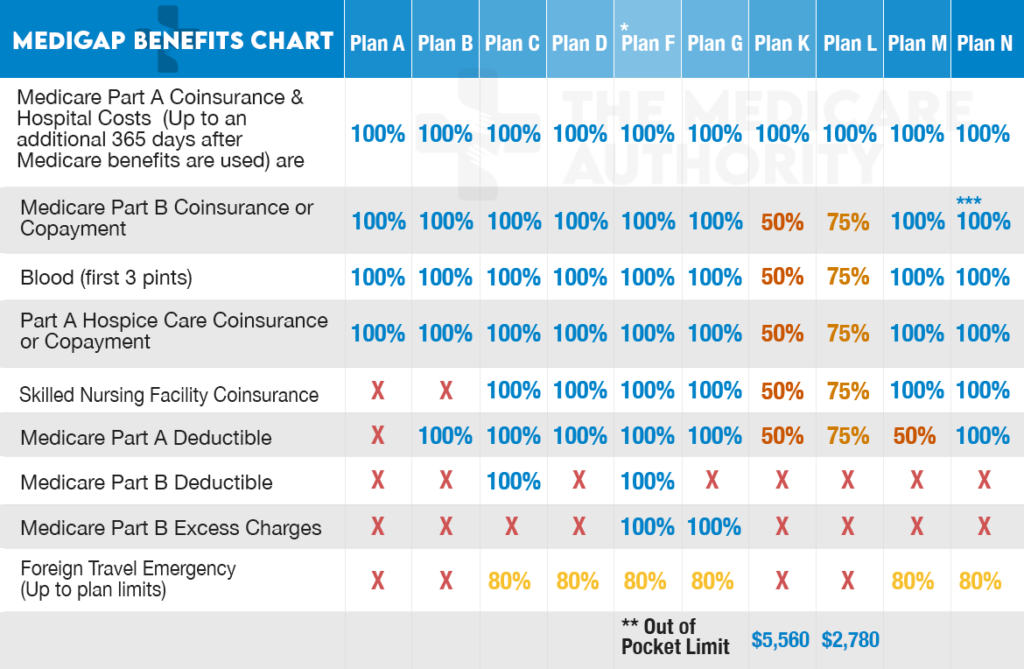

2021 Medicare Supplement Insurance Plans

| Medicare Supplement insurance plan type | C* | D | F* | K |

| Medicare Part B ‘excess charges’ | X | |||

| Foreign travel emergency basic benefits ... | 80%**** | 80%**** | 80%**** | |

| Out-of-Pocket Limit** | ||||

| $6,220 in 2021 |

Full Answer

How to choose the best Medicare supplement plans?

8 rows · Feb 03, 2022 · There are 10 standardized Medicare Supplement Insurance (Medigap) plans that are available ...

What are the top Medicare supplement plans?

10 rows · * There are also high-deductible versions of Plans F and G, where beneficiaries pay a deductible ...

Which Medicare supplement plan is the most popular?

Types of Medicare Supplement Plans | Medicare Strategist. All 11 plans fully cover Medicare part A coinsurance and hospital costs. All plans fully cover Medicare part B coinsurance/copayment except K and L, which cover 50% and 75% of costs, respectively. All …

Which Medicare supplement plan should I Choose?

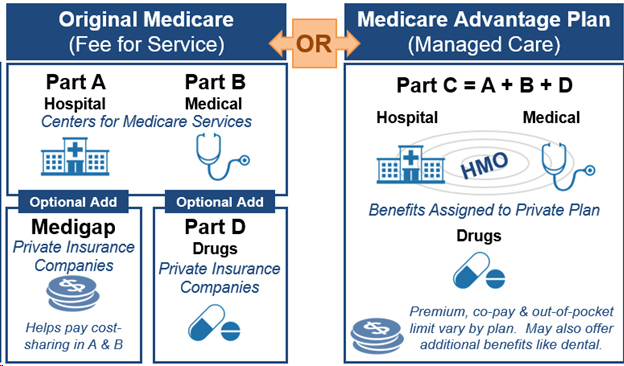

Contracts with Medicare to provide. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. and. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. benefits.

Is plan G as good as plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What is difference between plan D and plan G in Medicare?

Medigap Plan D It is very similar to Medigap Plan G, with only one benefit difference. Just like the difference in Plans F and C, the only difference in Plans G and D is the coverage of the Medicare Part B Excess charges. Whereas Plan G covers those at 100%, Plan D does not cover them at all.

What is the most common form of supplemental Medicare coverage?

Plan C. While Plan F is the most popular plan, Medigap Plan C, Plan G and Plan N are the next most popular Medicare Supplement Insurance plans. The most popular Medigap plans include: 49% of all Medigap beneficiaries are enrolled in Plan F.Oct 6, 2021

What is the difference between plan G and plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is the plan g deductible for 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the difference between a supplemental plan and a Medicare Advantage Plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Are all plan G Medicare supplements the same?

Because all Medicare Supplement Plan G policies provide the exact same coverage or benefits. This is what people mean when they say these plans are “standardized.” That said, not all Plan G policies cost the same. Insurance companies are free to charge what they want for them, and so they do.Nov 11, 2020

Can you have 2 Medicare Supplement plans?

En español | By law, Medigap insurers aren't allowed to sell more than one Medigap plan to the same person.

What is the difference between Plan G and Plan G select?

Plan G Select offers the same benefits as Plan G with the exception of national coverage. Plan G Select members use a local network of hospitals for inpatient services in exchange for lower premiums.Mar 6, 2017

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

What is Medicare Plan G deductible for 2021?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Which Is The Best Medicare Plan?

Plan F and Plan G are the two most popular Medigap plans. As you can see in the Medigap comparison chart, Plan F covers all the gaps in Medicare. P...

How to Compare Medigap Plans – Benefits

Medicare publishes a booklet each year that includes this Medicare Supplements Plans comparison chart. The Medigap comparison chart allows you to s...

Medigap Plans Comparison Chart

The Medigap Plans comparison chart above compares all of the plans side by side. This allows you to see which ones have the most benefits, and whic...

Shop Rates With Our Free Medigap Plans Comparison Report

Once you determine which Medigap plan feels right for you, you can then shop rates. Boomer Benefits makes this easy our free Medigap rate compariso...

Which states have Medicare Supplement plans?

Massachusetts, Minnesota, and Wisconsin standardize their Medicare Supplement insurance plans differently from the rest of the country. In all states, insurance companies that sell Medicare Supplement insurance aren’t required to offer all plan types.

How many different types of Medigap insurance are there?

There are 10 plan types available in most states, and each plan is labeled with a different letter that corresponds with a certain level of basic benefits. In most states, Medigap insurance plans have the same standardized benefits for each letter category.

What is county select?

County Select... Medicare Supplement (also known as Medigap or MedSupp) insurance plans help cover certain out-of-pocket costs that Original Medicare, Part A and Part B, doesn’t cover. There are 10 plan types available in most states, and each plan is labeled with a different letter that corresponds with a certain level of basic benefits. ...

Can you sell a plan C or F?

If an insurance company wants to offer other Medigap plans, it must sell either Plan C or Plan F in addition to any other plans it would like to sell. The chart below allows you to compare Medicare Supplement insurance plans based on what’s offered across the standardized plans that are available in most states.

What are the different types of Medicare Supplement Plans?

Depending on where you live, there may be three types of Medicare Supplement plans. This can include community-rated, issue-age-rated or attained-age-rated. In some states, attained-age-rated often ends up being the most cost-effective.

Which Medicare supplement plan requires copays?

When you are learning how to compare Medicare Supplement plans, just remember that Plan N is the one that requires copays from you for doctor and E.R. visits. That’s why the premiums are lower. People interested in the Medigap policies which offer the most affordable rates are usually interested in Plan N.

What is a Medigap Plan B?

Medigap Plan B. Medigap Plan B covers everything that Plan A covers but it also picks up the Medicare Part A hospital deductible. Plan B is a Medigap plan that pays after Medicare pays. Don’t confuse it with Part B, which is part of your Original Medicare benefits that pays for outpatient medical.

What is the difference between Plan F and Plan G?

Plan F and Plan G are the two most popular Medigap plans. As you can see in the Medigap comparison chart, Plan F covers all the gaps in Medicare. Plan G is only slightly different, so it is also a popular seller. When you compare Plans F and G side by side, you’ll immediately notice that Plan G has only one difference: the Part B deductible.

Does Medicare cover Plan A?

Medigap Plan A offers the most basic of all the Medigap plans. Even still, it will cover the 20% that Medicare doesn’t pay for on outpatient treatments. That’s arguably the most important piece of all Medigap plans. All Medicare insurance carriers must offer Plan A. However, some states do not require companies to offer it to people under age 65 on Medicare disability.

Is Medicare Supplement the same as Medigap?

This makes comparing Medicare Supplement plans pretty easy. ( Medicare Supplements and Medigap plans are the same thing) The Centers for Medicare and Medicaid Services updates the Medigap plans comparison chart every year, although most plans do not have benefit changes from year to year. Some Medigap plans will have higher premiums ...

Does Plan N cover excess charges?

Plan N offers lower premiums if you are willing to do a bit of cost-sharing. Unlike Plan F or G though, Plan N does not cover excess charges. You’ll want to read up on this and understand what that means before enrolling. For a list of Medicare supplement insurance companies, visit this page.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

How long does it take to get Medicare if you are 65?

If you are under 65 and get disability benefits, the Social Security Administration will enroll you in Medicare after you have received benefits for 24 months. — Read Full Answer.

When can I change my Medicare plan?

A: You can change plans or join original Medicare once a year during the annual open enrollment period, from Oct. 15 through Dec. 7, and your new coverage will begin Jan. 1 of the following year. — Read Full Answer.

How much will you pay for prescriptions after the doughnut hole is closed?

A: Once the doughnut hole is closed in 2020, you will pay approximately 25 percent of the cost of your prescriptions until you reach the last phase or catastrophic coverage level. — Read Full Answer

How much did you pay for drugs in 2017?

When you and the drug plan have paid a total of $3,700 for drugs in 2017, you enter the coverage gap or doughnut During this second phase, you will pay no more than 40 percent of the plan's price for a brand-name drug and 51 percent for a generic drug. — Read Full Answer.

Does Medicare Supplemental Insurance cover deductibles?

A: Medigap or Medicare supplemental insurance is sold by private insurance companies and helps pay some of the health care costs original Medicare doesn’t cover, including some or most Medicare deductibles and coinsurance. — Read Full Answer.

Can I buy Medicare Supplement Insurance?

A: If you have a Medicare Advantage plan, you cannot buy a Medicare Supplement Insurance or Medigap plan. — Read Full Answer. Q: Do Medicare Advantage plans provide the same coverage as Original Medicare? A: Medicare Advantage plans cover all Medicare-covered services and must include both Part A and Part B benefits.—.

Is the catastrophic phase of Medicare Part D permanent?

A: Yes, the catastrophic phase of the Part D benefit is permanent to help protect those people facing the greatest outpatient drug costs. — Read Full Answer. Q: Do Medicare Advantage plan also have a doughnut hole in their coverage? A: The doughnut hole (or coverage gap) is part of the Medicare Part D drug benefit.

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

A Crash Course on Medicare

Join our email series breaking down each of the key parts of a comprehensive end-of-life plan.

What Is Medicare Supplement Insurance?

Private heathy insurance companies offer Medicare supplement plans that were initially designed to help fill in the gaps of Medicare Parts A and B. It pays for things like co-payments, coinsurance, and deductibles.

What Are the Different Types of Medicare Supplement Plans?

The chart shown below gives you a quick look at the Standardized Medicare Supplement insurance plans available. These are some of the nuances, courtesy of medicare.gov:

How Much Does Medicare Supplement Insurance Cost?

According to valuepenguin.com, in 2022, a Medicare Supplement plan costs an average of $163 per month. However, costs will depend on two factors: the policy you select and your state’s pricing structure.

How Do Premiums and Payouts Work With Medicare Supplement Insurance?

Premiums and payouts for Medicare Supplement Insurance work much the same for health insurance. Premiums are typically auto-deducted from a bank account or billed quarterly, semi-annually, or annually.

Advantages of Medicare Supplement Insurance Plans

When you enroll in Medicare, you’ll need to decide if you’re going to enroll in a Medicare Part C Advantage Plan (described above) or a Medicare Supplement insurance plan.

Use a Medicare Specialist When Buying Medicare Supplement Insurance

As you can tell, there are many moving parts when it comes to Medicare enrollment and coverages. You have to be sure you’re applying at the right time, and you have to select from a multitude of options to ensure you have the best plans and coverage to meet your needs.

What is Medicare Supplement?

Medicare Supplement (also known as Medigap) insurance plans are sold by private insurers . Medicare Supplement insurance plans are designed to help pay some of the out-of-pocket costs not paid by Medicare. These costs typically include Medicare deductibles, copayments, and coinsurance.

How much is Medicare Supplement 2021?

If you choose either of these high-deductible options, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,370 in 2021 before your Medicare Supplement insurance plan will pay anything.

Does Medicare Supplement pay 100%?

The Medicare Supplement comparison chart shows you exactly which benefits each plan may cover. In the Medicare Supplement comparison chart, “ Yes” means the lettered Medigap insurance plan may pay 100% of the benefit. If a percentage appears in the row, the Medigap insurance plan may pay part of the benefit ...

Can you compare Medigap insurance?

Once you compare Medigap insurance plans to find the right benefits for you, you are ready to shop for the best price. All Medigap insurance plans of the same letter (Plan G, for example) must provide identical basic benefits. But companies can set their own premiums, and even offer extra benefits.