How do Medicare supplement plans work in Massachusetts?

We’ll go through how Massachusetts Medicare Supplement plans work. There are 335,911 Medigap Plan members in Massachusetts, accounting for approximately 31.9% of all Medicare participants. Medicare Supplement plans are regulated by the federal government, and Medigap plans from state to state have the same coverage.

What are the different types of Medicare supplement plans?

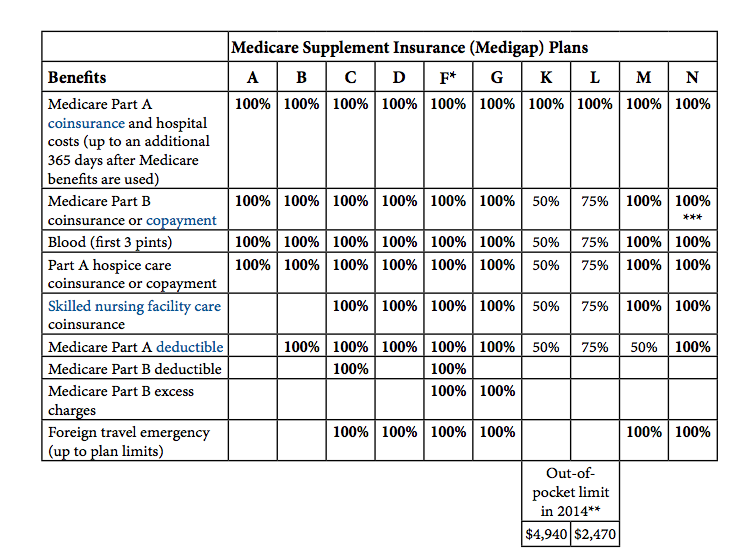

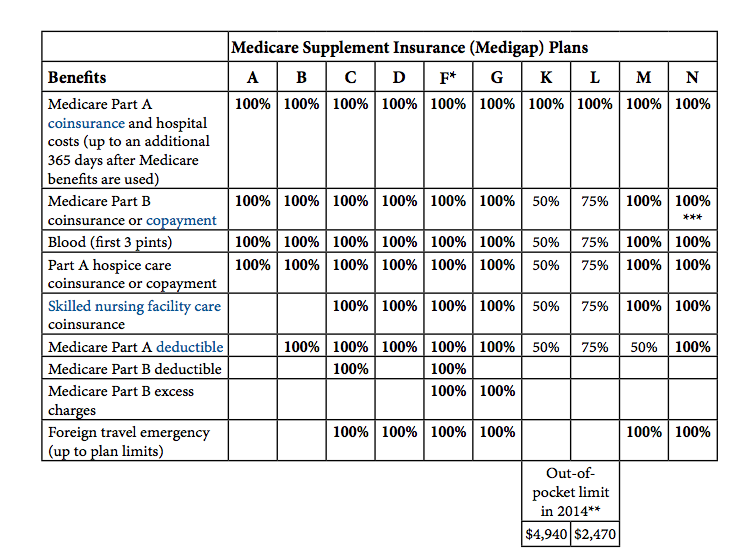

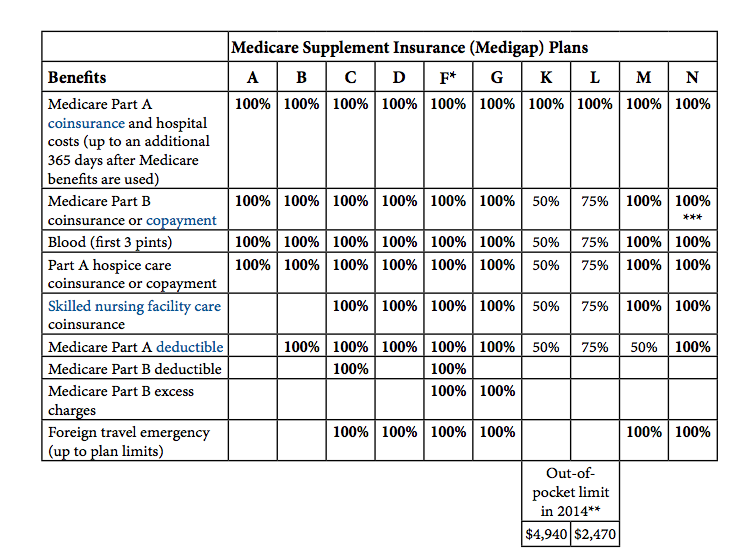

There are 10 standardized Medicare Supplement Insurance (Medigap) plans that are available in most states. These plans are labeled Plan A, B, C, D, F, G, K, L, M and N. When shopping for the best Medigap plan for your needs, it can help to compare Medigap quotes. How to Compare Medicare Supplement Plans

Can I switch to a Medicare supplement plan without underwriting?

But, in Maine, you can “try” the Advantage plan for three years, and you have 90 days after dropping the policy to switch to a supplement with Guaranteed Issue rights. Vermont – In Vermont, you can enroll in a Medigap plan without underwriting throughout the year. Also, you may need Medicare documents for Guarantee Issue rights.

What is the supplement 1A health plan in Massachusetts?

Most beneficiaries in Massachusetts will enroll in the Supplement 1A plan. While it’s are more expensive than the Core plan, its coverage is significantly more comprehensive. In the next section, we’ll use a 65-year-old woman from New Bedford, Massachusetts, as our example. The majority of state carriers use community age rating systems.

How much is Medicare deductible for 2020?

What states have Medigap policies?

What is coinsurance in Medicare?

What is covered benefits?

Where do you live in Medigap?

Do insurance companies have to offer every Medigap plan?

Does Medicare cover Part B?

See more

About this website

Are Medicare Supplement plans the same in every state?

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

Are Medicare rules different in each state?

In general, plans in all states need to follow the same rules. For example, all Medicare Advantage plans must cover all the same services as original Medicare. An exception to this is Medigap plans. In most states, Medigap plans will have the same letter names across all insurance companies and offer the same coverage.

Are Medigap policies only standardized in 3 states?

Although Medigap plans are issued by private insurance carriers, the policies are standardized. In all but three states, there are up to ten different Medigap plans available: A, B, C, D, F, G, K, L, M, and N (not all plans are available in all areas), and there are also high-deductible versions of Plan F and Plan G.

Why are Medigap plans different in Wisconsin?

Wisconsin Medicare Supplement plans are much different from the standard letter plans available through most of the nation. The program in this state includes a Basic Plan with the option of riders. State laws require Medigap insurance carriers to cover specific benefits in addition to the primary coverage.

Do Medigap premiums vary by state?

Medicare Supplement (Medigap) plan premiums vary from state to state. Although the benefits are standardized, Medicare costs by state are not the same. There are many reasons why some states have more expensive Medigap plans than others.

Can I change my Medicare supplement plan at any time?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

Which states have non standardized Medicare Supplement plans?

However, three states offer distinct types of Medigap plans. These states are Wisconsin, Massachusetts, and Minnesota. Rather than the traditional letter plans, these unique states provide more variety in coverage.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

What is the best Medicare plan in Wisconsin?

Medicare Advantage Plans in WisconsinInsurance companyMedicare ratingJ.D. Power rankingAetna4 starsFifth out of 10Humana4 starsThird out of 10UnitedHealthcare3.5 starsFourth out of 10

What Medicare Supplements are available in Wisconsin?

What Are the Most Popular Medicare Supplement Plans in Wisconsin?Medicare Part A coinsurance for inpatient hospital care.Medicare Part B coinsurance for medical care.The first three pints of blood per year for blood transfusions.Medicare Part A hospice coinsurance or copayment.

How many Medigap plans are in Wisconsin?

At least 32 insurers offer Medigap plans in Wisconsin; the state does its own Medigap plan standardization, so Medigap plans in Wisconsin are different from Medigap plans sold in most states.

2022 Medicare Supplement Insurance Plans Comparison Chart

Most Popular Medigap Plans. The most popular Medigap plan is Plan F, which is the only plan to provide maximum coverage in each benefit area. Because Plan F is not available for new beneficiaries who became eligible for Medicare after January 1, 2020, Plan G will likely become the most popular Medigap plan for new Medicare beneficiaries.

Updated 2022 | Medicare Supplement Comparison Chart ...

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,490 in 2022. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

Best Medicare Supplement Plans for Seniors in 2022

Did you know that roughly 20 percent of Medicare beneficiaries also have a Medigap plan? 1 Medigap plans, also known as Medicare supplemental insurance, are optional plans provided by private insurance companies to help lower health care costs, including deductibles, coinsurance, and copays. As its name suggests, Medigap helps fill the gaps in Original Medicare’s coverage.

What percentage of Massachusetts Medicare beneficiaries are enrolled in Medicare Advantage plans?

About 27 percent of Massachusetts Medicare beneficiaries are enrolled in Medicare Advantage plans. The Medicare Advantage market is robust in most of Massachusetts, but there are just three Advantage plans available for purchase in Dukes County and Nantucket County (up from just one in 2020). Nine insurers offer Medigap plans in Massachusetts.

How many Medigap plans are there in Massachusetts?

Medigap plans are different in Massachusetts — there are only three plan designs (and only two for newly-eligible enrollees), instead of ten. Louise Norris. Health insurance & health reform authority. November 18, 2020. facebook2.

How much is Medicare Part D in Massachusetts in 2021?

There are 27 stand-alone Medicare Part D prescription plans available in Massachusetts for 2021, with premiums that range from about $7 to $135 per month. Per-enrollee spending for Original Medicare in Massachusetts is a little lower than the national average.

What percentage of Medicare beneficiaries are under 65?

Sixteen percent of Medicare beneficiaries in Massachusetts are under the age of 65; nationwide, it’s 15 percent. On the high and low ends of the spectrum, 22 percent of Medicare beneficiaries in Alabama, Arkansas, Kentucky, and Mississippi are under 65, while just 9 percent of Hawaii’s Medicare beneficiaries are eligible due to disability.

How many insurance companies offer Medigap in Massachusetts?

There are nine insurers that offer Medigap plans in Massachusetts. In all but three states, Medigap plans are standardized under federal rules. But Massachusetts is one of the three states where a waiver allows the state to design different Medigap plans. In other states, there are ten different Medigap plan designs.

What is the Medicare Rights Center in Massachusetts?

The Medicare Rights Center is a nationwide service that can provide a variety of information and assistance with questions related to Medicare eligibility, enrollment, and benefits.

How many people in Massachusetts have Medicare?

1,354,179 people had Medicare in Massachusetts as of September 2020, amounting to about 19 percent of the state’s population. In most cases, filing for Medicare benefits goes along with retirement and turning 65.

How long can you switch Medicare Advantage plan in Maine?

But, in Maine, you can “try” the Advantage plan for three years, and you have 90 days after dropping the policy to switch to a supplement with Guaranteed Issue ...

How long does it take to switch Medigap plans?

Missouri – If you have a Medigap policy, you can switch plans within 60 days of your enrollment anniversary . New York – You can enroll in a Medigap policy without underwriting throughout the year. Washington – Allows Medigap enrollees to change Medigap plans (except for Plan A) at any point.

How long can you change your Medigap plan?

Some states allow the “Birthday Rule,” which allows a 30-day timeframe for you to change your Medigap plan after your birthday every year. Also, you can change plans without underwriting as long as the policy benefits are equal to or less than your current plan.

Does Medigap cover excess charges?

If you’re looking at purchasing a Medigap policy, you may find that some of the plans cover excess charges. When a doctor doesn’t accept Medicare, excess charges may occur; doctors can only charge 15% above the threshold.

Can you cancel your health insurance in Wisconsin?

In the state of Wisconsin, if the annual premium of your employer plan is over 125% of the Basic Annual Premium for your gender and age, then you may qualify for Guaranteed Issue. No Conditions – You may decide to cancel your group health insurance and make Medicare primary.

Is Medicare primary or secondary?

If your employer’s health care policy is the primary form of insurance, and Medicare is secondary.

Is Medicare open enrollment in 2021?

Updated on July 15, 2021. Even though Medicare is a Federal program, some states have different terms for Open Enrollment, Guaranteed Issue Rights, excess charges, disability, etc. Below, we’ll highlight what states have their own unique rules.

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.