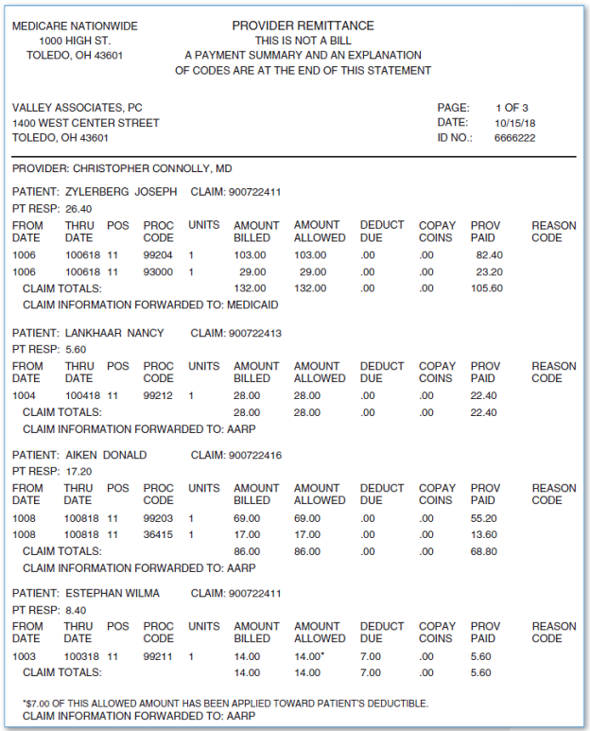

The approved amount, also known as the Medicare-approved amount, is the fee that a health insurance plan sets as as the amount a provider or supplier should be paid for a particular service or item. Original Medicare calls this assignment.

What are the guidelines for Medicare?

or other qualified health care professional, per calendar month, with the following required elements: multiple (two or more) chronic conditions expected to last at least 12 months, or until the death of the patient chronic conditions place the patient at significant risk of death, acute exacerbation/ decompensation, or functional decline …

What is allowed amount insurance?

Allowed Amount on a Health Insurance Statement

- Allowed Amount With In-Network Care. If you used a provider that’s in-network with your health plan, the allowed amount is the discounted price your managed care health plan negotiated in ...

- Allowed Amount With Out-Of-Network Care. ...

- Summary. ...

- A Word From Verywell. ...

What are the administrative costs of Medicare?

administrative expenses per member: for every year, as a percentage of reported benefits per beneficiary, reported administrative expenses of medicare abd (mean [sd], $147.13

14.28] per member,...

What is Medicare Advantage plan and cost?

Medicare Advantage plans & Medicare Cost plans are health plans that are provided by private insurance companies. Learn more about Medicare Advantage plans & Medicare Cost plans and understand the type of coverage each provides. Speak with a Licensed Insurance Agent. 1-844-847-2659, TTY Users 711 Mon - Fri, 8am - 8pm ET .

How do I find Medicare-approved amounts?

Finally, the best way to determine the Medicare-approved amount for a service is to ask your provider directly. They can give you all the information you need based on the services you are looking to receive.

Is there a maximum amount Medicare will pay?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

What is the difference between the Medicare-approved amount for a service or supply and the actual charge?

BILLED CHARGE The amount of money a physician or supplier charges for a specific medical service or supply. Since Medicare and insurance companies usually negotiate lower rates for members, the actual charge is often greater than the "approved amount" that you and Medicare actually pay.

What are Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is Medicare maximum out-of-pocket?

$7,550Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

What is the maximum out-of-pocket?

What is an out-of-pocket maximum? An out-of-pocket maximum is a predetermined, limited amount of money that an individual must pay before an insurance company or (self-insured health plan) will pay 100% of an individual's covered health care expenses for the remainder of the year.

What does approved amount mean?

Approved Amount means the maximum principal amount of Advances that is permitted to be outstanding under the Credit Line at any time, as specified in writing by the Bank.

Why is Medicare-approved amount different than Medicare paid?

These amounts are known as the “Medicare-approved amount,” which is the amount of money that Medicare will pay your doctor or other health care provider for treating you. The Medicare-approved amount may be less than what the provider charges other patients with other types of insurance.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

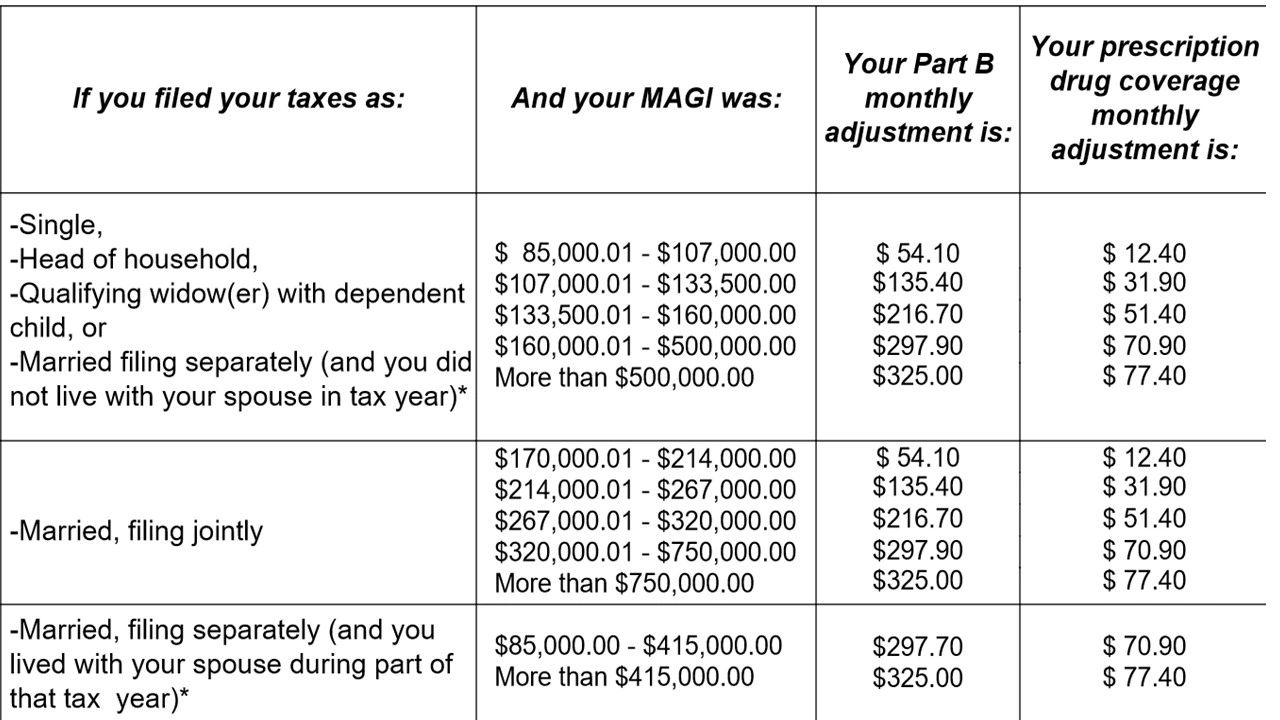

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

What is Medicare Supplement Insurance?

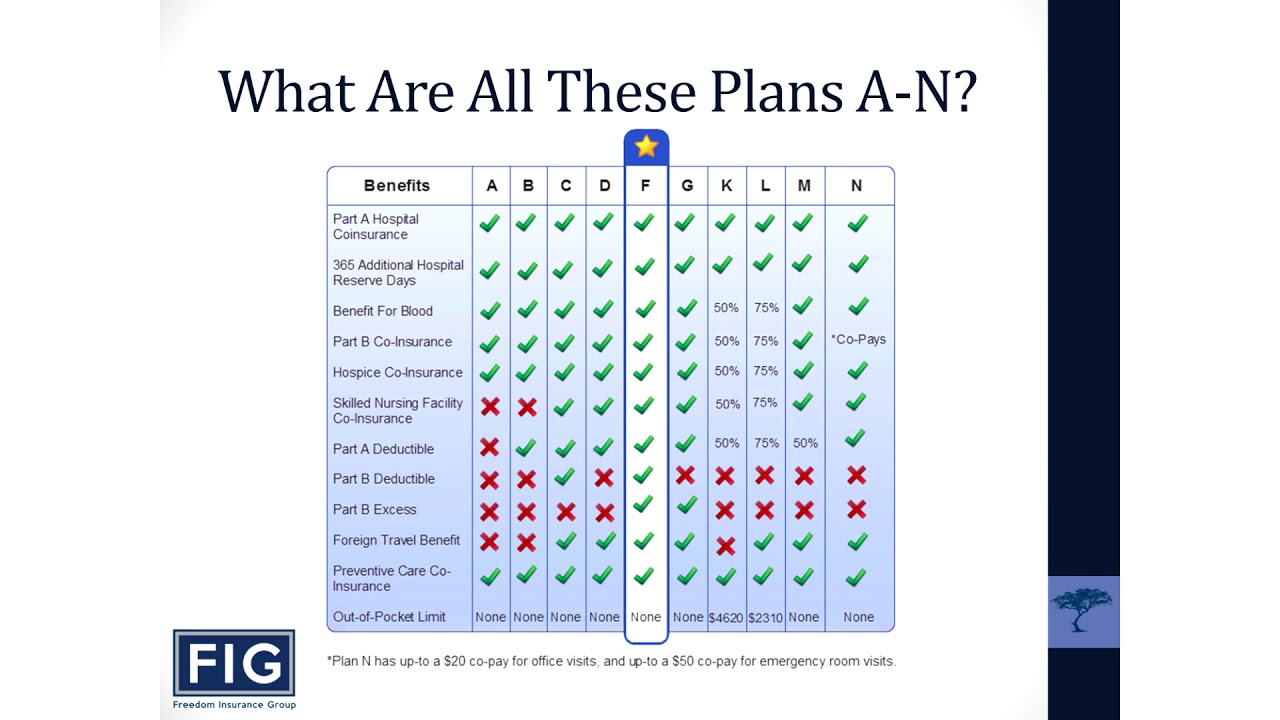

Some Medicare Supplement Insurance plans (also called Medigap) provide coverage for the Medicare Part B excess charges that may result when a health care provider does not accept Medicare assignment.

What is Medicare Part B excess charge?

What are Medicare Part B excess charges? You are responsible for paying any remaining difference between the Medicare-approved amount and the amount that your provider charges. This difference in cost is called a Medicare Part B excess charge. By law, a provider who does not accept Medicare assignment can only charge you up to 15 percent over ...

What is Medicare approved amount?

The Medicare-approved amount is the total payment that Medicare has agreed to pay a health care provider for a service or item. Learn more your potential Medicare costs. The Medicare-approved amount is the amount of money that Medicare will pay a health care provider for a medical service or item.

What is 20 percent coinsurance?

Your 20 percent amount is called Medicare Part B coinsurance. Let’s say your doctor decides to refer you to a specialist to have your shoulder further examined. The specialist you visit agrees to treat Medicare patients but does not agree to accept the Medicare-approved amount as full payment. You still only pay 20 percent ...

How much does Medicare pay for a doctor appointment?

Typically, you will pay 20 percent of the Medicare-approved amount, and Medicare will pay the remaining 80 percent .

How much can a provider charge for not accepting Medicare?

By law, a provider who does not accept Medicare assignment can only charge you up to 15 percent over the Medicare-approved amount. Let’s consider an example: You’ve been feeling some pain in your shoulder, so you make an appointment with your primary care doctor.

Do you have to ask your health care provider if they accept Medicare?

As you can see from the example above, it’s important to ask your health care providers if they accept Medicare assignment and how much you can expect to pay before receiving any medical services.

What does knowing the Medicare approved amount for a particular service or item help you determine?

Knowing the Medicare-approved amount for a particular service or item can help you determine your coinsurance amount and better budget your care.

How much does Medicare coinsurance increase?

The higher the Medicare-approved amount, the higher your coinsurance billed amount will likely be. If the Medicare-approved amount for the X-rays in the example above was $250 instead of $200, that would increase the total cost of the visit to $400, which would also increase the cost of your coinsurance payment to $80 (20% of $400).

What is Medicare approved amount?

The Medicare-approved amount, or “allowed amount,” is the amount that Medicare reimburses health care providers for the services they deliver. Learn more about the Medicare-approved amount and how it affects your Medicare costs. There’s a lot of terminology for Medicare beneficiaries to learn, and among them is “Medicare-approved amount” ...

How much is coinsurance for Medicare Part B?

Medicare Part B typically requires a coinsurance payment of 20% of the Medicare-approved amount for covered care after you meet your annual Part B deductible. Using the example above, your 20% coinsurance payment for your visit to the health clinic would likely be $70 (20% of $350).

What does Medicare cover?

The Medicare-approved amount applies mostly to services covered by Medicare Part B, which covers outpatient services like doctor’s appointments, and it also covers durable medical equipment (DME) such as wheelchairs and blood sugar test strips.

What is an excess charge for Medicare?

These providers reserve the right to charge up to 15% more than the Medicare-approved amount in what is known as an “excess charge.”

How much does Medicare pay for X-rays?

The X-rays may have a Medicare-approved amount of $200. And the brace itself might have a Medicare-approved amount of $50. (Note: these costs are hypothetical and are not based on actual Medicare costs for the services or items mentioned.) Based on the above costs, the health clinic would be allowed by Medicare to charge $350 total for ...

What is Medicare approved amount?

The Medicare-approved amount is the amount that Medicare pays to a healthcare provider or medical supplier who accepts assignment for Medicare-covered services. If a person visits a healthcare provider or supplier who does not accept assignment, they may have to pay an additional amount for the services or items.

How much can a non-participating provider charge for Medicare?

A nonparticipating provider can charge up to 15% more than the Medicare-approved amount, although there is a limit to the charges. A person is then responsible for the difference in cost between the amount that their healthcare provider charges and the Medicare-approved amount. The cost difference is called the Medicare Part B excess charge.

What is a non-participating provider?

A nonparticipating provider is a supplier or doctor who has not signed an agreement with Medicare to accept assignment for all Medicare-covered services.

How much is Medicare Part B deductible 2021?

A person pays a percentage of the Medicare-approved amount after they have paid their Medicare Part B annual deductible, which is $203 in 2021. The amount varies depending on several factors, including whether the healthcare provider is participating in the Medicare program.

How much is the deductible for Medicare?

They must also meet the annual deductible of $203 before Medicare funds any treatment. If a person chooses to go to a nonparticipating healthcare provider, they may have to pay an additional amount for the services or items. For example: A person visits their Medicare-participating doctor about a pain in their ankle.

How much is Medicare Part A in 2021?

Medicare Part A has an annual deductible, which is $1,484 in 2021, and a fee schedule for hospitalization. Medicare pays approved costs above a person’s coinsurance amount. These apply as follows for each benefit period in 2021: $0 coinsurance for days 1–60. $371 coinsurance per day for days 61–90.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Why is it difficult to know the exact cost of a procedure?

For surgeries or procedures, it may be dicult to know the exact costs in advance because no one knows exactly the amount or type of services you’ll need. For example, if you experience complications during surgery, your costs could be higher.

Does Medicare cover wheelchairs?

If you’re enrolled in Original Medicare, it’s not always easy to find out if Medicare will cover a service or supply that you need. Generally, Medicare covers services (like lab tests, surgeries, and doctor visits) and supplies (like wheelchairs and walkers) that Medicare considers “medically necessary” to treat a disease or condition.