2012 Medicare Premiums, Deductibles and Co-Pays

| Beneficiaries who file an individual tax ... | Beneficiaries who file a joint tax retur ... | Beneficiaries who are married, but file ... | Income-related monthly adjustment amount | Total monthly Part B premium amount |

| Less than or equal to $85,000 | Less than or equal to $170,000 | Less than or equal to $85,000 | $0.00 | $99.90 |

| Greater than $85,000 and less than or eq ... | Greater than $170,000 and less than or e ... | $40.00 | $139.90 | |

| Greater than $107,000 and less than or e ... | Greater than $214,000 and less than or e ... | $99.90 | $199.80 | |

| Greater than $160,000 and less than or e ... | Greater than $320,000 and less than or e ... | Greater that $85,000 and less than or eq ... | $159.80 | $259.70 |

Full Answer

What is the Medicare Part B deductible for 2012?

6 rows · Oct 27, 2011 · The Part A deductible paid by a beneficiary when admitted as a hospital inpatient will be $1,156 ...

What is the average cost of Medicare Part D in 2012?

2012 Medicare Part A Deductible: The Medicare Part A deductible will increase going from $1,132 per benefit period to $1,156 (*1184) per benefit period in 2012. 2012 Medicare Part A Co-payments: The cost of spending 61-90 days in the hospital will be …

How much did Medicare premiums increase in 2012?

6 rows · Oct 27, 2011 · On October 27, 2011 the Centers for Medicare and Medicaid Service (CMS) released notices detailing ...

What is the Medicare Part a deductible for hospital visits?

2012 Part A Deductible. 2012 Part A deductible – $1,156; in-patient days 61-90 – $289 per day; in-patient days 91+ – $578 per day; The Part B deductible is required prior to most out-patient services including doctors visits, diagnostic tests and facility charges. Part B Deductible 2011 vs 2012. 2011 Part B deductible – $162

What was the Medicare deductible for 2012?

In 2012, the Part B deductible will be $140, a decrease of $22 from 2011....INCOME RELATED ADJUSTMENT:Beneficiaries who file an individual tax return with income:Beneficiaries who file a joint tax return with income:Income-related monthly adjustment amountGreater than $214,000Greater than $428,000$66.404 more rows•Oct 27, 2011

What was the Medicare deductible for 2013?

This will increase to $1,184 in 2013, up from $1156 this year (an increase of 2.4%). Medicare Part B Deductible: The deductible will increase to $147 in 2013, from $140.Nov 16, 2012

What is the deductible each year for Medicare?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the Medicare annual deductible for 2020?

$198On November 8, 2019, CMS announced that the monthly Medicare Part B premium will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for Medicare Part B beneficiaries increased $13, from $185 in 2019 to $198 in 2020.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

How do I find out my deductible?

A deductible can be either a specific dollar amount or a percentage of the total amount of insurance on a policy. The amount is established by the terms of your coverage and can be found on the declarations (or front) page of standard homeowners and auto insurance policies.

What is the Part D deductible for 2021?

$445 a yearSummary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

What is Medicare Part A and B deductible for 2020?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.Nov 8, 2019

How much is Medicare deduction from Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

Can you write off Medicare Part B premiums from your taxes?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

What is changing in 2012?

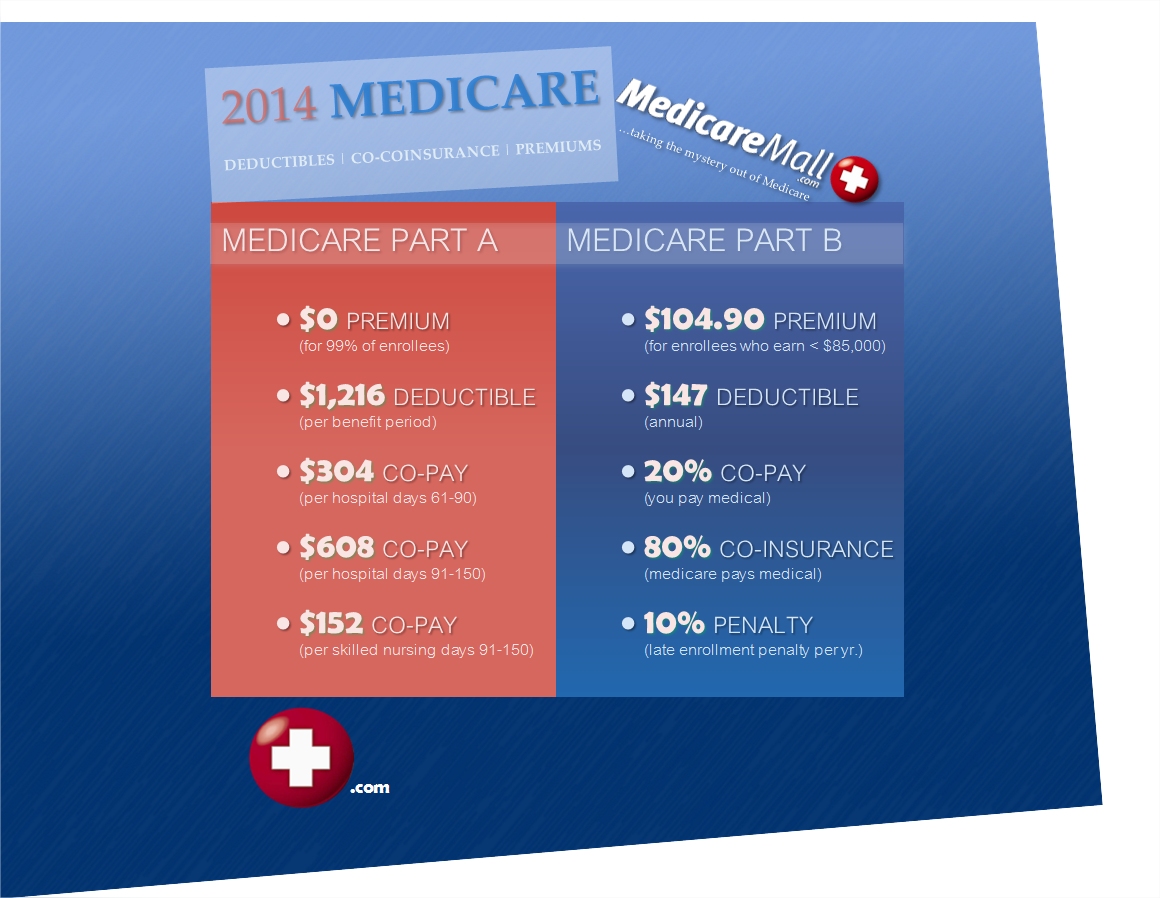

2012 Medicare Part A Premium: Your Medicare Part A premium will increase by $1 per month.

How do the 2012 changes in Medicare affect you?

2012 Medicare Part A Premium: This $1 increase in the 2012 Medicare Part A premium will not affect many beneficiaries because 99% of beneficiaries are exempt from paying the Medicare Part A premium. This is because most Americans pay into this amount while working.

How do the 2012 changes in Medicare affect you?

2012 Medicare Part B Premium: Although the actual 2012 cost for Medicare Part B premium seems lower, to most beneficiaries the $99.90 (*104.90) premium is an increase of $3.50. An increase in payments in social security benefit checks in 2012 is meant to offset this increase.

When is a Part A deductible required?

The Part A deductible is required beginning with the first day of in-patient hospital care. How the deductible gets paid varies depending on your type of plan as you will see below.

Is Part A and B deductible?

Your share of covered expenses will vary from plan to plan. You are not generally responsible for the Part A and B deductible but rather your cost sharing amounts will surely go toward your carrier paying those costs.

Medicare Part A

What changed: Medicare Part A Premiums will increase $1 per month and Medicare Part A deductible will increase by $24.

Medicare Part B Premium

What changed: The 2011 Medicare Part B premium was $115.40, so the 2012 $99.90 premium price would be a $15.50 decrease. Monthly social security payments to enrollees will increase by 3.6%.

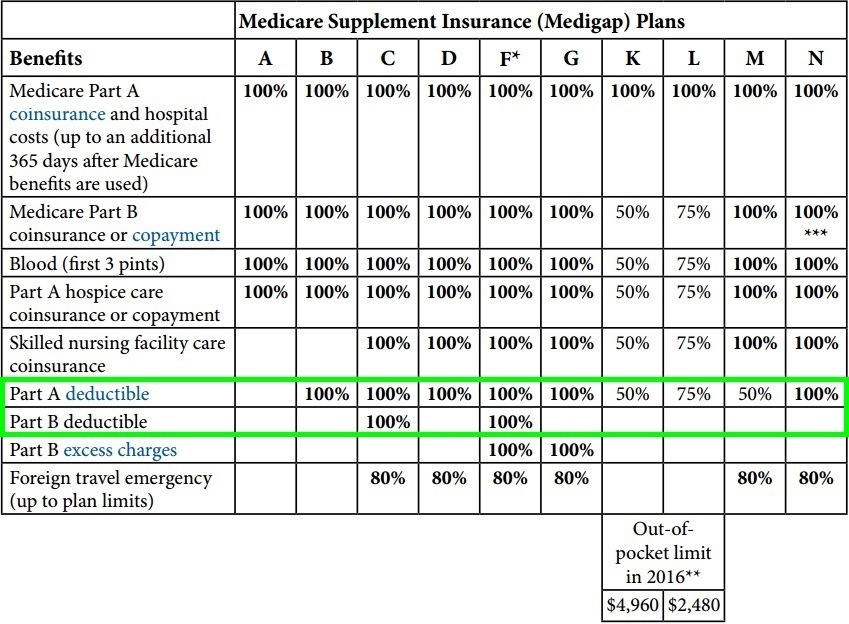

What was the Medicare Supplement Plan F deductible in 2012?

The Medicare supplement Plan F high deductible amount is also increasing in 2012. The deductible was $2,000 in 2011 and will be $2,070 for 2012. This is not too significant of a change if you already own this plan or if you are considering purchasing it.

What was the change in Medicare deductibles in 2012?

The most significant change to the Medicare deductibles for 2012 is the somewhat dramatic decrease for the Part B deductible out-of-pocket. This lower amount makes plans that do not already cover the Part B deductible more attractive. Typically the difference in premiums and coverage will dictate your purchase.

What is the standard premium for Medicare?

By law, the standard premium is set to cover one-fourth of the average cost of Part B services incurred by beneficiaries aged 65 and over, plus a contingency margin.

How many Medicare beneficiaries do not pay a premium?

All of these Part A program payment changes are determined in accordance with a statutory formula. About 99 percent of Medicare beneficiaries do not pay a premium for Medicare Part A services since they have at least 40 quarters of Medicare-covered employment.

What is Medicare Part B?

The monthly premium paid by beneficiaries enrolled in Medicare Part B covers a portion of the cost of physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and other items.

How to contact Medicare Part D?

Information is available at 1-800-MEDICARE (1-800-633-4227) and, for hearing and speech impaired, at TTY/TDD: 1-877-486-2048. Previous.

Why are Medicare Part A premiums decreasing?

Part A premiums are decreasing because spending in 2010 was lower than expected and the Affordable Care Act implemented policies that lower Part A spending due to payment efficiencies and efforts related to waste, fraud and abuse.

How much was the physician fee reduction in 2011?

First, the current law formula for physician fees will result in a payment reduction of 23 percent in December 2010 and, in this analysis, is projected to cause an additional reduction of about 6.5 percent starting January 2011. (The actual reduction in physician fees under current law for January 2011 is now known to be 2.5 percent.

Who pays the monthly adjustment for Part D?

In addition, the income-related monthly adjustment amounts to be paid by Part D beneficiaries who are married, but file a separate return from their spouse and lived with their spouse at any time during the taxable year are as follows:

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is a 504.90?

504.90. Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follow s: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...