5 Medicare Changes for 2018

- Some (but not all) Medicare premiums are on the rise. Medicare premiums typically go up each year in line with the...

- Some (but not all) Medicare deductibles will climb. Medicare also charges deductibles that participants have to pay...

- Coinsurance payments for hospital and skilled nursing stays will go up. Under Part A, participants...

How new changes to Medicare may affect your healthcare?

Understanding Health Insurance Changes for 2021

- The American Rescue Plan Has Made Subsidies Larger and More Widely Available for 2021 and 2022. ...

- Second Chance to Enroll or Make a Plan Change: Runs Through August 15, 2021 in Most States. ...

- ACA Has Not Been Repealed or Replaced, & Lawsuit Doesn't Affect Enrollment in 2021 Plans. ...

What are the proposed changes to Medicare?

- The Biden administration’s “human infrastructure” proposal would expand Medicare coverage for dental, vision, and hearing aids.

- It also would attempt to lower the cost for prescription drugs.

- The proposal also explores the possibility of lowering the eligibility age to under 65.

What are the new Medicare rules?

KEY TAKEAWAYS:

- Effective for services starting March 6, 2020 and for the duration of the COVID-19 Public Health Emergency, Medicare will make payment for Medicare telehealth services furnished to patients in broader ...

- These visits are considered the same as in-person visits and are paid at the same rate as regular, in-person visits.

- Starting March 6, 2020 and for the duration of the COVID-19 Public Health Emergency, Medicare will make payment for professional services furnished to beneficiaries in all areas of the country ...

When can I make changes to my Medicare coverage?

There are two opportunities outside of the Medicare Annual Enrollment Period when you may be able to make changes to your Medicare coverage: 1) the Medicare Advantage Open Enrollment Period and 2) the Special Enrollment Period for qualifying life events. The Medicare Advantage Open Enrollment Period runs from January 1 to March 31 each year.

What are the major Medicare changes for 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

What big changes are coming to Medicare?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.

What are the 2022 changes to Medicare?

Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022.

What changes have been made to the Medicare card?

You're getting a new Medicare card! Between April 2018 and April 2019, we'll be removing Social Security numbers from Medicare cards and mailing each person a new card. This will help keep your information more secure and help protect your identity.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What will the Medicare Part B premium be in 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Is 2022 Medicare free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Will Medicare premiums increase in 2022?

CMS is still assessing other current and projected Medicare Part B costs to inform the premium recommendation for 2023, which will be announced in Fall 2022 consistent with the statutory process. In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022.

Is Medicare sending out new cards for 2021?

The Centers for Medicare & Medicaid Services (CMS) will begin mailing out new Medicare cards to 58 million current beneficiaries this April, according to the AARP. Some things to know about the new Medicare card: Residents won't need to take any action to get their new Medicare card.

When did Medicare stop using Social Security numbers?

April 2019With the increased risk of identity theft posed by the use of Social Security numbers (SSNs) on Medicare cards, Congress passed and President Obama signed into law the Medicare Access and CHIP Reauthorization Act of 2015, mandating the removal of SSNs from all Medicare cards by April 2019.

What is the new Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What are the Medicare changes for 2020?

What Are the Medicare Changes 2020?Part A premium will be $458 (many qualify for premium-free coverage)Part B premium will increase to $144.60.Part B deductible will rise to $198.Supplement Plan F and Plan C will no longer be available to those who became eligible on or after January 1, 2020.More items...

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Is Medicare going up 2022?

Medicare Part A and Part B Premiums Increase in 2022 But for those who have not paid the required amount of Medicare taxes, Part A premiums will increase. Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021).

New Medicare Cards Have Been Released

If you haven’t received a new Medicare ID already, keep an eye out. New IDs will be sent out until April 2019.

Coverage Gaps Are Smaller

For years, Medicare has required enrollees with high prescription costs to pay the entire bill out of pocket once they reached the Medicare coverage limit of $3,750 for prescription drug purchases. This year, that’s changing, meaning you may no longer need supplemental insurance.

Monthly Costs Are Lower

This year, Medicare Part B premiums have decreased. Thanks to new cost of living adjustments (COLAs), Medicare recipients who make less than $86,000 will receive a social security check that’s gone up two percent.

Important Differences to Look for in 2019

Medicare is about to get a lot better in 2019 – that’s why it’s so crucial to enroll or make changes to your plan right now.

Why does Medicare go up each year?

Medicare premiums typically go up each year in line with the rising cost of healthcare . Yet 2018 is unusual, because some premiums that Medicare participants pay will stay the same.

How much does Medicare pay for hospital stays?

In 2018, Medicare participants will have to pay $335 per day as coinsurance for hospital stays that last longer than 60 days but are no more than 90 days. That's higher by $6 from 2017's numbers. Beyond the 90th day, Medicare participants can use up to 60 lifetime reserve days, but they'll need to pay $670 per day in coinsurance to do so, up $12 from 2017.

Does Medicare have a deductible?

Medicare also charges deductibles that participants have to pay before further coverage kicks in. Those amounts typically go up each year, but as with premiums, 2018 will be a bit unusual.

Is Medicare affected by the Affordable Care Act?

However, there are a few situations in which Medicare could be affected by what lawmakers are doing.

Part B

This is the branch of Medicare that pays for physicians in or outside of the hospital.

Part D Medicare Changes

Part D of Medicare covers prescription drugs. The annual deductible for 2019 is $415, as compared to last years which was $405.

When did Medicare start putting new brackets?

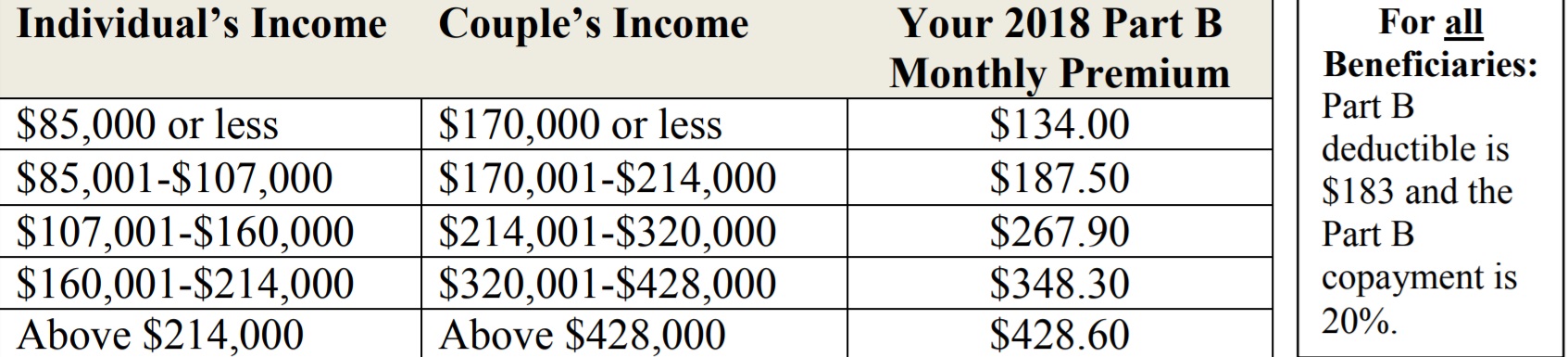

These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does not have a cap on out-of -pocket costs). The cap does not include the cost of prescription drugs, since those are covered under Medicare Part D (even when it’s integrated with a Medicare Advantage plan).

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Part A premiums have trended upwards over time and they increased again for 2022.

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020. People who became Medicare-eligible prior to 2020 can keep Plan C or F if they already have it, or apply for those plans at a later date, including for 2022 coverage.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.