CONS:

- MSA Plans have a higher deductible, which could make E.R. visits and unexpected surgeries harder to pay for.

- Unlike HSAs, only Medicare can make deposits into your MSA.

What are the benefits of Medicare MSA plans?

Other Benefits –Other benefits that may be offered under Medicare MSA plans include: Information services, called transparency, to help enrollees shop for health care by comparing the cost and quality of providers. Coverage for additional benefits such as vision, hearing or dental at an optional additional cost to the member.

What are the pitfalls of Medicare Advantage plans?

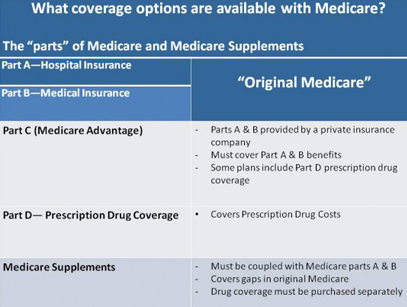

Pitfalls of Medicare Advantage Plans. Also known as Part C, these plans, which private insurers provide as an alternative to traditional Medicare, must provide the coverage required by Medicare at the same overall cost level. However, what they pay can differ depending upon your overall health.

How do Medicare high deductibles work with MSA funds?

To meet the high deductible, you can pay toward it with MSA funds or other money of your own. Once you’ve spent the MSA funds, you’ll pay out of pocket for any additional healthcare costs, at Medicare-approved rates, until you hit your deductible.

When can people disenroll from a Medicare MSA plan?

When Can People Disenroll from a Medicare MSA Plan? – Enrollment is generally for the full calendar year. Enrollees can leave their MSA plan between November 15 and December 31 of each year, effective January 1 of the next year. MSA enrollees cannot disenroll during the January 1 to March 31 period, as other MA enrollees can.

What happens to money left in a MSA at the end of the year?

Any money left in your account at the end of the year will remain in your account. If you stay with the Medicare MSA Plan the following year, the new deposit will be added to any leftover amount.

How is an MSA different than other plans?

Some MSAs offer additional benefits, such as vision and hearing care. Unlike other Medicare Advantage Plans, MSA plans include both a high deductible health plan (HDHP) and a bank account to help pay your medical costs. HDHPs have large deductibles that you must meet before receiving coverage.

Do MSA plans have a deductible?

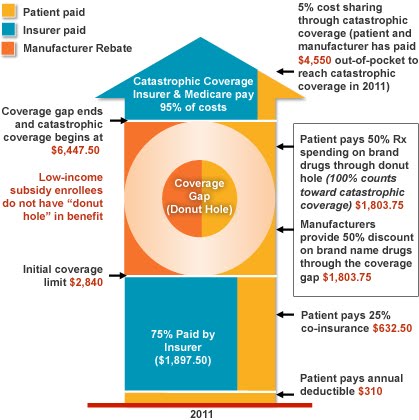

Enrollees of Medicare MSA plans can initially use their savings account to help pay for health care, and then will have coverage through a high-deductible insurance plan once they reach their deductible.

How much does Medicare contribute to an MSA?

After reaching your deductible, your MSA plan covers 100% of the cost for Medicare-covered services. Funds contributed to an MSA are not taxed as long as they are used to pay for qualified medical expenses.

What is the disadvantage of a MSA?

A person has the option of withdrawing their money from an MSA. However, if they do take it out, they must pay a 50% tax penalty as well as income taxes on the withdrawal. If a person does not use the money in the MSA by the end of the year, the remaining money rolls over into an account for the following year.

What does MSA cover?

What's covered? Medicare MSA plans cover the Medicare services that all Medicare Advantage Plans must cover. In addition, some Medicare MSA plans may cover some extra benefits like dental, vision, and hearing services. You may pay a premium for this extra coverage.

Can I use an MSA to pay Medicare premiums?

The Medicare MSA Plan deposits money in a special savings account for you to use to pay health care expenses. The amount of the deposit varies by plan. You can use this money to pay your Medicare-covered costs before you meet the deductible.

What can I use my MSA for?

You can use the money in your MSA account for non-medical expenses, such as groceries, rent, or utility bills. However, the amount you spend for non-medical purposes will not count toward your deductible and will be considered taxable income.

Can MSA be used for dental?

You can continue to use the carryover funds in the Limited-use MSA for dental and vision expenses incurred in 2020.

What is the difference between an HSA and MSA?

Medicare savings accounts (MSAs) and health savings accounts (HSAs) both give consumers tax-advantaged ways to fund the costs of healthcare. MSAs are only for people enrolled in high-deductible Medicare plans. HSAs are restricted to people in high-deductible private insurance plans.

How do I stop Medicare set aside?

There is one approach to avoiding MSAs that works — go to court or to the work comp board. The Centers for Medicare and Medicaid Services (CMS) will honor judicial decisions by a court or state work comp boards after a hearing on the merits of a work comp claim.