Medicare Supplement High Deductible Plan G

| PLAN | K | L | N |

| Part A Hospital Coinsurance | X | X | X |

| Hospital Reserve Days | X | X | X |

| 3 Pints of Blood | 50% | 75% | X |

| Part B Coinsurance | 50% | 75% | *Copays |

Full Answer

What is the best and cheapest Medicare supplement insurance?

A high-deductible Medicare Supplement Plan F or Plan G may be a good fit for you if you: Prefer a low monthly premium Live in a state that allows Medicare Part B excess charges (the difference between the Medicare-approved amount and the... Travel …

What are the best Medicare supplement programs?

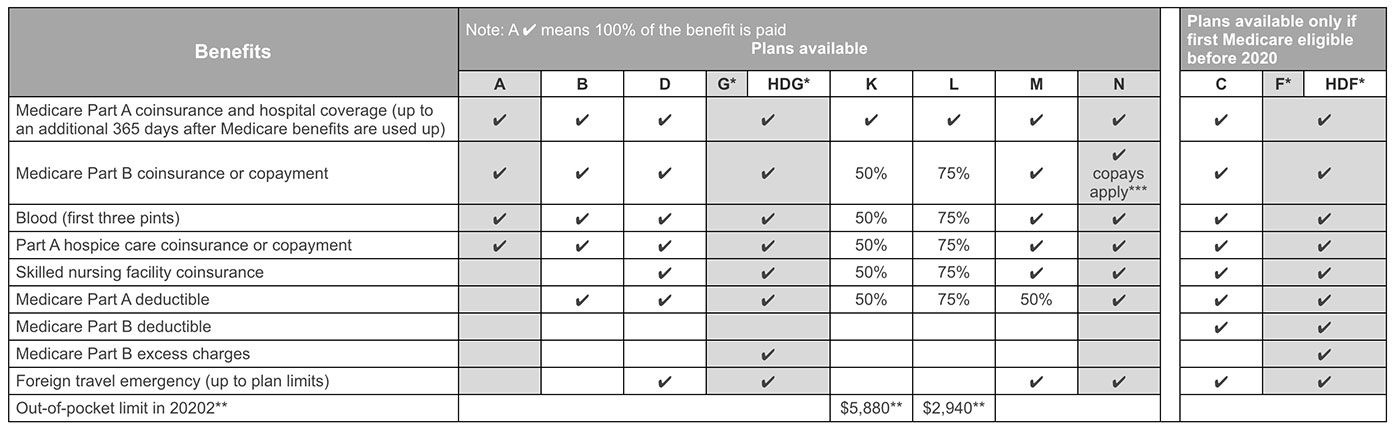

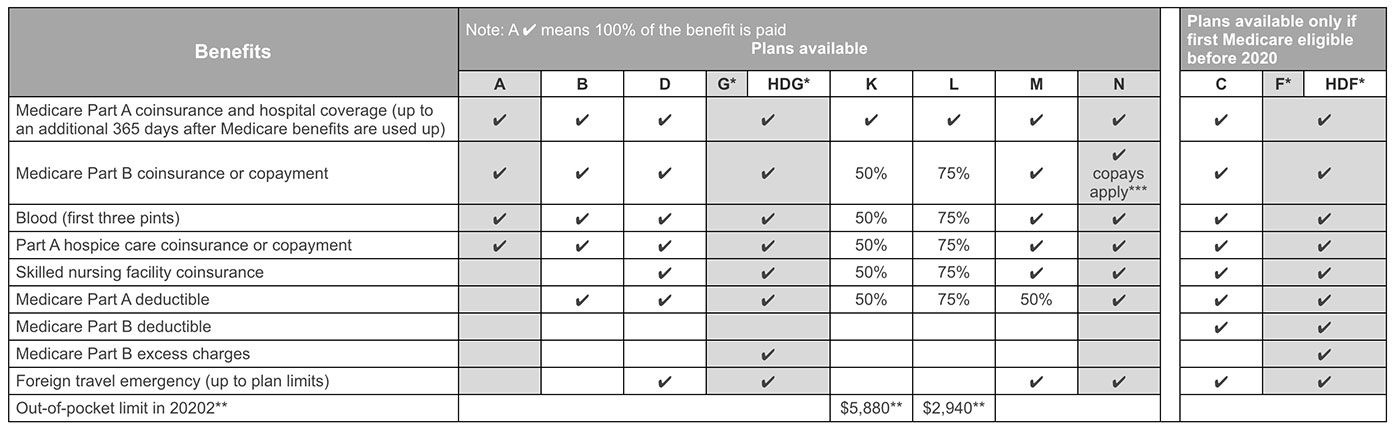

8 rows · Beginning in 2020, Plan G and Plan F will be the only two Medigap plans to offer a ...

What is the most comprehensive Medicare supplement plan?

Oct 26, 2021 · Medicare Supplement High Deductible Plan G for 2022. High Deductible Plan G is a Medicare Supplement plan that offers the same coverage as the standard Medigap Plan G. The premiums for this plan are lower than the premiums for the standard Plan G . Yet, enrollees must pay a higher deductible for coverage to kick in at 100%.

Do I really need a Medicare supplement?

14 rows · Dec 14, 2021 · Medicare Supplement High Deductible Plan G. This plan covers all of the same benefits as ...

What is the difference between high deductible Plan F and Plan G?

The only difference between High Deductible Plan G and High Deductible Plan F is the same as between Plan G and Plan F; the latter covers the Part B deductible. However, since the amount you pay towards the Part B deductible applies to the high-deductible for the plans, they are essentially the same plan.Mar 1, 2022

Does Medicare offer a high deductible plan?

With high-deductible plans, Medicare pays 80% of covered costs, and you pay 20% up to the deductible amount, which is $2,370 in 2021 and rising to $2,490 in 2022. After that, the high-deductible plans pay just like full Medigap plans F and G.Nov 18, 2021

What is the difference between Plan F and high deductible Plan F?

Plan F provides the most comprehensive coverage of any Medicare Supplement plan. High deductible Plan F offers similar coverage but requires you to pay out-of-pocket before your carrier pays for your healthcare. Plan F is only available if you qualified for Medicare before January 1, 2020.

Which Medigap plan has a high-deductible option?

Summary: Medicare supplemental (Medigap) Plans F and G can be sold with a high deductible option. Before June 1, 2010, Medigap Plan J could also be sold with a high deductible. The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020.

What is the deductible on high deductible plan G?

Here's what you need to know about the High Deductible Plan G: Original Medicare will still pay its 80% portion. You will pay the other 20% until you satisfy the $2,490 deductible. After the out-of-pocket deductible is met, the plan will pay the same benefits as regular Plan G.

What is Plan F 2020 high-deductible?

High Deductible Plan F is an alternative version of the standard Plan F. The difference is the beneficiary agrees to pay the deductible before full coverage kicks in. Once you reach the deductible, the plan covers the left-over costs going forward, keeping the monthly premium low.Mar 17, 2022

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the most comprehensive Medicare Supplement plan?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Does Medigap G have a deductible?

Medigap Plan G coverage includes the Medicare Part A deductible, Medicare Part B coinsurance, and more. Once you meet the Medicare Part B deductible, you won't have to worry about additional copayments or unexpected medical bills.Feb 4, 2022

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Does Plan N cover Medicare Part B deductible?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor's office and emergency room visits.Nov 23, 2021

How does a high deductible plan work?

How Does High-Deductible Plan G Work? High-deductible Medigap Plan G will offer the same benefits as standard Medigap Plan G, except the plan won’t pay its share of covered costs until you meet annual deductible amount. Once you spend a certain amount in qualified out-of-pocket Medicare expenses, you will meet your deductible ...

How much is Medicare Part A deductible?

Medicare Part A comes with a deductible, which is $1,408 per benefit period in 2020. Medigap Plan G will cover your deductible in full for each benefit period you require.

What is Medicare Part A?

Medicare Part A Coinsurance. Medicare Part A is known as hospital insurance, and it includes cost-sharing measures like coinsurance. Inpatient hospital stays covered by Medicare Part A require coinsurance fees if they exceed 60 days.

What is Medicare Part B coinsurance?

Medicare Part B Coinsurance and Copayment. Medicare Part B usually charges a coinsurance and copayments for doctor visits and other outpatient care . Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases.

Does hospice require copayments?

Hospice care provides medical treatment and care during a terminal illness. Medicare covers these services, but it requires copayments. These copayments include $5 for each symptom and pain relief prescription drugs and 5% of the Medicare-approved amount for inpatient respite care.

What is excess charge in Medicare?

Medicare Part B Excess Charges. Doctors can bill a procedure for up to 15% higher than what Medicare pays for it. The extra expenses are called “excess charges.”. If there are any excess charges for an approved visit, a person insured under Plan G would be fully covered after they meet their deductible.

What is the difference between a plan G and a plan F?

The primary difference in the benefits of these two plans is that high-deductible Plan F covers the Medicare Part B deductible, while high-deductible Plan G will not. In 2019, the Medicare Part B deductible is $185 for the year.

How Much Does High Deductible Plan G Cost?

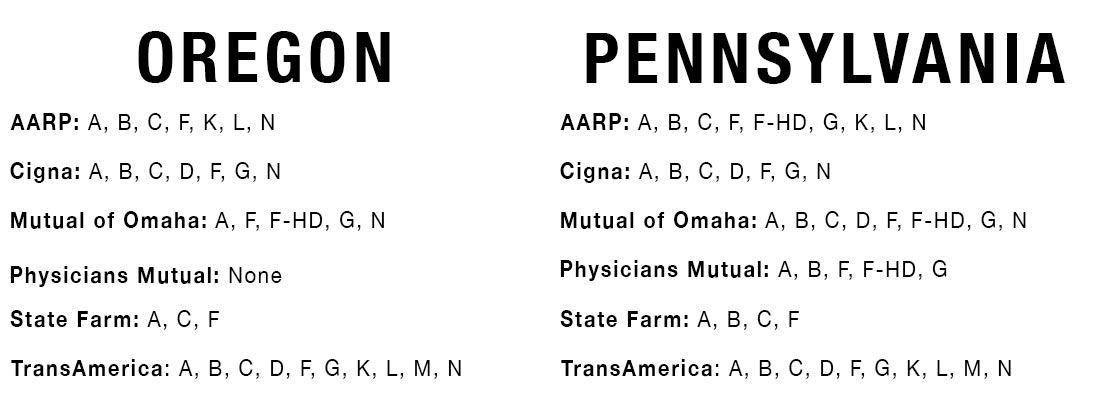

The average cost of High Deductible Plan G is around $40-$90 per month. Medigap premiums vary based on several factors, including your age and location.

What is the Deductible for High Deductible Plan G in 2021?

The deductible for High Deductible Plan G is $2,370. Beneficiaries reaching this deductible is what keeps the premiums low for this plan. Alternatively, if you’re more comfortable with higher monthly premiums and would rather not pay the higher deductible, standard Plan G would be the better choice for you.

Is High Deductible Plan G Better than High Deductible Plan F?

The only difference between High Deductible Plan G and & High Deductible Plan F is the same as between Plan G and Plan F; the latter covers the Part B deductible. However, since the amount you pay towards to Part B deductible applies to the high-deductible for the plans, essentially they are the same plan.

Can I Use Guaranteed Issue Rights to Enroll in High Deductible Plan G?

Due to the elimination of first-dollar coverage plans, if you aren’t eligible to enroll in one and have guaranteed issue rights, you can use them to enroll in High Deductible Plan G. Conversely, those who can use guaranteed issue rights to enroll in Plan F aren’t eligible to use them to enroll in either version of Plan G.

Get Quote

Compare rates side by side with plans & carriers available in your area.