2019 Medicare Prescription Drug Plan (Part D) Premiums

| 2017 Individual tax return | 2017 Joint tax return | 2017 Married and separate tax return | 2019 Part D premium |

| $85,000 or less | $170,000 or less | $85,000 or less | Your plan premium |

| More than $85,000 and up to $107,000 | More than $170,000 and up to $214,000 | N/A | Your plan premium + $12.40 |

| More than $107,000 up to $133,500 | More than $214,000 up to $267,000 | N/A | Your plan premium + $31.90 |

| More than $133,500 up to $160,000 | More than $267,000 up to $320,000 | N/A | Your plan premium + $51.40 |

How much does Medicare Part D premium cost?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

What are the best Medicare Part D plans?

They include:

- Switching to generics or other lower-cost drugs;

- Choosing a plan (Part D) that offers additional coverage in the gap (donut hole);

- Pharmaceutical Assistance Programs;

- State Pharmaceutical Assistance Programs;

- Applying for Extra Help; and

- Exploring national and community-based charitable programs.

What is the cheapest Medicare Part D plan?

which is as good or better than what Part D would provide. Medicare contracts with private plans to offer drug coverage under Part D. There are two ways to enroll in Part D. You can purchase a stand-alone Part D plan or enroll in a Medicare Advantage plan ...

Are Medicare Part D premiums based on income?

With Part D, the extra amount you pay is determined by Medicare based on your tax-reported income, but your total costs will depend on the Part D plan you have. Part D plans are only provided by private insurance companies, so premium amounts will vary.

What is the national average premium for Medicare Part D?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

What is the standard Part D premium for 2020?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2020 is $32.74, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

What is the Medicare Part D premium for 2022?

approximately $33The Centers for Medicare & Medicaid Services (CMS) today announced that the average basic monthly premium for standard Medicare Part D coverage is projected to be approximately $33 in 2022.

Does Medicare Part D get deducted from Social Security?

If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit or to pay the plan provider directly.

What is the 2021 Part D premium?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

Is Medicare Part D premium based on income?

With Part D, the extra amount you pay is determined by Medicare based on your tax-reported income, but your total costs will depend on the Part D plan you have. Part D plans are only provided by private insurance companies, so premium amounts will vary.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the $16 728 Social Security secret?

1:266:46My Review: Motley Fool's $16,728 Social Security Bonus - YouTubeYouTubeStart of suggested clipEnd of suggested clipIf you've read any of their articles you've probably seen this it says the sixteen thousand sevenMoreIf you've read any of their articles you've probably seen this it says the sixteen thousand seven hundred and twenty eight dollar social security bonus most retirees completely overlook.

Why am I being charged for Part D Medicare?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($91,000 if you file individually or $182,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

Can you use GoodRx If you have Medicare Part D?

While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.

How much is Medicare premium for 2019?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased ...

What is the Medicare Part B premium?

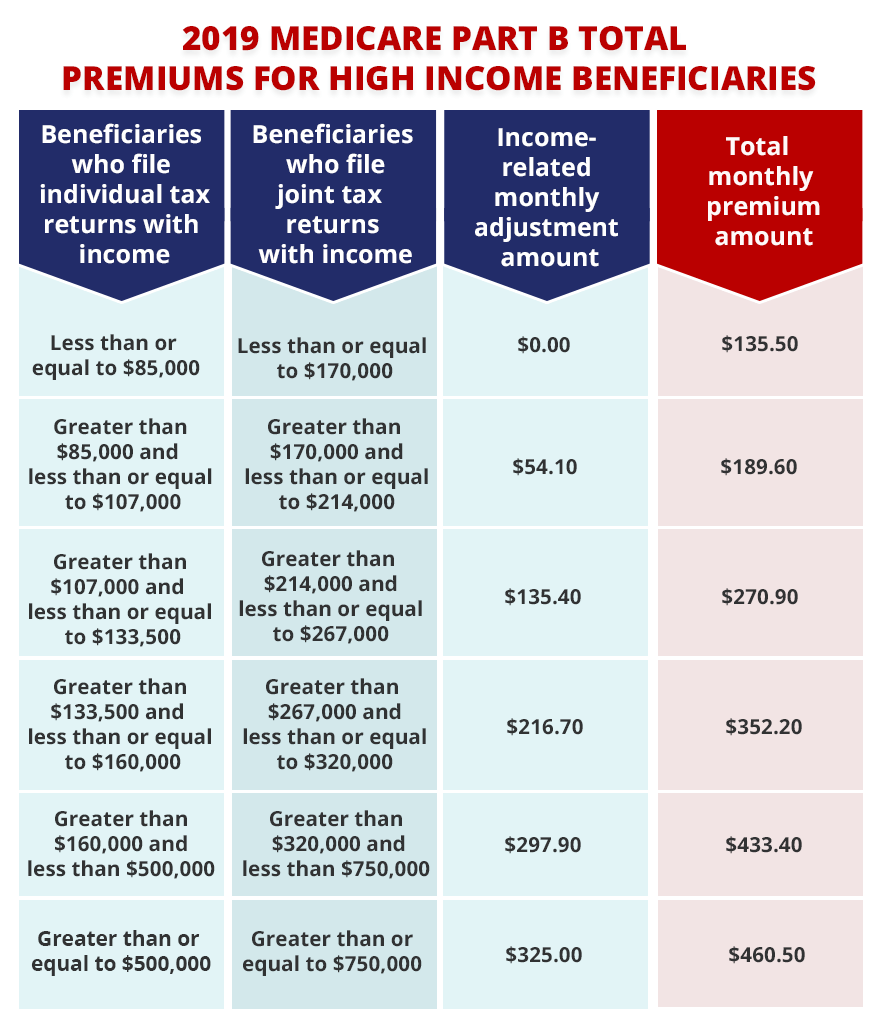

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

What happens if you don't receive your Part B?

If you don’t receive any of these benefit payments, you will simply get a bill in the mail for your Part B premium. How it changed from 2018. The 2019 Part B premiums rose by close to 1.1 percent from 2018 across all income levels.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

How much will Medicare Part D cost in 2019?

At a time when health insurance premiums are rising across-the-board, basic Part D premiums are expected to fall from $33.59 this year to $32.50 next year.

What is Medicare Part D?

In Medicare Part D, beneficiaries choose the prescription drug plan that best meets their needs, and plans have to improve quality and lower costs to attract beneficiaries. This competitive dynamic sets up clear incentives that drive towards value, as determined by beneficiaries.

When is Medicare open enrollment?

The upcoming annual Medicare open enrollment period for 2019 begins on October 15, 2018, and ends on December 7, 2018.

Can Medicare beneficiaries choose health insurance?

During this time, Medicare beneficiaries can choose health and drug plans for 2019 by comparing their current coverage and plan quality ratings to other plan offerings, or they can choose to remain in traditional Medicare.

What is Medicare Part D?

Tables. The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans ...

How many people are in Medicare Part D?

1. Medicare Part D enrollment has doubled since 2006, now totaling 45 million people in 2019. Figure 1: Medicare Part D Enrollment, 2006-2019 (in millions) A total of 45 million people with Medicare are currently enrolled in plans that provide the Medicare Part D drug benefit, representing 70 percent of all Medicare beneficiaries.

What percentage of Medicare Part D enrollees are in PDPs?

In 2019, close to half of all Part D enrollees are enrolled in stand-alone PDPs (46%), but nearly 4 in 10 (39%) are in Medicare Advantage prescription drug plans (MA-PDs). The remaining 15 percent of Part D enrollees are in employer/union group plans, both PDPs and MA-PDs. Over time, enrollment in MA-PDs has increased, reflecting enrollment growth in Medicare Advantage plans overall. Between 2018 and 2019, the number of MA-PD enrollees increased by 9 percent, from 16.0 million to 17.4 million, while enrollment in PDPs fell by a modest 0.3 percent, from 20.64 million to 20.57 million.

How much is the PDP premium?

In 2019, PDP enrollees are in plans with a weighted average monthly premium of $39.63, a 4 percent reduction (-$1.61) from 2018. The average monthly PDP premium amount has remained within a few dollars of this amount since 2010.

What companies are part of Part D?

The top three firms—UnitedHealth, Humana, and CVS Health —cover nearly 60 percent of all beneficiaries enrolled in Part D in 2019 (57%), while the top five firms—including WellCare and Cigna—account for three-quarters (75%) of Part D enrollment (see also Table 1). The recent acquisitions of Aetna by CVS Health and Express Scripts by Cigna have resulted in further consolidation of the Part D marketplace. In particular, between 2018 and 2019, Cigna increased its market share from 3 percent to 8 percent, while CVS Health increased its market share from 14 percent to 17 percent. Under the CVS Health-Aetna merger, Aetna divested its stand-alone PDP business to WellCare, resulting in a more than doubling of WellCare’s Part D market share, from 4 percent in 2018 to 10 percent in 2019.

What percentage of Medicare beneficiaries will see a decrease in premiums in 2019?

About 26 percent of enrollees staying in current plans will see their premiums decline in 2019. Approximately 46 percent of enrollees in their current plan will have a zero premium in 2019. Access to Medicare Advantage and prescription drug plans will remain nearly universal, with about 99 percent of Medicare beneficiaries having access to ...

How many Medicare Advantage plans are there in 2019?

Due to new flexibilities available for the first time in 2019, nearly 270 Medicare Advantage plans will be providing an estimated 1.5 million enrollees new types of supplemental benefits: Expanded health-related supplemental benefits, such as adult day care services, and in-home and caregiver support services; and.

How much is Medicare premium per month?

The average monthly premium for a basic Medicare prescription drug plan in 2019 is projected to decrease by $1.09 (3.2 percent decrease) to an estimated $32.50 per month.

What is CMS's plan for 2019?

The policies CMS finalized in April 2018 for Medicare health and drug plans for 2019 advance broader efforts to promote innovation that empowers Medicare Advantage and Part D sponsors with new tools to improve quality of care and provide additional plan choices for Medicare Advantage and Part D enrollees. Through policies adopted through the 2019 Rate Announcement and Call Letter and the final rule, CMS is providing more choices for beneficiaries, a greater number of affordable options, and new benefits to meet their unique health needs.

How many Medicare beneficiaries are there in 2019?

The data released with the 2019 Medicare Advantage and Part D landscape provides important premium and cost sharing information for Medicare health and drug plans offered in 2019: Enrollment in Medicare Advantage is projected to be at an all-time high in 2019 with 22.6 million Medicare beneficiaries.

How many Medicare beneficiaries will be enrolled in Medicare Advantage in 2019?

Based on projected enrollment, 36.7% of Medicare beneficiaries will be enrolled in Medicare Advantage in 2019. Medicare Advantage premiums, on average, have steadily declined since 2015 from the actual average premium of $32.91.

How much is Medicare Part B?

Medicare Part B requires a monthly premium. The standard premium for Part B in 2019 is $135.50 per month, although some people will pay more than that amount and others may pay less.

What happens if you don't accept Medicare?

If you visit a health care provider who does not accept Medicare assignment (which means they don't accept Medicare reimbursement as payment in full for their services), the provider reserves the right to charge you up to 15% more than the Medicare-approved amount.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

When will Medicare Part D be released?

2019 Medicare Part D Outlook. Below are the finalized 2019 defined standard Medicare Part D prescription drug plan parameters as released by the Centers for Medicare and Medicaid Services (CMS), April 2018. Search Tools and Links. News on Medicare for 2019.

When will Medicare Part D enrollment start in 2022?

If you would like for us to send you an email as additional 2022 Medicare Part D plan information comes online and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

How much does Medicare pay for a donut hole?

Medicare Part D beneficiaries who reach the Donut Hole will also pay a maximum of 37% co-pay on generic drugs purchased while in the Coverage Gap (receiving a 63% discount). For example: If you reach the 2019 Donut Hole, and your generic medication has a retail cost of $100, you will pay $37.

How much is the Donut Hole discount for Medicare?

2019 Donut Hole Discount: Part D enrollees will receive a 75% Donut Hole discount on the total cost of their brand-name drugs purchased while in the Donut Hole.

What is the ICL for Medicare?

Initial Coverage Limit ( ICL ): will increase from $3,750 in 2018 to $3,820 in 2019. Out-of-Pocket Threshold (or TrOOP ): will increase from $5,000 in 2018 to $5,100 in 2019. Coverage Gap (Donut Hole): begins once you reach your Medicare Part D plan’s initial coverage limit ($3,820 in 2019) and ends when you spend a total of $5,100 out ...

How much is Medicare Part A deductible?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,364 in 2019, an increase of $24 from $1,340 in 2018.

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018.

What is the deductible for Medicare Part B?

The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How many Medicare beneficiaries will pay less than the full Medicare premium?

An estimated 2 million Medicare beneficiaries (about 3.5%) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

How much is coinsurance for 2019?

In 2019, beneficiaries must pay a coinsurance amount of $341 per day for the 61st through 90th day of a hospitalization ($335 in 2018) in a benefit period and $682 per day for lifetime reserve days ($670 in 2018).