What Are the Medicare Income Limits in 2021?

- There are no income limits to receive Medicare benefits.

- You may pay more for your premiums based on your level of income.

- If you have limited income, you might qualify for assistance in paying Medicare premiums.

What are the income limits for Medicare?

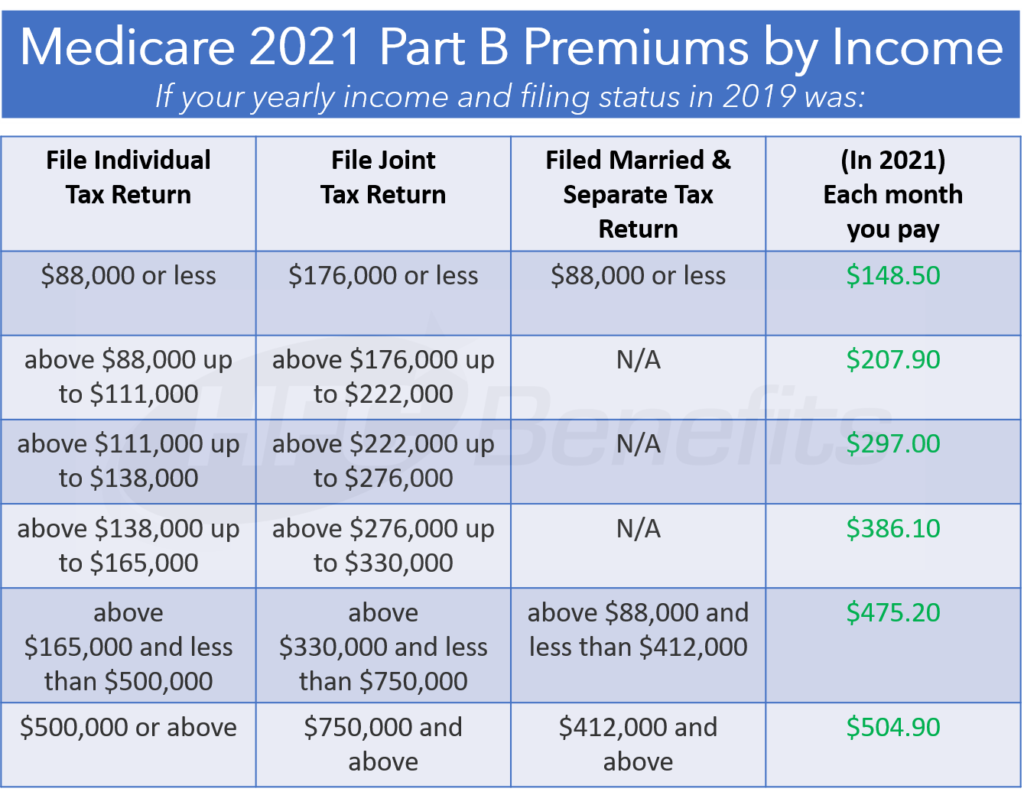

There are different tax brackets for married couples who file their taxes separately. If you earn less than $88,000 per year, you must pay $148.50 per month. If you earn more than $88,000 but less than $412,000 per year, you must pay $475.20 per month. If …

Are there limits to my Medicare coverage?

7 rows · Oct 22, 2021 · In 2021, those individuals with a modified adjusted gross income above $88,000 will have an ...

Who is eligible for Medicare Part B premium reimbursement?

Nov 11, 2021 · In 2021, IRMAA surcharges apply to individual Medicare beneficiaries who earn more than $88,000, and to couples who earn more than $176,000. For 2022, these limits are projected to increase to $91,000 and $182,000, respectively.

Who qualifies for Medicare extra help?

Nov 06, 2020 · The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act …

What is the Medicare threshold for 2021?

In 2021, those individuals with a modified adjusted gross income above $88,000 will have an income-related monthly adjustment (IRMA) to their Medicare premiums. For couples who file a joint tax return, that threshold is $176,000 per year.Oct 22, 2021

At what income do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.Nov 16, 2021

What are the Irmaa brackets for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.90Married filing jointly12 more rows•Dec 6, 2021

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is modified adjusted gross income for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

How do you calculate Magi for Irmaa?

MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).Jan 25, 2022

Does Social Security income count towards Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

What year is 2021 Irmaa based on?

Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren't included in the income for determining IRMAA.Mar 10, 2022

How does Medicare determine your income?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does Social Security count as income?

While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.Jan 28, 2019

What are Medicare income limits?

Medicare beneficiaries with incomes above a certain threshold are charged higher premiums for Medicare Part B and Part D. The premium surcharge is...

Why does Medicare impose income limits?

The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. And for Part D, they took effect in 2011, under the Affor...

Who is affected by the IRMAA surcharges and how does this change over time?

There have been a few recent changes that affect high-income Medicare beneficiaries: In 2019, a new income bracket was added at the high end of the...

Will there be a rate increase in 2022?

We don’t yet have concrete details from CMS. But the Medicare Trustees Report, which was published in late August, projects that the standard Part...

Income Limits

There is no income limit for Medicare. But there is a threshold where you will have to pay more for your Medicare coverage.

Medicare Premiums by Type

It’s important to note that most Medicare beneficiaries get Medicare Part A for free. Generally, if you paid Medicare taxes for 30-39 quarters you will not have to pay for your Medicare Part A coverage. If you have been paying Medicare taxes for less than 30 quarters, the standard Part A premium is $471 for 2021.

Medicare Income Process

Your income from 2 years ago (as reported on your IRS tax return) is a factor in determining your Medicare Part B premium.

Will my premium increase if my income increasing during my policy?

Your premium will be recalculated every year based on your MAGI from 2 years prior to the current year. This means that if your income goes up, your Medicare Part B premium will go up. But this also means that if your income goes down, your Medicare Part B premium will also go down.

What are the rules for higher-income beneficiaries?

The income brackets for those making $88,000/ year individually and $176,000 jointly are as follows:

Is the income limit based on a household?

No, the income limit is based on your individual or jointly filed tax return.

How is the income limit calculated?

According to Social Secuity, the IRMA payments are calculated based on how much most beneficiaries pay for the true cost of Medicare Part B.

What are Medicare income limits?

Put in place in 2007, Medicare income limits (quite literally) limit the amount of money you can make to qualify for Medicare. Individuals aged 65 and over generally qualify for the healthcare program, as do young people with disabilities and those with end-stage renal disease.

Why do they exist?

While there are several reasons why Medicare income limits exist, the main reason is to ensure fairness—and longevity of the program. “ These rules were put in place to ensure that beneficiaries with higher incomes would pay a larger portion of the cost of their coverage,” Norris says.

Who is affected by the 2021 change, implemented at the beginning of the year?

Medicare beneficiaries earning more than $88,000 and couples earning more than $176,000 were affected by the 2021 change. “Medicare’s 2021 income limits and corresponding surcharges apply to all beneficiaries with part B and/or part D coverage,” Worstell tells Parade.

How much can you expect to pay for Medicare coverage?

Individuals making $88,000 or less and married couples who file a joint tax return and make $176,000 or less will pay the standard amount, i.e. their monthly payment will be $148.50. This is for Medicare part B.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is a 504.90?

504.90. Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follow s: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What happens when the SSA makes its final initial determination regarding IRMAA?

When SSA makes their final initial determination regarding IRMAA, they will send a notice that will contain appeal rights and tell you to contact SSA if one of the following situations apply:

How often is IRMAA calculated?

For example, in 2021, the SSA will look at your 2019 tax return to make your IRMAA determination. IRMAA is calculated every year and may change if your income changes. You may be subject to Medicare premium income limits one year, but not the next if your income falls below the lower limit.

What is IRMAA pre determination notice?

IRMAA Pre-Determination Notice. Newly eligible Medicare beneficiaries will be charged the standard Part B premium or the prescription drug plan premium without an IRMAA until the SSA receive your Modified Adjusted Gross Income (MAGI) from IRS.

What is an IRMAA notice?

When you first become eligible for Medicare, you will get an initial IRMAA determination notice if you have Medicare Part B and/or Part D and Social Security determine s IRMAA applies to you. This notice includes information about Social Security’s determination and appeal rights.

How long does it take to appeal an OMHA denial?

If your appeal is denied, you can choose to appeal to the Council within 60 days of the OMHA level denial date. If your Council appeal is successful, your Part B or Part D premiums will be corrected.

What is the IRMAA?

The income-related monthly adjustment amount (IRMAA) is a surcharge for high-income people that affects how much they have to pay for Medicare Part B and Part D premiums. The IRMAA, which applies to Medicare Part B premiums, went into effect in 2007, while the IRMAA impacting Part D premiums was implemented in 2011.

When can a beneficiary supply a copy of the PY-2?

SSA used PY-3 data (tax information from three years before the premium year), and the beneficiary can supply a copy of the PY-2 (tax information from two years before the premium year) Federal income tax return .

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is appealing an IRMAA?

Appealing an IRMAA. Lower income assistance. Takeaway. There are no income limits to receive Medicare benefits. You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums. Medicare is available to all Americans who are age 65 or older, ...

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What happens if your MAGI is greater than $88,000?

If you file your taxes using a different status, and your MAGI is greater than $88,000, you’ll pay higher premiums (see the chart below, Modified Adjusted Gross Income (MAGI), for an idea of what you can expect to pay).

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

What Are Medicare Income Limits?

- Put in place in 2007, Medicare income limits (quite literally) limit the amount of money you can make to qualify for Medicare. Individuals aged 65 and over generally qualify for the healthcare program, as do young people with disabilities and those with end-stage renal disease. However, the portion you pay for Medicare varies, depending upon your income level. “Medicare beneficiar…

Why Do They Exist?

- While there are several reasons why Medicare income limits exist, the main reason is to ensure fairness—and longevity of the program.“These rules were put in place to ensure that beneficiaries with higher incomes would pay a larger portion of the cost of their coverage,” Norris says. “Medicare’s income limits are similar to the tax brackets used by the IRS to tax income,” Christia…

Who Is Affected by The 2021 Change, Implemented at The Beginning of The Year?

- Medicare beneficiaries earning more than $88,000 and couples earning more than $176,000 were affected by the 2021 change. “Medicare’s 2021 income limits and corresponding surcharges apply to all beneficiaries with part B and/or part D coverage,” Worstelltells Parade. “To determine eligibility, Medicare will use 2019 tax data for the 2021 plan year. “ That said, it’s important to not…

How Much Can You Expect to Pay For Medicare Coverage?

- Individuals making $88,000 or less and married couples who file a joint tax return and make $176,000 or less will pay the standard amount, i.e. their monthly payment will be $148.50. This is for Medicare part B. Individuals making between $88,000 and $111,000 and couples making between $176,000 to $222,000 will pay $207.90 a month, and the rates increase from there. A fu…

Sources

- “Medicare Income Limits: What to Know.” Medical News Today.

- “Who Relies on Medicare? A Profile of the Medicare Population.” AARP.

- Louise Norris, a licensed broker and analyst

- Christian Worstell,a senior staff writer with Medicare Advantage and licensed health insurance agent