The disparate parts of Medicare are funded in different ways. Medicare Part A, which covers hospital and inpatient care, receives most of its funding, 89%, from payroll taxes. Medicare Part B, which covers outpatient services, obtains most of its funding, 74%, from general revenue.

How is Medicare Part A funded?

The U.S. Treasury Department runs two trust funds. One for Social Security and one for Medicare. How is Medicare Part A Funded? Your hospital coverage through Part A has funding through the Hospital Insurance trust fund. This trust fund covers inpatient care like hospice, home health care, and skilled nursing facilities.

What are the major Medicare trust funds?

The below-listed items describe the major Medicare trust funds that finance Medicare Part A, and Medicare Parts B and D. Medicare Part B is Medical insurance coverage. It is part of the national health care system that protects more than 50 million people. Medical insurance combines with Part A Hospital Insurance to form the Original Medicare.

How does Medicare Part a pay for hospital care?

Your hospital coverage through Part A has funding through the Hospital Insurance trust fund. This trust fund covers inpatient care like hospice, home health care, and skilled nursing facilities. Typically, people pay 2.9% on Medicare taxes from their payroll earnings.

How is Medicare Advantage funded?

Medicare Advantage, or Part C, is a health insurance program. It is funded from two different sources. The monthly premiums of beneficiaries provide part of the funding. However, the main source is a federal agency called the Centers for Medicare & Medicaid Services, which runs the Medicare program.

How is Medicare Part A financed?

Part A is financed primarily through a 2.9 percent tax on earnings paid by employers and employees (1.45 percent each) (accounting for 88 percent of Part A revenue). Higher-income taxpayers (more than $200,000/individual and $250,000/couple) pay a higher payroll tax on earnings (2.35 percent).

What are the three sources of revenue for Medicare Advantage plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the HI and the SMI trust funds.

Is Medicare Part B funded by Social Security?

Funding for Medicare comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries. Other sources include taxes on Social Security benefits, payments from states, and interest.

Is Medicare funded by taxpayers?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

How is Medicare Part A and B funded?

While Part A is funded primarily by payroll taxes, benefits for Part B physician and other outpatient services and Part D prescription drugs are funded by general revenues and premiums paid for out of separate accounts in the Supplementary Medical Insurance, or SMI, trust fund.

How is Medicare Part B funded quizlet?

Part B (Medical Insurance) is financed through Medicare Beneficiary monthly paid premiums and the general revenues of the federal government. The typical Medicare Beneficiary participating in Part B pays 25% of the cost of his or her Part B premium. The federal government pays 75% of the premium.

Who is Medicare Part B financed by?

Medicare Part B Financing: Medicare Part B is financed through general federal revenues (72%), premiums (26%), and interest and other sources (2%). In 2020, the standard part B premium was $144.60 per month, but this amount increases for individuals with incomes >$87,000 per year.

How does the government finance the trust fund to cover costs of Medicare Part B?

The Medicare trust fund finances health services for beneficiaries of Medicare, a government insurance program for the elderly, the disabled, and people with qualifying health conditions specified by Congress. The trust fund is financed by payroll taxes, general tax revenue, and the premiums enrollees pay.

Who administers funds for Medicare?

The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, and the Children's Health Insurance Program (CHIP).

Is Medicare paid for by the government?

Medicare is an insurance program. Medical bills are paid from trust funds which those covered have paid into. It serves people over 65 primarily, whatever their income; and serves younger disabled people and dialysis patients.

How much of my taxes go to Medicare?

1.45%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Who pays for Medicare?

Medicare is funded through multiple sources: 46% comes from general federal revenue such as income taxes, 34% comes from Medicare payroll taxes and...

Is Medicare funded by the state or federal government?

Medicare is a federal program, and as a result, the vast majority of Medicare funding comes from the federal government. However, state governments...

What percentage of Medicare is paid by the federal government?

The federal government finances 99% of the Medicare budget, while the remaining 1% comes from states.

Are Medicare and Medicaid funded in the same way?

Medicare and Medicaid are two different programs, serving two disparate populations, and the programs are funded differently. As a federal program,...

How much does the government pay Medicare Advantage plans?

Medicare pays Medicare Advantage plans more than $1,000 a month for each beneficiary enrolled in their plan. Medicare spends more than $348 billion...

What are the sources of Social Security?

Another source of funding for the program comes from: 1 Income taxes on Social Security benefits 2 Premiums associated with Part A 3 Interest accrued on trust fund investments

What are the sources of revenue for Advantage Plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the H.I. and the SMI trust funds.

What is benchmark amount for Medicare?

Benchmark amounts vary depending on the region. Benchmark amounts can range from 95% to 115% of Medicare costs. If bids come in higher than benchmark amounts, the enrollees must pay the cost difference in a monthly premium. If bids are lower than benchmark amounts, Medicare and the health plan provide a rebate to enrollees after splitting ...

What is supplementary medical insurance?

The supplementary medical insurance trust fund is what’s responsible for funding Part B, as well as operating the Medicare program itself. Part B helps to cover beneficiaries’ doctors’ visits, routine labs, and preventative care.

Will Medicare stop paying hospital bills?

Of course, this isn’t saying Medicare will halt payments on hospital benefits; more likely, Congress will raise the national debt. Medicare already borrows most of the money it needs to pay for the program. The Medicare program’s spending came to over $600 billion, 15% of the federal budget.

Does Medicare Supplement pay for premiums?

Many times, seniors who are retired may have their premiums paid by their former employers. The federal government doesn’t contribute financially to Medigap premiums.

How did the Affordable Care Act affect Medicare?

Combined with the Sequester, the Affordable Care Act made spending reductions in Medicare. It moved funds away from benefits by reforming and improving payment and administration processes, and put money into relief for prescription drugs, and added new no cost prevention and wellness benefits.

What are the benefits of Medicare?

Medicare and the Affordable Care Act 1 Added prevention and wellness benefits at no costs to users 2 Reduced the Donut Hole and help it disappear in future years 3 Management improvement, costs reduction, and better patient outcomes 4 Strengthened the Trust Fund for Hospital Insurance

What is Medicare insurance?

It has grown into an entitlement for older Americans to have comprehensive medical and hospitalization insurance coverage . Most participants pay for the insurance benefits from payroll deductions for social security over years of work in jobs or businesses with taxable income.

Why is the Affordable Care Act important?

This emphasizes the importance of initial care. Thorough diagnostics and impactful treatment processes reduce the need for further and far more costly treatment in future years for these patients.

What is Part B coverage?

Part B and Gap Coverage. Part B coverage leaves a gap that consumers must fill on their own efforts. Many use backup insurance like the Medicare Supplement policies. Those eligible for Medicaid as well as Medicare can use Medicaid to help fill in the funding gaps left by Part B Medical Insurance.

How many accountable care organizations are there?

Using advanced management techniques, nearly 500 accountable care organizations have begun the serious work of analyzing and improving healthcare delivery and management. Working under contract with the Centers for Medicare and Medicaid, the ACO’s have earned millions in incentives for proving inefficiencies and correcting them.

Can Part B premiums be deducted?

They also cost more for those who started late and must pay the Part B late enrollment fee. Part B premiums can be deducted or paid by other arrangements. When connected with a Part A enrollment, Original Medicare fulfills the Affordable Care Act obligation.

How does Medicare get money?

Medicare gets money from two trust funds : the hospital insurance (HI) trust fund and the supplementary medical insurance (SMI) trust fund. The trust funds get money from payroll taxes, as allowed by the Federal Insurance Contributions Act (FICA) enacted in 1935.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How much is the Medicare deductible for 2020?

A person enrolled in Part A will also pay an inpatient deductible before Medicare covers services. Most recently, the deductible increased from $1,408 in 2020 to $1,484 in 2021. The deductible covers the first 60 days of an inpatient hospital stay.

What is Medicare for adults?

Medicare is the federal healthcare program for adults aged over 65, adults with disabilities, and people with end stage renal disease. The program provides coverage for inpatient and outpatient services, and prescription drugs. Medicare gets money from two trust funds: the hospital insurance (HI) trust fund and the supplementary medical insurance ...

How many parts does SMI have?

The SMI trust fund has two parts, namely Part B and Part D, funded by the premiums paid for each part. In addition, it receives funds authorized by Congress, and the interest from trust fund investments.

How much is Medicare spending in 2019?

According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion. This article looks at the ways in which Medicare is funded. It also discusses changes in Medicare costs.

How much will Part D premiums be in 2021?

The adjusted monthly fee for 2021 ranges from $12.30 to a maximum of $77.10.

How Is Medicare Funded?

Medicare is a Federal program that is managed by the Centers for Medicare & Medicaid Services (CMS). The funds for the program come from a few different sources, with the primary source being FICA payroll taxes. These taxes are in addition to the 6.2% Social Security tax or OASDI tax that you will see withheld from your paycheck.

Is Medicare Funded By State Or Federal?

Many people wonder whether Medicare is a state or federal program. Medicare is really funded by you, the taxpayer. It is a Federal program that is administered by the Federal government. There is little to no state involvement with the Medicare program. Medicare provides health care coverage for retirees and disabled persons who can qualify.

How Does Medicare Work For Those Who Are Self-Employed?

Medicare insurance plans work exactly the same for those who are self-employed. If you have enough work credits to qualify for Medicare, then you will be automatically enrolled in Part A coverage at age 65. There is one major difference that self-employed individuals need to be aware of.

Conclusion

Medicare funding is extremely important to provide coverage to those individuals who rely on this insurance system, so it is helpful that you have a good understanding of where this funding comes from. Medicare is a Federally administered program that is funded primarily through taxpayer dollars.

Frequently Asked Questions

The government provides very few subsidies for Medicare. The program is almost entirely funded through federal income taxes, employer payroll taxes, and premium payments. However, with its current funding, the program may begin to run out of money in the next 5-10 years. The current funding model may be forced to change to keep the program running.

What are the sources of Medicare funds?

Two trust funds held by the United States Department of the Treasury supply the money for Medicare payments. The funds are the Hospital Insurance Trust Fund and the Supplemental Medical Insurance Trust fund.

What factors influence Medicare contribution?

Another factor that influences Medicare’s contribution is the expected healthcare costs of the beneficiaries, based on their medical records. Medicare’s funding comes from a variety of sources, such as taxes and funding authorized by Congress.

How does Medicare bidding work?

First, each plan submits a bid to Medicare, based on the estimated cost of Part A and Part B benefits per person. Next, Medicare compares the amount of the bid against the benchmark.

What determines the amount of Medicare payments?

The amount of the monthly payments depends on two main factors: the healthcare practices in the county where each beneficiary lives, which influences a procedure called the bidding process. the health of each beneficiary, which governs how Medicare raises or lowers the rates, in a system known as risk adjustment.

What is Medicare Advantage?

Medicare spending. Summary. Medicare Advantage, or Part C, is a health insurance program. It is funded from two different sources. The monthly premiums of beneficiaries provide part of the funding. However, the main source is a federal agency called the Centers for Medicare & Medicaid Services, which runs the Medicare program.

What happens if Medicare bid is lower than benchmark?

If the bid is lower than the benchmark, the plan gets a rebate from Medicare that is a percentage of the difference between the bid and the benchmark. Plans that receive rebates should use a portion of the rebates to fund supplemental benefits or to reduce premiums.

What is benchmark Medicare?

The benchmark is a percentage of costs of average Medicare spending per individual. Each county in the United States has its own benchmark. It reflects the practice patterns of resident healthcare providers that bill Medicare. Practice patterns differ among counties, so their benchmarks also differ.

How is Medicare Part D funded?

Part D is financed by general revenues (71 percent), beneficiary premiums (17 percent), and state payments for beneficiaries dually eligible for Medicare and Medicaid (12 percent). Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

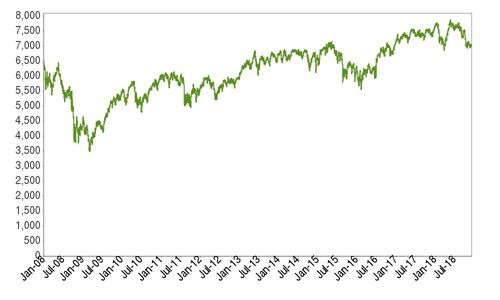

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.