The biggest change to Medicare rules in 2020 comes in the form of a new modifier related to services provided by PTAs. Coming in 2022, services provided by PTAs will be greeted with a payment reduction. However, starting on January 1, 2020, you must use the CQ modifier to denote a service provided by a Physical Therapist Assistant.

What are the Medicare changes for enrollees?

Enrollees need to keep a close eye on the annual Medicare updates. Historically, Medicare changes usually expand the program, but changes also involve the amount you pay in premiums, deductibles, and coinsurance – some go up, some go down. So, what are the Medicare changes in 2022?

What are the changes in the contract year 2023 Ma?

The measures set forth in the Contract Year 2023 MA and Part D Policy and Technical Changes final rule build on the agency’s strategic pillars to be a responsible steward of public programs, as it continues to expand access to quality, affordable care and advance health equity for people with Medicare and Medicaid.

When can I Change my Medicare coverage?

Each year, Medicare subscribers have the chance to make changes to their coverage. During a brief window from October 15 to December 7, anyone who’s on Medicare can change plans and update their coverage for the next year.

What are the Medicare updates every year?

Every year, Medicare announces a list of new updates to the insurance program. The updates might seem trivial and minor, but they can significantly impact enrollees’ finances and coverage. Enrollees need to keep a close eye on the annual Medicare updates.

What changed with Medicare in 2020?

In 2020, the Medicare Part A premium will be $458, however, many people qualify for premium-free Medicare Part A. The Medicare Part B premium will increase to $144.60, and the Medicare Part B deductible will rise to $198 in 2020.

What are the major Medicare changes for 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What are the big changes to Medicare?

The biggest change Medicare's nearly 64 million beneficiaries will see in the new year is higher premiums and deductibles for the medical care they'll receive under the federal government's health care insurance program for individuals age 65 and older and people with disabilities.

Are Medicare costs going up in 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What are the changes to Medicare in July 2021?

A number of changes will be made to the Medicare Benefits Schedule (MBS) from 1 July 2021, including indexation of most items and changes to general surgery, orthopaedic and cardiac services recommended by the MBS Review Taskforce. The MBS indexation factor for 1 July 2021 is 0.9%.

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What are the 2022 changes to Medicare?

Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022.

What changes are coming to Medicare in 2021 Australia?

Budget 2021-22 They include new, ended and amended MBS listings. orthopaedic surgical items. varicose veins services • HbA1c testing at point of care • hydatidiform mole testing. pain management items related to implanted devices, nerve blocks, and surgical co-claiming.

Is Medicare changing their cards for 2022?

15 through Dec. 7, the more than 63 million Medicare beneficiaries can pick a new Medicare Part D drug plan, a new Medicare Advantage plan, or switch from Original Medicare into a Medicare Advantage plan or vice versa. Any coverage changes made during this period will go into effect Jan. 1, 2022.

What will the Medicare Part B premium be in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Why is Medicare Part B going up so much in 2022?

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

What is the Part B monthly premium for 2021?

$148.50The standard Part B premium amount is $148.50 (or higher depending on your income) in 2021. You pay $203.00 per year for your Part B deductible in 2021.

When does Medicare change plans?

Each year, Medicare subscribers have the chance to make changes to their coverage. During a brief window from October 15 to December 7, anyone who’s on Medicare can change plans and update their coverage for the next year. Since significant changes in coverage are planned each year, make sure to search online to find out more about 2021 changes ...

What is the most important change in Medicare?

One of the most important changes happening within Medicare is the addition of more coverage for telehealth services and telemedicine. As increasingly more individuals need to meet with doctors in their own homes, telemedicine is providing the opportunity for patients to schedule appointments to “see” doctors on video calls. It’s a great way for seniors and high-risk people to get medical treatment without leaving home.

How long does Medicare cover long term care?

In years past, both Original Medicare and Medicare Advantage plans have both covered only skilled services or rehabilitative care for a maximum of 100 days.

When will Medicare open enrollment for ESRD 2020?

Coverage for these new plans will begin on January 1 , 2021. This gives individuals with ESRD more choices and more coverage options. And it comes with a number of benefits.

Will Medicare Advantage plan be expanded in 2021?

This is changing in 2021. Medicare Advantage plans will begin offering increased home care services, with additional supplemental coverage to better meet subscribers’ needs. The coverage will vary from plan to plan, so make sure to look into the details of different Medicare Advantage plans during open enrollment.

Can you telehealth with Medicare?

Depending on the specifics of the coverage you choose, you may be able to meet with telehealth providers for your primary care, cardiology, dermatology, psychiatry, gynecology, and endocrinology needs. During open enrollment, make sure to look into telehealth and telemedicine coverage as you update or re-enroll in Medicare.

Does Medicare pay for telehealth?

Now, Medicare is offering to pay for some of the costs of these telehealth services. In 2021, you’ll be able to take advantage of virtual services like e-visits and virtual check-ins with doctors and other healthcare professionals. 1. Additionally, Medicare Advantage plans are also offering increased coverage for telehealth services.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

How long is a skilled nursing deductible?

See more Medicare Survey results. For care received in skilled nursing facilities, the first 20 days are covered with the Part A deductible that was paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility.

Medicare Part A Changes 2022

Medicare Part A is free coverage, often referred to as ‘hospital insurance. The plan provides coverage for inpatient care during hospital admittance, skilled nursing facilities, and home health care in specific scenarios.

Medicare Part B Changes for 2022

Unlike Medicare Part A, Medicare Part B requires a monthly premium – an amount that is automatically deducted from an individual’s benefit payment. In addition, Part B covers outpatient hospital services (X-rays, diagnostic tests, medical supplies), physician fees, certain home health services, and other medical services not covered by Part A.

Medicare Part D Changes 2022

Medicare Part D is a program introduced by the federal government to get Medicare beneficiaries prescription drug coverage. Part D plans are run by private insurance companies that follow the rules set by Medicare.

Adjusted Rates for High Income Brackets

It’s widely known that Medicare beneficiaries with high incomes pay higher premiums for Part B and Part D. And in 2021, the income brackets have been adjusted for inflation. The high-income threshold has been increased to $88,000, up from $87,000.

Changes to Medicare Supplement Plans (Medigap) 2022

As of January 2020, Medigap Plan C and Plan F are no longer available for new Medicare enrollees. These two Medigap plans were popular because they covered Part B deductible costs in full. However, a person previously enrolled in Plan C or Plan F can keep the policy.

What changes will Medicare make in 2020?

The first change: The donut hole closed completely, as of January 1. Contrary to popular opinion, this does not mean drugs will be free. The donut hole is officially known as the Coverage Gap.

What is Medicare Supplement Insurance?

Many people who choose Original Medicare instead of Medicare Advantage purchase Medicare Supplement insurance, also known as Medigap. There are 10 active Medigap plan types, which are identified by letter – like Plan D, Plan K, or Plan M. Medigap helps cover premiums, copayments and additional out-of-pocket costs that Original Medicare doesn’t cover.

Will Medicare cost decrease in 2020?

Overall, the cost of Medicare Advantage plans (plans offered by private insurance companies that replace your Original Medicare) decreased in 2020. Premiums are the lowest they’ve been in 13 years.

Can I enroll in Medicare Part D?

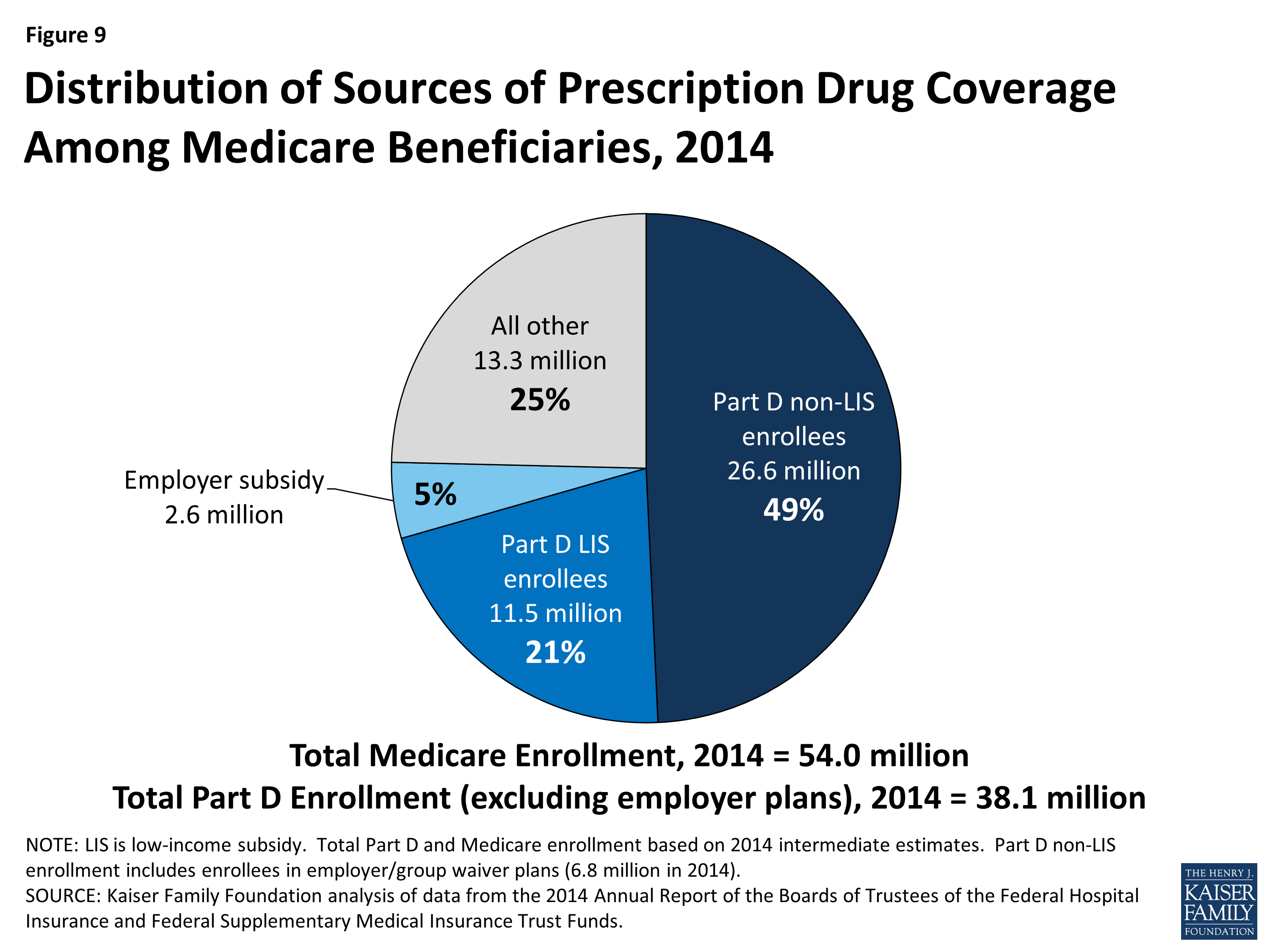

Original Medicare beneficiaries who want coverage for prescription drugs can enroll in a Medicare Part D plan. Like Medicare Advantage, there are many Part D plans, and you can use the Medicare Plan Finder tool to find and compare plans available to you.

Increased Coverage For Telehealth Services

New Long-Term Care Coverage Options

- Long-term care coverage isn’t exactly comprehensive under Medicare. In years past, both Original Medicare and Medicare Advantage plans have both covered only skilled services or rehabilitative care for a maximum of 100 days. While Medicare Advantage plans might offer some supplemental coverage, seniors’ options have long been limited. This is changing in 2021. Medic…

More Choices and Coverage For Seniors with End-Stage Renal Disease

- In years past, individuals living with end-stage renal disease (ESRD) had very limited options under Medicare. They could only enroll in Medicare Advantage under certain restricted circumstances. But during the 2020 open enrollment period, those living with ESRD can sign up for Medicare Advantage and pick a new plan. Coverage for these new plans will begin on January 1, 2021. Thi…

Make Changes to Your Medicare Coverage Before Open Enrollment Ends

- You only get one opportunity to make changes to your Medicare coverage – and it’s during open enrollment. This is the one time per year that you can enroll in a new plan as a current Medicare subscriber. It’s also the perfect opportunity to consider and compare different plans with coverage that might better meet your needs. Make sure to do your research before you pick a new Medica…