Keep in mind, however, that there is no wage base limit for Medicare tax. While the employee is only subject to Social Security tax on the first $147,00, they will have to pay 1.45% Medicare tax on the entire $165,000. Workers who earn more than $200,000 in 2022 are also subject to an 0.9% additional Medicare tax. 13

Full Answer

Is there a limit on the amount of earnings subject to Medicare?

Mar 15, 2022 · For earnings in 2022, this base is $147,000. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

What is the maximum amount of the employer's Social Security tax?

Aug 14, 2021 · After 24 months, you cannot collect Social Security Income (SSI) benefits without signing up for Medicare Part A. If you require care at a hospital, your Medicare Part A benefits will lower your costs.

What are the Social Security and Medicare tax withholding rates and limits?

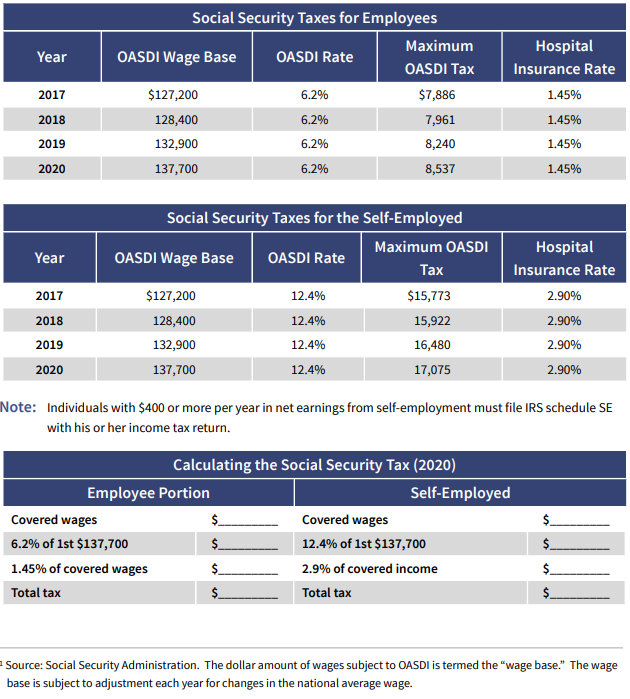

For 2020, the maximum limit on earnings for withholding of Social Security (old-age, survivors, and disability insurance) tax is $137,700.00. The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all …

What is the wage base limit for the additional Medicare tax?

Social Security Program (Old Age, Survivors and Disability Insurance – OASDI) 2021 Maximum Taxable Earnings: OASDI–$142,800; Hospital Insurance (HI, also called Medicare Part A)–No limit Federal Tax Rate: Max OASDI Max HI

Is there a limit on employer Medicare tax?

What is the employer portion of Social Security and Medicare?

What is the maximum Social Security payroll deduction for 2020?

What is the maximum Social Security withholding for 2021?

How much should my employer be withholding for federal taxes?

What is Social Security threshold?

How much Medicare is withheld from Social Security?

Who is exempt from Social Security and Medicare withholding?

What is the maximum payout for Social Security?

What happens if employer does not withhold Social Security tax?

What is the income limit before Social Security is taxed?

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

Can employers contribute to Medicare premiums?

Medicare Premiums and Employer Contributions. Per CMS, it’s illegal for employers to contribute to Medica re premiums. The exception is employers who set up a 105 Reimbursement Plan for all employees. The reimbursement plan deducts money from the employees’ salaries to buy individual insurance policies.

Is Medicare billed first or second?

If your employer has fewer than 20 employees, then Medicare becomes primary. This means Medicare is billed first, and your employer plan will be billed second. If you have small group insurance, it’s HIGHLY recommended that you enroll in both Parts A and B as soon as you’re eligible. If you don’t, your employer’s group plan can refuse ...

What happens if you don't have Part B insurance?

If you don’t, your employer’s group plan can refuse to pay your claims. Your insurance might cover claims even if you don’t have Part B, but we always recommend enrolling in Part B. Your carrier can change that at any time, with no warning, leaving you responsible for outpatient costs.

Is Part B premium free?

Since Part B is not premium-free like Part A is for most, you may wish to delay enrollment if you have group insurance. As stated above, the size of your employer determines whether your coverage will be considered creditable once you retire and are ready to enroll. Group coverage for employers with 20 or more employees is deemed creditable ...

What is CMS L564?

You will need your employer to fill out the CMS-L564 form. This form is a request for employment information form. Once the employer completes section B of the form, you can send in the document with your application to enroll in Medicare.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is the maximum Social Security tax for 2020?

The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax.

What is the FICA tax rate for 2020?

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold). The information in the following table shows the changes in Social Security withholding limits from 2019 to 2020.

How much Medicare tax do self employed people pay?

They also pay a 2.9% Medicare tax on their entire net earnings. An additional Medicare tax rate of 0.9% is applicable to the threshold amount mentioned. But, the self-employed individuals are allowed to claim the deduction for half of the social security tax to reduce their taxable income.

What is the wage base limit?

The Wage Base Limit is the annual limit on the wages earned for which the social security tax is paid. It is set on a yearly basis and adjusted based on the change in wage growth. This wage base limit will change every year.

What is FICA tax?

What are FICA Taxes? Federal Insurance Contributions Act (FICA) is an act that mandates withholding of taxes from employees’ paycheck and matching that with an equal contribution from the employer to fund the Social Security and Medicare Program .

What is the FICA tax rate for 2021?

FICA Tax Rates 2021. FICA tax is a combination of social security tax and Medicare tax. The taxes imposed on social security tax will be 6.2% and 1.45% for Medicare tax for each employee with matching contributions from their employer. FICA Tax Rates. Employee Contribution.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA) is used to fund the federal unemployment program that benefits people who lose their job. No taxes are withheld from the employee paycheck towards FUTA tax. Only the employer contributes to this program.

How does Medicare work?

The program is funded by payroll taxes paid by the employees with matching contributions from their employer, and also self-employed individuals.

Does 123paystubs calculate Medicare?

Yes, 123PayStubs calculates your employee taxes including Medicare taxes accurately based on the employee's wages. Create pay stubs for your employees with accurate tax calculations. Many businesses use 123PayStubs for its.

How long can you get SSI if you are a medical student?

If you are eligible under Section 1619 of the Social Security Act and you enter a medical institution, you are eligible for a regular SSI benefit for up to 2 months.

How long does SSI disability last?

This provision applies to SSI recipients who have received Social Security disability benefits for at least 24 months. This provision does not apply to SSI only beneficiaries. If you receive SSI only, we will conduct regularly scheduled medical reviews, unless you are using your Ticket to Work.

Can you deduct blindness on SSI?

If you are blind, we will deduct any part of your earned income that you spend to be able to work (such as for transportation, taxes, or special equipment) from the amount of income we use to figure your SSI benefit. The expense does not have to be related to your blindness.

What is the ticket to work law?

The Ticket to Work and Work Incentive Improvement Act of 1999 (Public Law 106-170) provides several important opportunities for people ages 18 through 64 who receive Social Security disability or SSI benefits and who want to go to work or increase their earnings.

Can I get medicaid if my income is too high?

Section 1619 (b) provides that, in most cases, even if your earned income (after the applicable exclusions) is too high to permit an SSI cash benefit, you may still be eligible for Medicaid as long as you need Medicaid in order to work and your earnings are under a “threshold” amount.

Does Social Security have a continuing disability review?

Effective January 1, 2002, Social Security will not conduct a continuing disability review of a disabled beneficiary based on work activity alone. This provision applies to SSI recipients who have received Social Security disability benefits for at least 24 months. This provision does not apply to SSI only beneficiaries.

What is a buy in for medicaid?

What is Medicaid Buy–in? Medicaid Buy–in is designed to provide Medicaid to working people with disabilities who, because of relatively high earnings, cannot qualify for Medicaid under one of the other provisions.

How long do you have to wait to get Medicare if you get SSDI?

If you get Social Security Disability Income (SSDI), you probably have Medicare or are in a 24-month waiting period before it starts. You have options in either case.

Can I get medicaid if I have SSDI?

You may be able to get Medicaid coverage while you wait. You can apply 2 ways: Create an account or log in to complete an application. Answer “ yes” when asked if you have a disability.

What is SSI disability?

Supplemental Security Income (SSI) Disability & Medicaid coverage. Waiting for a disability status decision and don’t have health insurance. No disability benefits, no health coverage. The Marketplace application and disabilities. More information about health care for people with disabilities.

What is the maximum Social Security tax for 2021?

Hence, the maximum amount of the employer's Social Security tax for each employee in 2021 is $8,853.60 (6.2% X $142,800). Since employees also have the Social Security payroll tax withheld from their wages, salaries, etc., the employer is in effect matching each employee's Social Security payroll tax.

What is the Social Security payroll tax rate for 2021?

The employer's Social Security payroll tax rate for 2021 (January 1 through December 31, 2021) is 6.2% of each employee's first $142,800 of wages, salaries, etc. (This amount is identical to the employee's Social Security tax that is withheld from the employee's wages, salaries, etc.) If an employee's wages, salaries, etc. are greater than $142,800, the amount in excess of $142,800 is not subject to the Social Security tax. Hence, the maximum amount of the employer's Social Security tax for each employee in 2021 is $8,853.60 (6.2% X $142,800).

What is the payroll tax rate for 2021?

The employer's Social Security payroll tax rate for 2021 (January 1 through December 31, 2021) is 6.2% of each employee's first $142,800 of wages, salaries, etc. (This amount is identical to the employee's Social Security tax that is withheld from the employee's wages, salaries, etc.)