2022 costs at a glance

| Part A premium | Most people don't pay a monthly premium ... |

| Part A hospital inpatient deductible and ... | You pay: $1,556 deductible for each bene ... |

| Part B premium | The standard Part B premium amount is $1 ... |

| Part B deductible and coinsurance | $233. After your deductible is met, you ... |

| Part C premium | The Part C monthly premium The periodic ... |

Full Answer

Why is my Medicare so expensive?

In 2022, you pay $0 for the first 20 days of each benefit period $194.50 per day for days 21–100 of each benefit period All costs for each day after day 100 of the benefit period. Medicare Part B (Medical Insurance) Costs. Part B monthly premium. Most people pay the standard Part B monthly premium amount ($170.10 in 2022).

How much is monthly premium for Medicare?

Nov 12, 2021 · The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. The increases in the 2022 Medicare Part B premium and deductible are due to:

How much will my Medicare premiums be?

Feb 08, 2022 · If you have paid Medicare taxes for fewer than 30 quarters, you have to pay for Part A coverage. Your premium will be $499 in 2022, up to $28 from 2021. If you have paid Medicare taxes for 30 to 39 quarters, your new monthly premium will be $274 per month in 2022, up to $28 from 2021. Medicare Part B Cost in 2022

How much will Medicare cost this year?

Feb 15, 2022 · If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $499 per month. 2022 Part A deductible

What is the estimated Medicare cost for 2022?

$170.10 per monthFor most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums. For high-earners, the cost of Medicare Part B is based on your adjusted gross income (AGI) from your previous year's taxes.Mar 18, 2022

Is the Medicare premium for 2022 going up?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

What is the monthly cost for Medicare Part B in 2022?

$170.10 forThe standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Are Medicare premiums going down in 2022?

In 2021, the Part B premium increased by only $3 a month, but Congress directed CMS to begin paying that reduced premium back, starting in 2022.Jan 25, 2022

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

What changes are coming to Medicare in 2022?

Also in 2022, Medicare will pay for mental health visits outside of the rules governing the pandemic. This means that mental health telehealth visits provided by rural health clinics and federally qualified health centers will be covered. Dena Bunis covers Medicare, health care, health policy and Congress.Jan 3, 2022

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

What is the deductible for Medicare Part D in 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

How much is Medicare Part A deductible for 2021?

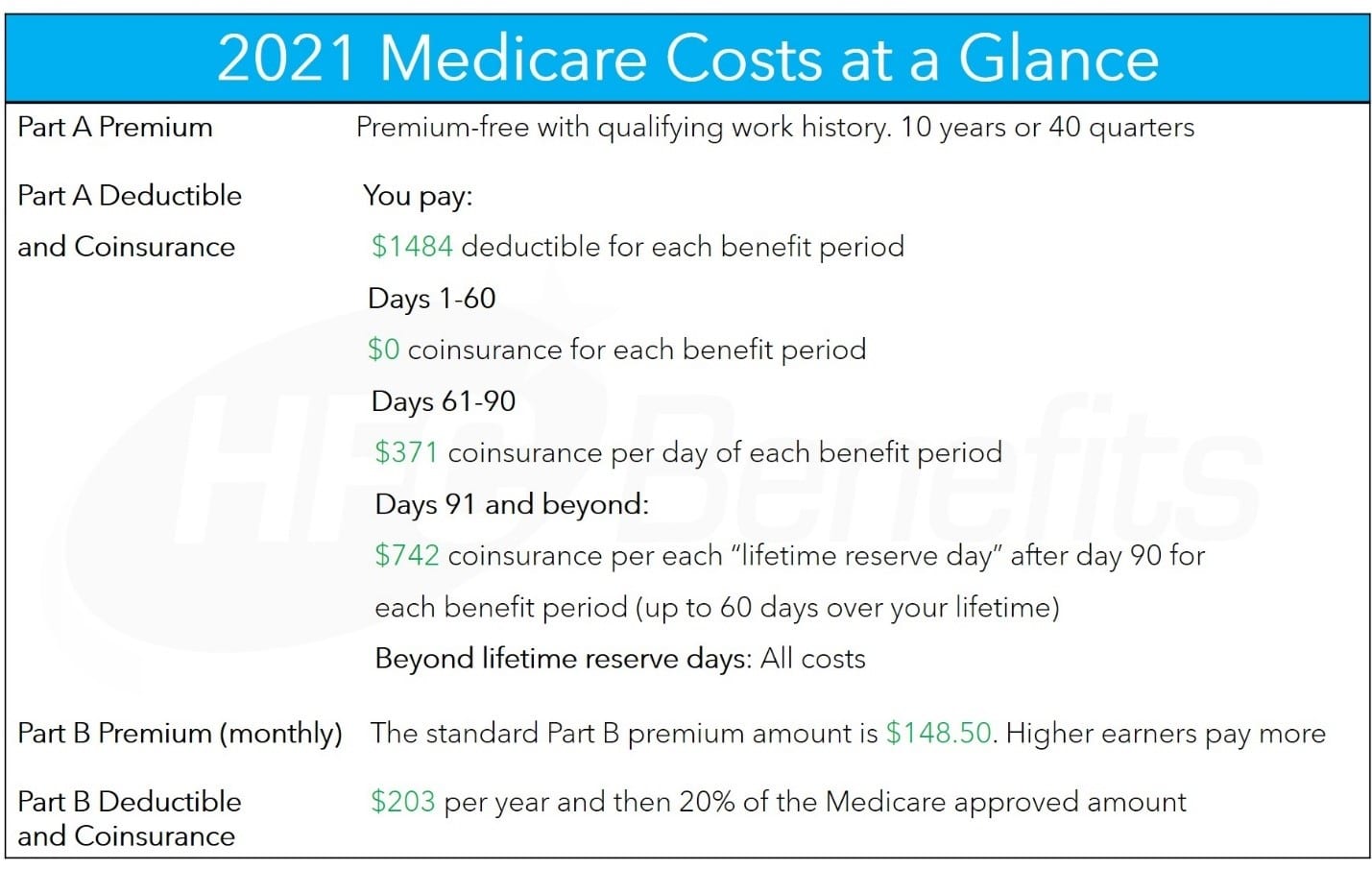

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is the Medicare deductible for 2021?

What are the Medicare Part A Deductible, Coinsurance and Premium amounts in 2021? The Medicare Part A deductible for 2021 is $1,484, which is up $76 from $1,408 per benefit period in 2020. A benefit period begins the day you’re admitted to the hospital and ends when you’ve been out for 60 days in a row.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Medicare Part B 2021?

The standard monthly Medicare Part B premium for 2021 is $148.50, which is up only $3.90 from $144.60 in 2020. Medicare Part B helps pay for doctor visits and outpatient care. Most people will pay the standard Part B premium amount, but you could pay more based on your income. Medicare uses your reported income from two years ago to determine ...

How much is the Part A premium for 2021?

The Part A premiums for 2021 are as follows: ·$259 for individuals who had at least 30 quarters of coverage, or who are married to someone with 30 quarters of coverage. ·$471 for certain uninsured individuals or with less than 30 quarters of coverage, ...

Is the Medicare donut hole closing?

The Medicare Part D donut hole technically “closed” on January 1, 2020, but it’s not exactly going away completely. The donut hole – also called the “coverage gap” – is still one of the four Medicare Part D payment stages.

Is the Donut Hole closed?

The donut hole is considered closed because as of January 2020 you no longer have to pay more for your drugs while you’re in that coverage stage. You will pay the same amount for your drugs from the initial payment stage through the donut hole.

Does Medicare Part A cover hospitalization?

Medicare Part A covers hospital and inpatient care. If you have a Medicare Advantage plan (Part C ), the Part A deductible and other Part A costs usually won’t apply. Each plan sets its own cost-sharing terms for hospitalizations .