The Top 10 Medicare Supplement Insurance Providers

| Provider | Available Plans | Discounts | Number of States Served | Medicare Part D |

| Aetna | A, B, F*, High Deductible F*, G, N | Household Discount | 42 | Yes |

| Anthem Blue Cross | A, F*, G, N (Innovative, Select, and Inn ... | Automatic Payment Discount Year in Advan ... | 14 | Yes |

| State Farm | A, B, C*, D, F*, G, N | Bundle Discount | 46 | No |

| Humana | A, B, C, F*, High Deductible F*, G, K, L ... | Online Discount | 50 | Yes |

Full Answer

What are the best supplement insurance companies?

21 rows · · Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement ...

What are the top 10 Medicare companies?

· Aetna stands out because it offers several Medicare Supplement plans, including Parts A, B, C, D, F, G, and N, with each plan’s information and coverage clearly laid out on the company website....

What are the best Medicare companies?

· Top 10 Supplemental Medicare Insurance Companies in 2022 Mutual of Omaha – Best Overall Aetna – High-Quality Nationwide Availability Cigna – Superior Customer Care United American – Best Enrollment Experience Capitol Life – Competitive Premium Cost Nationwide UnitedHealthcare – Best Underwriting Process Manhattan Life – Best Website Experience

What is the best Medicare supplement insurance plan?

While the above companies made our list of top 10 Medigap companies, there may still be some other solid and reputable insurance companies that offer Medicare Supplement plans near you, depending on where you live. These companies can include, in no particular order: Central States Indemnity (CSI) GPM Health and Life Insurance Company; National General

Who is the largest Medicare supplement insurance company?

AARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

What are the top 3 most popular Medicare supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the common name for supplement Medicare insurance?

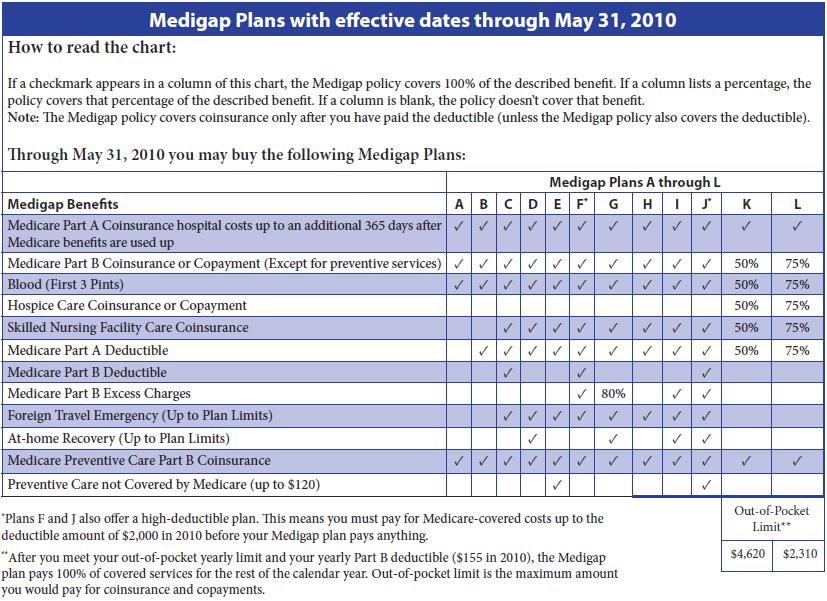

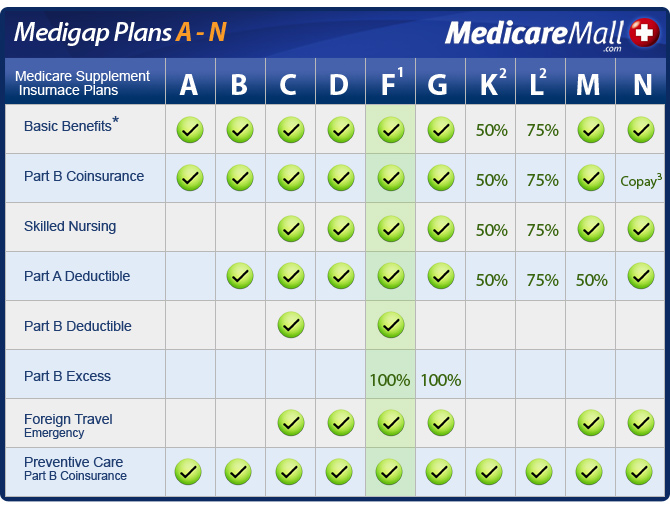

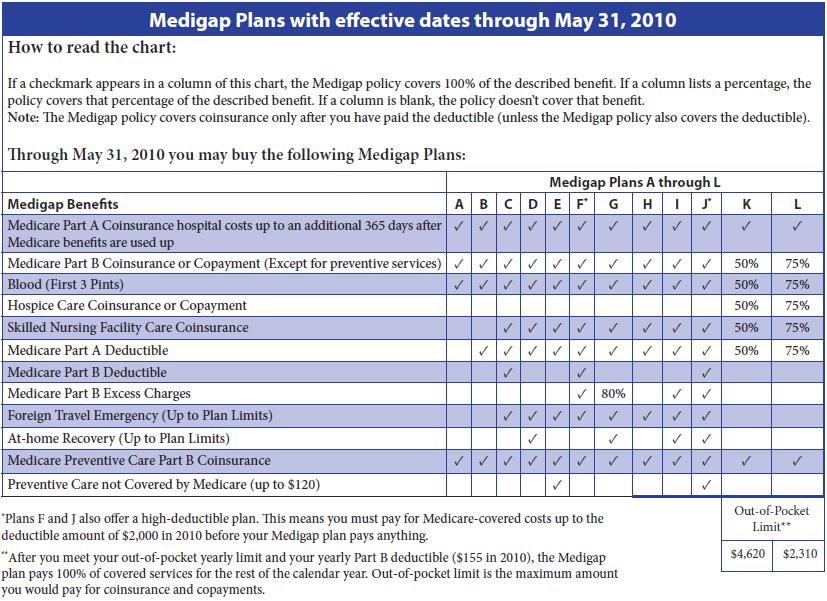

Medigap policiesservices and supplies. Medicare Supplement Insurance policies, sold by private companies, can help pay your share of some of the health care costs that Original Medicare doesn't cover, like copayments, coinsurance, and deductibles. Medicare Supplement Insurance policies are also called Medigap policies.

What is the average cost of a Medicare supplement plan?

Medicare Supplemental Insurance (Medigap) Costs. In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

What is the deductible for Plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the difference between a Medicare Advantage plan and a Medicare supplement plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Do Medicare supplement plans cover deductible?

Most Medicare Supplement insurance plans cover the Part A deductible at least 50%. All Medicare Supplement plans also cover your Part A coinsurance and hospital costs 100% for an additional 365 days after your Medicare benefits are used up. Medicare information is everywhere.

Do you need Medicare Part B to get a supplement?

*You don't technically need Medicare Part B to enroll in a Medicare Supplement plan, however without it, your supplement won't cover any of your outpatient costs. Ultimately, it's not likely to be cost-efficient to have a Medicare Supplement plan without Medicare Part B, and it isn't recommended.

Are Medicare supplement premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are $0 premium plans?

A zero-premium plan is a Medicare Advantage plan that has no monthly premium. In other words, you don't pay anything to the insurance company each month for your coverage. That's in comparison with the average Medicare Advantage premium of $23/month in 2020.

Do all Medicare supplement plans pay the same?

Medicare Supplement insurance plans are sold by private insurance companies and can help you pay for out-of-pocket costs for services covered under Original Medicare. Different Medicare Supplement insurance plans pay for different amounts of those costs, such as copayments, coinsurance, and deductibles.

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

Why is AARP the best Medicare supplement?

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older. This is especially helpful if you are still covered under your employer's insurance and may require coverage after the age of 65.

What is the Cigna app?

For those who are digitally inclined, Cigna offers three different apps through Google Play and the App store. The Cigna Envoy app helps customers access health benefits and resources specifically, while myCigna stores all your Cigna details, from your ID card information and account balances to cost comparisons for drugs and medical procedures. The Cigna Wellbeing app helps encourage healthy behaviors.

How is Medicare Supplement Plan cost determined?

The cost of a Medicare Supplement plan is determined by the individual insurance company that sells it. When researching different companies, be sure to ask how they price their policies. 10 Learning which factors they base their pricing on will help you determine both the costs for you today and what to expect in the future if your health situation changes.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

When is the best time to buy a Medicare Supplement?

The best time to buy a Medicare Supplement policy is during your Initial Medicare Open Enrollment Period. This is a one-time only, six-month span when federal law allows you to sign up for any Medicare Supplement policy you want that is sold in your state. Preexisting conditions are accepted during this time period, and you can't be denied a Medicare Supplement policy or charged more due to past or present health problems. Make sure you know when your Open Enrollment Period starts. 12

What to do if you have a gap in Medicare?

If you’re experiencing a gap in coverage from Medicare, then you may need to choose supplemental coverage . Explore your options when it comes to finding out what coverage you’re lacking and if things like prescriptions, doctor visits, vision, and dental care are covered or if you need help paying for them. If you’re not fully covered, then consider purchasing supplemental insurance.

Why do Medicare premiums vary?

Thus, while comparing options, you may wonder why your premium rate quotes vary between carriers for the same letter plan. In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age, location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board.

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

Is Mutual of Omaha the same as Medigap?

The above are the top 10 most well-known companies offering Medicare Supplement policies. Every Medigap plan meets government standardization requirements. No matter which company you choose, the benefits are the same when the plan is identical. So, Plan G coverage with Mutual of Omaha is the same as Plan G with Medico.

When was Aetna founded?

One of the most established insurance companies, Aetna was founded in 1853. Over 39 million customers rely on Aetna for health care, including Medicare. Aetna has excellent ratings all around; an A from AM Best and an A+ from S&P underscore the reasons for this company’s longevity.

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Is it good to choose an established insurance company?

Lastly, you’ll benefit from selecting a policy from an established company. The insurance companies that started long ago and stand the test of time tend to be those offering products with which clients are satisfied.

Does Cigna have the same coverage as Plan G?

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.

How to find the best Medicare Supplement insurance?

One great way to find the best Medicare Supplement Insurance companies that offer plans where you live is to compare plans for free online, with no obligation to enroll, using an independent source.

What states have Medicare Supplement Plans?

First, Medicare Supplement plans – also called Medigap – offer benefits that are standardized in every state except for Massachusetts, Minnesota and Wisconsin. This means each company’s plans pay for the same out-of-pocket Medicare costs as the same types of Medigap plans sold by other companies. Second, Medicare Supplement plan prices ...

How many Medigap plans does Aetna have?

Aetna sells 7 Medigap plans and serves customers in 44 states. Aetna is among the oldest health insurance companies around, with a long history of satisfied customers.

What is the 7% discount for Medicare?

Plans aren't available in all 50 states. Offers a dental, vision and hearing plan that you can pair with your Original Medicare benefits and Medigap plan. Only offers Medigap Plans A, C, F, G and N.

What factors should be considered when choosing an insurance company?

Lastly, consider factors such as an insurance company’s financial strength ratings, customer service reviews and overall reputation to ensure you can trust them with your business.

Does Cigna have a Medicare app?

The company offers 4 different Medigap plans, and the selection is diverse enough to offer something for just about everyone. Cigna also has multiple mobile apps for the more digitally savvy seniors, which can help with everything from checking on the status of a Medicare claim to paying monthly premiums.

Does Medicare fluctuate?

Second, Medicare Supplement plan prices and plan selection can fluctuate from one company to another and from one location to the next, so the “top” company in one city or state might be different from the top company in another location.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Does Medicare cover prescription drugs?

Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage. If you want prescription drug coverage, you can join a Medicare Prescription Drug Plan (Part D). If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is a Medigap plan?

Medigap, sometimes called Medicare supplemental insurance, helps cover your out-of-pocket costs for Original Medicare. Medigap policies are sold by private insurers. Finding the Medigap plan that’s right for you requires research.

How many people use Medigap?

More than 14 million Americans relied on Medigap to help cover their Original Medicare out-of-pocket costs in 2018, according to the American Association for Medicare Supplement Insurance.

How popular is Medigap?

Medigap, sold through private insurance companies, has become increasingly popular over the years. More than 23 percent of Medicare enrollees owned a Medigap plan in 2018, and enrollment in supplement plans increased by nearly 5 million between 2010 and 2018.

How long has Medigap been around?

Medigap has been around since 1980 in one form or another. Private insurers were loosely regulated in what they could sell at first. Today, there are 10 standardized plans that all insurers have to stick to, though they may offer different options in Wisconsin, Massachusetts and Minnesota.

How many members does Cigna have?

Cigna and its subsidiaries have an A- rating from A.M. best. The company was the fourth largest health insurer in the United States with 15.9 million members and $41.6 billion in revenue in 2019 according to Becker’s Healthcare.

Why is it important to compare what each company has to offer?

Comparing what each company has to offer can help you decide which is the best fit for your needs and finances.

Is Medigap standardized?

While the plans are standardized, pricing and other features can vary widely from company to company. When shopping for a Medigap policy, be sure to compare the same Medigap plan between one company and others offering the same plan.

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

How to find a Medicare Supplement Plan?

To begin the process of finding a Medicare Supplement Plan with Go Medigap, you'll enter your zip code to ensure that they have providers in your area. Next, enter your first and last name, your gender and your birthdate. Then, you'll be asked for your email address and preferred contact phone number (which gives them - and their "business partners" - permission to call or text you). Finally, click the button to get your quote.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How long do you have to call Medicare Supplement?

What about this company's service once the Medicare Supplement Plan has been issued? They will call you 30 days prior to your plan's renewal date to see if you're satisfied, or whether your needs have changed. Beyond that, you can call and ask them questions at any time. Approximately 98% of Medicare Supplement customers never change the plan they're on - the major exception is when people have a financial downturn and need something with lower monthly premiums (and less coverage). Our rep also said that United Medicare Advisors can often get answers for you quicker than if you called the insurance company directly. This is because they leverage their professional relationships on your behalf.

What is the Learn About Medicare tab?

Under the Learn About Medicare tab, you can find information on Medicare Supplement, Medicare Advantage, Prescription Drug Plans, and Medicare Parts A and B. They provide access to blogs covering health care news, retirement, and health wellness.

How many states does United Medicare Advisors work in?

While this is fairly common in today's internet age, it's still something to note. Another fact is that United Medicare Advisors is active in 44 states, leaving out Alaska, California, Hawaii, Massachusetts, New York and Rhode Island. If you live in one of those states, you should keep reading further in our reviews.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

What is Medicare subsidized by?

In the simplest terms, Medicare is a health insurance plan subsidized by the federal government. It was originally created to help Social Security beneficiaries receive healthcare services, but it’s now been expanded to cover everyone who is:

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

Which pays first, Medicare or group health insurance?

If you have group health plan coverage through an employer who has 20 or more employees, the group health plan pays first, and Medicare pays second.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).