2022 Monthly Income Limits for Medicare Savings Programs

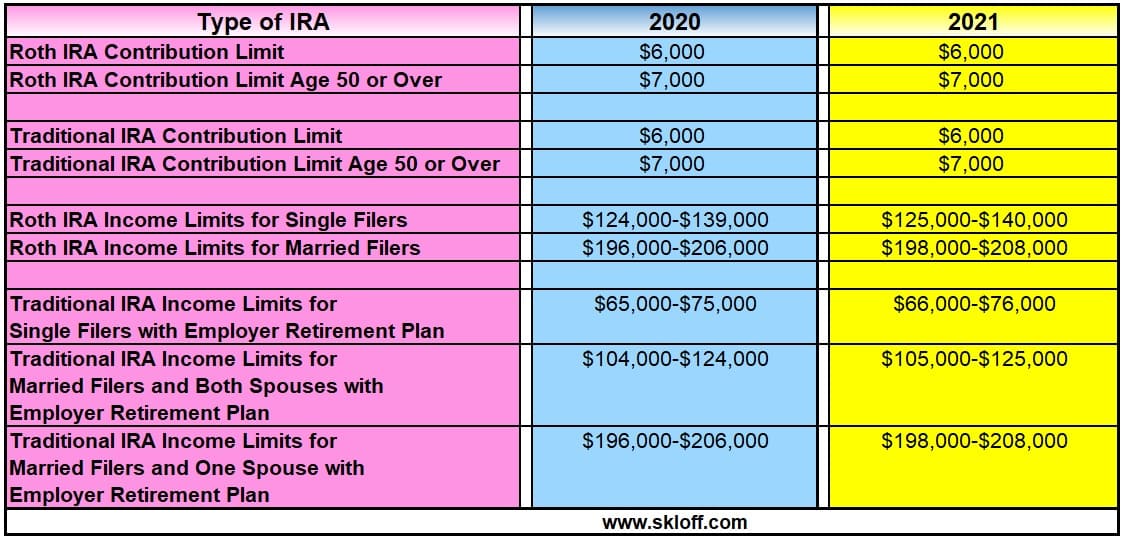

| Medicare Savings Program | Monthly Income Limits for Individual | Monthly Income Limits for Married Couple |

| QMB | $1,153 | $1,546 |

| SLMB | $1,379 | $1,851 |

| QI | $1,549 | $2,080 |

| Income at or Below | Resources at or Below | |

|---|---|---|

| Single: | $859 per month | $15,450 |

| Couple: | $1,267 per month | $22,800 |

How much does Medicare Part B cost in New York State?

Some "dual eligible" beneficiaries (people who have Medicare and Medicaid) are entitled to receive reimbursement of their Medicare Part B premiums from New York State through the Medicare Insurance Premium Payment Program (MIPP). The Part B premium is $148.50 in 2021 .

How is the New York Medicaid income limit calculated?

The New York Medicaid Income Limit is calculated as a percentage of the Federal Poverty Line. To qualify, you must meet the New York Medicaid Income limits listed below. Here is the Federal Poverty Level (FPL) for 2021. Additionally, to be eligible for Medicaid, you cannot make more than the income guidelines outlined below:

What are the monthly income limits for Medicare savings programs?

2021 Monthly Income Limits for Medicare Savings Programs Medicare Savings Program Monthly Income Limits for Individual Monthly Income Limits for Married Couple QMB $1,084 $1,457 SLMB $1,296 $1,744 QI $1,456 $1,960 3 more rows ...

Who is eligible for Medicaid in New York?

In New York, the New York State Department of Health manages the Medicaid Program. Who Can Get Medicaid in New York? You should apply for Medicaid if your income is low and you match one of the descriptions below:

What is the maximum income for Medicaid in NY?

Qualifying When Over the Limits In 2022, the medically needy income limit is $934 / month for a single applicant and $1,367 / month for a couple.

What is the Medicare threshold for income?

an individual monthly income of $4,379 or less. an individual resources limit of $4,000. a married couple monthly income of $5,892 or less. a married couple resources limit of $6,000.

How do you qualify for Medicare in NY?

Who Is Eligible for Medicare in New York?You are 65 or older.You have been on Social Security Disability Insurance (SSDI) for two years.You have end-stage renal disease (ESRD) or Lou Gehrig's disease.

What is the highest income to qualify for Medicaid?

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.

What is the Medicare earnings limit for 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are the requirements for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

Who qualifies for free Medicare Part A?

age 65 or olderTo be eligible for premium-free Part A on the basis of age: A person must be age 65 or older; and. Be eligible for monthly Social Security or Railroad Retirement Board (RRB) cash benefits.

Who is not eligible for Medicare Part A?

Why might a person not be eligible for Medicare Part A? A person must be 65 or older to qualify for Medicare Part A. Unless they meet other requirements, such as a qualifying disability, they cannot get Medicare Part A benefits before this age. Some people may be 65 but ineligible for premium-free Medicare Part A.

Who is eligible for Medicaid NY?

Be responsible for a child 18 years of age or younger, or. Blind, or. Have a disability or a family member in your household with a disability, or. Be 65 years of age or older.

Which state has highest income limit for Medicaid?

AlaskaThe state with the highest income limits for both a family of three and individuals is Washington, D.C. If you live in this area, a family of three can qualify for Medicaid if their income is at 221% of the FPL....Medicaid Income Limits by State 2022.StateAlaskaParents (Family of 3)138.00%Other Adults138.00%2022 Pop.720,76349 more columns

How do I qualify for dual Medicare and Medicaid?

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance).

Does New York help with my Medicare premiums?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In...

Who's eligible for Medicaid for the aged, blind and disabled in New York?

Medicare covers a great number services – including hospitalization, physician services, and prescription drugs – but Original Medicare doesn’t cov...

Where can Medicare beneficiaries get help in New York?

New York Health Insurance Information Counseling and Assistance Program (HIICAP) You can access no cost Medicare counseling by contacting the New Y...

Where can I apply for Medicaid in New York?

Medicaid eligibility is overseen by the Human Resources Administration (HRA) in New York City and by Local Departments of Social Services (LDSS) el...

What is the income limit for HCBS in New York?

The monthly income limits to be eligible for Medicaid nursing home coverage in New York are $875 (single) and $1,284 (if married and both spouses are applying). The monthly income limits to be eligible for HCBS in New York are $875 ...

What is the Medicaid spend down in New York?

In New York, the Medicaid spend-down covers Long Term Services and Supports. Income eligibility: The income limit is $875 a month if single and $1,284 a month if married. Asset limits: The asset limit is $15,750 if single and $23,100 if married.

How much does Medicaid ABD cover?

Medicaid ABD pays for an eye exam every two years, and will cover eyeglasses for enrollees needing a minimum of .50 diopter correction. Income eligibility: The income limit is $875 a month if single and $1,284 a month if married. (This is equal to 84 percent of the federal poverty level.) Asset limits: The asset limit is $15,750 for single ...

How long is the lookback period for nursing home benefits in New York?

New York uses a 60-month lookback period to calculate its asset transfer penalty for nursing home benefits. New York pursues estate recovery of all Medicaid benefits it paid for enrollees beginning at the age of 55.

How much housing allowance can a spouse have in New York?

In New York in 2020, spousal impoverishment rules allow community spouses to keep a housing allowance ranging from $386 in Western New York to $1,451 in NYC. In New York, applicants for Medicaid LTSS must have a home equity interest of $893,000 or less.

How to contact Medicare in New York?

You can access no cost Medicare counseling by contacting the New York Health Insurance Information Counseling and Assistance Program (HIICAP) at 1-800-701-0501. HIICAP can help you enroll in Medicare, compare and change Medicare Advantage and Part D plans, and answer questions about state Medigap protections.

What is extra help for prescriptions in New York?

Medicare beneficiaries who are enrolled in Medicaid, an MSP, or Supplemental Security Income (SSI) also receive Extra Help – a federal program that reduces prescription expenses under Medicare Part D.

What is PCAP in Medicaid?

Prenatal Care Assistance Program ( PCAP) was Medicaid for pregnant women and children under age 19, with higher income limits for pregnant woman and infants under one year (200% FPL for pregnant women receiving perinatal coverage only not full Medicaid) than for children ages 1-18 (133% FPL).

Is the income limit for a family of 5 higher than the income limit for a single person?

In other words, the income limit for a family of 5 may be higher than the income limit for a single person. HOWEVER, Medicaid rules about how to calculate the household size are not intuitive or even logical. There are different rules depending on the "category" of the person seeking Medicaid.

What is the eligibility for Medicaid in New York?

For New York long-term care Medicaid eligibility, an applicant must have a functional need for such care. This most commonly means one must require a nursing facility level of care. Furthermore, additional criteria may need to be met for some program benefits.

What is Medicaid in New York?

New York Medicaid Definition. Medicaid is a wide-ranging, state and federally funded, health care program for low-income individuals of all ages. While there are several different eligibility groups, including pregnant women, children, and disabled individuals, this page is focused on Medicaid eligibility for New York senior residents ...

How long does it take for Medicaid to look back in New York?

At the time of this update, the look back rule only applies to Institutional Medicaid and is a period of 60 months (5 years) that immediately precedes one’s Medicaid application date.

What are the exempt assets for Medicaid?

Exemptions include IRA’s and 401K’s in payout status, personal belongings, household items, a vehicle, burial funds up to $1,500, and pre-paid funeral agreements (given they cannot be refunded).

What is considered income for Medicaid?

What Defines “Income”. For Medicaid eligibility purposes, all income that one receives from any source is counted towards the income limit. This may include employment wages, alimony payments, pension payments, Social Security Disability Income, Social Security Income, gifts, and payments from annuities and IRAs.

How much can a spouse retain in 2021?

In 2021, the community spouse can retain half of the couple’s joint assets, up to $130,380, as the chart indicates above. However, if the couple has more limited assets, the non-applicant spouse is able to retain 100% of their joint assets, up to $74,820.

Is Medicaid managed care in New York?

Make note, Medicaid in New York is sometimes referred to as Medicaid Managed Care. Medicaid for the Disabled, Aged or Blind (DAB) is also known as NON-MAGI. The American Council on Aging now offers a free, quick and easy Medicaid eligibility test for seniors.

How many people are covered by Medicaid in New York?

As of 2020, the program, along with the Children’s Health Insurance Program (CHIP) covered 6.6 million people. This includes 2.5 million children as shown by the image below. In New York, the New York State Department of Health manages ...

What are the income requirements for medicaid?

Additionally, to be eligible for Medicaid, you cannot make more than the income guidelines outlined below: 1 Children up to age 1 with family income up to 218 percent of FPL 2 Any child age 1-5 with a family income up to 149 percent of FPL 3 Children ages 6- 18 with family income up to 149 percent of FPL 4 CHIP for children with family income up to 400 percent of FPL 5 Pregnant women with family income up to 218 percent of FPL 6 Parents of minor children with family income up to 133 percent of FPL 7 Individuals who are elderly, blind, and disabled with family income up to 83% of the FPL 8 Adults without dependents under Medicaid expansion with income up to 200% of the FPL

What percentage of FPL is pregnant?

Pregnant women with family income up to 218 percent of FPL. Parents of minor children with family income up to 133 percent of FPL. Individuals who are elderly, blind, and disabled with family income up to 83% of the FPL. Adults without dependents under Medicaid expansion with income up to 200% of the FPL.

How many people are on medicaid in 2020?

According to the Centers for Medicare & Medicaid Services, as of November 2020, here are the number of people enrolled in Medicaid and Chip in the entire United States: 78,521,263 individuals were enrolled in Medicaid and CHIP. 72,204,587 individuals were enrolled in Medicaid. 6,695,834 individuals were enrolled in CHIP.

What is Medicaid insurance?

What is Medicaid? Medicaid is a federal and state health insurance program for people with a low income. It provides free or low-cost health coverage to millions of Americans, including families and children, pregnant women, the elderly, and people with disabilities.

When did New York expand Medicaid?

New York Medicaid Expansion Update. The state of New York expanded Medicaid as of January 1, 2014. Between the fall of 2013 and August 2018, the state’s total Medicaid enrollment grew by 14 percent, to nearly 6.5 million people. Medicaid expansion covers more than 2 million New Yorkers.

Can you get medicaid if your income is higher than poverty level?

You cannot have an income higher than the Federal Poverty Level percentage described for your group to be eligible for Medicaid. Similarly, when you identify the income group that applies to you, the income limit you see refers to the maximum level of income you can earn to qualify for benefits.

What is the Medicare Part B premium in New York?

The Part B premium is $148.50 in 2021 . MIPP is for some groups who are either not eligible for -- or who are not yet enrolled in-- the Medicare Savings Program (MSP), which is the main program that pays the Medicare Part B premium for low-income people. Some people are not eligible for an MSP even though they have full Medicaid with no spend down . This is because they are in a special Medicaid eligibility category -- discussed below -- with Medicaid income limits that are actually HIGHER than the MSP income limits . MIPP reimburses them for their Part B premium because they have “full Medicaid” (no spend down) but are ineligible for MSP because their income is above the MSP SLIMB level (120% of the Federal Poverty Level (FPL). Even if their income is under the QI-1 MSP level (135% FPL), someone cannot have both QI-1 and Medicaid ). Instead, these consumers can have their Part B premium reimbursed through the MIPP program.

How long does it take for Medicaid to be paid in New York?

If Medicaid case is with other local districts in NYS, call your local county DSS. Once enrolled, it make take a few months for payments to begin. Payments will be made in the form of checks from the Computer Sciences Corporation (CSC), the fiscal agent for the New York State Medicaid program.

What is MIPP in Medicare?

MIPP is for some groups who are either not eligible for -- or who are not yet enrolled in-- the Medicare Savings Program (MSP), which is the main program that pays the Medicare Part B premium for low-income people. Some people are not eligible for an MSP even though they have full Medicaid with no spend down .

What is the income limit for Medicaid in 2021?

They can be eligible for Medicaid at much higher income limits. The 2021 MBI WPD income limit is $2,684 per month (250% FPL), compared to the regular disabled/aged/blind (DAB) Medicaid income limit of $884 per month. See this article for income limits. Earned income has a special "disregard" as a work incentive.

Can I enroll in MSP if I have a 120% FPL?

MAGI-like consumers can be enrolled in either MSP or MIPP, depending on if their income is higher or lower than 120% of the FPL. If their income is under 120% FPL, they are eligible for MSP as a SLIMB. If income is above 120% FPL, then they can enroll in MIPP.

What are the expenses that go away when you receive Medicaid at home?

When persons receive Medicaid services at home or “in the community” meaning not in a nursing home through a Medicaid waiver, they still have expenses that must be paid. Rent, mortgages, food and utilities are all expenses that go away when one is in a nursing home but persist when one receives Medicaid at home.

How long does it take to get a medicaid test?

A free, non-binding Medicaid eligibility test is available here. This test takes approximately 3 minutes to complete. Readers should be aware the maximum income limits change dependent on the marital status of the applicant, whether a spouse is also applying for Medicaid and the type of Medicaid for which they are applying.

Is income the only eligibility factor for Medicaid?

Medicaid Eligibility Income Chart by State – Updated Mar. 2021. The table below shows Medicaid’s monthly income limits by state for seniors. However, income is not the only eligibility factor for Medicaid long term care, there are asset limits and level of care requirements.

What is the number to call for Medicare in New York?

1-800-MEDICARE (800) 633-4227 for assistance to find out more about coverage options. TTY users should call (877) 486-2048. Medicare and You Handbook. One-on-one counseling assistance from the New York State Office for Aging Health Information Counseling and Assistance Program (HIICAP).

What is the 80 percent excess benefit for Medicare?

The 80 percent Medicare Part B Excess benefit, available in Plan G, was changed to a 100 percent coverage benefit. Insurers are also now required to offer Plans A and B, as well as either Plan C or Plan F. Previously insurers only had to offer Plans A and B.

What are the benefits of Medigap?

Each standardized Medigap policy must provide the same basic core benefits such as covering the cost of some Medicare copayments and deductibles. Some of the standardized Medigap policies also provide additional benefits such as skilled nursing facility coinsurance and foreign travel emergency care.

How to contact Medicare Advantage?

For more information about the Medicare Advantage Plans or Medicare Prescription Drug Plans available in your area, visit the federal Medicare website or call 1-800-MEDICARE (800) 633-4227. TTY users should call (877) 486-2048.

What is open enrollment for Medicare?

During the federal Open Enrollment period, current or newly eligible Medicare beneficiaries, including people with Original Medicare, can review current health and prescription drug coverage, compare health and drug plan options available in their area, and choose coverage that best meets their needs. This is the time when Medicare eligible individuals can enroll in Medicare Advantage and Medicare Part D prescription drug plans.

How often does Medicare Part B exam?

If you have had Medicare Part B for longer than 12 months, you can get a yearly wellness visit to develop or update a personalized prevention plan based on your current health and risk factors. Again, you will pay nothing for this exam if the doctor accepts assignment. This exam is covered once every 12 months .

What is Medicare Supplement?

Medicare Supplement (Medigap) insurance is health insurance that is sold by private insurance companies to cover some of the "gaps" in expenses that are not covered by Medicare. For policies sold before June 01, 2010, there are fourteen standardized plans A through L.