Questions usually ask for information about your age, weight, drug use (including tobacco and alcohol), chronic health conditions, vision, issues with your circulatory system, prescription drugs you take, and more. Some insurance companies may have more extensive questionnaires, and may also ask about other issues like your mental health history.

Full Answer

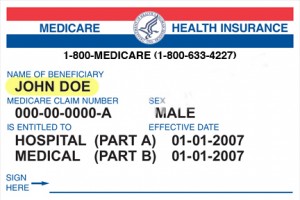

Where to get answeres to your Medicare questions.?

Medicare Eligibility, Applications and Appeals

- What help is available? ...

- Am I eligible? ...

- How do I apply? ...

- How do I check the status of my application? ...

- How do I complain or appeal a Medicare decision? ...

- Who do I contact for extra help? ...

- Is there anything else I need to know? ...

Is Medicare Supplement Health Insurance a good idea?

The good news is that Medicare beneficiaries who have supplemental Medicare coverage will generally find that their resulting coverage is quite comprehensive. And depending on the cost of the employer-sponsored plan (including premiums and out-of-pocket costs), some people also end up with lower overall healthcare costs once they switch to Medicare.

What do you need to know about Medicare supplements?

You must be enrolled in Medicare parts A and B to be eligible for a Medicare Supplement plan (it’s not available to Medicare Advantage enrollees). Like Medigap Plan F, Plan C is no longer ...

Do I really need Medicare supplement?

YES. Because we have many options for covering the gaps, there is no need to run around without supplemental coverage. If you find yourself asking whether you really need a Medicare supplement, ask yourself if you can afford to pay 20% of a $50,000 knee replacement or 20% of eight weeks of cancer chemotherapy.

What are the Medicare questions?

Here are some of the most common Medicare questions and answers.How Do I Know What Medicare Coverage Is Right For Me?How Much Does Medicare Cost?What Do I Do About Medicare If I Work Past Age 65?How Can I Get Dental and Vision Coverage with Medicare?What's the Difference Between a Medicare Advantage HMO and PPO?

Can I be denied a Medicare Supplement plan?

The insurance company may deny coverage or charge you more without a guaranteed issue right. Even if you enroll in a plan, you may have to wait for your health condition to be covered. This coverage gap is known as a pre-existing condition waiting period.

What questions are asked during the Medicare interview?

Medicare Interviewer Interview Questions1Tell me how you organize, plan, and prioritize your work.2Share an effective method you have used to answer applicants' questions about benefits and claim procedures.3What is the key to success when communicating with the public.14 more rows

What are the criterias of a Medicare Supplement plan?

You must be enrolled in BOTH Parts A and B at the time of application. You must be age 65 or older (in several states, some Plans are offered to those under 65 who are on disability). You must reside in the state in which the Supplement Plan is offered at the time of application.

When can someone enroll in a Medicare Supplement without the chance for denial premium increase or exclusions due to pre-existing conditions?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded.

Can I change Medicare Supplement plans anytime?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

How do I get my Medicare question answered?

Do you have questions about your Medicare coverage? 1-800-MEDICARE (1-800-633-4227) can help. TTY users should call 1-877-486-2048.

What is medical underwriting for Medigap?

Medical underwriting is a health test that helps insurers decide whether they want you as a customer and, if so, how much to charge you. If you have certain health issues, you may not be able to apply for Medigap, the supplemental insurance for Medicare Parts A and B.

What questions does Social Security ask when applying for Medicare?

Information About YouYour date and place of birth and Social Security number;The name, Social Security number and date of birth or age of your current spouse and any former spouse. ... The names of any unmarried children under age 18, age 18-19 and in elementary or secondary school, or disabled before age 22;More items...

What is the best supplemental insurance with Medicare?

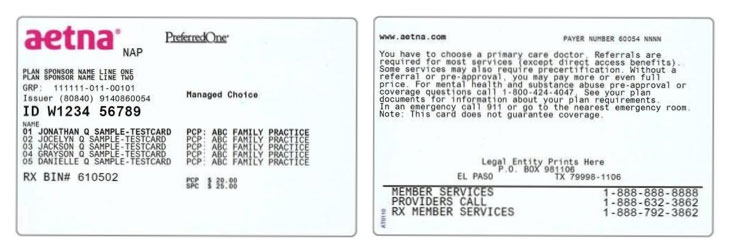

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

How many pints of blood are covered by Medicare Supplement core benefits?

three pintsHow many pints of blood will be paid for by Medicare Supplement core benefits? Medicare Supplement core policy benefits will pay for the first three pints of blood.

Who is the largest Medicare Supplement provider?

UnitedHealthCareAARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

Can Medigap deny coverage for preexisting conditions?

Be aware that under federal law, Medigap policy insurers can refuse to cover your prior medical conditions for the first six months. A prior or pre-existing condition is a condition or illness you were diagnosed with or were treated for before new health care coverage began.

Can I be turned down for Medicare Part D?

To disenroll from a Medicare drug plan during Open Enrollment, you can do one of these: Call us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Mail or fax a signed written notice to the plan telling them you want to disenroll.

Can you be denied Medicare Part G?

The answer is yes, you can be denied Medigap coverage. But you can also be guaranteed Medigap coverage if you apply during your Medigap open enrollment period.

What states allow you to change Medicare supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) is an optional type of insurance that can be used in combination with Original Medicare (Parts A and B). A Medicare Supplement Insurance plan helps pay for out-of-pocket expenses that are associated with Original Medicare, such as deductibles, coinsurance and copayments, as well as other costs.

How old do you have to be to get Medicare Supplement?

In order to be eligible for a Medicare Supplement Insurance plan, you must meet each of the following requirements: You must be at least 65 years old or live in a state that allows Medigap coverage for people under 65 who have end-stage renal disease or a qualifying disability*.

How many types of Medigap are there?

Each of the 10 types of Medigap plans are standardized across the country in terms of coverage. In other words, a plan type sold by a company in one area of the country must offer the exact same combination of benefits as the same plan type sold by a different company in another part of the country.

When is the best time to enroll in Medigap?

The best time to enroll in Medigap is during your Medigap open enrollment period . This is a six-month period that begins the month that you are enrolled in Medicare Part B and are at least 65 years old (or qualify because of a disability or end-stage renal disease).

How to shop for insurance?

Because the prices and availability of plans can differ from one insurance company to another, the best way to shop for a plan is to compare offerings from multiple insurance companies in your area. The best way to do this is to have an agent provide you with a range of plan options and price quotes once you are age-eligible .

Does Medicare Supplement Insurance accept Medicare?

Any physician or facility that accepts Medicare also accepts Medicare Supplement Insurance. So as long as your provider accepts Medicare, your Medigap plan will also be accepted.

Is Medicare Supplement Insurance private or public?

Medicare Supplement Insurance is sold on the private marketplace, so each insurance company is free to set their own prices for any given plan. The cost of a plan can vary greatly based on a few factors.

What is supplemental Medicare?

In the case of supplemental Medicare insurance, it covers the difference between what is paid for by original Medicare and the overall cost of the health care treatment provided. Sold by private insurers, supplemental health insurance helps with charges like copays, deductibles, and coinsurance. Erin Bueltel, a product specialist ...

How long does it take to get Medicare Part B?

An open enrollment period occurs within 6 months of obtaining Medicare Part B, and you can apply for a Medicare Supplement policy without having to answer health questions.

Does Medicare cover hearing aids?

But does supplemental insurance cover routine physical exams, hospice, or hearing aids? Medicare may help with some of those charges, but Medicare Supplement policies do not usually cover dental, vision, hearing, long-term, and private-duty nursing care. They do cover hospice care.

Is Medicare Supplement insurance an add-on?

The answer is no, Medicare Supplement insurance is an add-on, just like Medicare Part D, which covers prescriptions. “However, many individuals elect to add other supplemental coverage, such as Hospital Indemnity insurance, to their Original Medicare or Medicare Advantage plans to limit their out-of-pocket exposure to medical costs,” Bueltel says.

Does Medicare cover medico?

In terms of Medico’s coverage, “as long as Medicare would pay for your medical services, Medico’s Medicare Supplement plan would cover services related to those conditions,” Bueltel explains. 5.

What happens if you aren't truthful on your Medicare Supplement application?

If you aren't truthful on your Medicare Supplement application, the insurance company will rescind your policy as soon as they find the inconsistency.

How many questions are asked on Medigap?

Answer a set of 10-20 health questions on the Medigap application.

What Is Medical Underwriting?

Almost all kinds of insurance have underwriting processes. For example, if you've ever applied for a mortgage, you went through mortgage underwriting. The lender goes through an extensive process to determine if the risk of offering you a mortgage loan is acceptable.

What is prequalifying for insurance?

Talk to your insurance agent about your health, and they'll do something called prequalifying, or comparing your health status and current medications against a company's Underwriting Guide.

How long does open enrollment last?

Open Enrollment allows you to purchase any plan without having to pass any medical underwriting for six months. This only happens once in your life – when you're signing up for Medicare Part B for the first time. For most people, this is when they're turning 65.

What happens if you choose an expensive company during your open enrollment?

If you choose an expensive company during your Open Enrollment, you're stuck there unless you decide to switch carriers. And to switch carriers, you have to go through medical underwriting. Here's a common scenario: a woman turning 65 soon gets a Medicare Supplement mailer from a well-known company.

Why do insurance companies use medical underwriting?

For the most part, insurance companies use medical underwriting to determine whether they should offer you coverage, and if so, at what price.

Which states have Medicare Supplement Plans?

Every state has Medicare Supplement plans in some form or another, with the main differences happening in Massachusetts, Minnesota , or Wisconsin.

When does Medicare Part A and B start?

If your Medicare Part A and B starts on Jan 1st then your personal enrollment period will last until July 30th.

How long does Medicare coinsurance last?

Medicare Part A coinsurance costs up to an additional 365 days after Medicare benefits have been used up.

What does it mean when your insurance premiums are based on your age?

If your premiums are based on an attained age, this means as you get older your premiums will also increase.

Does Medicare Supplement cover vision?

On the other side of things, a Medicare Supplement plan does not have to cover vision, dental, long-term care, or hearing aids.

Is AARP no longer offering bonus?

In 2018 AARP announced that it will no longer be offering this feature as an added bonus so you can scratch them off of the list if this program is important to you.

Do you get more benefits with a health insurance plan?

Depending on the plan that you choose, there are even more benefits.

How long is an Open Enrollment Period for Medicare Supplement policies?

You can pre-enroll in Medigap up to 6 months before the Part B effective date with some companies. But, many companies only allow you to pre-enroll 3 months before Part B effective date. The Open Enrollment Period for Medigap lasts for 6 months and begins the day your Part B is effective.

What drugs are covered under Medicare Part D?

There are many drugs covered under Medicare. Plus, every plan must cover the six protected classes. If you have medications that need coverage, use the Medicare plan finder tool to identify the policy that will cover your medications.

How old do you have to be to get Medicare?

Most people are eligible for Medicare at age 65. Those under 65 can qualify for Medicare when they collect Social Security Disability for at least 24 months.

How much does Medicare cost at age 65?

The cost of Medicare depends on many things. Those with a low income will likely pay less than the standard amount and may qualify for Medicare and Medicaid. Those with a higher income will likely pay more for Part B; this is called the Part B Income Related Monthly Adjustment Amount.

Do I need Medicare Part B if I have other insurance?

When you delay enrollment because you’re delaying retirement, you won’t need to rush to sign up for Part B. Although; you may choose to enroll in Part A, especially since, in many cases, it’s free.

What age to apply for Medicare?

For the most part, people sign up for Medicare at age 65. But, some may choose to delay enrollment due to delaying retirement. In contrast, others may enroll before age 65 if they’re on Social Security Disability for at least 24 months.

Do you have to sign up for Medicare at 65 if you are still working?

You should sign up for Medicare at age 65 if you’re working for a small employer (less than 20 employees). But, if you work for a larger employer, you could delay enrollment.

What is Medicare Supplement?

Medicare is a federal health insurance program with several different parts and seemingly endless rules and regulations that dictate how it is administered . Many people struggle to understand every aspect of Medicare and Medicare Supplement Insurance (also called Medigap).

What is Medicare Advantage?

What is Medicare Advantage?#N#Medicare Advantage (Medicare Part C) is a way to get your Medicare benefits through a private insurance company that contracts with the federal government. Most Medicare Advantage plans offer additional benefits beyond what is offered by Original Medicare, such as dental, vision or prescription drug coverage.

What kind of health questions do you have to answer for medical underwriting?

Questions usually ask for information about your age, weight, drug use (including tobacco and alcohol), chronic health conditions, vision, issues with your circulatory system, prescription drugs you take, and more.

How long does the Medigap OEP last?

Your Medigap OEP begins on the first month that you are both enrolled in Medicare Part B and are 65 years of age. It lasts for six months.

What is medical underwriting?

Medical underwriting is in essence a risk assessment about a person. An insurance company wants to know how likely it is that you may file a claim based on your medical history. It is similar to car insurance, where they review your driving record to guess how likely you are to have an accident If the insurance company expects you to file many claims, they are less likely to sell you a plan, or may charge you a higher premium.

Can a Medigap plan be underwritten?

Medigap insurers can't use underwriting if you have guaranteed issue rights, which require companies to sell you certain plans. The conditions for gaining these rights can vary.

Does Medicare use underwriting?

Original Medicare (Parts A and B) doesn’t use underwriting at all , and neither do Medicare Advantage health plans. Medicare Part D prescription drug plans do not use underwriting either.