Key takeaways

- The standard Part B premium is $148.50 for 2021 (the increase was limited by a federal spending bill).

- The Part B deductible is $203 in 2021 (up from $198 in 2020).

- Part A premiums, deductible, and coinsurance are also higher for 2021.

- Medigap Plans C and F are no longer available for purchase by newly-eligible Medicare beneficiaries.

Full Answer

What is current Medicare deductible?

Nov 14, 2020 · The Medicare Part A benefit period deductible jumped from $1,408 in 2020 to $1,484 for 2021, while coinsurance rates jumped over 5 percent. Where beneficiaries paid $352 coinsurance per day of each benefit period between days 61-90 and $704 for days 91+, they will now pay $371 and $742, respectively. Medicare Part B

Is Medicare Part B premiums tax-deductible?

2021 Medicare Deductibles According to Medicare.gov, the Part A hospital inpatient deductible for 2021 is $1,484 per benefit period. A benefit period begins the day you go into a hospital or skilled nursing facility and ends when you have been out for 60 days in a row.

What is the monthly premium for Medicare Part B?

Nov 20, 2020 · Medicare Administrative Contractors (MACs), including Home Health and Hospice (HH&H) MACs and Durable Medical Equipment (DME) MACs for services provided to Medicare beneficiaries. WHAT YOU NEED TO KNOW. This article informs you of the new Calendar Year (CY) 2021 Medicarepremium, coinsurance, and deductible rates. BACKGROUND

Are part B premiums tax deductible?

This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible. Find out who to call about Medicare options, claims and more.

What is the 2021 Medicare deductible?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the Medicare Part B deductible for 2021?

$203For 2019, it increased slightly, to $185. And for 2020, it increased by another $13, to $198. The $5 increase in 2021 pushed it over $200 for the first time, with the 2021 Part B deductible reaching $203. And for 2022, the increase was fairly significant, pushing the deductible to $233.

What is the annual deductible for Medicare?

The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

What is the new monthly Medicare premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the deductible for Medicare Part D in 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the standard deductible for Medicare Part A?

$1,556If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. You pay: $1,556 deductible for each benefit period.

What is the Irmaa for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

Did Medicare premiums go up for 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

What is Medicare Part C?

Medicare Part C, also known as Medicare Advantage, includes the benefits of both Parts A and B of Original Medicare while adding some additional benefits, like prescription drug coverage on select plans. Part C is provided through private companies, so the rates for individual plans vary. Call us for help comparing Medicare Advantage premium rates at 888-446-9157.

Will Medicare increase in 2021?

Medicare’s Annual Enrollment Period is officially underway, and beneficiaries can expect a few changes for the coming year including Medicare rate increases. Beneficiaries can expect to see increases in 2021 Medicare premiums and deductibles.

How much is the Part B deductible for 2021?

The Part B deductible and coinsurance for 2021 is $203 plus 20 percent of the Medicare-approved amount for most doctor services after the deductible is met.

What is Medicare Advantage?

Medicare Advantage. If you want an alternative to Original Medicare, you may purchase a Medicare Advantage insurance policy. These insurance policies are sold by private companies that are approved by Medicare. They include coverage for Medicare Part A, Medicare Part B, and usually Medicare Part D.

Does Medicare Supplement pay for coinsurance?

If you have Original Medicare, Medicare Supplement insurance policies can help pay for some of the remaining health care costs. If you buy a Medicare Supplement insurance policy, it can help pay Medicare copayments, coinsurance, and deductibles.

Is United American a Medicare Supplement?

United American has been a prominent Medicare Supplement insurance provider since Medicare began in 1966. Additionally, we’ve been a long-standing participant in the task forces working on Medicare Supplement insurance policy recommendations for the National Association of Insurance Commissioners.

What is the Medicare deductible for 2021?

Medicare Part A. Medicare Part A has the most complex deductible. For 2021, the Medicare Part A deductible is $1,484. However, this is not a yearly deductible. Rather, it is a deductible for each benefit period. The benefit period begins the first day you enter a hospital or skilled nursing care facility for an inpatient stay.

How much is Medicare Part B deductible in 2021?

Medicare Part B. The deductible for Medicare Part B is $203 per year in 2021. After you spend this amount out of pocket on covered services, you will usually pay 20% of the Medicare-approved amount for most services.

Does Medicare Advantage have a deductible?

Medicare Advantage plans that offer prescription drug coverage may sometimes feature two different deductibles, with one being for medical costs and the other for prescription costs.

What is Medicare Part C?

Medicare Part C (Medicare Advantage) The deductibles for Medicare Advantage plans are more like those of conventional private health insurance. Part C plan deductible amounts will vary from one plan to the next. This is different from Medicare Part A and Part B (Original Medicare) where deductibles come at a fixed amount for everyone enrolled.

What is Medicare Supplement Insurance?

A Medicare Supplement Insurance plan, or “Medigap,” can provide coverage for Medicare Part A and Part B deductibles, among other out-of-pocket expenses. There are several Medigap plans that offer full coverage for the Medicare Part A deductible and some plans that offer partial coverage.

Who is Christian Worstell?

Or call 1-800-995-4219 to speak with a licensed insurance agent. Christian Worstell is a health care and policy writer for MedicareSupplement.com. He has written hundreds of articles helping people better understand their Medicare coverage options.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

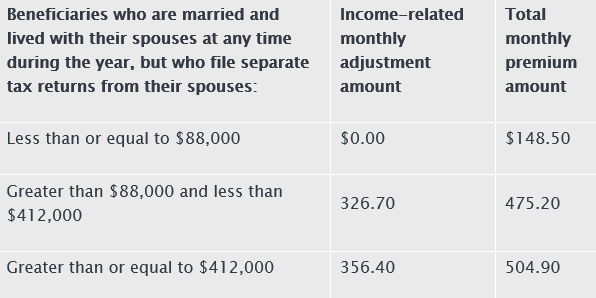

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.