Over the next 10 years, Trump’s 2020 budget proposal aims to spend $1.5 trillion less on Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

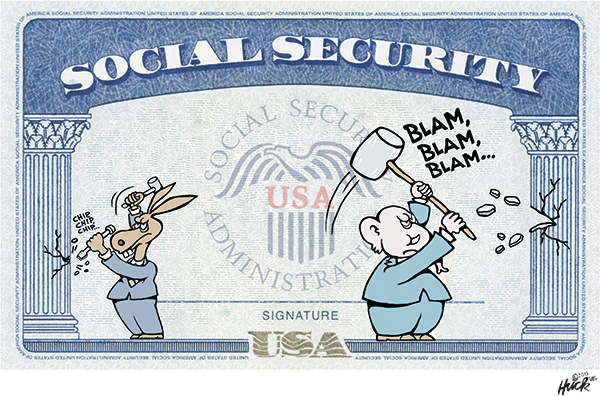

Are Social Security benefit cuts a real possibility?

Yes, as it has done several times in the past. Most of these remedies involve higher payroll taxes, benefit cuts, or a combination. Higher taxes could spread across the board or focus on higher earners, for example. Benefit cuts also could be applied across the board or target high earners.

Can Social Security survive without benefit cuts?

Social Security can survive without benefit cuts. Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare. Published 7:58 AM ET Tue, 24 Jan 2017 Updated ...

Should you worry about social security being cut?

The Social Security Trust Fund could be depleted by 2031 as a result of the coronavirus pandemic and subsequent economic collapse, according to new projections — and today's youngest retirees could be among the first in the nation to see benefit cuts.

Will Social Security cut my benefits?

You can get Social Security retirement benefits and work at the same time. However, if you are younger than full retirement age and make more than the yearly earnings limit, we will reduce your benefit. Starting with the month you reach full retirement age, we will not reduce your benefits no matter how much you earn.

What are the Social Security changes for 2021?

The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000. The earnings limit for workers who are younger than "full" retirement age (see Full Retirement Age Chart) will increase to $19,560. (We deduct $1 from benefits for each $2 earned over $19,560.)

Are Social Security payments going to be cut?

A report from Social Security and Medicare trustees said benefits will have to be cut by 2034 — a year earlier than previously projected — if Congress doesn't address the program's long-term funding shortfall.

What changes are coming for Social Security?

The biggest change beneficiaries will see in Social Security in 2022 is a 5.9 percent cost-of-living adjustment (COLA) to monthly retirement checks and Supplemental Security Income (SSI) checks. The increase is the largest COLA since 1982.

How much will the Medicare deduction from Social Security be in 2022?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Is Social Security being cut in 2021?

According to the 2022 annual report of the Social Security Board of Trustees, the surplus in the trust funds that disburse retirement, disability and other Social Security benefits will be depleted by 2035. That's one year later than the trustees projected in their 2021 report.

What would cause Social Security benefits to be reduced?

If you recently started receiving Social Security benefits, there are three common reasons why you may be getting less than you expected: an offset due to outstanding debts, taking benefits early, and a high income.

Are seniors getting extra money in 2022?

OAS payments have been increased by 1.0% for the April-June quarter of 2022. Old Age Security is also being permanently increased by 10% for seniors 75 and older starting in July 2022. This means eligible seniors will receive an additional $770.70 per year in OAS ($642.25 x 110% x 12).

Will seniors get a raise in 2022?

Social Security beneficiaries saw the biggest cost-of-living adjustment in about 40 years in 2022, when they received a 5.9% boost to their monthly checks. Next year, that annual adjustment may even go as high as 8%, according to early estimates.

What are the new changes for Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What will the Medicare Part B premium be in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What are the temporary fiscal interventions of 2020 and 2021?

The temporary fiscal interventions of 2020 and 2021, which the senators opposed, provide a much higher bang for the buck than the long-term budget busting trickle-down tax cuts of 2017, which many supported.

When did the Cares Act expire?

The pandemic-related deficits are mainly temporary. Congress enacted the CARES Act in March 2020, which offered temporary relief mainly to families, unemployed workers and closed business. Most of its provisions expired in the second half of 2020. The newly elected Congress then enacted the American Rescue Plan in March 2021.

What was Donald Trump's signature legislative achievement?

Donald Trump’s signature legislative achievement was the Tac Cuts and Jobs Act of 2017. It showered trillions of dollars on highly profitable corporations and the richest American households that had seen the largest economic gains in the wake of the Great Recession from 2007 to 2009. Moreover, many provisions of this tax legislation are now permanent fixtures of the tax code and many temporary ones, such as tax cuts for high-income earners will likely become permanent, if past supply-side tax cuts are any indication.

What are the immediate benefits of a tax increase?

The immediate benefits are less inequality and better health outcomes, both of which ultimately support stronger economic growth. Improving revenues for these programs by, for example, increasing payroll taxes on the top income earners will ultimately result in stronger growth and shrinking federal deficits.

Is the program cutting push for a balanced budget wrong?

The program-cutting push for a balanced budget ignores two key aspects of fiscal policy. First, it matters whether fiscal interactions create temporary or permanent deficits and second, it matters whether the spending or tax cuts underlying the deficits resulted in faster growth. On both counts, using the pandemic-related fiscal measures to justify cuts for Social Security, Medicare and Medicaid is wrong.

Does the Cares Act help the economy?

In contrast, the CARES Act offered much needed relief amid the worst unemployment crisis since the Great Depression, while it helped to stem the tide on declining economic growth. And experts predict that ARPA will boost economic growth to its highest rate in decades.

Will the Federal Reserve keep interest rates low?

The Federal Reserve will also likely keep interest rates low for some time. Congress will eventually need to worry about the long-term health of the U.S. government, but that does not mean a balanced budget, especially one that is achieved by cutting only vital programs.

How many people received Social Security in 2019?

In 2019, 54.1 million people received Social Security benefits. About 40% of Americans over the age of 60 who are no longer working full time rely solely on Social Security benefits for their income, according to the National Institute on Retirement Security. The annual benefit is about $17,000. GET FOX BUSINESS ON THE GO BY CLICKING HERE.

When will Social Security run out?

The Social Security Disability Insurance program, meanwhile, is projected to run out in 2026. "Based on CBO's figures, Social Security’s retirement benefit would be cut by roughly one-quarter in 2031," the CRFB said in an analysis on Wednesday. "In other words, today’s youngest retirees will face a sharp 25% drop in their benefits ...

When will Trump's unemployment benefit run out?

TRUMP'S UNEMPLOYMENT BENEFIT MAY ONLY LAST 3 WEEKS. The non-partisan agency said in the report the Social Security fund could plunge from $2.8 trillion to $533 billion in 2030. It estimates the fund would run out the following year. The Social Security Disability Insurance program, meanwhile, is projected to run out in 2026.

Is Social Security insolvent?

The Congressional Budget Office said in an analysis released last month noted that the Social Security Old Age and Survivors Insurance fund, which pays out retirement benefits, faces insolvency within a little over a decade unless Congress takes action to address the shortfalls.

Will Social Security be depleted in 2031?

The Social Security Trust Fund could be depleted by 2031 as a result of the coronavirus pandemic and subsequent economic collapse, according to new projections — and today's youngest retirees could be among the first in the nation to see benefit cuts. This as the Social Security Administration prepares to release the Cost ...

What percentage of people oppose cutting Social Security?

Opposition to reducing either Social Security or Medicare benefits transcended party lines in the survey. Among all respondents age 50-plus, 85 percent strongly oppose cutting Social Security and the same percentage strongly oppose decreasing Medicare benefits to reduce the federal deficit. The survey also found that 87 percent of Democrats, 79 percent of independents and 88 percent of Republicans strongly oppose cutting Social Security. When asked about Medicare, 87 percent of Democrats, 80 percent of independents and 86 percent of Republicans said they strongly oppose reducing that program's benefits.

How many members of the Trust Act would be needed to support a bill?

Under the Time to Rescue United States’ Trusts Act — or TRUST Act, for short — all it would take for legislation cutting these programs to be fast-tracked in Congress would be for seven members of one of these rescue committees to support a proposed bill. Under the act, lawmakers would be unable to make any changes to a TRUST Act bill once it went to the U.S. House of Representatives or the Senate.

What is the margin of error of AARP survey?

The AARP survey, which was conducted among 1,016 people age 50 and over from April 22 through April 26, has a margin of error of plus or minus 4.3 percent. The survey was fielded soon after legislation was reintroduced in Congress that would establish small “rescue committees” whose job would be to propose changes to Social Security ...

When was the Trust Act introduced?

All members of Congress should be held accountable for any action on Social Security and Medicare.”. The TRUST Act was first introduced in 2019 but has not become law. AARP has strongly opposed this and other such measures, supporting instead broad public debate.

Can the Trust Act be changed?

Under the act, lawmakers would be unable to make any changes to a TRUST Act bill once it went to the U.S. House of Representatives or the Senate. “Older Americans overwhelmingly oppose cutting Social Security and Medicare to reduce the deficit. Proposals like the TRUST Act would give a handful of lawmakers the power to propose cuts ...

Is the federal budget deficit a problem?

En español | While the vast majority of Americans age 50 and older say the federal budget deficit is a big problem, almost that same majority strongly oppose using cuts to Social Security or Medicare benefits to reduce that debt, according to a new AARP survey.

When will Social Security be depleted?

If Congress takes no action, the Social Security trust fund will become depleted in 2035 (though the program still would be able to pay about 80% of promised benefits); Medicare’s will run dry in 2026 (it covers the Part A hospital fund; the other parts of Medicare are funded by premiums), but the program still would be able to pay 90% of benefits. ...

How much does a person get from Social Security?

The average Social Security benefit today is $1,543 per month or about $18,500 a year, just a few thousand dollars above the federal poverty line. Nearly half of seniors rely on their Social Security benefits for all or most of their income. Research indicates that tomorrow’s seniors will rely on their earned benefits for financial survival even more than today’s retirees do.

What is the most alarming thing about the Trust Act?

What’s most alarming about the TRUST Act is that it does not instruct the “rescue committees” to take into account the adequacy of seniors’ earned benefits, as if they are simply figures on a ledger.

What is Mitt Romney's trust act?

Sen. Mitt Romney’s TRUST Act, which was just reintroduced after going nowhere in the previous Congress, is setting off alarm bells for seniors’ advocates. And rightly so. The Time to Rescue United States Trusts Act would create “ rescue committees ” in Congress to propose legislation to “shore up” various trust funds, ...

Do seniors rely on Social Security?

Nearly half of seniors rely on their Social Security benefits for all or most of their income. Research indicates that tomorrow’s seniors will rely on their earned benefits for financial survival even more than today’s retirees do. On the Medicare side, the TRUST Act’s boosters say that cost reductions would be on the table, ...

Does the Trust Act affect Medicare?

On the Medicare side, the TRUST Act’s boosters say that cost reductions would be on the table, especially reforms to address the overall cost of health care. We support cost containment measures on the condition that they do not affect the quality of care, provider choice, or increase beneficiaries’ out-of-pocket spending.

Can seniors trust the Trust Act?

Seniors simply cannot trust the TRUST Act with the all-important financial and health security that Social Security and Medicare provide. Max Richtman is president and CEO of the National Committee to Preserve Social Security and Medicare.