medigap cover?

All 10 of the standard Medigap plans offered by private insurance companies supplement your Part A coverage by paying 100% of coinsurance beginning with Day 61 of a hospital stay and extending that coverage for up to 365 days after you exhaust your lifetime reserve days.

What is Medicare Supplement?

Also known as Medicare supplement insurance, Medigap is private health insurance that supplements your coverage and helps with your healthcare costs. You must have Part A and Part B (“medical insurance”) of Original Medicare to add a Medigap plan.

What is a medical deductible?

A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself. ($1,484 in 2021).

How much coinsurance do you pay for a 90 day stay?

If your stay extends beyond 90 days, you pay $742 of coinsurance for up to 60 “lifetime reserve days.”. Lifetime reserve days can be used over multiple benefit periods. Once your lifetime reserve days are exhausted, Part A doesn’t provide any coverage.

Does Medigap cover Medicare Part A?

Some Medigap plans also cover the Medicare Part A deductible. If you live in Wisconsin, Minnesota or Massachusetts, your Medigap plan is not the same as other states. In most cases, a Medigap plan purchased in Illinois is the same if you find yourself in Texas. It’s standard.

Medicare Part A: Hospital Insurance

Part A is often called hospital insurance because it pays for care while admitted as an inpatient at the hospital. It also pays some costs outside a hospital, such as skilled nursing facility stays, home health care, and hospice care.

Medicare Part B: Medical Insurance Medicare

Part B helps pay for health care services such as doctor services, preventive benefits, hospital outpatient surgery and care, ambulance services, outpatient mental health services, durable medical equipment, and home health care (not covered by Part A).