If your income and resources are above the limits, but you think you may still qualify for a LIS, you should still apply. Income limits are $19,140 for an individual and $25,860 for a married couple. There are levels of assistance you can receive from a LIS, depending on your need.

What are the income limits for Medicare?

the applicable 2022 resource limits are $ 9,900 ($15,600 if married) for the full low-income subsidy and $15,510 ($30,950 if married) for the partial low-income subsidies. Please see the following table for the updated resource limits for determining eligibility for the low-income subsidy in 2022.

What is Medicare lis?

Dec 01, 2021 · Eligibility for Low-Income Subsidy This page contains information on eligibility for the Low-Income Subsidy (also called "Extra Help") available under the Medicare Part D prescription drug program. It includes information on how one becomes eligible for the Low-Income Subsidy as well as useful outreach material.

How does Medicare determine your income?

the applicable 2021 resource limits are $ 9,470 ($14,960 if married) for the full low- income subsidy and $14,790 ($29,520 if married) for the partial low-income subsidies. Please see the following table for the updated resource limits for determining eligibility for the low-income subsidy in 2021.

Who qualifies for Medicare extra help?

Dec 01, 2021 · The Low Income Subsidy (LIS) helps people with Medicare pay for prescription drugs, and lowers the costs of Medicare prescription drug coverage. How can I help people get the LIS? We work with our partners to find and enroll people who may qualify for the LIS, and we encourage local organizations to tell people in their communities about it.

What is Medicare LIS?

The Low Income Subsidy (LIS) helps people with Medicare pay for prescription drugs, and lowers the costs of Medicare prescription drug coverage.Dec 1, 2021

What are the 4 levels of Lis?

Monthly premiumSubsidy LevelsCompleteStandard PlusLevel 4 - 100%$0$131.00Level 4 - 75%$0$140.00Level 4 - 50%$0$149.00Level 4 - 25%$0$158.003 more rows

Is Lis the same as extra help?

Extra Help is a federal program that helps pay for some to most of the out-of-pocket costs of Medicare prescription drug coverage. It is also known as the Part D Low-Income Subsidy (LIS).

What is LIS 2 Medicare?

The Medicare Part D Low Income Subsidy, sometimes referred to as LIS or Extra Help, assists people with limited incomes and resources with paying for their prescriptions.

What is the income limit for extra help in 2021?

You should apply for Extra Help if: Your yearly income is $19,140 or less for an individual or $25,860 or less for a married couple living together. Even if your yearly income is higher, you still may qualify if you or your spouse meet one of these conditions: – You support other family members who live with you.

Does lis cover deductible?

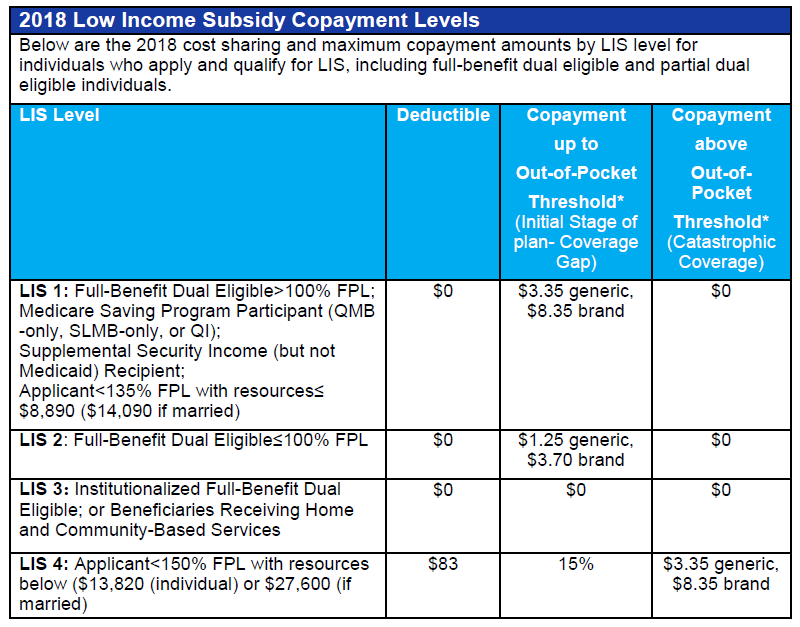

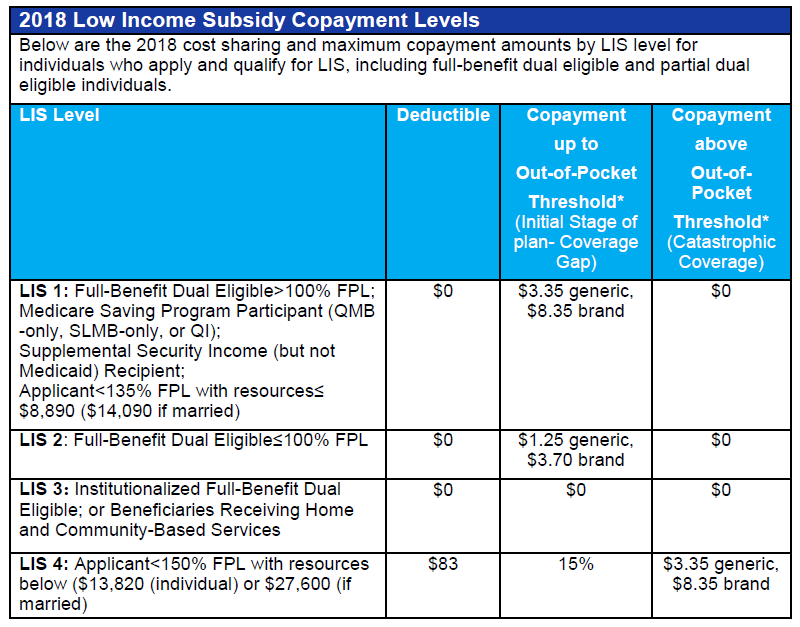

Medicare's Part D Low Income Subsidy (also called LIS/Extra Help) helps cover the Part D prescription drug plan costs. Depending on your income and assets, the program either covers some or all of your Part D costs, including Part D premiums, deductibles, and copayments.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

What are the Medicare income limits for 2022?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

How do you qualify for the give back benefit with Medicare?

What Are the Qualifications for Medicare Give Back Benefits?Enrolled in Medicare Parts A and B.Responsible for paying your own Part B premium, meaning you don't receive Medicaid or other forms of assistance for paying Part B premiums.Living in a service area for a plan offering give back benefits.Jan 20, 2022

Does Social Security count as income for QMB?

An individual making $1,800 from Social Security cannot qualify for QMB because they are over the $1,133 income limit.

What does full LIS mean?

The Low-Income Subsidy (LIS) program helps pay for a portion of Part D prescription drug plan costs, including Part D premiums, deductibles and copayments. Depending on your income and assets, you may qualify for the full subsidy or a partial subsidy.

What is extra help from Social Security?

Medicare beneficiaries can qualify for Extra Help paying for their monthly premiums, annual deductibles, and co-payments related to Medicare prescription drug coverage. We estimate the Extra Help is worth about $5,100 per year.

What's the Low Income Subsidy (LIS)?

The Low Income Subsidy (LIS) helps people with Medicare pay for prescription drugs, and lowers the costs of Medicare prescription drug coverage.

How can I help people get the LIS?

We work with our partners to find and enroll people who may qualify for the LIS, and we encourage local organizations to tell people in their communities about it.

Who might need help with their LIS?

There are 4 groups of people who already have the LIS, but may need some help to keep it or to understand that their LIS is changing. We send them targeted notices on colored paper when there are changes to their LIS.

What is the income limit for 2021?

Income limits are not yet released for 2021, but they are currently $19,140 for an individual and $25,860 for a married couple. There are levels of assistance you can receive from a LIS, depending on your need. You could qualify for partial assistance based on your assets. See the chart below for limits.

What is SSI in retirement?

Supplemental Security Income (SSI) In contrast to Social Security retirement benefits, SSI benefits are available to those with limited income and resources who are over 65, blind, or disabled. Social Security taxes do not fund SSI. Instead, its funding comes from U.S. Treasury general funds.

What is the MQB program in Nebraska?

Keep in mind that this program is called MQB in North Carolin a and replaced with Medicaid in Nebraska. A QMB program pays your premiums for Part A and Part B, your annual deductible for Part B, and coinsurance and deductibles for Part A services.

How long do you have to correct a Social Security claim?

Yet, if you’re denied, you’ll receive a Pre-Decisional Notice, explaining why you aren’t eligible. Then, you have ten days to correct the information. Social Security will send you a Notice of Award, explaining your level of coverage. If you don’t meet the qualifications, you’ll get a Notice of Denial.

Can you get medicaid if you don't qualify?

Even if you don’t qualify for Medicaid, you may be eligible for one of these programs . Although, if you do qualify for Medicaid, you’re automatically eligible for extra help.

Can I apply for medicaid online?

If you’re over 65, you cannot apply online. Instead, call the toll-free number for Social Security or visit your local Social Security office. If you’re eligible for SSI, you will likely be eligible for Medicaid in your state. Being Medicaid-eligible will qualify you to have your state pay your Medicare premiums.

Do you have to have Medicare to be eligible for Medicaid?

To be eligible you must have Medicare and a lower income . Assets must be below a certain amount as well. Some people may find they’re ineligible for Medicaid, yet still eligible for Low-Income Subsidy.

How much does Medicare pay for Part D?

If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

What happens if you retire in 2020 and only make $65,000?

Loss of income from another source. If you were employed in 2019 and earned $120,000 but retired in 2020 and now only make $65,000 from benefits, you may want to challenge your IRMAA. To keep track of your income fluctuations, fill out the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form.

How much do you have to pay in taxes if you make more than $412,000 a year?

If you earn more than $412,000 per year, you’ll have to pay $504.90 per month in taxes. Part B premiums will be cut off directly from your Social Security or Railroad Retirement Board benefits. Medicare will send you a fee every three months if you do not receive either benefit.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

How much will Part D cost in 2021?

Through the Extra Help program, prescriptions can be obtained at a significantly reduced cost. In 2021, generic drugs will cost no more than $3.70, while brand-name prescriptions will cost no more than $9.20.

How much do you have to pay for Part B?

If this is the case, you must pay the following amounts for Part B: If you earn less than $88,000 per year, you must pay $148.50 per month. If you earn more than $88,000 but less than $412,000 per year, you must pay $475.20 per month.

What is the state health insurance assistance program?

The State Health Insurance Assistance Program is a national program that offers one-on-one counseling and assistance to people with Medicare and their families. For more information, and to find your local SHIP branch, please see:

Does Extra Help apply to Medicare?

You must be enrolled in a Medicare Prescription Drug plan. Extra Help only applies to the costs associated with Medicare prescription drug coverage. There are other programs that may help with other Medicare costs, but the Low-Income Subsidy (or “Extra Help”) is only for Medicare prescription drug costs.