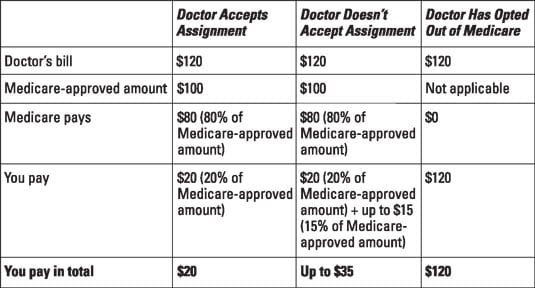

IRMAA is an extra charge added to your premium. The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the

What is an irmaa in Medicare?

Medicare IRMAA: What Is It and When Does It Apply? What Is an IRMAA in Medicare? What is it? An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income.

What is the irmaa surcharge for Medicare Part B and Part D?

For high-income Medicare beneficiaries, Part B and Part D premiums include an additional charge based on your modified adjusted gross income. Medicare beneficiaries who are being assessed the IRMAA surcharge will receive notice from the Social Security Administration. | Image: fizkes / stock.adobe.com

How do you calculate irmaa from Standard Premium?

This can be seen in table 1. Part B IRMAA is calculated by multiplying the average expenditure (which is the standard premium multiplied by 4) by the subsidy percentage assigned to a particular income bracket. The subsidy amounts can be found in table 2. The resulting answer is the total amount you will pay (standard premium plus IRMAA).

What is the irmaa surcharge for 2021 Medicare premiums?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

What are Irmaa rates for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

What are the Irmaa rates for 2020?

Combined Medicare Part B premiums and IRMAA surcharges will range from $220.40 per month to $491.60 per month per person in 2020. High-income Medicare beneficiaries are also subject to monthly surcharges for their Medicare Part D prescription drug plans.

How does Medicare calculate Irmaa?

How is my income used in my IRMAA determination? IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

What are the Irmaa surcharges for 2022?

Your 2022 IRMAA is based on your Modified Adjusted Gross Income (MAGI) from 2020. The Medicare Part B 2022 standard monthly premium is $170.10. Updated 2022 IRMAA brackets can increase Medicare Part B monthly premiums by as much as $408.20 and Medicare Part D monthly premiums by as much as $77.90.

How do you calculate modified adjusted gross income for Irmaa?

MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).

Does Social Security count towards Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

How do I stop Irmaa surcharges?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

Does Irmaa adjust automatically?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Is Irmaa based on AGI or taxable income?

The government determines whether you qualify for IRMAA by finding your modified adjusted gross income (MAGI). Your monthly IRMAA payment for each year is determined by your MAGI from two years prior. Your MAGI is your adjusted gross income (AGI) with certain costs added back to it.

What are the income brackets for Irmaa Part D and Part B?

A chart explaining how income affects the Part B premium and Part D IRMAASingleMarried Filing JointlyPart B Premium$111,001 to $138,000$222,001 to $276,000$297.00$138,001 to $165,000$276,001 to $330,000$386.10$165,001 and under $500,000$330,001 and under $750,000$475.20$500,000 or above$750,000 and above$504.902 more rows•Oct 4, 2021

Does everyone pay Irmaa?

Most people will pay the standard Part B premium amount. If your modified adjusted gross income, as reported on your IRS tax return from 2 years ago, is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What is IRMAA Part D?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

What age can you contribute to an IRA?

The SECURE Act has a number of different features – such as allowing IRA contributions after age 70½ if you’re still earning an income – and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

Can I appeal an IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

How is Medicare Part B Premium Figure?

Most people have a $0 premium for their Medicare Part A hospital insurance. But as you probably know there is a monthly premium assigned for your Medicare Part B . The standard Medicare Part B premium in 2021 is $148.50 per month. That is for individuals making less than $88,000 a year and joint earners making less than $176,000 a year.

What Is Medicare IRMAA?

Here is a web page from Medicare’s website on IRMAA. You can see here under the “What Is It Heading.” It states, You’ll get this notice if you have Medicare Part B and/or Medicare Part D and social security determines that any Income Related Monthly Adjustment Amounts (IRMAA) apply to you.

What Aspects of Medicare are Affected by IRMAA?

Medicare is an essential public service for the elderly here in America, which helps cover medical expenses in various terms. Some people will be more affected by these changes than others due to their specific needs when it comes down to coverage.

How Much is Medicare Part B Premium 2021?

The cost for Medicare Part B premium in 2021 is $148.50 per month, and an additional IRMAA surcharge may apply depending on your income. This surcharge amount varies based on how you filed taxes two years ago (IRS tax return information).

How much will IRMAA Charge Me for Medicare Part D?

It can be a little challenging to figure out the monthly premium for Medicare Part D plans. The company offering the policy will determine its price, and since there’s no standard, it could range from one program to another. But that’s not all! You also have to add surcharges into your calculations depending on how you filed taxes two years ago.

Important YouTube Channel Details

I appreciate you looking through my article. If it is interesting to you, please subscribe to my YouTube channel.

What does IRMAA mean on Medicare?

IRMAA stands for Income Related Monthly Adjustment Amount. Medicare.gov explains that, if your modified adjusted gross income as reported on your IRS tax return from two years ago is above a certain amount, you’ll pay the standard premium amount and IRMAA.

What is IRMAA based on?

Your IRMAA is based on your income from two years ago. If your circumstances have changed since that time, you can file an appeal with Medicare to let them know about a reduction in income.

What is the lowest bracket for Medicare?

Lowest Bracket: People in the lowest income bracket will pay their plan’s premium with no Medicare surcharge. The lowest bracket is for those: Filing jointly with income of 176,000 or less/year. Filing as an individual with income of $88,000 or less/year.

How to avoid IRMAA?

With some planning, there are steps you can take to avoid or reduce IRMAA. Here are 5 ideas: 1. Find Out if You Will Pay a Medicare Surcharge, IRMAA . You can use the NewRetirement Planner to see your projected annual income and assess when you might be assessed for IRMAA. Free members can review the Cash Flow Forecast.

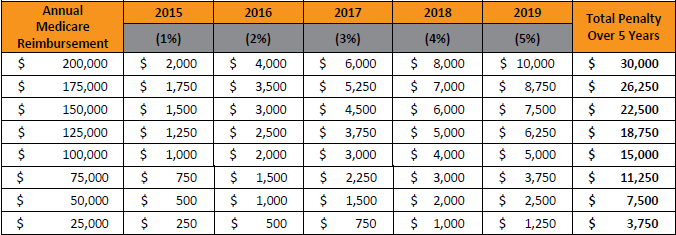

What is Medicare surcharge?

Not everyone knows this, but there are Medicare surcharges (officially called Income Related Monthly Adjustment Amount , or IRMAA) that correspond to income brackets. These additional costs can really add up. It is the highest-earning 5% of Medicare recipients who pay more for their health coverage.

How much does Medicare cost in 2021?

The monthly premiums for Medicare Part A range from $0–$471. Most people don’t pay a monthly premium for Part A. If you buy Part A, you’ll pay $471 each month in 2021 if you paid Medicare taxes for less than 30 quarters and $259 each month if you paid Medicare taxes for 30–39 quarters.

Do you pay monthly premiums for Medicare?

You may pay monthly premiums, IRMAA (see below), coinsurance, as well as co-pays and deductibles. Your total out-of-pocket costs for Medicare will vary tremendously depending on the types of coverage you select, your income, where you live, your health status, and healthcare usage.

What is the Medicare IRMAA?

Medicare IRMAA (Income-Related Monthly Adjustment Amount) stipulates that higher income earners must pay more for Medicare Part B and Part D premiums. Here’s how it works. The standard premium for Medicare Part B is $148.50 in 2021. However, some people may receive a bill for more than that amount along with an IRMAA ...

When was IRMAA enacted?

IRMAA was enacted for Medicare Part B premiums in 2003 as a provision of the Medicare Modernization Act. It was then expanded to Part D coverage in 2011 as part of the Affordable Care Act (ACA, also called Obamacare). IRMAA was developed by the federal government as a means of strengthening the financial stability of the Medicare program.

What is Medicare Part B based on?

Your Medicare Part B and Part D premiums are based on your modified adjusted gross income ( MAGI) that is reported on your IRS tax return from two years prior. For example, your 2021 Medicare Part B premiums will be based on your reported income from 2019. If your MAGI is $88,000 or less when filed individually (or married and filing separately), ...

How much is the MAGI for 2021?

If your MAGI is $88,000 or less when filed individually (or married and filing separately), or $176,000 or less when filed jointly, you will pay the standard Part B premium of $148.50 per month in 2021, and you won’t pay a Part B IRMAA.

Will Medicare Part B and Part D be paid in 2021?

But if your modified adjusted gross income from 2019 is more than those amounts, you will pay more than the standard Part B and Part D premiums in 2021, because you will pay an IRMAA. The full breakdown is as follows: Medicare Part B & Part D IRMAA. 2019 Individual tax return. 2019 Joint tax return. 2019 Married and separate tax return.

What is the income used to determine IRMAA?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA. As if it’s not complicated enough for not moving the needle much, ...

How many income brackets are there for IRMAA?

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

What percentage of Medicare premiums do Medicare beneficiaries pay?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

How much does Medicare premium jump?

If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

When will IRMAA income brackets be adjusted for inflation?

The IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and the projected brackets for 2022 coverage. Before the government publishes the official numbers, I’m able to make projections based on the inflation numbers to date.