Medicare Part A Premium and Part A Deductible

| Year | Premium | Deductible |

| 2017 | $413 | $1,316 |

| 2016 | $411 | $1,288 |

| 2015 | $407 | $1,260 |

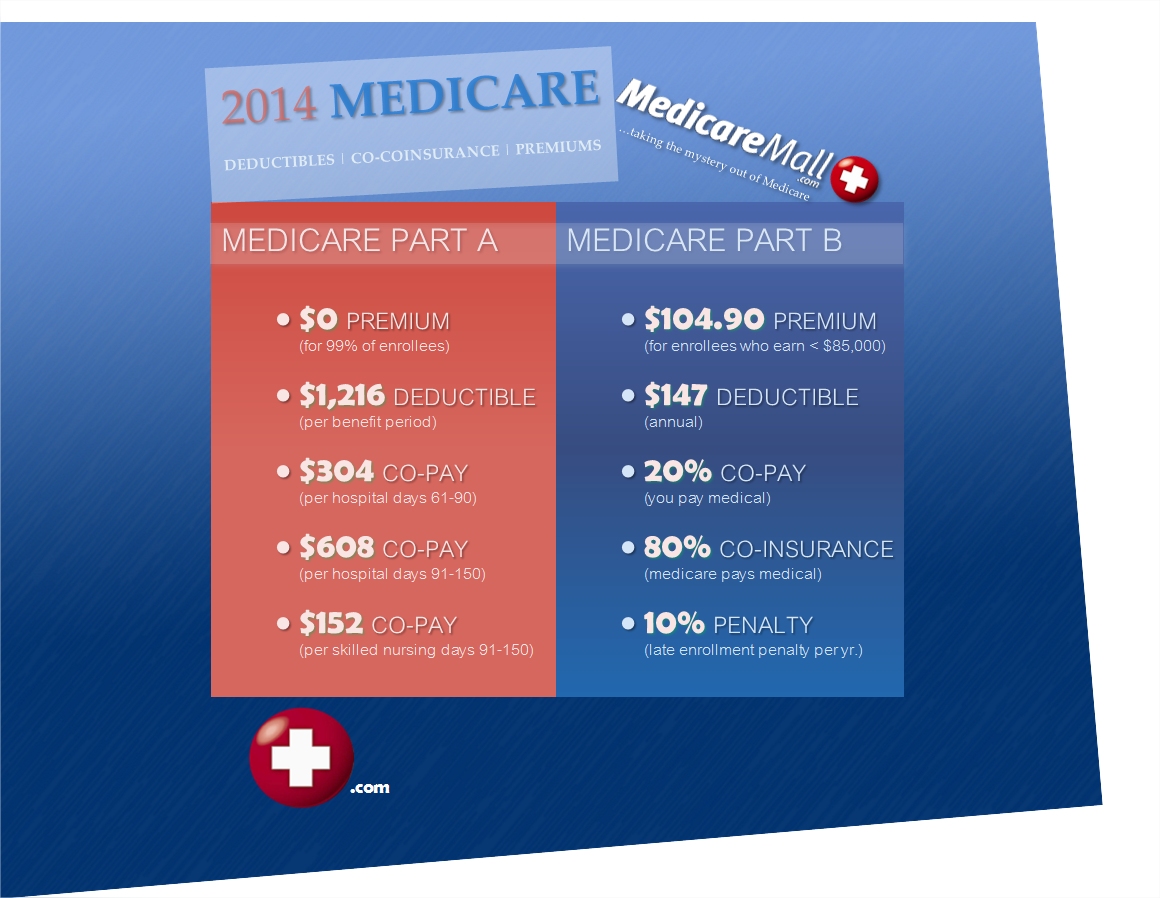

| 2014 | $426 | $1,216 |

Full Answer

What amount is currently deducted from your pay for Medicare?

6 rows · Nov 10, 2016 · The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the ...

How much is the Medicare yearly deductible?

Nov 29, 2016 · The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from …

Does Medicare have a yearly deductible?

2017 Medicare Part A Part A is Hospital Insurance and covers costs associated with confinement in a hospital or skilled nursing facility. Benefit Period: Medicare Covers: You Pay (per day of …

Do I have to pay the annual Medicare deductible?

Nov 16, 2016 · 2017; MEDICARE PART A-----Inpatient Hospital Deductible: $1,288/benefit period: $1,316/benefit period: Days 61-90: $322/day: $329/day: Days 91-150: $644/day: $658/day: …

What was the cost of Medicare in 2017?

What was the Medicare Part B deductible for 2017?

What was Medicare deductible in 2018?

What is the deductible each year for Medicare?

What was Medicare Part B premium in 2016?

What are the Irmaa brackets for 2017?

| If Your Yearly Income Is | 2017 Medicare Part B IRMAA | |

|---|---|---|

| $85,000 or below | $170,000 or below | $0.00 |

| $85,001 - $107,000 | $170,000 - $214,000 | $53.50 |

| $107,001 - $160,000 | $214,000 - $320,000 | $133.90 |

| $160,001 - $214,000 | $320,000 - $428,000 | $214.30 |

What was the Medicare deductible for 2019?

What is the Medicare deductible for 2019 Part B?

What is the Medicare Part B deductible for 2021?

What is the 2022 Medicare Part A deductible?

How do Medicare Deductibles work?

What is the deductible for Medicare Part D in 2022?

After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

Medicare Premiums and Deductibles for 2017

Medicare beneficiaries are required to pay monthly premiums and annual deductibles like most individuals enrolled in other health insurance plans. Medicare coverage is separated into four “parts”, each covering different health care products and services.

Tara O'Neill Hayes

Tara O'Neill Hayes is the Director of Human Welfare Policy at the American Action Forum.

Part A Costs

Most people don't pay a monthly premium for Medicare Part A (hospital insurance). But if you have to pay for Part A because you or your spouse doesn't have a long enough work history, you'll pay between $227 (for 30-39 work credits) and $413 (for fewer than 30 work credits).

Part B Costs

Most people pay a Part B premium of $109 each month (up from $104.90 in 2016). But if you first enroll in Medicare Part B during 2017, or you are not collecting Social Security benefits, your premium will be $134 per month (up from $121.80 in 2016).

Part D Costs

Part D premiums vary depending on the plan you choose. The Part D deductible for 2017 is $400 per year (though some plans waive the deductible).

More on the Part B Premium. This was taken directly from Medicare.gov

The standard Part B premium amount in 2017 will be $134 (or higher depending on your income). However, most people who get Social Security benefits will pay less than this amount. This is because the Part B premium increased more than the cost-of-living increase for 2017 Social Security benefits.

In other words

If you’re currently getting your premium deducted from your Social Security check, this number is not what you will pay. You will actually pay less. The Social Security office will inform you of your rate. This is because the part B premium increase was more than the Social Security cost of living increase.

Comments?

These numbers will be updated on the Medicare section of this website ( https://simpleseniorhealth.com/starting-point/what-is-medicare) when the new year starts. Please comment below. What are your thoughts on these changes? Find out events and other news at our Facebook page. Don’t forget to like us!

What is the Medicare Part B deductible for 2017?

2017 Medicare Part B (Medical) Monthly Premium & Deductible. CMS announced that the annual deductible for all Part B beneficiaries will be $183 in 2017, an increase of $17 from the 2016 Part B annual deductible of $166.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the "hold harmless" provision are: those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2017, dual eligible beneficiaries who have their premiums paid by Medicaid, and.

What is dual eligible Medicare?

dual eligible beneficiaries who have their premiums paid by Medicaid, and. beneficiaries who pay an additional income-related premium. These groups account for about 30 percent of the 52 million Americans expected to be enrolled in Medicare Part B in 2017.

What happens if you don't get Part A?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up.

How long do you have to pay for Part A?

For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period.

Do you pay late enrollment penalty?

Usually, you don’t pay a late enrollment penalty if you meet certain conditions that allow you to sign up for Part B during a special enrollment period. Example: Mr. Smith’s initial enrollment period ended September 30, 2013. He waited to sign up for Part B until the General Enrollment Period in March 2016.