The cumulative cut includes:

- Restoration of the 2% Medicare sequester, which has been frozen during the public health emergency (PHE)

- Implementation of a statutory 4% cut as a pay-for triggered by the 2021 COVID-19 relief legislation

- Application of a 3.75% decrease to the Medicare Physician Fee Schedule rate, which was increased by the same amount for...

Are providers facing Medicare reimbursement cuts in 2021?

Sep 30, 2021 · In 2021, CMS implemented cuts to Medicare part B rehabilitation services to offset increases in reimbursement for primary care physicians according to the physician fee schedule. After writing numerous letters to Congress refuting the cuts, rehab professionals learned, to their relief, that a Covid relief package reduced the cuts from 9% to 3.6%.

What is the Medicare specialty payment cut for outpatient PT in 2021?

from $34.89 in 2021 • The 3.75% reduction combined with the 2% annual sequester that was delayed last year and the 4% statutory cut due to ARPA could result in over 9% cuts to Medicare payments to physicians Numerous medical associations have urged Congress to prevent the cuts to Medicare physician payments, citing increased costs of care

How much does Medicare cost in 2021?

Dec 08, 2021 · Dec 08, 2021 - 08:11 AM. The House last night voted 222-212 to pass a legislative package that would extend the moratorium on the 2% Medicare sequester cuts until April 1, 2022, and reduce the cuts from 2% to 1% from April 1 through June 30, 2022. The package also would stop the 4% statutory Pay-As-You-Go sequester from taking effect early next year.

Will Medicare reimbursements increase in 2022?

Apr 05, 2022 · The cumulative cut includes: Restoration of the 2% Medicare sequester, which has been frozen during the public health emergency (PHE) Implementation of a statutory 4% cut as a pay-for triggered by the 2021 COVID-19 relief legislation Application of a 3.75% decrease to the Medicare Physician Fee ...

What are Medicare payment cuts?

Mandated by the Pay-As-You-Go Act of 2010, these cuts were meant to offset increases in the federal deficit. Exempts Medicare programs from Budget Control Act sequestration cuts through March 31, 2022. The sequestration reductions will then be 1% from April 1, 2022, through June 30, 2022, and 2% for the rest of 2022.Dec 17, 2021

What is the Medicare conversion factor for 2021?

$34.8931This represents a 0.82% cut from the 2021 conversion factor of $34.8931. However, it also reflects an increase from the initial 2022 conversion factor of $33.5983 announced in the 2022 Medicare physician fee schedule final rule.Feb 7, 2022

Is Medicare holding payments for 2021?

President Biden signed into law legislation that pauses a 2% cut to Medicare payments through the rest of 2021. Biden signed the law on Wednesday, nearly a day after the House voted 384-38 to pass the legislation for another extension of a moratorium on the cuts created under the sequester.

Are Medicare payments changing?

The standard premium for Medicare Part B is $170.10/month in 2022. This is an increase of nearly $22/month over the standard 2021 premium, and is the largest dollar increase in the program's history.

How Much Does Medicare pay for 99214 in 2021?

$110.43By Christine Frey posted 12-09-2020 15:122021 Final Physician Fee Schedule (CMS-1734-F)Payment Rates for Medicare Physician Services - Evaluation and Management99214Office/outpatient visit est$110.4399215Office/outpatient visit est$148.3399417Prolng off/op e/m ea 15 minNEW CODE15 more rows•Dec 9, 2020

What percent of the allowable fee does Medicare pay the healthcare provider?

80 percentMedicare pays the physician or supplier 80 percent of the Medicare-approved fee schedule (less any unmet deductible). The doctor or supplier can charge the beneficiary only for the coinsurance, which is the remaining 20 percent of the approved amount.Jan 1, 2021

What is the Medicare 2% sequestration?

Medicare FFS Claims: 2% Payment Adjustment (Sequestration) Changes. The Protecting Medicare and American Farmers from Sequester Cuts Act impacts payments for all Medicare Fee-for-Service (FFS) claims: No payment adjustment through March 31, 2022. 1% payment adjustment April 1 – June 30, 2022.Dec 16, 2021

Is Medicare holding payments for 2022?

However, the legislation only stops a 2 percent Medicare sequester cut until April 2022, when providers will face a 1 percent cut through June and the full cut after. The PAYGO cuts are also slated to resume at the start of 2023, and Congress failed to delay the Medicare Physician Fee Schedule cuts entirely.Dec 20, 2021

Is the 2 Medicare sequestration still in effect?

From April 2022 through June 2022 a 1% sequester cut will be in effect, with the full 2% cut resuming thereafter. Jun. 3, 2021 Update: Congress has passed legislation that continued the moratorium on sequestration. As a result, CMS has extended the moratorium on sequestration until December 31, 2021.Dec 22, 2021

What is the standard Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Is Medicare Part B going up 2022?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

What is the physician fee for 2021?

Key things to know about the 2021 Physician Fee Schedule: The 2021 conversion factor is $32.4085, a decrease of almost $4 from last year; cuts to GI could be about 4 percent, depending on your practice’s mix of services.

How long is the holding providers harmless from Medicare cuts act?

Tell Congress to pass the “ Holding Providers Harmless from Medicare Cuts Act ” (H.R. 8702), which provides a two-year reprieve while the GI societies and other specialties work toward a permanent resolution.

Will Medicare cut GI reimbursement in 2021?

Medicare plans significant payment cuts for 2021. Cuts to physicians are deep — GI reimbursement could drop 4%. CMS just finalized policy and payment regulations that take effect Jan. 1, 2021. Cuts to physicians are deep — GI reimbursement could drop 4%. Congressional action is our last option.

What Medicare Cuts Mean for Our Patients

From a clinical perspective, Medicare cuts are relevant in that they impact our ability to provide quality care to patients who need our services. In addition, high copays for commercial/secondary insurances significantly impact patients — especially those with serious medical comorbidities.

What Medicare Cuts Mean for Clinicians

Many clinicians have 6 figures of student loan debt on top of their basic living expenses, which tragically have deterred many from pursuing careers in rehab.

What Can Clinicians Do

Fortunately, not all hope is lost at this time. What can we do to continue to advocate for our profession? As we continue to move forward in these uncertain times, we must continue to write to our leaders in Congress as well as diligently educate others on our vital role in healthcare.

The picture on Capitol Hill

The prospects for getting any of the cuts reversed are murky. The ongoing negotiations and debate in the Democratic caucus over the budget reconciliation bill and the bipartisan infrastructure bill are limiting the window for including additional provisions in subsequent legislation to fund the government and raise the debt limit.

The implications on the ground

AMGA released findings from a survey of 92 representatives of medical groups and integrated health systems. Among respondents, 43% said they would freeze or delay hiring and 37% expected to eliminate services if the cuts go through as scheduled.

What insurance plans will be affected by the Medicare cuts?

The cuts could also lead some private insurance plans, including Medicare Advantage and Part D prescription drug plans, to make up for their financial losses in the future by charging higher premiums or cost-sharing.

When is the Medicare bill going to be voted on?

The U.S. House of Representatives is scheduled to vote on such a bill on March 19. The Medicare reductions would affect reimbursements to providers. “While these automatic cuts to Medicare do not impact benefits directly, Congress should nevertheless prevent across-the-board program cuts that may affect access and service,” Nancy LeaMond, ...

When is the House of Representatives scheduled to vote on automatic cuts?

The U.S. House of Representatives is scheduled to vote on such a bill on March 19.

What is the American Rescue Plan Act?

Passage of the American Rescue Plan Act — the latest relief package for COVID-19 — as well as provisions in the overall spending bill enacted in December 2020 would trigger across-the-board budget cuts in a number of federal programs, including Medicare.

What the House Passed

The Medicare-related legislation, doesn't do everything APTA and other organizations have asked for, but it comes close. Here's what's in the bill.

The Senate Path

While the House passed the Medicare changes as standalone legislation, the journey the changes will take in the Senate is a little trickier— which could be a good thing. (This is where staying awake in civics class pays off.)

No Guarantees

As with all machinations on Capitol Hill, there's never a sure bet. That's why we need to be ready to advocate for S.610. Stay tuned to APTA — by way of our website, member emails, social media, and the APTA Advocacy Network — for calls to action in the coming days.

Medicare PAYGO Cuts

The American Rescue Plan Act of 2021, signed into law by President Biden in March, increased spending without offsets to other federal programs. Under statutory Pay-As-You-Go (PAYGO) rules, any increases to the federal deficit automatically triggers an additional series of acrossthe-board deductions to federal programs.

Medicare Sequester Delay Extension

At the onset of the COVID-19 pandemic, Congress delayed the automatic 2% Medicare sequestration cuts as providers were struggling to keep their doors open to their communities. Various delays were enacted during this public health emergency, with the last pause setting to expire on January 1, 2022.

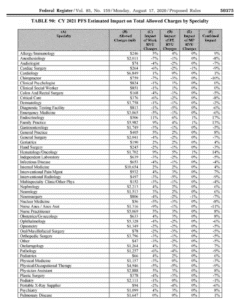

Changes to the Medicare Conversion Factor

Last year, due to a temporary patch approved by Congress, the Centers for Medicare & Medicaid Services (CMS) increased all providers’ payments by 3.75% to offset a change in the Medicare conversion factor that CMS implemented as part of a change to Evaluation and Management (E/M) codes designed to increase support for primary care services.