Each part of Medicare covers different services and has different costs:

- Part A covers inpatient care.

- Part B covers outpatient care.

- Part C covers everything parts A and B do and often includes Part D as well.

- Part D covers prescription drugs.

What is the best Medicare coverage plan?

- Best Medicare Advantage Plan Providers

- Compare Medicare Advantage Plans

- What is a Medicare Advantage Plan

- Medicare Law and Medicare Advantage Plans

- Best Medicare Insurance Providers 1. ...

- Pros + Cons of Medicare Advantage Plans Advantages of Medicare Part C Disadvantages of Medicare Part C

- How to Compare Medicare Advantage Plans

How to choose a Medicare plan?

- Issue-age rated: premiums are based on your age when you enroll and don’t go up as you get older.

- Community-rated: all plan members pay the same premium, regardless of their age.

- Attained-age rated: premiums are based on your current age, so your premium costs rise as you get older.

How do I know what Medicare plan I have?

- Review your Medicare plan coverage options. It’s a good idea to review your Medicare coverage every year to make sure the benefits of your Medicare plan remain aligned with your ...

- Make changes to your Medicare plan coverage during the right time of year. ...

- Find out what Medicare plan may fit your needs. ...

Which prescription drugs are covered with my plan?

To find out which prescriptions are covered through your new Marketplace plan: Visit your insurer’s website to review a list of prescriptions your plan covers; See your Summary of Benefits and Coverage, which you can get directly from your insurance company, or by using a link that appears in the detailed description of your plan in your Marketplace account. Call your insurer directly to find out what is covered. Have your plan information available.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What are the 3 types of Medicare?

Different types of Medicare health plansMedicare Advantage Plans. ... Medicare Medical Savings Account (MSA) Plans. ... Medicare health plans (other than MA & MSA) ... Rules for Medicare health plans.

What are the five types of Medicare?

The 5 Parts of MedicareMedicare Part A (Hospital Insurance) ... Medicare Part B (Medical Insurance) ... Medicare Supplements or Medigap. ... Medicare Part D (Medicare Prescription Drug Coverage) ... Medicare Part C (Medicare Advantage Plans)

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is covered by Medicare Part C?

Medicare Part C outpatient coveragedoctor's appointments, including specialists.emergency ambulance transportation.durable medical equipment like wheelchairs and home oxygen equipment.emergency room care.laboratory testing, such as blood tests and urinalysis.occupational, physical, and speech therapy.More items...

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Are there disadvantages to a Medicare Advantage plan?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Who is the best provider for Medicare?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Jun 8, 2022

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

When can I change my Medicare plan?

A: You can change plans or join original Medicare once a year during the annual open enrollment period, from Oct. 15 through Dec. 7, and your new coverage will begin Jan. 1 of the following year. — Read Full Answer.

How long does it take to get Medicare if you are 65?

If you are under 65 and get disability benefits, the Social Security Administration will enroll you in Medicare after you have received benefits for 24 months. — Read Full Answer.

Can I buy Medicare Supplement Insurance?

A: If you have a Medicare Advantage plan, you cannot buy a Medicare Supplement Insurance or Medigap plan. — Read Full Answer. Q: Do Medicare Advantage plans provide the same coverage as Original Medicare? A: Medicare Advantage plans cover all Medicare-covered services and must include both Part A and Part B benefits.—.

Is the catastrophic phase of Medicare Part D permanent?

A: Yes, the catastrophic phase of the Part D benefit is permanent to help protect those people facing the greatest outpatient drug costs. — Read Full Answer. Q: Do Medicare Advantage plan also have a doughnut hole in their coverage? A: The doughnut hole (or coverage gap) is part of the Medicare Part D drug benefit.

Can I choose Medicare Advantage or Original?

You can choose Original Medicare. This is the traditional fee-for-service plan provided by Medicare. Or, you can choose Medicare Advantage (also known as Part C). You can also get Medicare prescription drug coverage to help cover some of the costs of your prescription drugs. AARP’s Medicare Question and Answer Tool is a starting point ...

Does Medicare pay for Part A?

Medicare will pay its share of the charge for each service it covers.

Do you get a monthly statement from your insurance?

A: You should receive a monthly statement from your plan showing your total out-of-pocket costs for covered prescription drugs and indicating if that amount puts you in the coverage gap or takes you out. — Read Full Answer.

What is a Medigap plan?

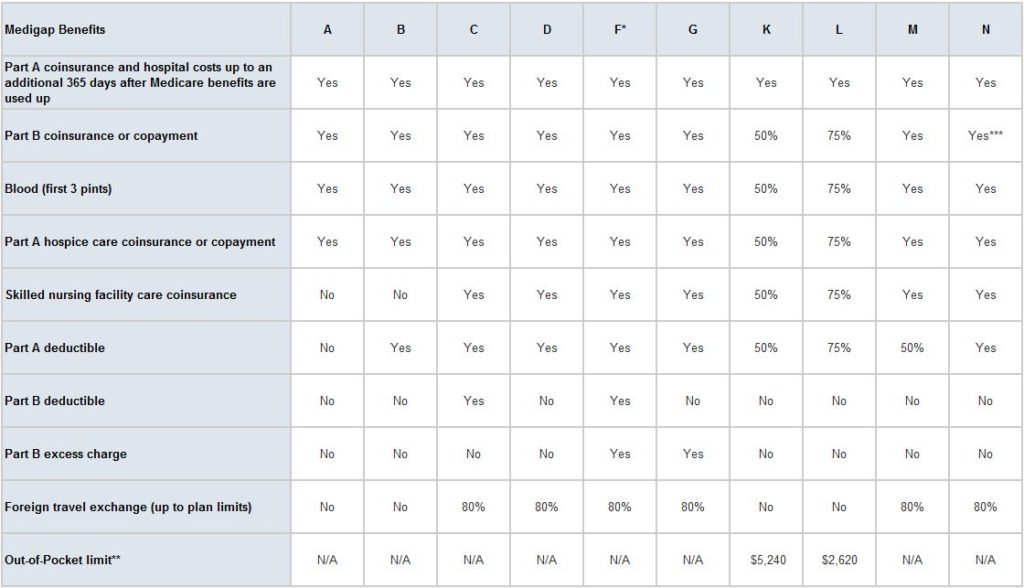

Medigap policies are voluntary and beneficiaries must pay monthly or quarterly premium payments to receive assistance from their Medigap plan. Medigap has differing plans, from Plan A to Plan L, which provide differing levels of extra coverage. Plan A provides the fewest benefits but has the lowest premium while Plan L provides ...

When did Medicare come out?

Medicare has come a long way since 1965 . Beneficiaries no longer have just Part A and Part B to choose from but can also seeks outside coverage from private providers who offer Medicare approved plans.

What is Medicare Part D?

Part D provides senior citizens with assistance in covering the costs of prescription medications necessary to beneficiaries with the drugs vital to their quality of life.

What is Medicare Supplemental Insurance?

Individuals who struggle to afford Medicare coverage under Part A and Part B can enroll in a Medicare Medigap Policy (also known as Medicare Supplemental Insurance) to help cover the cost of co-payments, deductibles, and coinsurance.

When was Medicare first developed?

When Medicare was first developed in 1965 , beneficiaries had only the option of enrolling in Medicare Part A and Part B. These two portions of Medicare provide beneficiaries with coverage for expenses related to hospital stays, related rehabilitation needs, and general medical insurance.

Which plan has the lowest premium?

Plan A provides the fewest benefits but has the lowest premium while Plan L provides the most benefits but comes with a higher premium. Generally, Medicare would pay its share of costs related to hospital or Medicare insurance and an individual’s Medigap policy would then pay its share.

Does Medicare Part A and Part B cover hospital?

Senior citizens who choose to go with the original Medicare Part A and Part B coverage will be provided with hospital coverage and general medical coverage without the beneficiary having to pay a monthly premium.

What is Medicare Advantage?

For those who qualify for Medicare — including individuals ages 65 and up and younger people with disabilities — Advantage plans, or Part C, are an alternative way to get covered.

How does Medicare Advantage differ from regular Medicare?

Unlike with original Medicare, there are geographic restrictions on the Advantage plans available to you and the healthcare providers they cover. That generally means you’ll have less choice or need to spend more to see a physician outside your plan’s network. “Beneficiaries who travel a lot within the U.S.

Why do Medicare Advantage plans get a bad rap? The Medigap disadvantage

Medigap is the supplemental insurance available to people with original Medicare. It fills in coverage gaps by covering things like deductibles (what you pay before insurance kicks in) and copays (the set amount you pay for a doctor’s visit and other services).

What are the six types of Medicare Advantage plans?

These plans cover care and services by providers within a defined network. For care outside the network, you usually have to pay the entire bill.

The bottom line

If you’re considering enrolling in a Medicare Advantage plan, you’ll want to compare not only individual plans but also different types of coverage. HMOs are the most popular option and can save you money, but they also come with restrictions.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

What is a Medigap plan?

Coverage. Plan A. Medicare Part A coinsurance and the costs of 365 days’ worth of care after Medicare benefits are exhausted, Part B coinsurance or copayments, the first 3 pints of a blood transfusion, and hospice care coinsurance or copayments. Plan B.

What age does Medicare cover?

Medicare provides healthcare coverage to people over age 65 and those with disabilities or certain health conditions . This complex program has many parts, and it involves the federal government and private insurers working together to offer a wide variety of services and products.

What is Medicare Part C?

Medicare Part C (Medicare Advantage) is a private insurance product that gives you all the coverage of Medicare parts A and B, plus extra services. Most of these plans offer prescription coverage in addition to inpatient and outpatient services. Benefits like dental and vision coverage can be added too.

How much will Medicare cost in 2021?

Under Medicare Part B, you can expect to pay the following costs in 2021: a premium of at least $148.50 per month (this amount increases if your individual income is above $88,000 per year or $176,000 per year for married couples) a $203 deductible for the year.

Does Medicare cover outpatient prescriptions?

some outpatient prescription medications. To be sure Medicare Part B covers your appointment, service, or medical equipment, ask if your doctor or service provider accepts Medicare. You can also use the Medicare coverage tool to determine whether your appointment or service is covered.

Is Medicare Advantage a private insurance?

Premiums and copayments apply, but they’re usually income-based and may be subsidized. Medicare Advantage (Part C) plans are private insurance plans. These plans combine multiple elements of Medicare, like parts A and B , with other services, such as prescription, dental, and vision coverage.

Does Medigap cover out of pocket costs?

Medigap plans may not cover all out-of-pocket costs, but you can find the one that best suits your financial and health needs. You have a variety of plans and coverage levels to choose from. Here’s an overview of what each of the 10 Medigap plans cover: Medigap plan. Coverage. Plan A.