Some of the out-of-pocket costs you can expect to pay with Original Medicare include deductibles, copayments and coinsurance. Deductible A deductible is the amount you must pay for covered medical expenses before Medicare pays its share.

How much are healthcare out of pocket costs?

Feb 15, 2022 · The standard Medicare Part B premium is $170.10 per month. However, the Part B premium is based on your reported taxable income from two years prior. The table below shows what Part B beneficiaries will pay for their premiums in 2022, based off their 2020 reported …

How much is health insurance out of pocket cost?

Factors that affect Original Medicare out-of-pocket costs. Whether you have Part A and/or Part B. Most people have both. Whether your doctor, other health care provider, or supplier accepts assignment. The type of health care you need and how often you need it.

How much did you pay out of pocket?

Jan 03, 2022 · Some of the out-of-pocket costs you can expect to pay with Original Medicare include deductibles, copayments and coinsurance. Deductible A deductible is the amount you must pay for covered medical expenses before Medicare pays its share.

How much does Medicare take out of your paycheck?

There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare ... before Original Medicare starts to pay. You pay this deductible once each …

What is the maximum out-of-pocket for original Medicare?

What is the out-of-pocket amount for Medicare?

What is the maximum out-of-pocket for Medicare in 2020?

What is the MOOP for original Medicare?

What counts towards out-of-pocket maximum?

Does original Medicare Parts A and B include an out-of-pocket limit?

Do Medigap plans g have an out-of-pocket maximum?

What is the average cost of supplemental insurance for Medicare?

Is Medicare Part A free at age 65?

Does MOOP include premium?

What is the difference between overall deductible and out-of-pocket limit?

What factors affect Medicare out of pocket costs?

Whether you have Part A and/or Part B. Most people have both. Whether your doctor, other health care provider, or supplier accepts assignment. The type of health care you need and how often you need it.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

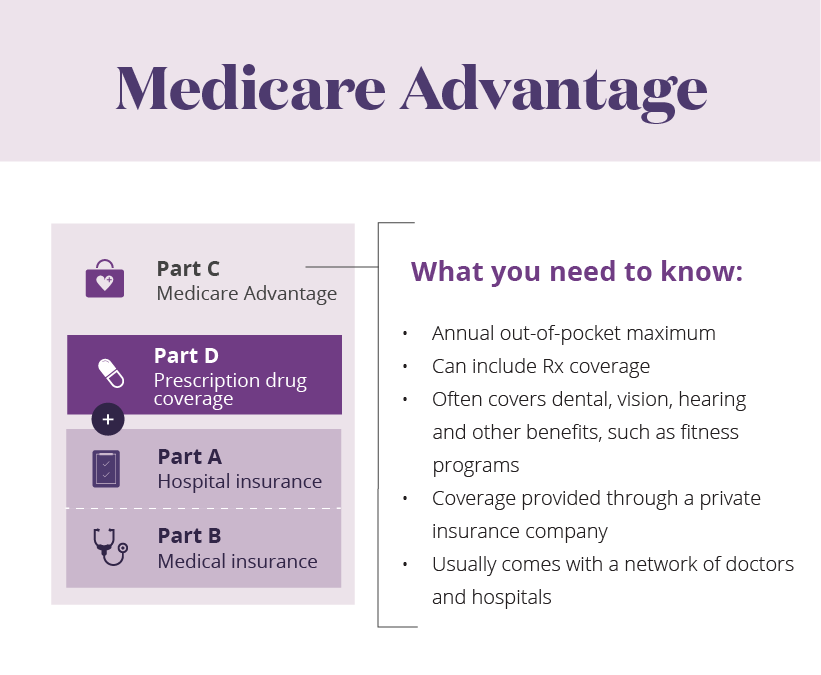

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover health care?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it. Whether you have other health insurance that works with Medicare.

Does Medicare cover prescriptions?

With a few exceptions, most prescriptions aren' t covered in Original Medicare. You can add drug coverage by joining a

What are the out-of-pocket costs of Medicare?

Some of the out-of-pocket costs you can expect to pay with Original Medicare include deductibles, copayments and coinsurance.

What is Medicare out of pocket?

Original Medicare (Part A and Part B) is the federal health insurance program for people age 65 and older and individuals with certain disabilities. Although Original Medicare provides comprehensive coverage, it still leaves some out-of-pocket costs to recipients.

What is coinsurance in Medicare?

Coinsurance is the percentage of costs you pay for health care expenses after your deductible is met. In most cases, your Medicare Part B coinsurance is 20 percent of the cost of Medicare-approved services. In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows:

How much is Medicare Part A coinsurance for 2021?

In 2021, your Medicare Part A coinsurance for inpatient hospital care is as follows: Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each lifetime reserve day after day 90 for each benefit period ...

How many Medigap plans are there?

Medicare Supplement Insurance provides full or partial coverage for some of the out-of-pocket expenses listed above. There are currently 10 standardized Medigap plans available in most states, and each includes a unique blend of basic benefits.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

General out-of-pocket costs

Most every insurance has the following out-of-pocket elements. Medicare also imposes penalties for signing up too late for Part B or Part D. All rates below are for 2021.

Provider-based expenses

Your out-of-pockets are directly affected by the healthcare provider you see. Make sure you take this into consideration before you schedule any appointments.

Hospital-based expenses

Staying overnight in a hospital does not necessarily mean you are admitted as an in -patient. You pay for inpatient hospital stays with a Part A deductible and a 20% Part B coinsurance for any physician services. When you are placed under observation, Part B provides your only coverage.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

How much is Medicare Part B?

Medicare Part B has a standard monthly premium of $144.60 in 2020, for people who earn up to $87,000 a year ($174,000 for a married couple). The premiums are higher if your income exceeds that amount. Part B enrollees pay an annual deductible of $198 in 2020. The Social Security Cost of Living Adjustment (COLA) was sufficient to cover the full amount of the Part B premium increase in 2020 for most beneficiaries, so most people are paying the standard premium.

How much is Medicare premium for 2020?

Although most Medicare beneficiaries receive Part A with no premium, if you do have to pay for it, the premium in 2020 is $458 per month if you worked less than 7.5 years, and $252 per month if you worked between 7.5 and 10 years.

How much is Medicare Part A deductible in 2022?

If you’re hospitalized, Medicare Part A has a deductible of $1,556 in 2022 (per benefit period ). There is also a coinsurance amount that is charged on a per-day basis after a patient has spent 60 days in the hospital during a single benefit period. In 2022, it’s $389 per day for days 61-90. Each beneficiary has 60 “lifetime reserve days” which can be used if the person still needs to be hospitalized after 90 days in a single benefit period. In 2022, the lifetime reserve coinsurance is $778 per day. All Medigap plans cover these coinsurance charges, plus up to another 365 days of inpatient care after Medicare benefits are exhausted.

Is Medicare A free for people on Social Security?

Medicare A is also free for people under 65 who have been on Social Security disability for at least two years, or who have end-stage renal disease.

Is Medicare Part A free for seniors?

A: Medicare Part A (hospital insurance) is free for most seniors. If you or your spouse worked at least 10 years in a job where you paid Medicare taxes, you’re eligible for free Medicare Part A when you turn 65.

Does Medicare cover prescription drugs?

Most Medicare beneficiaries also have private Medicare Part D coverage for prescription drugs, either as a stand -alone plan or as part of a Medicare Advantage plan. Employer-sponsored coverage for current employees or retirees can also provide supplemental drug coverage for Medicare beneficiaries. If you purchase supplemental coverage, the premiums will be in addition to the Part B premiums (and if applicable, the Part A premiums).

What are the financial aspects of Medicare?

Once you enroll in Medicare Parts A and B, you are responsible for paying coverage-related premiums, deductibles and copayments. In this blog post, we’ll explore the anticipated costs for Original Medicare.

How much does Medicare cost in 2021?

If you don’t qualify for premium-free Part A, you’ll pay a monthly premium that is calculated each year. In 2021, if you paid Medicare taxes for 30 to 39 quarters, the premium is $259 per month ; if you paid Medicare taxes for fewer than 30 quarters, the premium is $471 per month.

What is Medicare Part B?

Medicare Part B covers outpatient medical care, doctor’s visits, preventative services, occupational therapy, physical therapy, mental health services and some home health care services. Like Part A, costs for Part B can change every year.

Is Medicare free for out-of-pocket expenses?

Medicare isn’t free. Thus, you are responsible for certain out-of-pocket costs when you seek care under Medicare. Under Part A Medicare, your costs primarily include deductibles and copayments. For example, if you go into the hospital, you would be responsible for a $1,484 deductible for your stay. After the deductible, depending on the length of your stay, you could be responsible for more Part A related expenses starting on the 61st day. After meeting your deductible, coinsurance is $0 for the first 60 days of each benefit period. A benefit period refers to the duration of time you’re admitted to a hospital or skilled nursing care and ends after you’ve been discharged for 60 days without readmission. From day 61 to day 90, your coinsurance rate rises to $371 per day of each benefit period. After day 90, you will pay $742 coinsurance for every “lifetime reserve day” for each benefit period. That’s up to 60 days over your lifetime.

How much does Medicare pay for a hospital stay?

Part A: No fee for hospital stays of 60 days or less. For 61 to 90 days, $341 per day. For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once.

How much does Medicare pay for 91 days?

For 91 days or more, $682 per day or full cost of stay. Medicare also provides 60 “lifetime reserve days” that beneficiaries can use if they need to stay in a hospital for more than 90 days. These can only be used once. Part B: Typically, 20 percent of the Medicare-approved cost of the service for most services.

What is QMB in Medicare?

The Qualified Medicare Beneficiary (QMB) program helps pay for Part A and Part B premiums as well as deductibles, coinsurance and copays. If you qualify for this program, you automatically qualify for the Extra Help prescription drug program to help you with the out-of-pocket costs of your medicines. This program has the lowest income threshold of the four.

How much will Medicare Advantage cost in 2021?

If you sign up for a Medicare Advantage plan that includes prescription drugs with a mid-priced premium, CMS predicts you’ll pay $4,339 in 2021. These are just estimates, of course, but they can help you choose the policy that’s best for your health care needs and financial situation.

How often does the Medicare tab swing?

And the tab can swing wildly each year, depending on the state of a beneficiary’s health, where he or she lives, and whether the government and insurers have instituted any price increases — or decreases. Individual plans can also tinker with the services and drugs they cover.

How much is Part B for Social Security in 2021?

Part B: $148.50 monthly for 2021 (automatically deducted from Social Security benefit payments). Individuals with an annual income of more than $88,000 pay a higher premium.

Does Medicare cover out of pocket expenses?

Medicare covers the majority of your health care expenses each year. But you still may have to pay thousands of dollars in out-of-pocket costs: