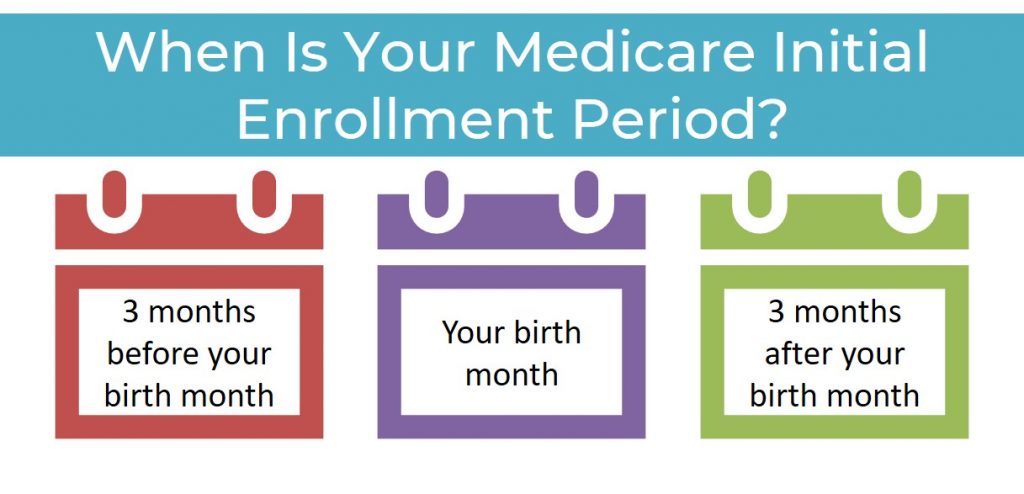

Nevertheless, you can enroll when you turn 65. The enrollment window is seven months long. It starts three months before your birthday month. Also, it ends three months after the month that you turn 65. If you don’t sign up on time, you can face a penalty. The penalty is a 10% surcharge on your Medicare part B premium.

Will you be penalized for not getting Medicare at 65?

If you didn’t get Medicare at 65, you would not be later charged with late-enrollment penalties, so long as your employer signed this form indicating you’ve had insurance coverage. The form would...

Is it mandatory to go on Medicare at 65?

In this circumstance, it is mandatory to sign up for Medicare unless you are one of the few people who pay premiums for Part A. You’ll still want to sign up for Medicare at age 65 to avoid late penalties, delayed coverage, and loss of Social Security benefits.

What to do before you turn 65 Medicare?

at least 3 months BEFORE you turn 65. EVERYONE WHO IS TURNING 65 should complete these tasks: Get familiar with Medicare and its “parts” To learn about Medicare, see the “ Introduction to Medicare ” fact sheet. You can also visit Medicare.gov or call 1-800-MEDICARE (1-800-633-4227); TTY users should call 1-877-486-2048.

Does Medicare cover all medical expenses after age 65?

The short answer is “no”; however, it will cover a significant portion of a person’s medical expenses. Thus, the challenge for the patient is to understand what Medicare, Medigap, prescription plans, and other plans will cover. Medicare is a federal insurance program that guarantees health coverage for people 65 and older, those with extreme disabilities and infants who have significant medical problems at birth.

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

How do I avoid Medicare Part B penalty?

If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

Can I decline Medicare at 65?

If you keep working beyond age 65, you may have health insurance through your employer or have purchased a plan outside of Medicare. In this case, you may choose to refuse Medicare coverage. However, delaying enrollment can add extra costs or penalties down the road.

Do you have to sign up for Medicare or is it automatic when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What happens if you decline Medicare Part B?

Declining Part B Coverage If you don't have other insurance, you'll have to pay an additional 10% on your premium for every full year that you decline Part B coverage. In 2022, the Medicare Part B premium is $170.10 or a bit less per month, depending on your situation. It's higher if your annual income is over $91,000.

Can Medicare penalties be waived?

You may qualify to have your penalty waived if you were advised by an employee or agent of the federal government – for example by Social Security or 1-800-MEDICARE – to delay Part B. Asking for the correction is known as requesting equitable relief.

Why are there Medicare penalties?

Medicare charges several late-enrollment penalties. They're meant to discourage you from passing up coverage, then getting hit with costly medical bills. To avoid higher Medicare premiums, you need to know about these penalties and take steps to avoid them.

Can you have Medicare and employer insurance at the same time?

Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

What do I need to do before I turn 65?

Turning 65 Soon? Here's a Quick Retirement ChecklistPrepare for Medicare. ... Consider Additional Health Insurance. ... Review Your Social Security Benefits Plan. ... Plan Ahead for Long-Term Care Costs. ... Review Your Retirement Accounts and Investments. ... Update Your Estate Planning Documents.

Do they automatically send you a Medicare card?

You should automatically receive your Medicare card three months before your 65th birthday. You will automatically be enrolled in Medicare after 24 months and should receive your Medicare card in the 25th month.

Does Medicare coverage start the month you turn 65?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

How much is the penalty for Part B?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers.

What happens if you don't get Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

What happens if you don't buy Medicare?

If you have to buy Part A, and you don't buy it when you're first eligible for Medicare, your monthly premium may go up 10%. You'll have to pay the higher premium for twice the number of years you didn't sign up.

How long do you have to pay for Part A?

If you were eligible for Part A for 2 years but didn't sign up, you'll have to pay the higher premium for 4 years. Usually, you don't have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a special enrollment period.

Can you get Medicare if you have limited income?

If you have limited income and resources, your state may help you pay for Part A, and/or Part B. You may also qualify for Extra Help to pay for your Medicare prescription drug coverage. Find out when you're eligible for Medicare.

What happens if you don't get Medicare at 65?

If you didn’t get Medicare at 65, you would not be later charged with late-enrollment penalties, so long as your employer signed this form indicating you’ve had insurance coverage. The form would be presented when you later needed Medicare. There is an eight-month special enrollment period that begins on the date a person aged 65 ...

How long does Medicare cover after you stop working?

It sounds like you will have retiree coverage and Medicare for five years after you stop working. It would be a good idea for you to find out exactly what your retiree plan covers and how it and Medicare would coordinate payment of any covered insurance claims.

How old do you have to be to qualify for unemployment if you die?

If he died at age 60 or younger, she would qualify for benefits because the agency would adjust the hours needed. Thirty-eight quarters of so-called covered earnings would be enough to qualify for someone who died two years before reaching the earliest age at which benefits normally are available.

Can I collect Social Security at 66?

When you apply for your benefit at age 66, she will be eligible for a spousal benefit. If it’s larger than her survivor benefit, she’d receive an additional payment equal to the difference. If not, her benefit would stay the same. Frank: I’m planning to collect Social Security at age 66 this fall.

Can my wife file for spousal benefits at 62?

Under new rules passed in late 2015, there is no way she can file for a spousal benefit while deferring her own retirement filing.

Should people with Cobra be penalized?

The main concern for people with COBRA should not be penalties but making sure they do not have an unintentional lapse in primary health coverage. Phil Moeller: You should not have to worry about penalties.

What happens if you don't get Medicare at 65?

If you didn’t get Medicare at 65, you would not be later charged with late-enrollment penalties, so long as your employer signed this form indicating you’ve had insurance coverage. The form would be presented when you later needed Medicare. There is an eight-month special enrollment period that begins on the date a person aged 65 ...

How long does Medicare cover after you stop working?

It sounds like you will have retiree coverage and Medicare for five years after you stop working. It would be a good idea for you to find out exactly what your retiree plan covers and how it and Medicare would coordinate payment of any covered insurance claims.

How old do you have to be to qualify for unemployment if you die?

If he died at age 60 or younger, she would qualify for benefits because the agency would adjust the hours needed. Thirty-eight quarters of so-called covered earnings would be enough to qualify for someone who died two years before reaching the earliest age at which benefits normally are available.

How long is the eligibility period for Medicare?

Phil Moeller: You should not have to worry about penalties. There is a seven-month initial eligibility period for Medicare, and the start date of your coverage depends on when during this period you enroll.

Can my wife file for spousal benefits at 62?

Under new rules passed in late 2015, there is no way she can file for a spousal benefit while deferring her own retirement filing.

What happens if I don't sign up for Medicare at 65?

What happens if I don’t sign up for Medicare when I’m 65? A. Joining Medicare is voluntary. But there may be consequences—in the form of a late penalty—if you don’t enroll at the “right” time, depending on your circumstances.

What happens if you delay a car insurance payment for 5 years?

For example, if you delay five years, you’ll pay an extra 50 percent of the cost of that year’s premium. The penalty amount grows larger over time because it’s pegged to the cost of each year’s Part B premiums, which generally rise every year.

What happens if you delay signing up for Part B?

You need to carefully consider your rights and options .) Part B (doctors and outpatient services): If you delay signing up for Part B beyond the time when you’re first eligible for it, you could incur a late penalty. (The exception is if you’re still working and have “primary” health insurance from your employer.)

Is there a penalty for not signing up for Part A?

Part A (hospital insurance) : There is no penalty for delaying to enroll in Part A if you qualify for it automatically on the basis of you or your spouse’s work record. But in most circumstances, there’s no reason not to sign up as soon as you’re eligible.

Do you have to pay a late penalty for prescription drugs?

There are exceptions. You would not risk a late penalty for as long as you have other insurance for prescription drugs (such as coverage under an employer health plan or retiree benefits) that is considered at least as good as Part D. If this is the case, you won’t need Part D unless you lose or drop such coverage.

Are You Automatically Enrolled in Medicare When You Turn 65?

In some instances, yes. For example, Medicare will enroll you for coverage automatically if you’re already receiving Social Security benefits. They may also do so if you receive Railroad Retirement Board (RRB) benefits.

How Do I Sign up for Medicare?

You can apply for Medicare during the initial enrollment period. However, there are also two other ways that you can sign up for coverage.

Get Free Help Signing up for Medicare!

Now you know more about how to sign up for Medicare. However, the original Medicare plan has considerable gaps in coverage.

What is the penalty for late enrollment in Medicare?

This penalty will tack on 10% to monthly Part B premiums (now $135.50 for most enrollees) for each full year you are late in enrolling.

Do you have to notify Medicare of your intention to get Medicare?

You do not need to notify Medicare of your intention not to get Medicare. In fact, Medicare doesn’t even handle Medicare enrollments. Social Security does this work. I urge people who turn 65 to pay careful attention to their Social Security mail, because the agency occasionally does mistakenly enroll people in Medicare.