What is the Part D coverage gap for 2020?

Summary: The Medicare Part D donut hole officially closed in 2020. This means that you pay only 25% for both brand and generic prescription drugs in the coverage gap.

What is the initial coverage limit for Part D?

$4,430The Initial Coverage Limit (ICL) will go up from $4,130 in 2021 to $4,430 in 2022. This means you can purchase prescriptions worth up to $4,430 before entering what's known as the Medicare Part D Donut Hole, which has historically been a gap in coverage.

What is the coverage gap in Medicare Part D prescription drug plan?

The Medicare Part D donut hole or coverage gap is the phase of Part D coverage after your initial coverage period. You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430.

What is the initial coverage period for Medicare Part D?

7 monthsFor people who are new to Medicare, the Initial Enrollment Period (IEP) for Part D is 7 months long. It begins 3 months prior to the month you become eligible for Medicare Part A or B, includes the month you become eligible and ends 3 months later.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

What is the 2022 Part D initial coverage limit?

$4,430CMS has released the following 2022 parameters for the defined standard Medicare Part D prescription drug benefit: Deductible: $480 (up from $445 in 2021); Initial coverage limit: $4,430 (up from $4,130 in 2021); Out-of-pocket threshold: $7,050 (up from $6,550 in 2021);

What is the Medicare Part D coverage gap for 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.

What is the Part D donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Do all Medicare Part D plans have a donut hole?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap.

What is the initial coverage stage?

Initial Coverage Your plan pays for a portion of each prescription drug you purchase, as long as that medication is covered under the plan's formulary (list of covered drugs). You pay the other portion, which is either a copayment (a set dollar amount) or coinsurance (a percentage of the drug's cost).

What are the 4 phases of Part D coverage?

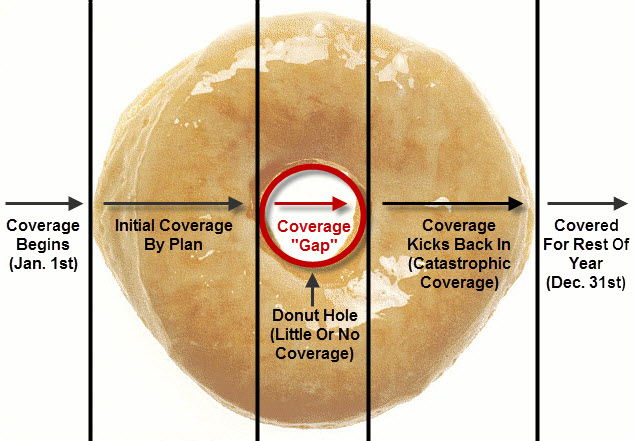

Throughout the year, your prescription plan costs may change depending on the coverage stage you're in. If you have a Part D plan, you can move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Can I change Part D plans anytime?

When Can You Change Part D Plans? You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want.

How is initial coverage calculated?

The Initial Coverage Limit is the measured by the retail cost of your drug purchases and is used to determine when you leave your Medicare plan's Initial Coverage Phase and enter the Donut Hole or Coverage Gap portion of your Medicare Part D prescription drug plan.

What is the coverage gap for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

What is the standard Part D coverage?

THE PART D STANDARD BENEFIT The standard benefit includes an annual deductible and a gap in coverage, previously referred to as the “Donut Hole.”[77] Sponsors may also offer plans that differ from – but are actuarially equivalent to – the standard benefit.

What are the 4 phases of Part D coverage?

Throughout the year, your prescription plan costs may change depending on the coverage stage you're in. If you have a Part D plan, you can move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What is the Medicare Part D donut hole?

The Medicare Part D “donut hole” is a temporary coverage gap in how much a Medicare prescription drug plan will pay for your prescription drug cost...

What happens in the donut hole coverage gap in 2020?

Once you enter the donut hole in 2020, your Part D plan’s coverage becomes more limited. In 2020, you’ll pay no more than 25 percent of the price f...

What happens when the donut hold goes away in 2020?

Once you reach the $6,350 threshold in 2020, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastr...

Overview

The Medicare Part D coverage gap (informally known as the Medicare doughnut hole) is a period of consumer payment for prescription medication costs which lies between the initial coverage limit and the catastrophic-coverage threshold, when the consumer is a member of a Medicare Part D prescription-drug program administered by the United States federal government. The gap is reached after shared insurer payment - consumer payment for all covered prescription drugs rea…

Details

In 2006, the first year of operation for Medicare Part D, the doughnut hole in the defined standard benefit covered a range in true out-of-pocket expenses (TrOOP) costs from $750 to $3,600. (The first $750 of TrOOP comes from a $250 deductible phase, and $500 in the initial coverage limit, in which the Centers for Medicare and Medicaid Services (CMS) covers 75 percent of the next $2,000.) In the first year of operation, there was a substantial reduction in out-of-pocket costs an…

2020 Medicare Part D Standard Drug Benefit

The following table shows the Medicare benefit breakdown (including the donut hole) for 2020.

The costs shown in the table above represent the 2020 defined standard Medicare Part D prescription drug plan parameters released by the Centers for Medicare and Medicaid Services (CMS) in April 2017. Individual Medicare Part D plans may choose to offer more generous benefits but must meet the minimum standards established by the defined standard benefit.

Low Income Subsidy

The Low-Income Subsidy (LIS), also known as "Extra Help" provides additional cost-sharing and premium assistance for eligible low-income Medicare Part D beneficiaries with incomes below 150% the Federal Poverty Level and limited assets. Individuals who qualify for the Low-Income Subsidy (LIS) or who are also enrolled in Medicaid do not have a coverage gap.

To qualify for the LIS, Medicare beneficiaries must qualify for full Medicaid benefits, be enrolled i…

Impact on Medicare beneficiaries

The U.S. Department of Health and Human Services estimates that more than a quarter of Part D participants stop following their prescribed regimen of drugs when they hit the doughnut hole.

Every Part D plan sponsor must offer at least one basic Part D plan. They may also offer enhanced plans that provide additional benefits. For 2008, the percentage of stand-alone Part D (PDP) plans offering some form of coverage within the doughnut hole rose to 29 percent, up from 15 percen…

Phase-out

The Affordable Care Act (ACA), which was passed in 2010, ensured that the coverage gap or, so-called "doughnut hole", would be closing for patients on Medicare Part D. From 2017 to 2020, brand-name drug manufacturers and the federal government will be responsible for providing subsidies to patients in the doughnut hole.

In an effort to close the coverage cap, in 2010, the Affordable Care Act provided a $250 rebate c…

External links

• cms.gov, the official website of the Centers for Medicare and Medicaid Services

• Medicare.gov — the official website for people with Medicare

• How Stuff Works – Medicare