To determine the Part B IRMAA surcharge simply multiply the current year’s Part B premium by 4 and then multiply that number by the subsidy (($148.50 x 4 = $594.00) ($594.00 x subsidy = surcharge)). And again, for the Part D IRMAA charge it is, for right now, a waiting game on when they will release the information annually.

Full Answer

How does irmaa affect Medicare Part B and Part D premiums?

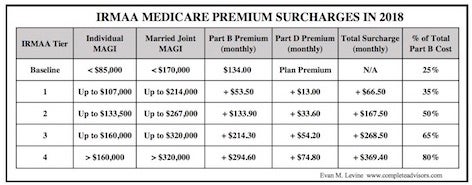

Beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Part D – pay a surcharge that’s added to their Part B and Part D premiums. IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income.

What is irmaa and what does it cost?

IRMAA is an extra charge added to your premium. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

What is the Medicare income-related monthly adjustment amount (irmaa)?

In 2019, Medicare covered about 61.5 million Americans and is predicted to increase to 75 million by 2027. Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income. One such case might be an income-related monthly adjustment amount (IRMAA).

What is the Medicare irmaa surcharge?

The surcharge is called IRMAA, which stands for Income-Related Monthly Adjustment Amount. I haven’t seen any numbers that show how much collecting IRMAA really helps the government in the grand scheme. I’m guessing very little. One report said 7% of all Medicare beneficiaries pay IRMAA.

What are the Irmaa brackets for 2016?

If Your Yearly Income Is2016 Medicare Part B IRMAA$85,000 or below$170,000 or below$0.00$85,001 - $107,000$170,000 - $214,000$48.70$107,001 - $160,000$214,000 - $320,000$121.80$160,001 - $214,000$320,000 - $428,000$194.903 more rows•Jul 30, 2015

What are the income brackets for Irmaa Part D and Part B?

What are the income brackets for IRMAA Part D and Part B?SingleMarried Filing JointlyPart D IRMAA$88,000 or less$176,000 or less$0 + your plan premium$165,001 and under $500,000$330,001 and under $750,000$70.70 + your plan premium$500,000 or above$750,000 and above$77.10 + your plan premium3 more rows

What are the Irmaa brackets for Medicare?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2019More than $160,000 but less than $500,000 More than $500,000$433.40 $460.50Married filing jointlyMore than $170,000 but less than or equal to $214,000$189.60More than $214,000 but less than or equal to $267,000$270.909 more rows•Dec 6, 2021

Is there an Irmaa for Medicare Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

How do you calculate modified adjusted gross income for Irmaa?

That means your 2021 premiums and IRMAA determinations are calculated based on MAGI from your 2019 federal tax return. MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).

How are Irmaa brackets calculated?

IRMAA is based on your Modified Adjusted Gross Income (MAGI) from two years ago. In other words, the 2022 IRMAA brackets are based on your MAGI from 2020. If the 2020 amount is not available, your 2019 MAGI is used.

What are the Irmaa brackets for 2022 Part D?

2022 Medicare Part D Income Related Adjustment Amount (IRMAA) Income BracketsIf your filing status and yearly income in 2020 (filed in 2021) wasabove $142,000 up to $170,000above $284,000 up to $340,000above $170,000 and less than $500,000above $340,000 and less than $750,000$500,000 and above$750,000 and above4 more rows•Nov 13, 2021

What are the Irmaa surcharges for 2022?

How much are Part B IRMAA premiums?Table 1. Part B – 2022 IRMAAIndividualJointMonthly Premium$91,000 or less$182,000 or less$170.10> $91,000 – $114,000> $182,000 – $228,000$238.10> $114,000 – $142,000> $228,000 -$284,000$340.203 more rows

What is the Part D Irmaa for 2022?

What is an IRMAA for Medicare?2020 Individual tax return2020 Joint tax return2022 Part D premiumMore than $170,000 up to $500,000More than $340,000 up to $750,000Your plan premium + $71.30More than $500,000More than $750,000Your plan premium + $77.904 more rows•Feb 15, 2022

Does Social Security income count towards Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

How is Irmaa calculated 2022?

2022 IRMAA Brackets Remember the income on your 2020 tax return (AGI plus muni interest) determines the IRMAA you pay in 2022. The income on your 2021 tax return (to be filed in 2022) determines the IRMAA you pay in 2023. Higher-income Medicare beneficiaries also pay a surcharge for Part D.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is IRMAA Part D?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What age can you contribute to an IRA?

The SECURE Act has a number of different features – such as allowing IRA contributions after age 70½ if you’re still earning an income – and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

Can I appeal an IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

What is the Medicare IRMAA?

Medicare IRMAA (Income-Related Monthly Adjustment Amount) stipulates that higher income earners must pay more for Medicare Part B and Part D premiums. Here’s how it works. The standard premium for Medicare Part B is $148.50 in 2021. However, some people may receive a bill for more than that amount along with an IRMAA ...

When was IRMAA enacted?

IRMAA was enacted for Medicare Part B premiums in 2003 as a provision of the Medicare Modernization Act. It was then expanded to Part D coverage in 2011 as part of the Affordable Care Act (ACA, also called Obamacare). IRMAA was developed by the federal government as a means of strengthening the financial stability of the Medicare program.

What is Medicare Part B based on?

Your Medicare Part B and Part D premiums are based on your modified adjusted gross income ( MAGI) that is reported on your IRS tax return from two years prior. For example, your 2021 Medicare Part B premiums will be based on your reported income from 2019. If your MAGI is $88,000 or less when filed individually (or married and filing separately), ...

How much is the MAGI for 2021?

If your MAGI is $88,000 or less when filed individually (or married and filing separately), or $176,000 or less when filed jointly, you will pay the standard Part B premium of $148.50 per month in 2021, and you won’t pay a Part B IRMAA.

Will Medicare Part B and Part D be paid in 2021?

But if your modified adjusted gross income from 2019 is more than those amounts, you will pay more than the standard Part B and Part D premiums in 2021, because you will pay an IRMAA. The full breakdown is as follows: Medicare Part B & Part D IRMAA. 2019 Individual tax return. 2019 Joint tax return. 2019 Married and separate tax return.

How much is the IRMAA premium for 2021?

In 2021, the standard monthly premium for Part B is $148.50. Depending on your yearly income, you may have an additional IRMAA surcharge. This amount is calculated using your income tax information from 2 years ago. So, for 2021, your tax information from 2019 will be assessed.

Who does IRMAA apply to?

IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, and the parts of Medicare that it applies to.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

How many people will be covered by Medicare in 2027?

It’s made up of several parts. In 2019, Medicare covered about 61.5 million Americans and is predicted to increase to 75 million by 2027. Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.