What is Medicare Plan F and what does it cover?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the "Cadillac" coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor's visit,...

Can I choose any doctor that accepts Medicare Plan F?

Yes. You will have the freedom to choose any doctor or hospital that accepts Medicare. Your Plan F will be accepted by any participating provider, regardless of which insurance company you choose to buy your supplement from. Currently Medicare has over 900,000 participating providers across the nation.

How do I Use my Medicare Plan F supplement card?

Whether you have a hospital stay, or a diagnostic exam or a doctor’s visit, you will simply present your Medicare card along with your Plan F supplement card. You will be good to go. As long as Medicare approves the service or treatment you have done, then Medicare will pay its share.

Does Medicare Part F cover all doctor visits?

Most doctors will inform you if they offer tests that Medicare does not cover. Plan F coverage also includes your other doctor visits for illnesses and injuries. Medicare Part B first pays 80%. Then your Plan F supplement pays your deductible and the other 20%.

How do you qualify for Medicare Plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

Does Medicare Plan F cover cataract surgery?

Also good: Plan A, B, D, G, M and N pay 100% of Part B coinsurance, which is your portion of cataract procedure costs. Best plans if you're eligible: Plan C and Plan F pay 100% of the Medicare Part B coinsurance and the Part B deductible.

What is included in plan F?

Medicare Supplement Plan F offers basic Medicare benefits including:Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end.Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.More items...•

Why is Medicare getting rid of F?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Does Medicare Plan F cover vision?

Plan F is one of the most comprehensive Medicare supplement plans you can purchase, but it doesn't cover everything. This plan will not cover the following: Things that Medicare doesn't normally cover, like acupuncture, vision exams and dental work, are not included in Plan F coverage.

Does Medicare Plan F cover shingles vaccine?

Yes. 100% of Medicare prescription drug plans cover this drug.

What does Medigap plan F not cover?

Medigap Plan F doesn't cover the following, nor do any Medigap plans sold to new Medicare members: Prescription drugs. Long-term care (like non-skilled care you get in a nursing home). Dental care.

Does Medicare Plan F cover deductible?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022.

Is Medicare Plan F being discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

What is Medicare Plan F being replaced with?

No plan completely replaces Medicare Part F, but the closest available is Medicare Supplement Plan G. Like Plan F, Plan G covers 100% of many benefits, including: Part A coinsurance and hospital costs. Part B copays/coinsurance (not deductibles)

Will plan F premiums rise after 2020?

We don't know yet how premiums for Plan F will be affected in 2020 but there is a chance that the increases for Plan F will be higher annually after 2020 than the increases on G, so Plan G now is a good buy for your situation.

Is plan F guaranteed issue?

Outside of your Medicare Supplement OEP, guaranteed-issue rights are often limited to certain Medicare Supplement insurance plans: A, B, C**, D, F**, G, K, or L. Please note: Not all plans are sold in every state. A high-deductible Plan G might be available in your state.

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

Do you need to answer questions about your health to qualify for new coverage?

In many states, you need to answer questions about your health and get through underwriting to qualify for new coverage. While medical underwriting can cause some stress, many individuals successfully pass under writing and change coverage annually, so don’t worry. Let’s dive into information about the situations typically resulting in approval.

Does Medigap require a supplement policy?

Oregon and California allow beneficiaries to change their supplement policy within the birthday month with no supplement underwriting. This does require that you have a supplement policy currently active to qualify. Talk to your agent; they can get quotes to check if a lower rate exists.

Can you keep your Medicare coverage if you have a chronic illness?

Keep Your Coverage if you have a Chronic, Incurable Condition. There are plenty of health issues that can be treated but are still considered incurable illnesses. When you have an illness that requires treatment forever, you’ll see that there are questions on many Medicare Supplement applications that can exclude you.

Is Medicare Supplement underwriting required?

Medicare Supplement underwriting questions aren’t always mandatory. Sometimes, like during your Open Enrollment Period, you receive a waiver for health question requirements. If you’re changing a Medigap plan or miss your OEP, underwriting is likely a must.

What is Medicare Plan F?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the “Cadillac” coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor’s visit, you will simply present your Medicare card ...

What are the important imaging exams for Medicare?

Important imaging exams like colonoscopies and mammograms. Screenings for diabetes, cardiovascular conditions, bone density and other conditions. Medicare dictates which preventive screenings are allowed – your primary care doctor will know which screenings to provide to you that will be covered.

How much is Plan F for 2021?

Here’s a list view of your Plan F coverage at the hospital: Hospital deductible ($1,484 in 2021) and coinsurance. 365 days of additional hospital coverage after Medicare’s coverage is exhausted. Hospice care at any hospice facility. Blood (if needed in a transfusion)

Does Plan F pay for deductible?

Then your Plan F supplement pays your deductible and the other 20%. Some doctors charge a 15% excess charge beyond what Medicare pays. Plan F covers that for you. Plan F also pays the 20% for a long list of other Part B services.

Does Medicare pay for eyeglasses after cataract surgery?

The answer is no if the matter is routine. Medicare will, however, pay for one pair of very basic eyeglasses after a cataract surgery. One exception is that Medicare supplement Plan F will cover up to $50,000 in foreign travel emergency benefits. Since this care occurs outside the U.S., Medicare obviously does not cover that.

Does Medicare cover outpatient prescriptions?

If Medicare pays its 80% share on such a drug, your Plan F will cover the rest of it. However, neither Original Medicare nor Plan F cover outpatient prescriptions.

Does Medicare pay for Supplement Plan F?

Then your Medicare Supplement Plan F will pay the remaining amount that Medicare does not cover.

What are some examples of Medicare Advantage plans?

Another scenario we see is an individual that's working past age 65, and their employer's group health plan is ending. In these circumstances, you have a 63-day window to choose a plan. YouTube. Medicare Allies.

What does "denial of claim" mean on Medicare?

That means if they determine your answers on the application were incorrect or untrue, they can deny your benefits or rescind coverage. Don't lie on an application! The insurance company will find out about it eventually.

What is medical underwriting?

In short, medical underwriting is a process used by insurance companies to verify your health status. For the most part, insurance companies use medical underwriting to determine whether they should offer you coverage, and if so, at what price. To qualify for a Medicare Supplement, also called Medigap plan, you typically have to go ...

Is Medigap a Plan G?

The government has standardized Medigap plan benefits across the board, so a Plan G is a Plan G, no matter which company you choose. If you have any kind of health condition, we'll prequalify you for coverage. And if we run into any hurdles, we'll walk you through all of the available options.

Is Medigap the same as underwriting?

Not all Medigap carriers are the same when it comes to medical underwriting. Since plan benefits are standardized, the two main differences between Medigap carriers are pricing and underwriting. You may find one company will accept your health condition, while most others won't.

Do you have to go through underwriting for Medicare Supplement?

The same kind of process happens when you apply for a Medicare Supplement, also called Medigap. There are times when you don't have to go through underwriting – we'll get to shortly. But unless you qualify for those special times, you'll have to go through the medical underwriting process. While each Medicare Supplement company does things ...

What is a plan F?

Plan F, simply put, is one of the plans available to you when you buy a Medicare supplement policy, also known as a Medigap policy.

Which Medicare plan covers 100% of deductibles?

And, based on our enrollment experience: Plan F is the most popular plan. It covers 100% of the deductibles, copays, and coinsurance listed in the chart above that you would normally pay out of your pocket if you were enrolled in just Medicare Part A and Medicare Part B (Original Medicare).

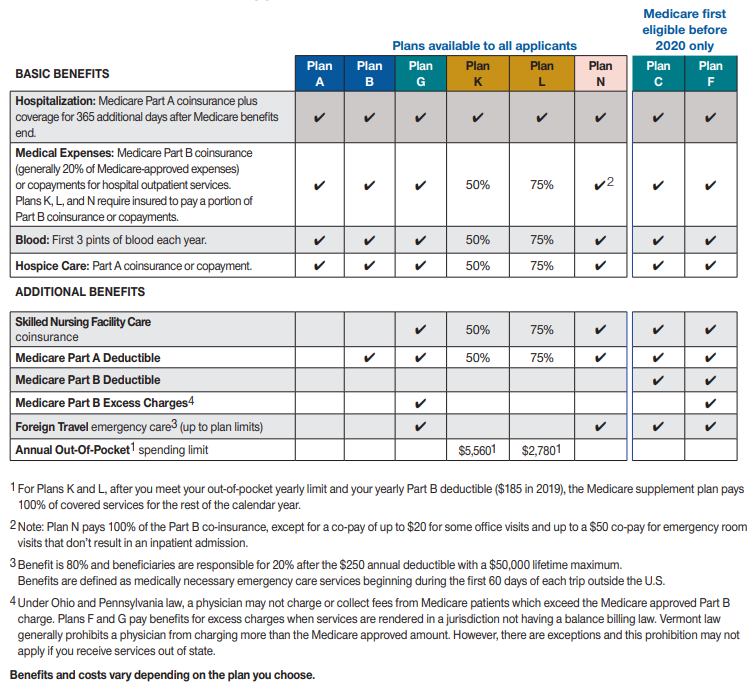

How many Medigap plans are there?

There are ten standardized Medigap plans. They are denoted by the letters A through N. Because these plans are offered by private insurance companies, the cost and availability of each lettered plan may differ, but not the benefits. In other words, all companies that offer, say Plan F, must offer the same standardized benefits.

When is the best time to buy a Medigap policy?

For example, if you turn 65 and are enrolled in Part B in June, the best time for you to buy a Medigap policy is from June to November. This is your open enrollment period. After this enrollment period, your option to buy a Medigap policy may be limited and it may cost more.

Do Plan F rates increase over time?

Another fact you must know: The company with the lowest initial Plan F rate may have substantially higher rate increases in the future than a company with higher initial rates. So, you may pay less over time with a policy from the company with the higher initial rate.

Does every insurance company offer all ten Medigap plans?

In other words, all companies that offer, say Plan F, must offer the same standardized benefits. Not every insurance company, though, offers all ten plans. The chart below shows basic information about the different benefits that the 10 Medigap policies cover. If a check mark appears, the plan covers the described benefit 100%.

What is a plan F?

Plan F is a very comprehensive plan, helping cover expenses that original Medicare doesn’t. This includes your deductibles, coinsurance, and copays when receiving medical care. It even covers a portion of your medical expenses during foreign travel.

What is the deductible for Plan F?

High-deductible plan F. Plan F also has a high deductible option. While monthly premiums for this option may be lower, you must pay a deductible before Plan F begins paying for benefits. For 2021, this deductible is set at $2,370.

How many Medicare Supplement Plans are there?

There are 10 different Medicare supplement plans. You’ll see them designated as letters: A through D, F, G, and K through N. Each of these different plans is standardized, meaning the same set of basic benefits needs to be offered.

What are the disadvantages of Medigap Plan F?

Disadvantages of Medigap Plan F. On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if you’re newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

Does Medicare Supplement cover healthcare?

Medicare supplement insurance can help pay for healthcare costs that original Medicare doesn’t cover. About 25 percent. Trusted Source. of people who have original Medicare are also enrolled in a Medicare supplement plan. Private companies sell Medicare supplement plans. There are 10 different Medicare supplement plans.

Is Medicare Supplement Plan F a part of Medicare?

You may have also heard of something called Medicare Supplement Plan F. Medicare Plan F isn’t a “part” of Medicare. It’s actually one of several Medicare supplement insurance ( Medigap) plans.

Is Medigap part of Medicare?

It’s actually one of several Medicare supplement insurance ( Medigap) plans. Medigap comprises several plans you can buy to help pay for things that original Medicare (parts A and B ) doesn’t. Keep reading to find out more about plan F, what it includes, and if it may be a good fit for you.

How many classes of drugs does Medicare cover?

There are many drugs covered under Medicare. Plus, every plan must cover the six protected classes. If you have medications that need coverage, use the Medicare plan finder tool to identify the policy that will cover your medications.

What is Medicare Part C?

Medicare Part C is a Medicare Advantage plan. These plans sometimes have a $0 per month premiums, and many of them include Part D drug coverage. However, there are some pitfalls to Medicare Advantage plans that you need to know before signing up.

What happens if you don't pay Medicare?

But, if you don’t pay the premium on a Medicare Advantage or Medigap plan, they can drop you. Also, if you don’t pay your Part D premium, the drug plan can drop you. Usually, they give multiple notices before the plan terminates your policy.

What is a medicaid supplement?

A Medigap plan is a supplemental option for Medicare. Medigap plans are also Medicare Supplement plans; these policies fill the gaps in Medicare. So, when Medicare would otherwise charge you 20% or a deductible, the Medicare Supplement could instead pick up the bill.

How long before Part B is effective?

You can pre-enroll in Medigap up to 6 months before the Part B effective date with some companies. But, many companies only allow you to pre-enroll 3 months before Part B effective date. The Open Enrollment Period for Medigap lasts for 6 months and begins the day your Part B is effective.

Does Medicare pay less if you have a low income?

The cost of Medicare depends on many things. Those with a low income will likely pay less than the standard amount and may qualify for Medicare and Medicaid. Those with a higher income will likely pay more for Part B; this is called the Part B Income Related Monthly Adjustment Amount.

Is Medicare mandatory?

Of course, Medicare isn’t mandatory, so you can choose whichever option makes the most sense for your situation. You can also always consult your benefits administrator at the office where you work to identify your options.

What is Plan F for Medicare?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What does Plan F cover?

Plan F also covers the Medicare Part B expenses. Part B covers doctor visits and related charges covered under Medicare for providers. Like Part A, Part B only covers 80% of the Medicare-approved expenses. It leaves the remaining 20% on the Part B participant.

What is Plan F?

Plan F covers the Medicare-approved expenses not covered under Medicare Part A (deductibles, coinsurances, and copays). Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay.

How long does Medicare cover skilled nursing?

Medicare limits this benefit to the first 100 days of a stay in a skilled nursing facility.

Why is Plan F standardized?

They did this with the specific goal of making shopping for a plan more manageable. No matter which company provides Plan F, they all must pay for Medicare approved expenses.

Does Plan F cover Medicare Part B?

It leaves the remaining 20% on the Part B participant. Plan F covers Medicare Part B approved services at the doctor’s office, such as: Plan F is one of only two Medicare Supplement plans that cover the Medicare Part B excess charges (the other being Plan G).

Is Medicare a la carte?

These states are often called “a la carte” states as there are no standardized plans. Medicare recipients essentially “build their own” plans benefit-by-benefit. However, individuals in these states would have the ability to build a plan identical to Plan F. Medicare Supplement Plan F vs. Other Medicare Supplement Plans.

When will Medicare plan F be available?

If you are currently enrolled in Plan F, you can keep your coverage. No action is required. If you were first eligible for Medicare before Jan. 1, 2020, Plan F will be available.

When was Medicare last updated?

Be in "the know" about Medicare. Facts about Medicare and Plan F. This article was last updated on Jan. 13, 2020. It can be hard to tell what’s fact or fiction, particularly when it comes to complex subjects like Medicare.

Is Medicare Part B deductible a part of MACRA?

The Medicare Access CHIP Reauthorization Act of 2015 ( MACRA) External Site. is no exception. As part of the law, people who are first eligible for Medicare after Jan. 1, 2020, are no longer able to enroll in a Medicare supplement plan that covers the costs of the Original Medicare Part B (medical coverage) deductible — no matter the carrier. ...

Does Wellmark Blue Cross and Blue Shield have a plan F?

So, if you are currently enrolled in Plan F, you can keep your coverage. Wellmark Blue Cross and Blue Shield has a history of stable Medicare supplement rates year after year and doesn’t anticipate rates for Plan F increasing due to MACRA. But, if you are thinking of moving to a different Wellmark MedicareBlue Supplement SM plan#N#Opens New Window#N#, know that you may have to answer health questions.

Does MACRA affect Wellmark Plan F?

The bottom line. MACRA does not affect Plan F for Wellmark members who were enrolled before 2020 or members who have group retiree benefits. The laws are always subject to change, so please visit Medicare.gov. for the most up-to-date information.