2018 Full Low-Income Subsidy Income Requirements (135% of FPL)

| Persons in Family | 48 Contiguous States & D.C. | Alaska | Hawaii |

| 1 | $16,389 | $20,493 | $18,846 |

| 2 | $22,221 | $27,783 | $25,556 |

| 3 | $28,053 | $35,073 | $32,265 |

What does Medicare Part D cost in 2018?

7 rows · begins once you reach your Medicare Part D plan’s initial coverage limit ($3,750 in ...

What is the catastrophic limit for Medicare Part D medications?

Part D coverage varies by plan, but as mentioned above, there are caps in place that all plans must follow. Your plan may have no deductible, but if it does, it must adhere to the caps set forth by Medicare. In 2018, Part D costs include: A standard deductible of $405 An initial coverage limit of $3,750 A catastrophic coverage limit of $5,000

Will premium brackets change for Part D in 2018?

Apr 03, 2017 · Today, the Centers for Medicare & Medicaid Services (CMS) released final updates to the Medicare Advantage (MA) and Part D programs through the 2018 Rate Announcement and Call Letter. The Advance Notice and Draft Call Letter were posted on February 1, 2017 and CMS accepted comments on all proposals through March 3, 2017.

What is Medicare Part A in 2018?

2018 Medicare Part D Formulary (List of Covered Drugs) Please Read: This document contains information about the drugs we cover in this plan. This Formulary was updated on December 22, 2017. For more recent information or other questions, please contact the MVP Medicare Customer Care Center. 1-800-665-7924. Monday–Friday, 8 am–8 pm Eastern Time

What was the Medicare Part D premium for 2018?

Premiums: Monthly Part D PDP premiums average $41 in 2018, but premiums vary widely among the most popular PDPs, ranging from $20 per month for Humana Walmart Rx to $84 per month for AARP Medicare Rx Preferred. Overall, average monthly PDP premiums increased by a modest 2 percent in 2018.May 17, 2018

Is there a limit on Medicare Part D?

Is there a limit on the number or type of prescription drugs a Medicare Part D drug plan will cover in a given year? En español | Your Part D drug plan cannot place a limit on the number of prescriptions you fill, either in a year or in a lifetime.

What were Medicare Part D premiums in 2019?

2019 Medicare Part D premiums The average Part D plan premium in 2019 is around $41.21 per month, which is a 2 percent increase from the 2018 average premium. Part D plan premiums can also be subject to a Medicare IRMAA for higher income earners.

What is the 2022 Part D initial coverage limit?

$4,430The Initial Coverage Limit (ICL) will go up from $4,130 in 2021 to $4,430 in 2022. This means you can purchase prescriptions worth up to $4,430 before entering what's known as the Medicare Part D Donut Hole, which has historically been a gap in coverage.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What does Medicare D cost?

Varies by plan. Average national premium is $33.37. People with high incomes have a higher Part D premium. Vary by plan and by drug within plan.

Is Medicare Part D deducted from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.Dec 1, 2021

Why do Medicare Part D plans have different premiums?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the plan D deductible for 2022?

Most Part D PDP enrollees who remain in the same plan in 2022 will be in a plan with the standard (maximum) $480 deductible and will face much higher cost sharing for brands than for generic drugs, including as much as 50% coinsurance for non-preferred drugs.Nov 2, 2021

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

What is the donut hole in Medicare?

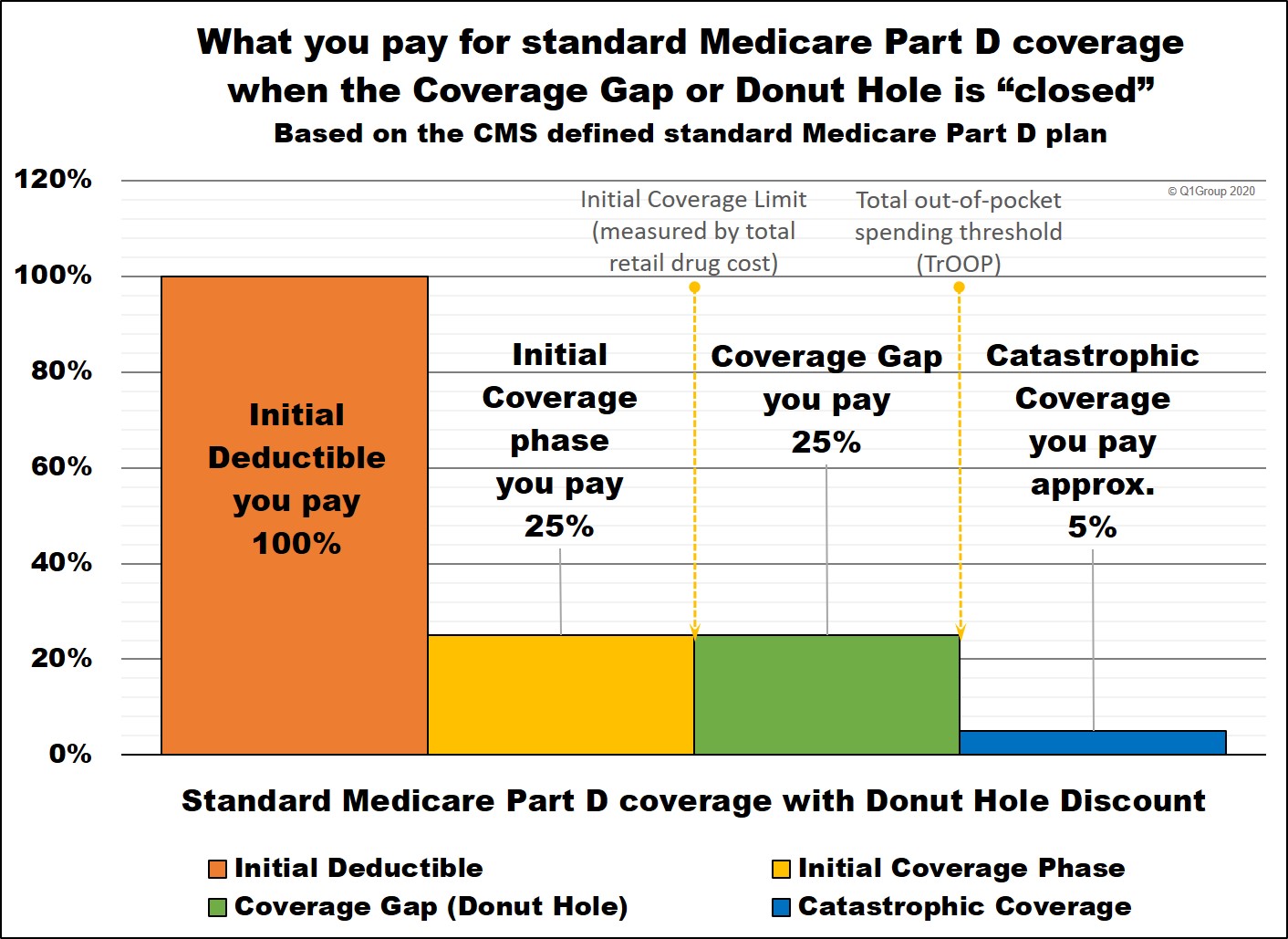

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is catastrophic limit?

This will effectively close the coverage gap. As it stands, the catastrophic limit prevents you from paying higher prescription drug costs forever. Once you hit the catastrophic limit ($5,000 in 2018), you’ll only be responsible for about 5 percent of the cost of your medications for the rest of your plan year.

What is the Medicare Part D benefit?

The CMS "Part D Benefit Parameters for Defined Standard Benefit" is the minimum allowable Medicare Part D plan coverage . However, CMS does allow Medicare Part D plans to offer a variation on the defined standard benefits (for example, a Medicare Part D plan can offer a $0 Initial Deductible). will be increased by $20 to $435 in 2020.

How much is Medicare Part D 2020?

will increase from $5,100 in 2019 to $6,350 in 2020. begins once you reach your Medicare Part D plan’s initial coverage limit ($4,020 in 2020) and ends when you spend a total of $6,350 out-of-pocket in 2020.

How much does Medicare pay for generic drugs?

Medicare Part D beneficiaries who reach the Donut Hole will also pay a maximum of 25% co-pay on generic drugs purchased while in the Coverage Gap (receiving a 75% discount). For example: If you reach the 2020 Donut Hole, and your generic medication has a retail cost of $100, you will pay $25.

When will Medicare Part D enrollment start in 2022?

If you would like for us to send you an email as additional 2022 Medicare Part D plan information comes online and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

How much does a drug cost in 2020?

will increase to $3.60 for generic or preferred drug that is a multi-source drug and $8.95 for all other drugs in 2020.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

When will Medicare Part D be released?

2019 Medicare Part D Outlook. Below are the finalized 2019 defined standard Medicare Part D prescription drug plan parameters as released by the Centers for Medicare and Medicaid Services (CMS), April 2018. Search Tools and Links. News on Medicare for 2019.

When will Medicare Part D enrollment start in 2022?

If you would like for us to send you an email as additional 2022 Medicare Part D plan information comes online and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

How much does Medicare pay for a donut hole?

Medicare Part D beneficiaries who reach the Donut Hole will also pay a maximum of 37% co-pay on generic drugs purchased while in the Coverage Gap (receiving a 63% discount). For example: If you reach the 2019 Donut Hole, and your generic medication has a retail cost of $100, you will pay $37.

How much is the Donut Hole discount for Medicare?

2019 Donut Hole Discount: Part D enrollees will receive a 75% Donut Hole discount on the total cost of their brand-name drugs purchased while in the Donut Hole.

What is the ICL for Medicare?

Initial Coverage Limit ( ICL ): will increase from $3,750 in 2018 to $3,820 in 2019. Out-of-Pocket Threshold (or TrOOP ): will increase from $5,000 in 2018 to $5,100 in 2019. Coverage Gap (Donut Hole): begins once you reach your Medicare Part D plan’s initial coverage limit ($3,820 in 2019) and ends when you spend a total of $5,100 out ...

How much will Medicare cover in 2021?

Once you and your plan have spent $4,130 on covered drugs in 2021, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

What is the coverage gap for Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,130 on ...

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance, and copayments. The discount you get on brand-name drugs in the coverage gap. What you pay in the coverage gap.

How much does Medicare pay for generic drugs?

Generic drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

Does Medicare cover gap?

If you have a Medicare drug plan that already includes coverage in the gap, you may get a discount after your plan's coverage has been applied to the drug's price. The discount for brand-name drugs will apply to the remaining amount that you owe.

How much does Medicare pay for therapy?

Starting in 2019, Medicare no longer limits how much it will pay for medically necessary therapy services. You will typically pay 20% of the Medicare-approved amount for your therapy services, once you have met your Part B deductible for the year.

How long does Medicare cover psychiatric care?

Medicare only covers 190 days of inpatient care in a psychiatric hospital throughout your lifetime. If you require more than the Medicare-approved stay length at a psychiatric hospital, there’s no lifetime limit for mental health treatment you receive as an inpatient at a general hospital.

What is Medicare Part A?

Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) cover inpatient hospital and outpatient health care services that are deemed medically necessary. " Medically necessary " can be defined as “services and supplies that are needed to prevent, diagnose, or treat illness, injury, disease, health conditions, ...

What is a Medigap policy?

Medicare Supplement Insurance (Medigap) policies are private health care plans designed to supplement your Original Medicare benefits and help pay for some of the out-of-pocket costs that Original Medicare doesn’t cover.

How long can you stay in a hospital with Medicare?

Medicare Part A covers hospital stays for any single illness or injury up to a benefit period of 90 days. If you need to stay in the hospital more than 90 days, you have the option of using your lifetime reserve days, of which the Medicare lifetime limit is 60 days.

What are the services that are beyond the annual limit?

Extended hospitalization. Psychiatric hospital stays. Skilled nursing facility care. Therapy services. If you require any of these services beyond the annual limits, and don't qualify for an exception, you may be responsible for the full cost of those services for the rest of the year.

Does Medicare cover hospital costs?

Medicare covers many of your hospital and medical care costs, but it doesn't cover 100% of them . Here's what you can do to help bridge the gaps left by Medicare limits and offset some of your healthcare costs.