Full Answer

What is the best Medicare plan for prescriptions?

- VA coverage includes its own drug formulary (a list of drugs covered by the plan). ...

- A drug prescribed by a doctor at a non-VA facility may not be covered by VA benefits without authorization.

- A non-VA pharmacy may be a more convenient way to obtain your drugs, especially if you reside in a nursing home or other long-term care facility.

How to choose the best Medicare drug plan?

How to Choose With 5 Tips

- Consider the Timing. Timing plays a key role in signing up for a Medicare plan. ...

- Do Your Research. There are two main types of Medicare plans: Original Medicare and Medicare Advantage. ...

- Review Drug Coverage. Many Medicare eligibles overpay for their Medicare plan by hundreds of dollars. ...

- Choose the Right Plan. ...

- Enroll. ...

Which prescription drugs are covered with my plan?

To find out which prescriptions are covered through your new Marketplace plan: Visit your insurer’s website to review a list of prescriptions your plan covers; See your Summary of Benefits and Coverage, which you can get directly from your insurance company, or by using a link that appears in the detailed description of your plan in your Marketplace account. Call your insurer directly to find out what is covered. Have your plan information available.

When should you keep the same Medicare Prescription Drug Plan?

Medicare and Prescription Drug Coverage from an Employer. When they turn 65, many people are automatically enrolled in Original Medicare, Part A and Part B, which generally doesn’t include prescription drug coverage. If you’re covered by an employer or union plan that includes prescription drug coverage, you may be able to keep it when you ...

What Medicare plan covers prescriptions?

Medicare Cost Plan Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1. Join a Medicare Prescription Drug Plan (PDP).

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What medications are covered by Medicare Part D?

All Part D plans must include at least two drugs from most categories and must cover all drugs available in the following categories:HIV/AIDS treatments.Antidepressants.Antipsychotic medications.Anticonvulsive treatments for seizure disorders.Immunosuppressant drugs.Anticancer drugs (unless covered by Part B)

What are the two types of Medicare Part D plan?

Are you thinking about Medicare Part D coverage for your prescription drugs? As you may know, there are two main ways to get this coverage: Stand-alone Medicare Part D Prescription Drug Plan. Medicare Advantage Prescription Drug plan.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

Who has the cheapest Medicare Part D plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

Which medication would not be covered under Medicare Part D?

For example, vaccines, cancer drugs, and other medications you can't give yourself (such as infusion or injectable prescription drugs) aren't covered under Medicare Part D, so a stand-alone Medicare Prescription Drug Plan will not pay for the costs for these medications.

What are the 4 standardized levels of Medicare prescription drug coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

What is the deductible for Medicare Part D in 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

Are all Part D drug plans the same?

All Medicare drug coverage must give at least a standard level of coverage set by Medicare. However, plans offer different combinations of coverage and cost sharing. Plans offering Medicare drug coverage may differ in the drugs they cover, how much you have to pay, and which pharmacies you can use.

What is the maximum out of pocket for Medicare Part D?

Discussion. Our analysis shows that close to 1 million more Medicare Part D enrollees would have had their out-of-pocket costs capped in 2019 under a $2,000 out-of-pocket drug spending limit (as under H.R. 3) than a $3,100 limit (as under the GOP bill and the 2019 Senate Finance Committee bill).

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference.

What is Medicare Part A?

Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage. Transplant drugs can be very costly. If you’re worried about paying for them after your Medicare coverage ends, talk to your doctor, nurse, or social worker.

How long does Medicare cover after kidney transplant?

If you're entitled to Medicare only because of ESRD, your Medicare coverage ends 36 months after the month of the kidney transplant. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage. Transplant drugs can be very costly.

What is a prodrug?

A prodrug is an oral form of a drug that, when ingested, breaks down into the same active ingredient found in the injectable drug. As new oral cancer drugs become available, Part B may cover them. If Part B doesn’t cover them, Part D does.

What happens if you get a drug that Part B doesn't cover?

If you get drugs that Part B doesn’t cover in a hospital outpatient setting, you pay 100% for the drugs, unless you have Medicare drug coverage (Part D) or other drug coverage. In that case, what you pay depends on whether your drug plan covers the drug, and whether the hospital is in your plan’s network. Contact your plan to find out ...

What is Part B covered by Medicare?

Here are some examples of drugs Part B covers: Drugs used with an item of durable medical equipment (DME) : Medicare covers drugs infused through DME, like an infusion pump or a nebulizer, if the drug used with the pump is reasonable and necessary.

Does Medicare cover transplant drugs?

Medicare covers transplant drug therapy if Medicare helped pay for your organ transplant. Part D covers transplant drugs that Part B doesn't cover. If you have ESRD and Original Medicare, you may join a Medicare drug plan.

What is the next phase of Medicare coverage?

The next phase of your coverage is called your initial coverage phase.

How much does Medicare Advantage cost in 2020?

In the case of a standalone plan, you also pay a set annual deductible. As of 2020, the amount can be no more than $435.00 per year.

What is the tier 3 drug coverage?

Tier three includes non-preferred, brand-name drugs with a higher copayment than tier two. The initial coverage phase has a limit of $4,020.00 as of 2020. If you reach this amount you move into the next phase. The coverage gap phase begins when you reach the dollar limit set in your initial coverage phase as mentioned above.

Is it cheaper to take prescription drugs at home?

Today, prescriptions drugs that you take at home are not inexpensive, but there are more prescription drugs are available now to treat conditions and illnesses than ever before. If you are considering getting a Medicare Part D plan to help with the expense of prescription drugs, you may want to know how these plans work.

Does Medicare cover prescriptions?

Original Medicare benefits do not cover prescription drug costs unless the drugs are part of inpatient hospital care or are certain drugs that your health care provider administers in a medical facility. Today, prescriptions drugs that you take at home are not inexpensive, but there are more prescription drugs are available now to treat conditions ...

What are the preferred pharmacies for Choice Plan?

For those with the Choice plan, there are fewer options. For example, the Choice plan preferred pharmacies are CVS, Walmart, and thousands of community-based independent drug stores. Then, the Plus plan includes CVS, Walmart, Publix, Kroger, Albertsons, as well as many grocery stores and retailers.

What is the SilverScript plan?

SilverScript Medicare Prescription Drug Plans. There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan. All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

What are the options for United Healthcare?

The three options available with UnitedHealthcare include the Walgreens plan, Preferred, and Saver Plus plans. Those looking for a lower premium option with UHC need to look into the Walgreens policy.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

How much is Value Plan deductible?

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $445 deductible on all other tiers. The Plus Plan has a deductible of $445 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

Does Humana Part D have a deductible?

Humana Part D Reviews. Many generics with Humana have a $0 deductible. Further, they have a variety of plan options, something for everyone. The high deductible on brand name medications isn’t that great, and you have to go to Walmart to get the best savings.

When will Medicare Part D be updated?

Home / FAQs / Medicare Part D / Top 5 Part D Plans. Updated on June 3, 2021. Medicare prescription drug plan changes in 2021 are noteworthy. Also, by knowing what to expect, you can stay ahead of the game. Drugs can be costly, and new brand-name drugs can be the most expensive. With age, you’re more likely to require medications.

How much will Medicare pay for prescription drugs in 2021?

In 2021 when you and your insurer have paid $4,130 in prescription drug costs, you are then responsible for 25% of all of your medicine costs. The higher cost-sharing you pay in the donut hole continues until you enter into what’s known as Medicare Part D catastrophic coverage.

What is creditable prescription drug coverage?

Creditable prescription drug coverage is coverage from your or a spouse’s employer or union that pays on average at least the same amount as Medicare standard drug coverage. Keep in mind the national base beneficiary premium often increases each year.

What is Medicare Part D?

Medicare Part D is an optional program that covers prescription drugs, with federally approved plans offered by private insurers. Most recipients pay a monthly premium that varies by plan, plus co-pays and other potential costs. Introduced in 2006, Part D is Medicare’s most recent ...

What is the Medicare Advantage premium for 2021?

The monthly premium for Medicare Part D plans varies. In 2021, the National Base Beneficiary Premium is $33.06, which will give you a comparison point while you shop. If you get drug coverage through a Medicare Advantage plan, your prescription drug coverage is often rolled into your Advantage plan premium.

How much will Medicare Part D cost in 2021?

If you delay joining when you’re first eligible and you don’t already have prescription drug coverage, you’ll pay 1% of the standard Medicare Part D premium ($33.06 in 2021) times the number of full months you didn’t have prescription drug coverage, and that number is added to your monthly premium.

How long does it take to enroll in Medicare Advantage?

This is the seven-month period starting three months before the month you turn 65, including your birthday month ...

What is Part D insurance?

Often Part D coverage uses a tiered cost-sharing structure. This means you will pay a different price for different categories of drugs. In general, you’ll pay more in copays or coinsurance for brand-name drugs and less for generics.

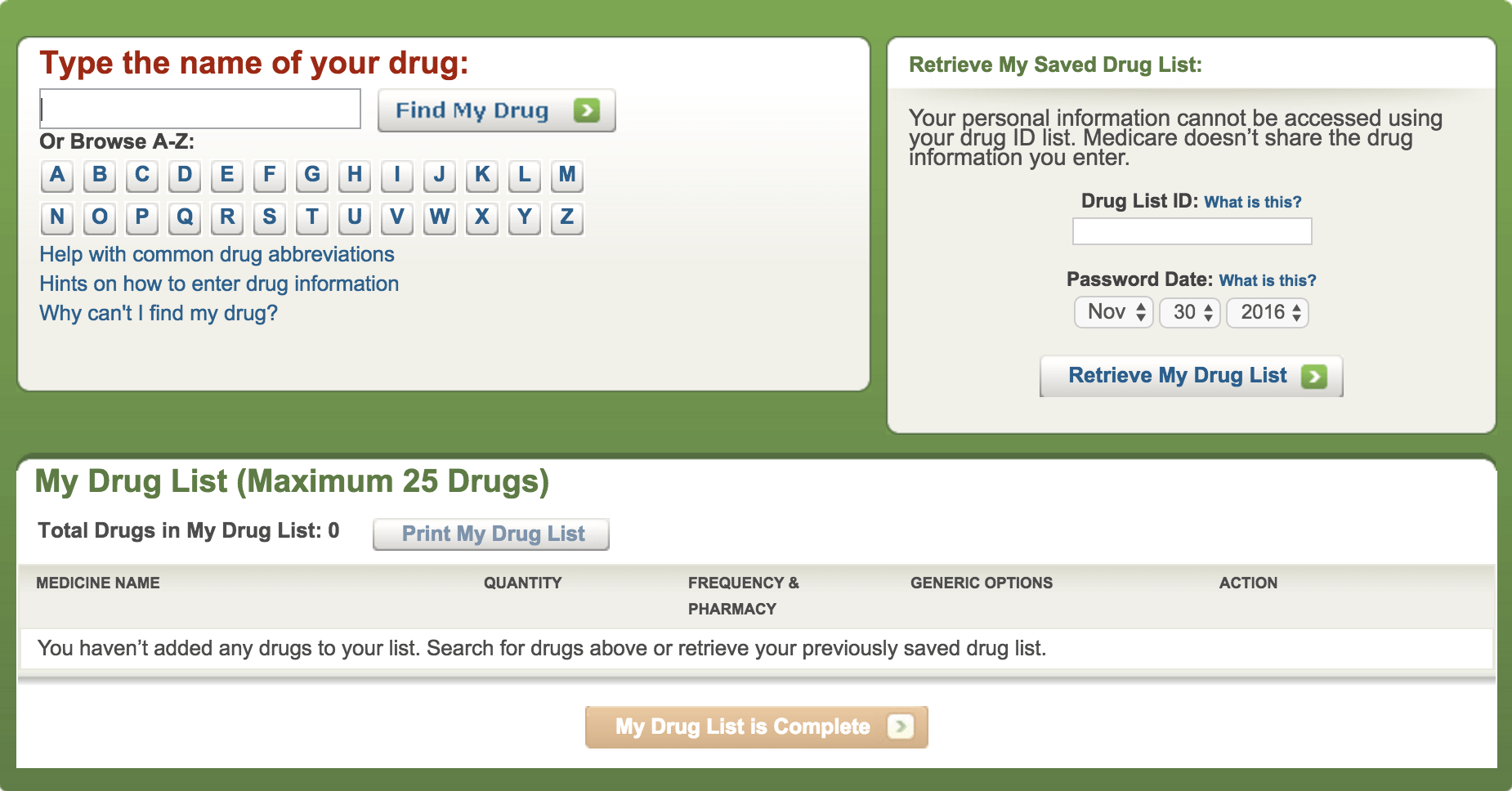

How to compare Medicare plans?

You can use the Medicare Plan Finder to compare different Medicare drug plans. Once you choose a Medicare drug plan , here's how you may be able to join: Enroll on the Medicare Plan Finder or on the plan's website. Complete a paper enrollment form. Call the plan. Call 1-800-MEDICARE. See more.

How to enroll in Medicare?

Once you choose a Medicare drug plan, here's how you may be able to join: 1 Enroll on the Medicare Plan Finder or on the plan's website. 2 Complete a paper enrollment form. 3 Call the plan. 4 Call 1-800-MEDICARE.

When does Medicare Part B start?

If you get Part B for the first time during the General Enrollment Period, you can also join a Medicare drug plan from April 1 – June 30. Your coverage will start on July 1. During open enrollment, between October 15 - December 7 each year.

When can I switch to Medicare?

Generally, you can join, switch, or drop a Medicare drug plan: When you first become eligible for Medicare because you’re turning or turned 65. You can sign up for a Medicare drug plan during your Initial Enrollment Period – the 7-month period that begins 3 months before the month you turn 65, includes the month you turn 65, ...

Does Medicare cover prescription drugs?

Medicare offers prescription drug coverage to everyone with Medicare. If you decide. not to join a Medicare Prescription Drug Plan (Part D) when you're first eligible, and. you don't have other creditable prescription drug coverage, or you don't get Extra.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is Medicare Part D?

Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too. Original Medicare (Parts A & B) doesn't provide prescription drug coverage.

How to get a PDP?

Enrolling in a Part D Prescription Drug Plan. To get a PDP plan, you will have to enroll directly with the plan provider. Unless you qualify for a Special Enrollment Period due to working past 65, it’s best to enroll in Part D when you’re first eligible for Medicare. This will be during your Initial Enrollment Period.

Can I combine my PDP with my Medicare?

Can I Combine a PDP Plan with Other Medicare Coverage? Yes, you can combine Medicare coverage parts with a Part D plan. A stand-alone PDP can work with Original Medicare (Parts A & B) and certain types of Medicare Advantage plans such as Medicare Medical Savings Account plans without drug coverage or Private Fee-for-Service plans. ...

Can you have a stand alone Medicare plan?

You can have a stand-alone prescription drug plan with certain types of Medicare Advantage plans so long as the plan: Can’t offer coverage for prescription drugs. Chooses not to offer coverage for prescription drugs. If after the first time you enroll you decide to change your PDP, you can do so each year during the Medicare Annual Enrollment ...

What is Medicare Part D?

Main article: Medicare Part D. The MMA's most touted feature is the introduction of an entitlement benefit for prescription drugs, through tax breaks and subsidies. In the years since Medicare's creation in 1965, the role of prescription drugs in patient care has significantly increased.

When did Medicare Advantage start?

Medicare Advantage plans. With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were given the option to receive their Medicare benefits through private health insurance plans, instead of through the Original Medicare plan (Parts A and B).

What is the "donut hole" in Medicare?

The "donut hole" provision of the Patient Protection and Affordable Care Act was an attempt to correct the issue.

When was Medicare Modernization Act enacted?

Signed into law by President George W. Bush on December 8, 2003. The Medicare Prescription Drug, Improvement, and Modernization Act, also called the Medicare Modernization Act or MMA, is a federal law of the United States, enacted in 2003. It produced the largest overhaul of Medicare in the public health program's 38-year history.

Can formularies be used to restrict prescription drug choices?

formularies can be used to restrict prescription drug choices. prescription coverage can be deferred to the patient or a Medicare Part D prescription plan. care other than emergency care can be restricted to a particular region. federal reimbursement can be adjusted according to the health risk of the enrollees.

Who was the chief architect of Medicare?

According to the New York Times December 17, 2004 editorial W.J."Billy" Tauzin, the Louisiana Republican who chaired the Energy and Commerce Committee from 2001 until February 4, 2004 was one of the chief architects of the new Medicare law. In 2004 Tauzin was appointed as chief lobbyist for the Pharmaceutical Research and Manufacturers of America (PhRMA), the trade association and lobby group for the drug industry with a "rumored salary of $2 million a year," drawing criticism from Public Citizen, the consumer advocacy group. They claimed that Tauzin "may have been negotiating for the lobbying job while writing the Medicare legislation." Tauzin was responsible for including a provision that prohibited Medicare from negotiating prices with drug companies.

Can Medicare negotiate drug prices?

Since the enactment of Medicare Prescription Drug, Improvement, and Modernization Act in 2003, only insurance companies administering Medicare prescription drug program, not Medicare, have the legal right to negotiate drug prices directly from drug manufacturers.