Some of the most important 2020 Medicare changes include:

- Part A premium will be $458 (many qualify for premium-free coverage)

- Part B premium will increase to $144.60

- Part B deductible will rise to $198

- Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020

- Medicare will begin closing the Medicare Part D Donut Hole in 2020

- Part A premium will be $458 (many qualify for premium-free coverage)

- Part B premium will increase to $144.60.

- Part B deductible will rise to $198.

- Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020.

What are the Medicare costs changing in 2020?

Among all the changes coming to Medicare Supplement plans and Medicare Part D, Medicare costs will also be changing in 2020. In 2020, the Medicare Part A premium will be $458, however, many people qualify for premium-free Medicare Part A.

What are the Medicare rule changes for 2019?

The changes opened the door to coverage of services such as adult daycare, home-based care, caregiver support, pain management, and safety devices. 1 Although the rule changes came late in the year in 2018, few insurers had time to integrate these changes into their 2019 plans before the October 1 filing deadline. Considering a Medicare Plan?

Are the Medicare changes that take effect in January impacting you?

These Medicare changes that will take effect in January may impact your decision. Here’s what you need to know to help find the Medicare coverage that’s best for you. Medicare Advantage plans are sold by private insurers who offer the same coverage as Original Medicare. These plans often offer extra benefits such as vision and dental.

Is Medicare cost-sharing going up in 2022?

But there are also changes to Original Medicare cost-sharing and premiums, the high-income brackets, and more. The standard premium for Medicare Part B is $170.10/month in 2022. This is an increase of nearly $22/month over the standard 2021 premium, and is the largest dollar increase in the program’s history.

What changes will Medicare make in 2020?

When did Medicare change coverage?

Does Medicare cover prescriptions?

About this website

What are the big changes coming to Medicare?

The biggest change Medicare's nearly 64 million beneficiaries will see in the new year is higher premiums and deductibles for the medical care they'll receive under the federal government's health care insurance program for individuals age 65 and older and people with disabilities.

What changes are coming to Medicare in 2021?

Premium and deductible increases For 2021, the standard Medicare Part B premium has increased to $148.50 per month from $144.60 in 2020. Part A premiums are also higher in 2021, although most Medicare recipients don't pay for Part A through either their own or a spouse's work history.

What are the 2022 changes to Medicare?

But there are also changes to Original Medicare cost-sharing and premiums, the high-income brackets, and more. The standard premium for Medicare Part B is $170.10/month in 2022. This is an increase of nearly $22/month over the standard 2021 premium, and is the largest dollar increase in the program's history.

Are Medicare premiums going down in 2021?

Health and Human Services Secretary Xavier Becerra on Monday announced that he is instructing the Centers for Medicare & Medicaid Services to reassess this year's standard premium, which jumped to $170.10 from $148.50 in 2021.

What are the changes to Medicare in July 2021?

A number of changes will be made to the Medicare Benefits Schedule (MBS) from 1 July 2021, including indexation of most items and changes to general surgery, orthopaedic and cardiac services recommended by the MBS Review Taskforce. The MBS indexation factor for 1 July 2021 is 0.9%.

Will Medicare Part B go up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

What will the Medicare Part B premium be in 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Is 2022 Medicare free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What changes will Medicare make in 2020?

Medicare Changes in 2020: Facts for Consumers. In 2020, Medicare expanded supplemental benefits and opioid treatment program coverage, but also enabled some drug plans to implement indication-based formularies. Beginning in 2020, Medicare made several changes to coverage of certain services, benefits, and prescriptions.... Skip to Main Content.

When did Medicare change coverage?

Beginning in 2020, Medicare made several changes to coverage of certain services, benefits, and prescriptions.... Skip to Main Content.

Does Medicare cover prescriptions?

Beginning in 2020, Medicare made several changes to coverage of certain services, benefits, and prescriptions. These included: Allowing Medicare Advantage plans to cover additional non-health related supplemental benefits for plan members with chronic illnesses.

What is Medicare Advantage 2020?

According to data from Medicare Advantage insurance company filings outlining their 2020 plans reported in the Washington Examiner, insurers are offering coverage for a broad range of services including grab bars, nutritional advice, rides to doctor appointments, acupuncture, massage therapy, and service animal support.

Who sells Medicare Advantage plans?

Medicare Advantage plans are sold by private insurers who offer the same coverage as Original Medicare. These plans often offer extra benefits such as vision and dental.

What is Medicare Supplement Insurance?

Many people who choose Original Medicare instead of Medicare Advantage purchase Medicare Supplement insurance, also known as Medigap. There are 10 active Medigap plan types, which are identified by letter – like Plan D, Plan K, or Plan M. Medigap helps cover premiums, copayments and additional out-of-pocket costs that Original Medicare doesn’t cover.

Will Medicare Advantage plan include additional benefits?

This year, however, a large number of Medicare Advantage plans are expected to include additional benefits. In addition, the government is allowing even more non-medical benefits for plan year 2020, especially for people with chronic illnesses.

Is Medicare coverage available to everyone?

Keep in mind, however, that unlike the uniform medical coverage offered to everyone enrolled in any type of Medicare plan, these expanded benefits are not available to everyone. Before you sign up for one of these expanded plans, be sure you know the limits involved, warns David Lipschutz, senior policy attorney at the Center for Medicare Advocacy.

Does Medicare cover prescription drugs?

Most important, look for changes in your Medicare prescription drug plan. Don’t assume that your plan’s formulary, the list of prescription drugs covered by your Part D or Medicare Advantage plan, is permanent. These lists change every year.

How much is Medicare Part A 2020?

In 2020, the Medicare Part A premium will be $458, however, many people qualify for premium-free Medicare Part A. The Medicare Part B premium will increase to $144.60, and the Medicare Part B deductible will rise to $198 in 2020.

When will Medicare change?

Why are Changes Coming to Medicare in 2020? Whether Medicare has been your health care plan for many years, or you expect to be eligible for Medicare on or after January 1, 2020, the changes coming to Medicare Supplement plans and the Donut Hole may affect you. Legislation established these changes in 2015 to try and reduce unnecessary costs ...

What is the deductible for Medicare Supplement Plan G?

In 2020, the high deductible amount is $2,340. Once you have reached $2,340, your Medicare Supplement plan will pay the remainder of the costs for your Medicare-approved treatment. Because of the potential for high out-of-pocket costs, premiums for this plan are typically much less expensive than for Plan G. Plan G High-Deductible may be a good choice for you if:

What is the Medicare premium for 2020?

Some of the most important 2020 Medicare changes include: Part A premium will be $458 (many qualify for premium-free coverage) Part B premium will increase to $144.60. Part B deductible will rise to $198. Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020.

What are the changes to Medicare?

Summary: Medicare 2020 changes may affect your Medicare Supplement plan options and Medicare Part A, Part B and Part D costs. Some of the most important 2020 Medicare changes include: 1 Part A premium will be $458 (many qualify for premium-free coverage) 2 Part B premium will increase to $144.60 3 Part B deductible will rise to $198 4 Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020 5 Medicare will begin closing the Medicare Part D Donut Hole in 2020

What is the Donut Hole 2020?

The “Donut Hole” is the nickname given to the part of your Part D plan in which your costs are the highest. As the Donut Hole closes, the percentage ...

How much does Medicare pay for Donut Hole?

Currently, Medicare pays 56% of the price of your generic drugs while you’re in the Donut Hole. You’re responsible for the remaining 44%. In 2020, the number you will be responsible for is only 25% of the cost. This results in a huge saving for Part D beneficiaries in the Donut Hole.

Have Part A Premiums or Deductibles Changed?

Among the 2020 Medicare changes were increases in Part A premiums, deductibles, and coinsurance.

Have Part B Premiums and Deductibles Increased?

The standard premium for Part B plans also changed this year, increasing from $135.50 per month in 2019 to $144.60 per month in 2020. Some Medicare recipients may pay less than this full amount depending on their Social Security cost of living adjustment (COLA).

Are There Any Changes to Medicare Advantage Premiums?

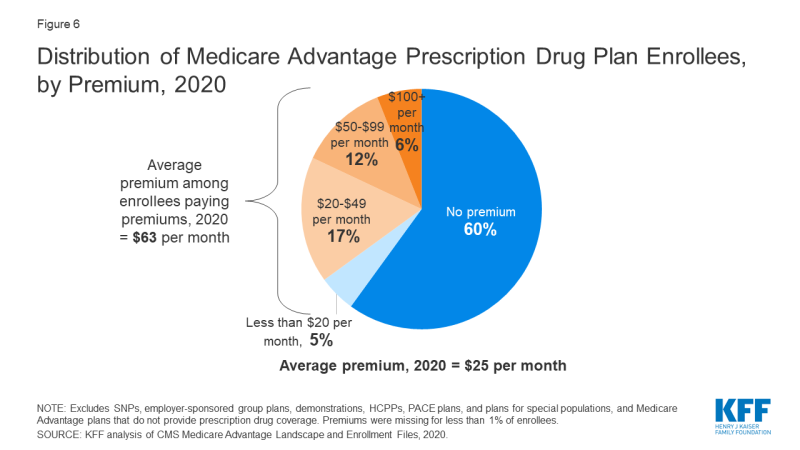

Medicare Advantage plans have been gaining in popularity in recent years as a comprehensive alternative to Original Medicare (Parts A and B). Average premiums for Medicare Advantage plans in 2020 are $23 per month.

What Is Happening to the Part D Donut Hole?

The Medicare “donut hole” is the name given to the time when you and your Part D plan have spent the maximum amount on prescription drugs, making you responsible for all out-of-pocket costs up to a yearly limit.

Can You Still Purchase Medigap Plans C and F?

Medicare Supplement insurance, or Medigap, has also experienced changes in 2020. Medicare Supplement Plans C and F is no longer be available for those who became eligible for Medicare on or after January 1, 2020. If you are unsure about your exact eligibility date, you can easily find that information listed on your Medicare card.

How Has the Medicare Plan Finder Tool Been Improved?

There also have been changes to the Medicare Plan Finder tool. This helpful online tool serves as a guide for those enrolling in Medicare.

What is the Medicare premium for 2020?

Part B premiums increased. According to Medicare Resources, in 2020, the standard premium for Medicare Part B was increased to $144.60 (up from $135.50 in 2019). This increase is due to the Social Security cost of living adjustment at 1.6% for 2020.

When was the Medicare Plan Finder tool upgraded?

In August 2019, The Medicare Plan Finder tool was upgraded. According to CMS, the new tool will make it easier for beneficiaries to see 2020 Medicare changes and to: Compare pricing between Original Medicare, Medicare prescription drug plans, Medicare Advantage plans, and Medicare Supplement Insurance (Medigap) policies; ...

How to compare Medicare plans?

In August 2019, The Medicare Plan Finder tool was upgraded. According to CMS, the new tool will make it easier for beneficiaries to see 2020 Medicare changes and to: 1 Compare pricing between Original Medicare, Medicare prescription drug plans, Medicare Advantage plans, and Medicare Supplement Insurance (Medigap) policies; 2 View different coverage options on their smartphones and tablets; 3 Compare up to three drug plans or three Medicare Advantage plans side-by-side; 4 Get plan costs and benefits, including which Medicare Advantage plans offer extra benefits; 5 Build a personal drug list and find Medicare Part D prescription drug coverage that best meets their needs.

How much is the catastrophic coverage for 2020?

The threshold for catastrophic coverage also increased to $6,350 in 2020, and copayments for the catastrophic coverage level increased slightly. As of 2020, enrollees in standard Part D plans pay 25% of the cost for brand-name and generic drugs after meeting their deductible. This will be the standard payment until they reach ...

How much is the 2020 Part B deductible?

The Part B deductible will increase by $13 to a total of $198 in 2020. If you are enrolled in Part B, you may have supplemental coverage that pays your deductible.

How long do you have to stay in hospital before you can transfer to a skilled nursing facility?

You have to have had an inpatient hospital stay of 3 or more days before you can transfer to a skilled nursing facility. Days 21 through 100 in a skilled nursing facility will require a coinsurance payment of $176 per day.

Can you keep Medigap plans?

In a summary of changes from Medicare Resources, their website explains that you can keep Medigap Plans C or F if you already have them. However, in an attempt to curtail the overutilization of services , these plans are no longer available to those who are newly-eligible for Medicare after January 1, 2020. A new high-deductible plan, Plan G, has been made available to replace the high deductible Plan F.

What is the Medicare premium for 2020?

The monthly premium, which almost all Medicare beneficiaries pay, is increasing to $144.60 in 2020 from $135.50 in 2019. Since Social Security is getting a COLA increase of 1.6% in 2020, nearly all Part B beneficiaries are going to be paying $144.60 monthly for Part B.

What is the donut hole in Medicare?

The donut hole is when consumers have to pay higher prices for their drugs due to having hit the initial coverage limit, which is increasing to $4,020 in 2020. It used to be that when you hit the donut hole, you would pay 100% of your drug costs. This percentage has been steadily reduced, but now, in 2020, the price for both brand name and generic drugs will be at 25% max both before and in the donut hole until you reach catastrophic coverage. In 2020, once you have paid $6,350 for your drug costs, you will move into the catastrophic coverage stage and you will pay significantly less for the rest of the year.

What is IRMAA in Medicare?

IRMAA, or the Income Related Monthly Adjustment Amount, is a surcharge high income Medicare beneficiaries pay for their Part B and Part D premiums. Currently, less than 5% of Medicare beneficiaries are charged IRMAA. IRMAA is tiered depending on your income and if you are married or single. The amount each tier pays in 2020 is increasing. The chart below breaks it down. The surcharge will be paid in addition to the Part B premium ($144.60 in 2020) and the Part D premium (varies by the plan you choose).

Is Plan F going away?

There has been a lot of talk about the Plan F going away in 2020. While there are changes happening, the Plan F is not completely disappearing. Due to the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), newly eligible Medicare beneficiaries from January 1, 2020 cannot sign up for a Supplement plan which covers the Part B deductible. The only Supplement plans that currently fall under MACRA regulations are Plan C, Plan F, and the high-deductible Plan F. This means that for anyone who was eligible for Medicare, usually meaning you were 65, before January 1, 2020 can keep their Plan F or even switch to a Plan F in the future. Anyone who turns 65 on or after January 1, 2020 cannot sign up for or ever get the Plan F.

How many Medicare Advantage plans will be available in 2020?

While some Medicare Advantage plans offered these and similar benefits for the 2019 plan year, many more are expected to do so in 2020. In fact, the Centers for Medicare and Medicaid Services (CMS) expects around 500 Medicare Advantage plans nationwide to offer these benefits to about 2.6 million enrollees. 1

When will Medicare change?

Medicare beneficiaries can expect some Medicare changes in 2020.

How much do you have to spend on drugs to get into the catastrophic coverage phase?

In 2019, beneficiaries left the donut hole coverage phase and entered the catastrophic coverage phase after spending $5,100 on covered drugs. In 2020, the amount you are required to spend before you enter the catastrophic coverage phase is $6,350.

What is a donut hole in Medicare?

The Medicare Part D “donut hole” is a temporary lapse in Part D prescription drug coverage once your out-of-pocket prescription drug spending has reached a certain amount for the year.

When will Medicare discontinue Plan F?

The new rule that discontinues Plan F and Plan C enrollment for new Medicare beneficiaries in 2020 is a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA).

What does "new year" mean for Medicare?

A new year often means a few changes to Medicare. Medicare costs typically fluctuate every year, but how will Medicare benefits change in 2020?

When will we have to spend more on drug costs?

You will have to spend more on your covered drug costs before you reach the donut hole in 2020.

What are the changes to Medicare?

The biggest changes to Medicare in 2020 will be: 1 Slightly higher premiums for Medicare Part A 2 Slightly higher premiums and deductibles for Medicare Part B and the requirement that the Medicare Part B deductible be part of every supplement plan 3 Discontinuation of supplement plans that don’t require payment of the Medicare Part B deductible—meaning Medicare Supplement plans C and F will no longer be options for people enrolling in Medicare in 2020 4 The addition of a higher-deductible Medicare Supplement plan in the form of Medicare Plan G 5 The closing of the Medicare Part D “donut hole” which will allow for a reduction in prescription medication costs for most people

What is the Medicare Part B premium?

The Medicare Part B premium will rise to $1 44.58 and the Medicare Part B deductible will rise to $198 as of 2020. As of 2020, any plan that does not require payment of the Medicare Part B deductible will no longer be allowed to be sold, which is why Medicare Supplement plans C and F are now discontinued.

Does Medicare cover prescription drugs?

Medicare Part D covers prescription medications. As far as Medicare changes in 2020, the secondary coverage for Medicare Part D—known as the “Medicare Part D donut hole”—continues to be more closed than it was in previous years.

Will Medicare Supplement Plan C and F be available in 2020?

The biggest Medicare changes of 2020 were to new enrollees. Medicare Supplement Plan C and F will no longer be available for people enrolling in Medicare in 2020. That means people who were enrolled before 2020 will in most cases be allowed to keep coverage, but for people newly turning 65 and enrolling Medicare, the Part C plan won’t be available.

Is open enrollment changing for Medicare?

With open enrollment rules changing each year, it can be hard to keep up with Medicare. Luckily, we’ve got a guide to the most important changes coming for people enrolling this year. Here is our guide to understanding Medicare changes 2020:

Is there a new Medicare Supplement Plan?

There’s a new high-deductible Medicare Supplement plan being introduced in 2020. It’s called Medicare Part G, and it’s similar to the previous Medicare Part F plan, except it also covers the Medicare Part B deductible so it’s still legal as of the changes to 2015 law that requires this coverage.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

When did Medicare start putting new brackets?

These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

What changes will Medicare make in 2020?

Medicare Changes in 2020: Facts for Consumers. In 2020, Medicare expanded supplemental benefits and opioid treatment program coverage, but also enabled some drug plans to implement indication-based formularies. Beginning in 2020, Medicare made several changes to coverage of certain services, benefits, and prescriptions.... Skip to Main Content.

When did Medicare change coverage?

Beginning in 2020, Medicare made several changes to coverage of certain services, benefits, and prescriptions.... Skip to Main Content.

Does Medicare cover prescriptions?

Beginning in 2020, Medicare made several changes to coverage of certain services, benefits, and prescriptions. These included: Allowing Medicare Advantage plans to cover additional non-health related supplemental benefits for plan members with chronic illnesses.